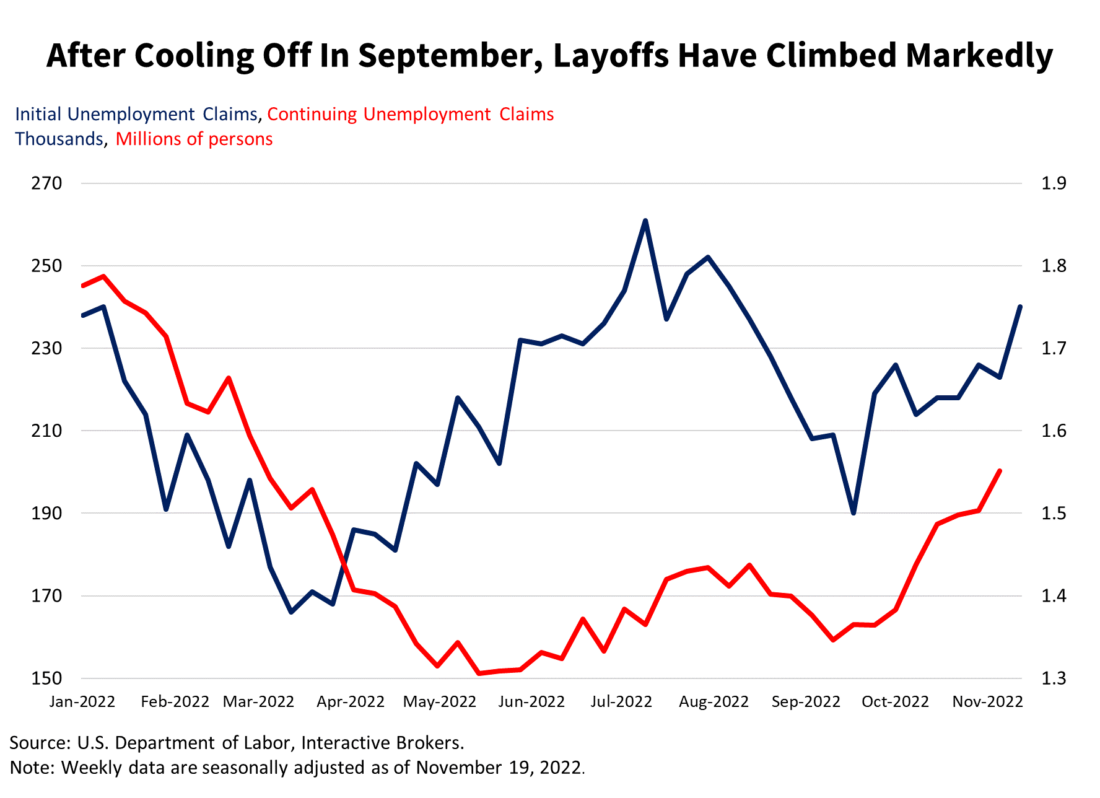

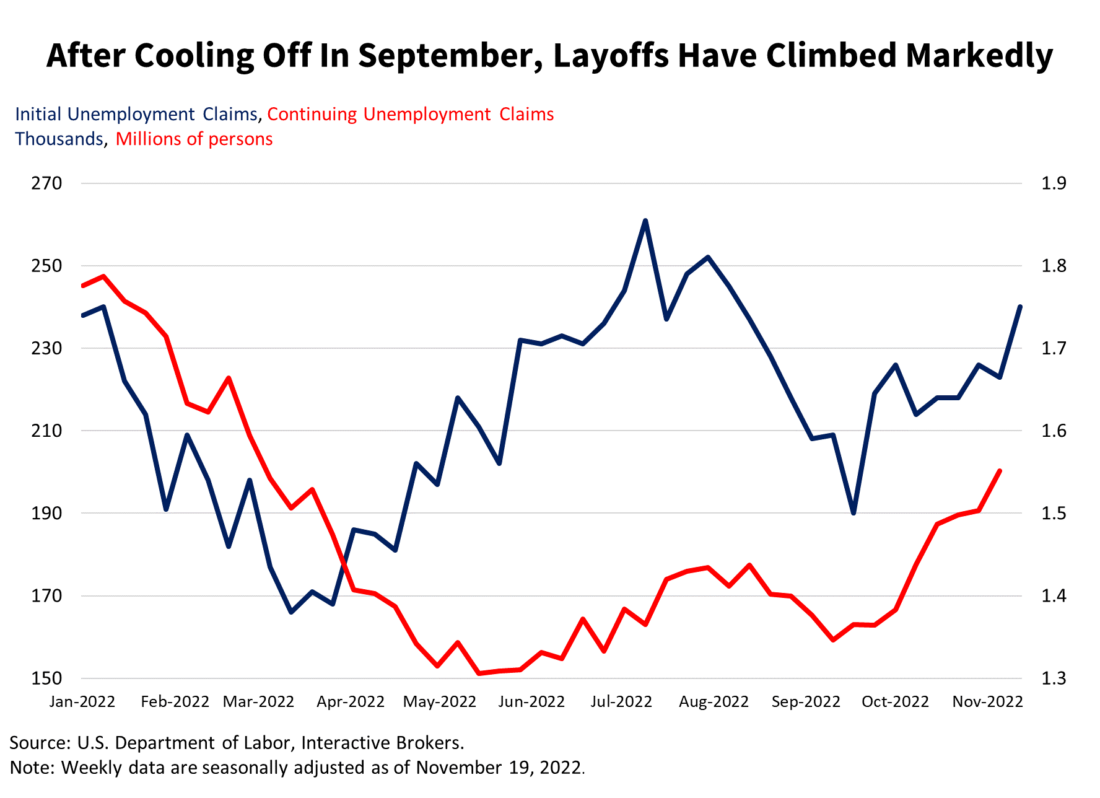

Overall manufacturing conditions have dropped into contraction territory, a result of two consecutive months of weakening results. Today’s November Flash Manufacturing PMI of 47.6 is a notable decline from October’s 50.4 level, which was barely above the expansion-contraction threshold of 50. Today’s reading fell short of consensus expectations of 50 and it underscores that the Federal Reserve’s (the Fed’s) aggressive monetary policy tightening is reducing demand, which helps in curtailing inflation but also creates challenging business conditions that weigh on economic growth and employment. The manufacturing weakness appears to have extended to the job market, with today’s unemployment claim data showing an increase in initial unemployment claims while continuing unemployment claims have also increased.

With decades high inflation continuing to exceed 7%, the PMI report’s update is generating strong interest among investors, especially since this month’s report showed easing price pressures in manufacturing and services. This has been a concern because price pressure within the services industry is pivotal to lowering inflation due to the difficulty in reversing price increases once they are established. Also on an encouraging note, businesses continued to report supply chain improvements.

The news alongside higher-than-expected unemployment claims is supporting investor optimism that the Federal Reserve may be more likely to pivot from its hawkish inflation stance with equities up, the dollar down, and yields down across the curve. Fed minutes later today at 2:00 pm may serve as a spoiler, reminding investors to resist the temptation of declaring victory on inflation prematurely, a mistake made in the 1970s by the late Arthur Burns. Chair Burns took his foot off of the monetary policy brakes only to experience another inflationary surge shortly after.

On a positive note for controlling inflation, unemployment claims rose last week as the labor market may be finally showing some signs of softening. Initial unemployment claims rose to 240,000, the highest level since mid-August. The figure was higher than expectations for 225,000 claims and from the previous week’s 223,000 claims. Continuing claims rose to 1.551 million, the highest level since early March, implying that laid off workers are having an incrementally more challenging time finding employment elsewhere. The figure was higher than expectations for 1.517 million and up from the previous week’s 1.503 million.

