Inflation and the Fed: December 9, 2022

The rate of overall inflation remains high but has moderated against the backdrop of slowing consumption and tighter financial conditions. The Fed’s preferred gauge of inflation, the core PCE, is at 5.0 percent as of October, two and a half times the Fed’s 2 percent target. The Fed is expected to continue raising the federal funds rate from its 3.88 percent level in order to dampen inflationary pressures. The market is currently expecting the Fed to raise 50 basis points at the December meeting to end the year at a rate of 4.38 percent. A series of 25 basis point increases in 2023 are expected, leaving the terminal rate at 5.13 percent. Modest interest rate cuts are expected in the second half of 2023, leaving 2023’s year-end rate around 4.63 percent. In addition, the Fed has increased the pace of its balance sheet reduction program to a monthly cap of $95 billion from $47.5 billion in the prior months, further constraining the money supply and financial conditions alike. Since the peak in April 2022, the Fed has reduced its balance sheet by $383 billion. As the Fed continues to tighten financial conditions, it places downward pressure on the money supply and inflation, upward pressure on short-term interest rates and downward pressure on GDP. The Fed has expressed a strong commitment of keeping rates higher for longer until it sees convincing evidence of inflation returning to the 2 percent target, even as economic conditions continue to deteriorate.

Leading economic indicators point to 4th quarter GDP growth of 0.8%.

Below we will examine what each leading economic indicator, as it is released, portents to our picture of the evolving economic landscape. This is our view at the moment and our projections may be confirmed or we may have to adjust them as different, new information, including freshly released economic indicators are made available.

