Key News

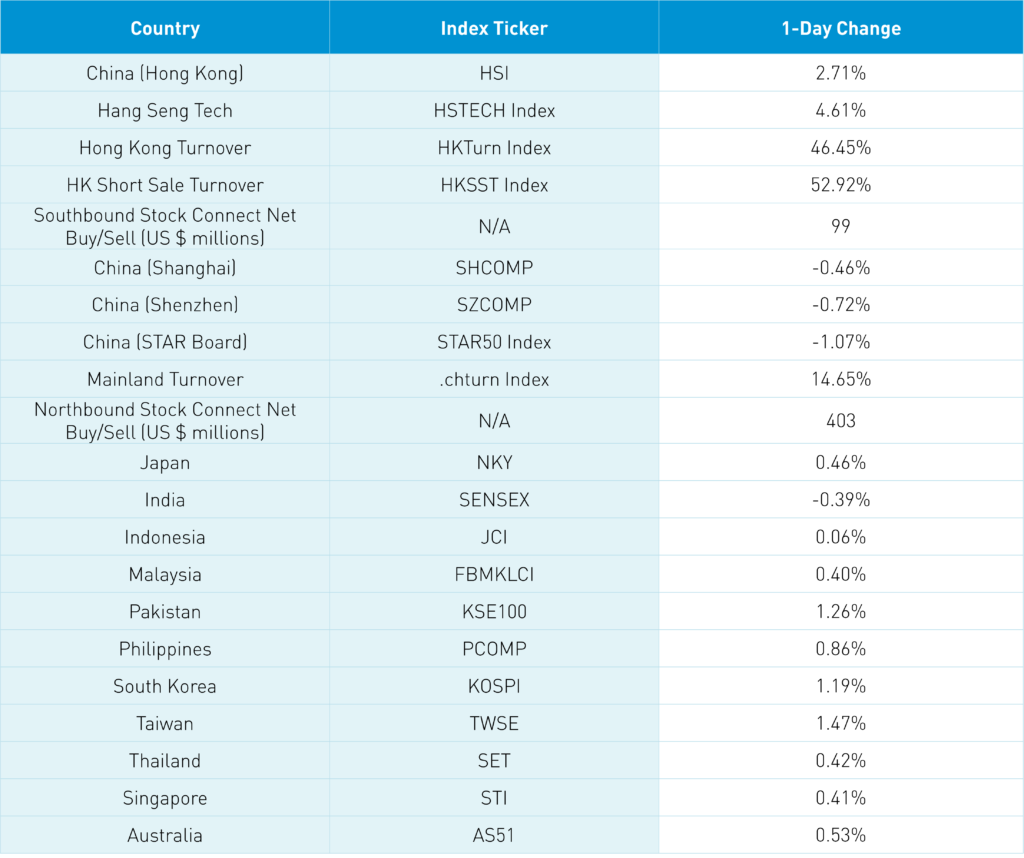

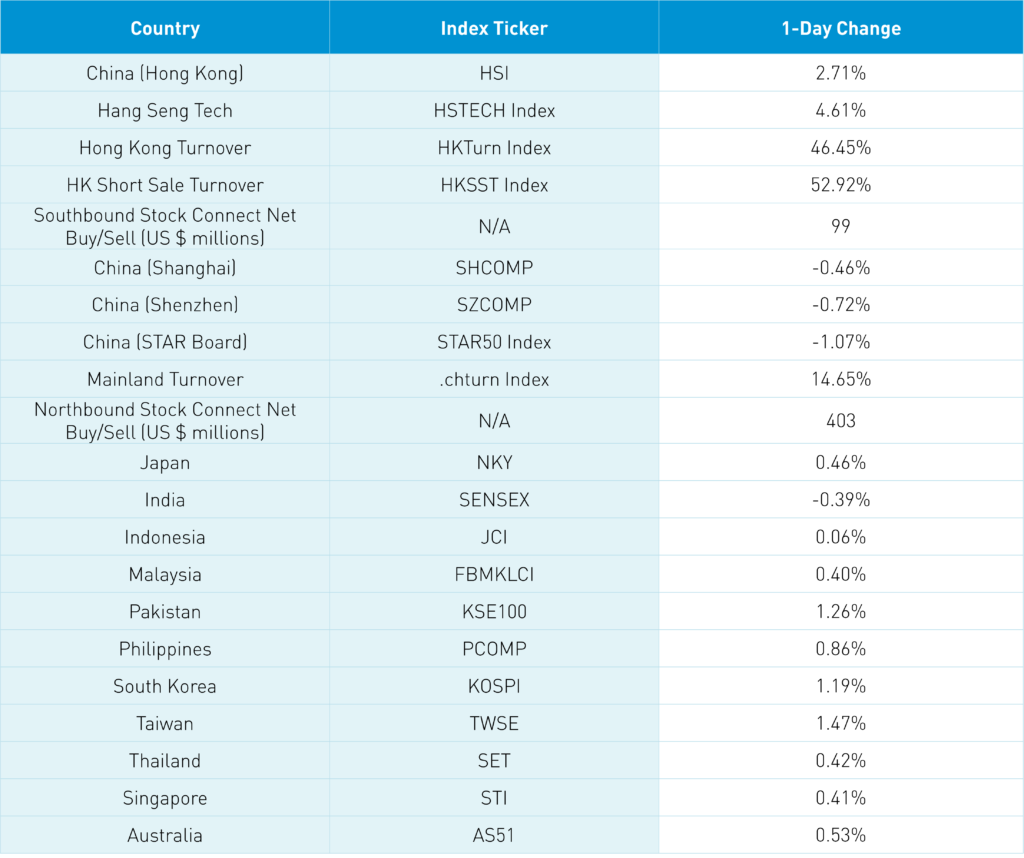

Asian equity markets had a good day as Hong Kong outperformed while Mainland China and India were off.

The nattering nabobs of negativity are so focused on COVID’s spread in China that they appear to be missing the Hong Kong market’s rebound. The top-performing sectors in both Mainland China and Hong Kong were consumer discretionary, consumer staples, and communication! Have you noticed how stable CNY has been over the past few weeks? The currency’s stability indicates an improvement in risk appetites.

