In the past several hours there were a few news items that might have made someone utter an amazed oath. Most notably by far, though somewhat buried by financial media, is the Department of Energy’s announcement of a breakthrough in nuclear fusion. Of all the goings-on, this is the one that is most likely to be viewed by future historians as a truly momentous event. The Bahamian arrest of Sam Bankman-Fried on the eve of his scheduled testimony before Congress was quite a shock as well. The FTX saga has been playing out for weeks, and this ensures that it will continue to be newsworthy as it grinds its way through the legal process. But the biggest shocker for those of us who follow markets was the reaction to a better-than-expected CPI print.

The CPI report was a good one, no matter how you slice it. The month-over-month headline rise was 0.1% and the core was 0.2%, both versus consensus expectations of 0.3%. It was truly shocking for those of us who check in on the Cleveland Fed’s Inflation Nowcast, which estimated rises of 0.47% and 0.51% respectively. According to the Bureau of Labor Statistics, the biggest improvements in the core came from declines in used car prices (-2.9%) and medical care services (-0.7%), while declines in utility gas services (-3.5%) and gasoline (-2.0%) paced the non-core declines. Shelter was the major influence to the upside, but its 0.6% rise was less than last month’s 0.8%.

I have to admit, the unexpurgated version of this piece’s title was my unvarnished reaction to the CPI report. I was already puzzled by the run-ups that we saw in major equity indices late yesterday and in equity futures immediately ahead of the report. Years of trading experience make me suspicious when I see large, high-conviction moves ahead of a key earnings or economic release, so I my “spidey-sense” was tingling even before the news hit the wires. The S&P 500 (SPX) rose about 30 points in the last hour of trading yesterday and ES futures spiked up another 36 points immediately before 8:30 EST. Those would normally be considered gutsy purchases, but they proved quite prescient when futures spiked 3-4% afterward. The move was abetted by sharp drops in bond yields and the dollar. All are reflecting a stronger consensus that Fed rate hikes will slow and that rates will peak at a lower level than before.

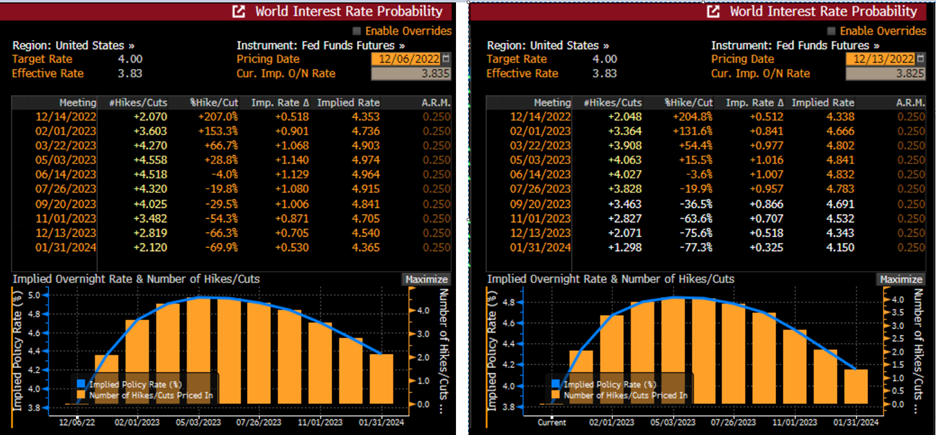

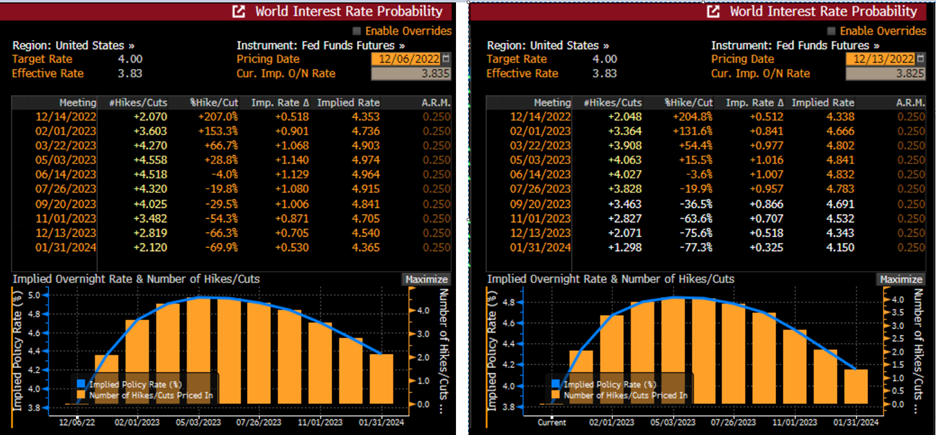

So, what’s really changed? Let’s compare a summary of the Fed Funds market’s implied probabilities before and after the report:

Fed Funds Futures Implied Probabilities, Last Week (12/6) vs. Today (12/13)

Source: Bloomberg

It is hard to see much of a difference in the curves, but there is indeed a distinct one. There is a roughly parallel shift lower. Last week we had a peak of 4.974% in May, while we now peak at 4.841%. A 13bp move is fairly significant, though not necessarily earth-shattering. The market consensus for a 50bp hike tomorrow remains in place, though the assumptions for the February meeting have shifted from a toss-up between 25 and 50 to a much higher likelihood of 25bp. Even with the lower peak, we still see expectations for two 25bp cuts by the end of 2023.

When we look at the results this way, we have to wonder whether asset markets are overreacting a bit. Short-term interest rate assumptions have improved, but really just because of a lower probability assigned to a 50bp hike at the subsequent FOMC meeting. That’s a positive, but hardly a paradigm shift. The bond market is still signaling recession fears, with the 2-10 inversion sliding to “only” 74 bp.

And the bigger the reaction today, the more the risk of disappointment tomorrow. While improving, core inflation remains well above the Fed’s 2% target. In the meantime, improving asset markets have been improving financial conditions – undoing some of the Fed’s efforts to tighten them. We noted yesterday that “sometimes the tone of [Chair Powell’s] comments is as important as the comments themselves.” Have we now given Mr. Powell a reason for a more strident tone at tomorrow’s press conference? If so, a steady stream of epithets from angry traders would hardly be out of character.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.