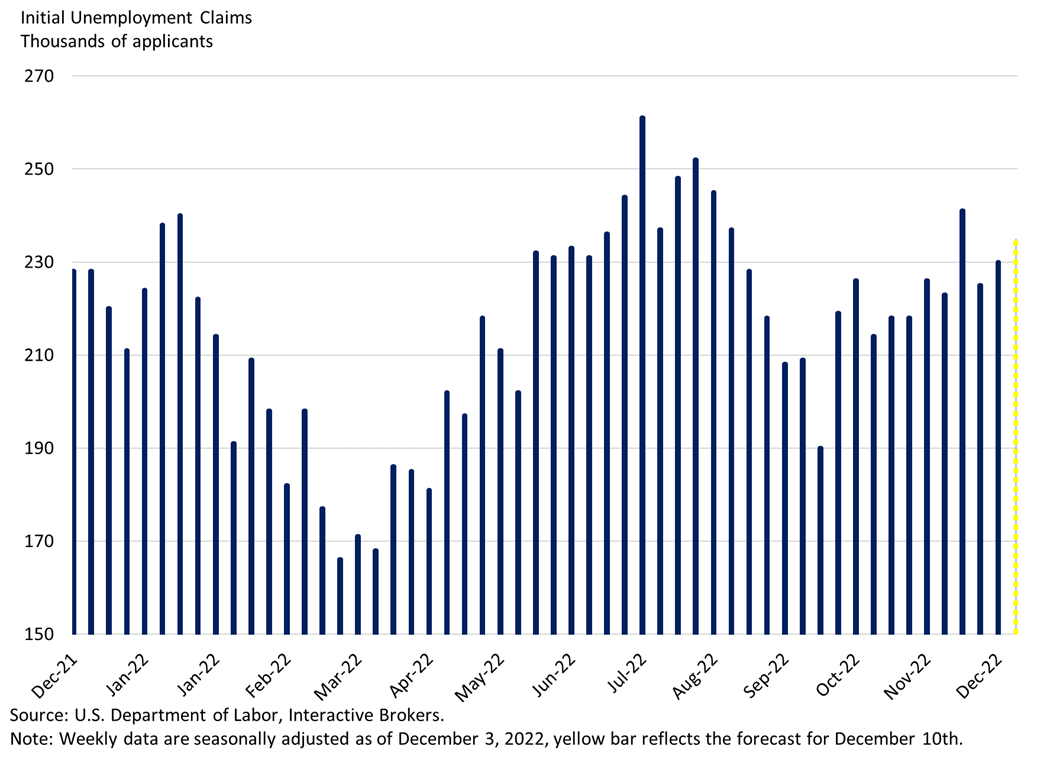

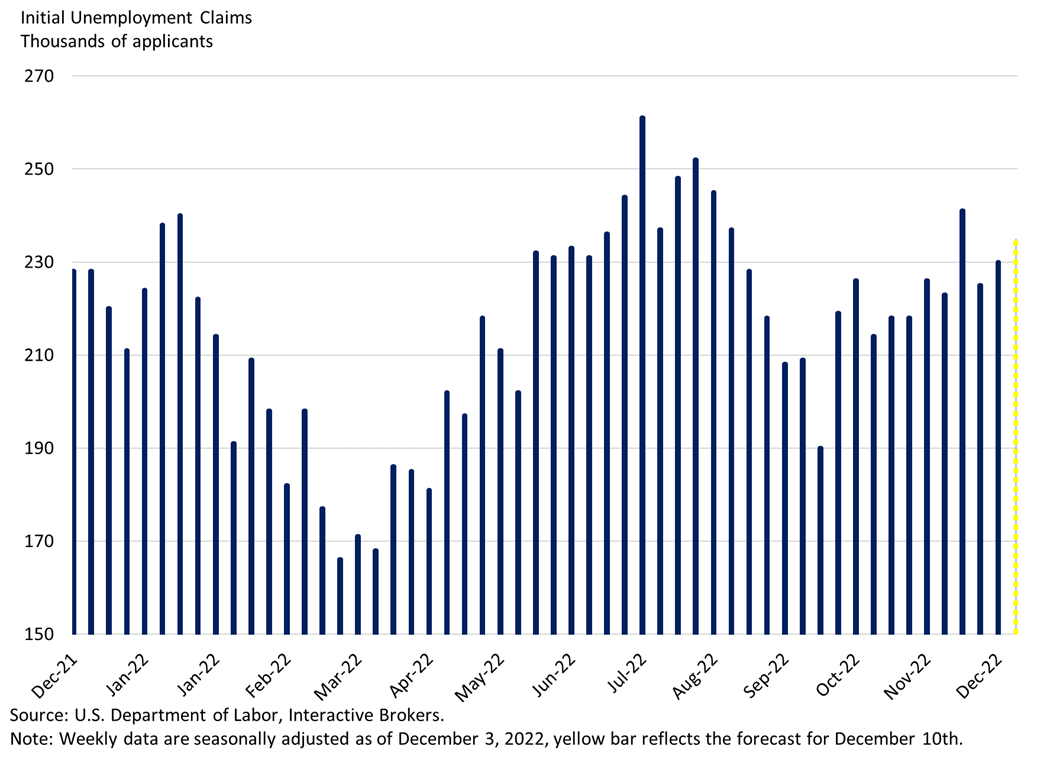

Initial Unemployment Claims

Initial unemployment claims have been volatile in the last few months against the backdrop of labor shortages, negative real wage growth and tighter financial conditions. While there’s been anecdotal evidence of hiring freezes and rising layoffs, we’ve also seen companies hoard labor due to difficulties hiring during the pandemic, the current labor shortage and compensation expenses that are rising slower than overall prices. We expect the economic slowdown, tighter credit conditions and higher interest rates to eventually lead to higher unemployment in 2023. Fiscal stimulus has been absent in 2022 unlike 2020 and 2021, constraining consumer spending. Persistent inflation has also pressured consumers and they’ve responded by consuming less, pressuring business revenue. During times of monetary policy tightening and higher interest rates, business revenue tends to slow because goods and services become more expensive to finance, leading to possible layoffs. If initial unemployment claims rise, it points to lower consumption, lower demand, lower inflation, lower long-term interest rates and lower GDP growth. If initial unemployment claims drop significantly, demand will rise, inflation will rise, long-term interest rates will rise and GDP growth will rise. The next release will be on December 15th. It is currently expected to be 235,000, an increase from the previous week’s reading of 230,000, sustaining the upward trend of the past few weeks. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