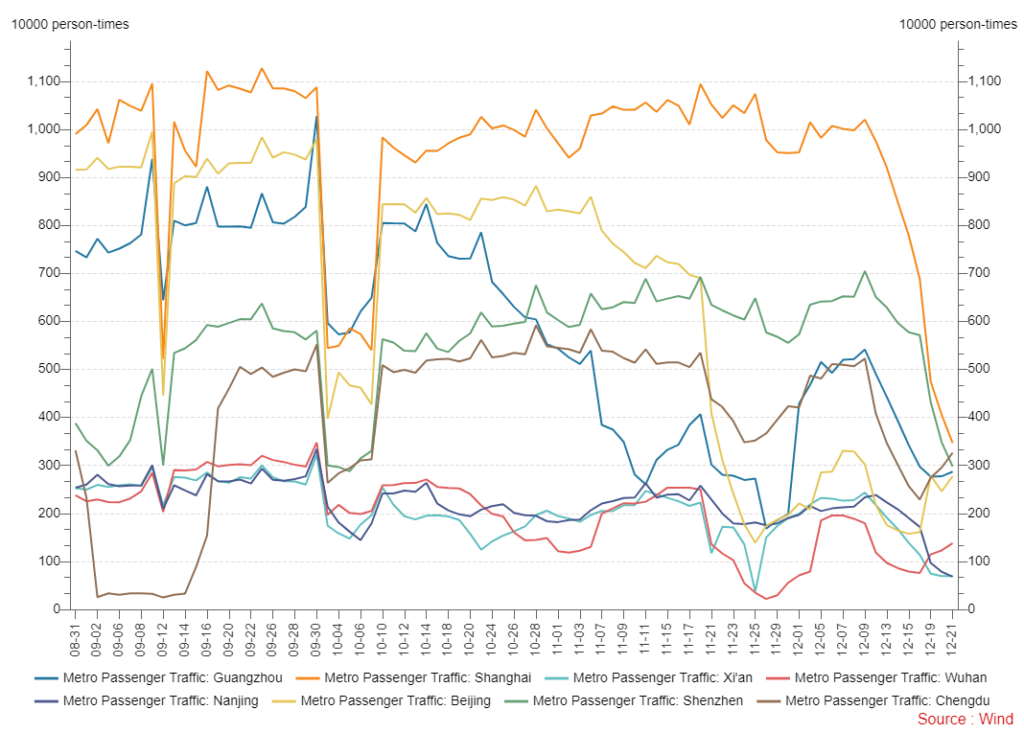

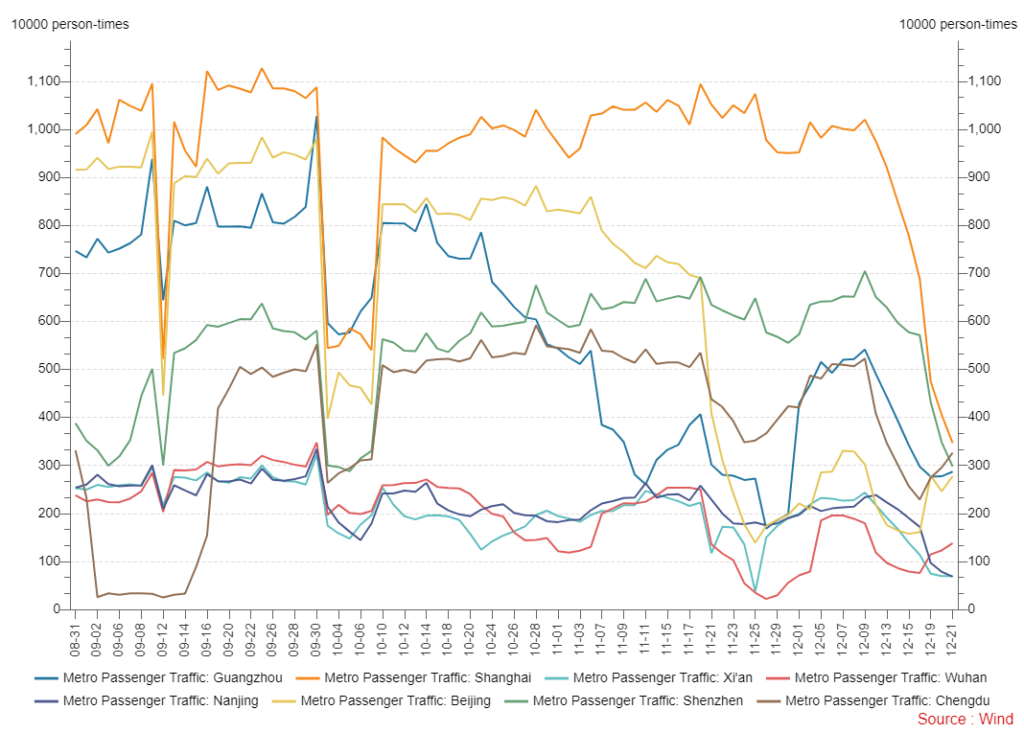

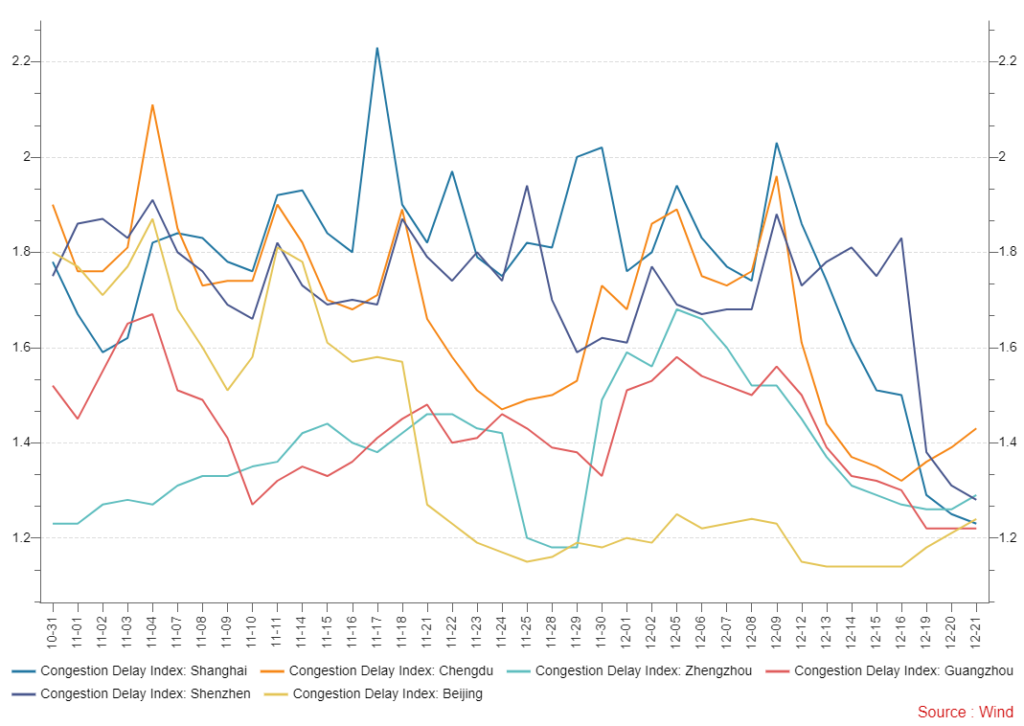