Even as layoffs have increased, employers reported persistent concerns with finding workers with the appropriate skills and say this challenge is hindering expansion. Businesses also reported increasing challenges from higher borrowing costs, increased costs of living and weakening demand domestically and in export markets.

While manufacturing conditions have hit contraction levels, durable goods orders increased 1% in October from September, much stronger than expectations for a 0.4% rise and a stronger reading from the previous month’s 0.3% gain. October’s read is the highest pace of growth since June of this year. Shipments were also strong, up 0.4% during the period and have now been positive in 17 of the last 18 months. New orders for nondefense capital goods excluding aircraft, a proxy for business investment, rose strongly to 0.7% during the period, recovering from the previous month’s 0.8% decline. Unfilled orders and inventories continue to increase; however, the former rose for 26 consecutive months while the latter rose for 21 consecutive months.

At this point in the cycle, we’re shifting from higher inflation to weakening employment and consumption. Monetary policy operates on long and variable lags which means that much of the interest rate hikes and balance sheet runoff that occurred this year, will hamper economic performance next year. The leading indicators continue to flash warning signals, while the coincident and lagging indicators are mostly doing just fine. 2023 will feature weak coincident and lagging indicator performance as margins come under pressure and corporates experience earnings contraction. Expectations of a 75 basis point hike in December remained subdued at 26% after these reports with market participants firmly expecting a 50 basis point hike. Cuts are expected by the end of 2023, but the federal funds rate is priced to stay firmly above 4 percent. With a new era of structurally higher inflation ahead of us, the days of the Fed cutting to zero are long gone.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.