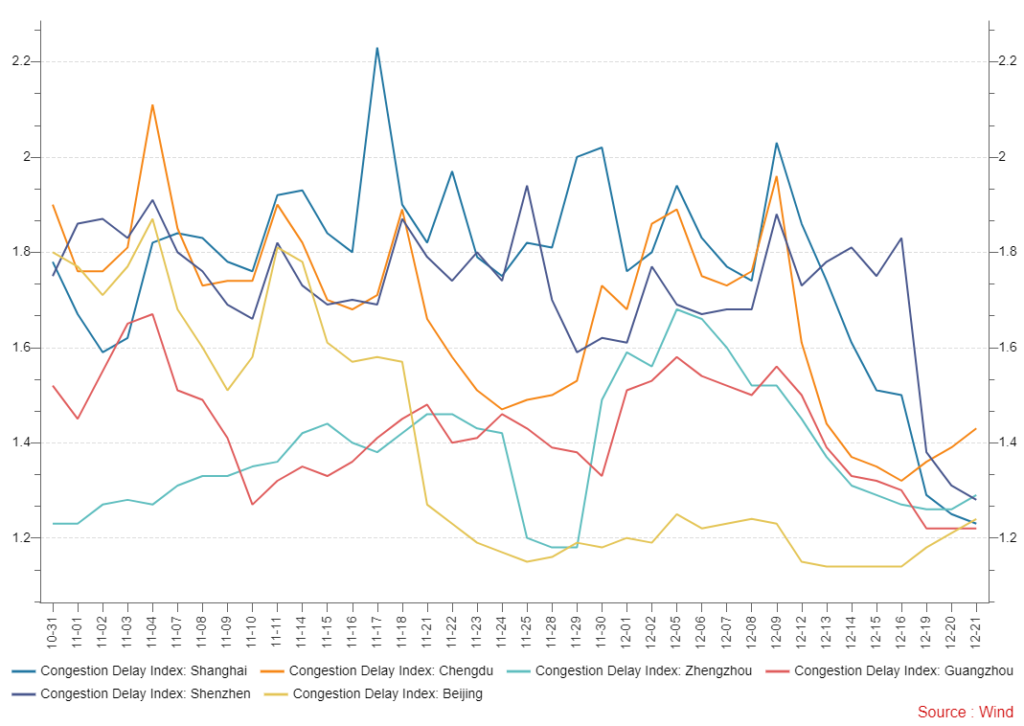

While our Chinese City Mobility Tracker shows declines in traffic and metro usage though several cities are showing stabilization. It was interesting to see a nice jump in volumes in Hong Kong.

The big news overnight was the potential relaxation of inbound China quarantines, to occur in early January. The requirement for foreign arrivals will be reduced to 0+3 (no government facility quarantine, followed by three days of home quarantine).

Also, the CSRC reiterated its policy support for the real estate sector following the PBOC and State Council’s releases. The WTO ruled in favor of China and against the US in a trade dispute dating back to the previous administration. FedEx and Nike’s better-than-expected financial results were also a catalyst as the latter’s China revenue was off only -3% year-over-year.

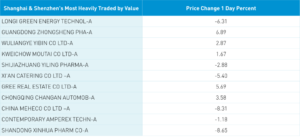

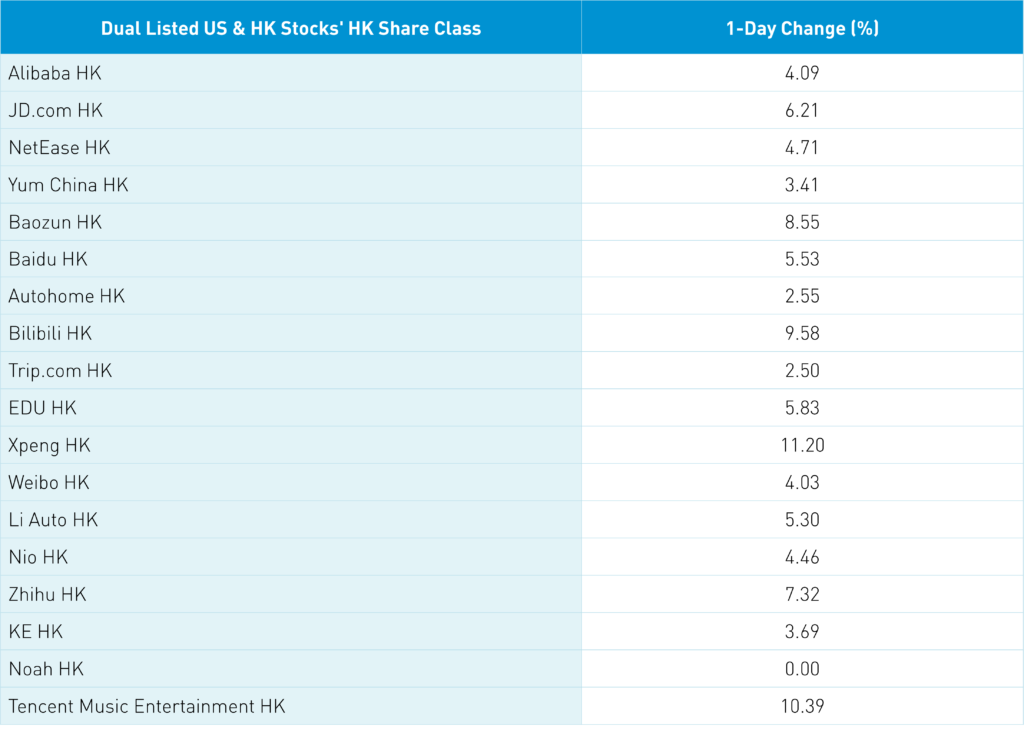

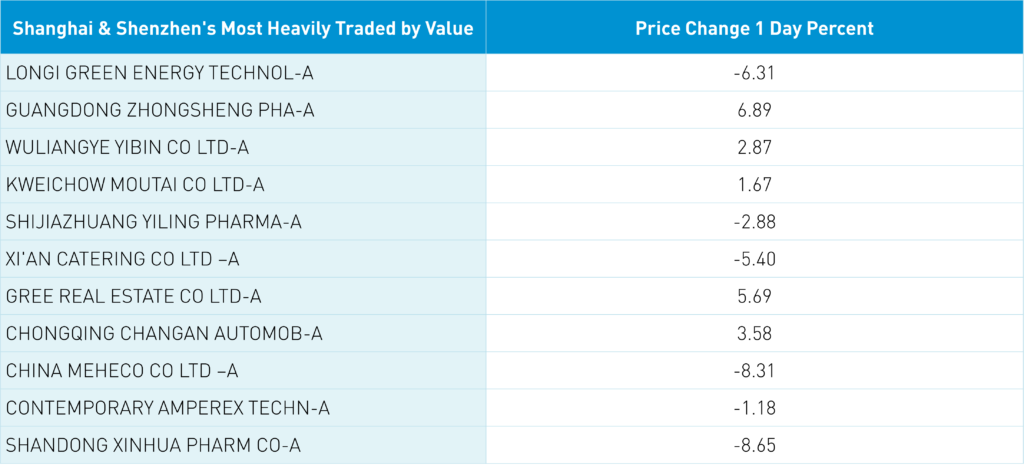

Hong Kong’s most heavily traded were Tencent, which gained +4.12%, Meituan, which gained +6.89%, and Alibaba, which gained +4.09%, as internet and electric vehicle (EV) stocks had a good day. Hong Kong shorts have been quiet during this rally, which was true today as well though Alibaba’s short turnover accounted for 34% of the total turnover. Mainland China was up all day though sold off into the close to close down though sectors were mixed, and foreign investors were net buyers to the tune of $403 million. Cleantech was off as CATL fell -1.18% despite announcing that their German EV battery plant is up and running.

We speak often about how onshore China and offshore China are two distinct markets. Onshore China, which is 95% owned by investors in China, reflects what the Chinese think about China. Offshore China (represented by US-listed ADRs and Hong Kong stocks) is reflective of what foreign investors think about China. Over the last two years, we have favored onshore over offshore due to all of the negative news from foreign media weighing on sentiment. However, now I might lean more toward offshore China to capture the recovery in sentiment.

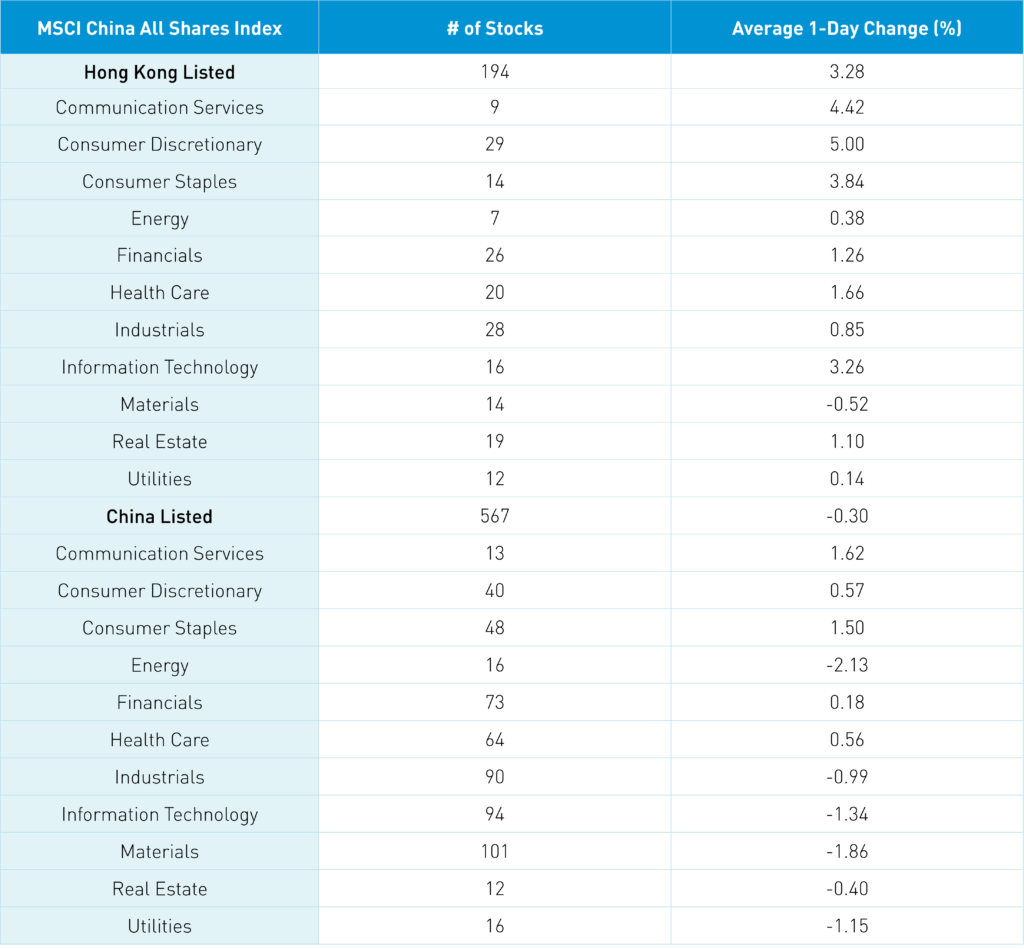

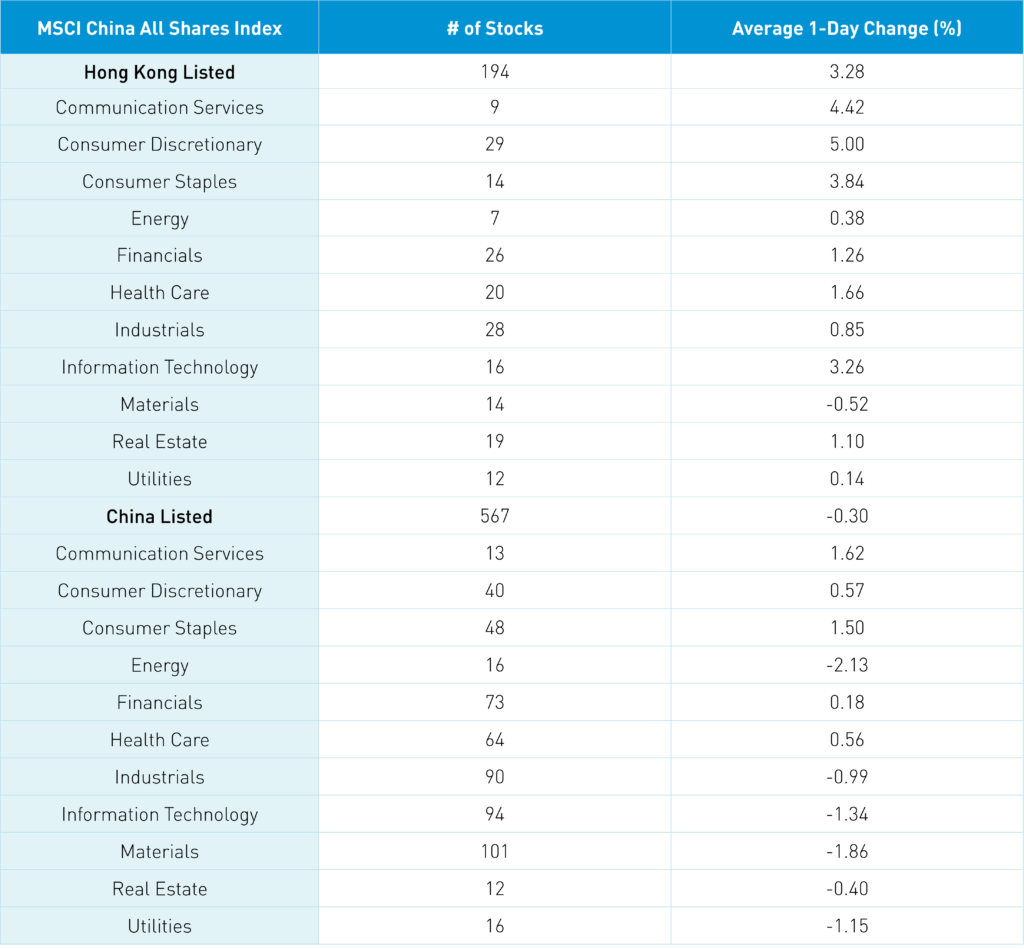

The Hang Seng and Hang Seng Tech gained +2.71% and +4.61%, respectively, on volume that was up +46.45% from yesterday which is 82% of the 1-year average. 390 stocks advanced while 94 stocks declined. Main Board short turnover increased +52.95% from yesterday which is 72% of the 1-year average as 15% of turnover was short turnover. Value and growth factors were mixed as small caps edged out large caps. Top sectors were discretionary gaining+5%, communication finishing up +4.42%, and staples closing higher +3.84% while materials was the only down sector -0.53%. Top sub-sectors were software, media, and retailing while materials and food were the only down sub-sectors. Southbound Stock Connect volumes were light as Mainland investors bought $99 million of Hong Kong stocks with Kuaishou a small net buy, Tencent and Meituan were moderate net buys.

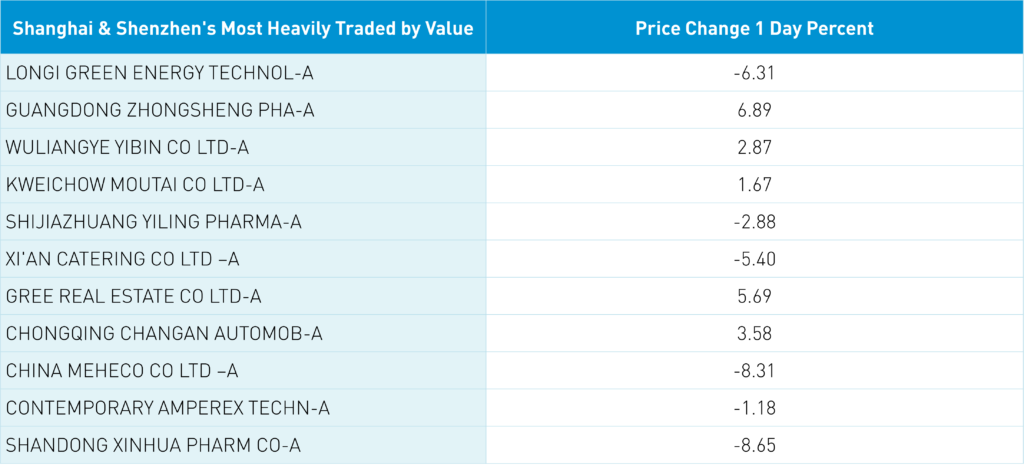

Shanghai, Shenzhen, and STAR Board eased -0.46%, -0.72%, and -1.07% on volume +14.65% from yesterday which is 70% of the 1-year average. 826 stocks advanced while 3,850 stocks declined. Value factors “outperformed” growth factors as large caps outpaced small caps. Top sectors were communication +1.62%, staples +1.5%, and discretionary +0.57% while energy -2.13%, materials -1.85%, and tech -1.33%. Top sub-sectors were chemical industry, education, and office supply while chemicals, fertilizer, and chemical fiber were among the worst. Northbound Stock Connect volumes were light as foreign investors bought $403 million of Mainland stocks. CNY was basically flat versus the US dollar at 6.98, Treasury bonds rallied again and copper gained +0.52%.

Major Chinese City Mobility Tracker

Some green shoots as several cities see stabilization/small rises though others are still in free fall.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.98 versus 6.98 yesterday

- CNY per EUR 7.41 versus 7.41 yesterday

- Yield on 10-Year Government Bond 2.85% versus 2.86% yesterday

- Yield on 10-Year China Development Bank Bond 3.01% versus 3.03% yesterday

- Copper Price +0.53% overnight

—

Originally Posted December 22, 2022 – Hong Kong Rally Enjoys The Silence

Author Positions as of 12/22/22 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.