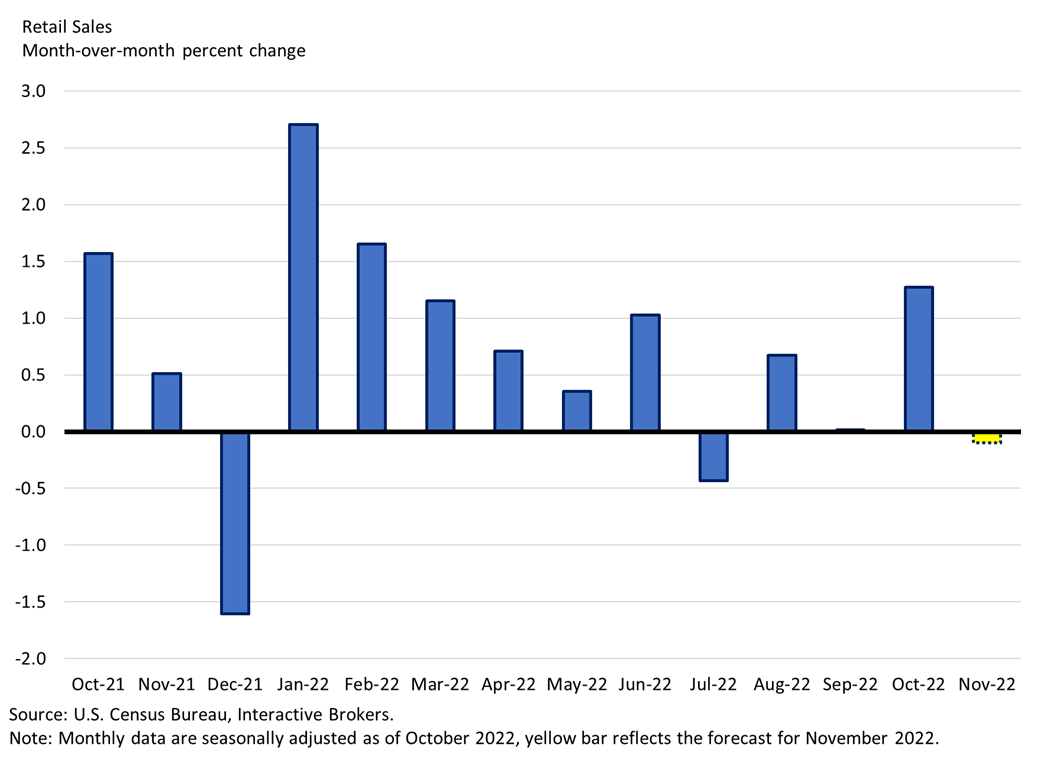

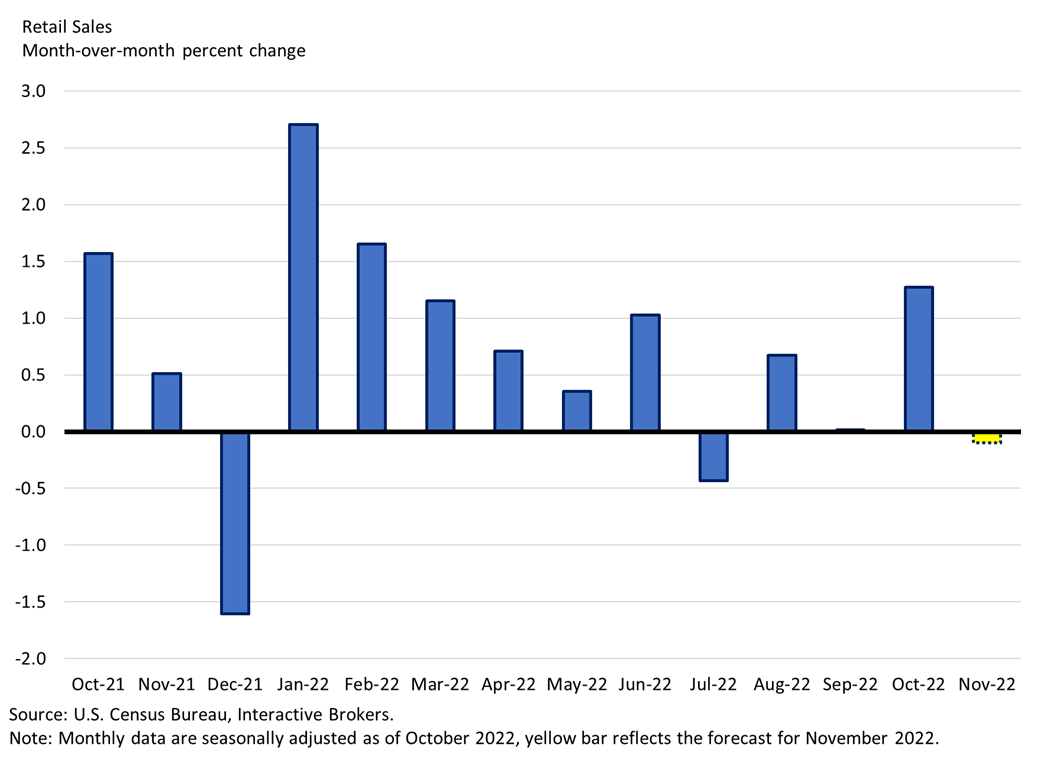

Retail Sales

The rate of retail sales growth is slowing against the backdrop of tighter financial conditions. After growing at a strong rate for most of the past two years supported by strong monetary and fiscal stimulus, retail sales have slowed and have contracted when adjusted for inflation in some recent months, implying that consumers are buying less on a volume basis. Expectations of continued slowing is expected as the Fed continues to tighten credit conditions and raise rates, slowing demand. Fiscal stimulus has been absent in 2022 unlike 2020 and 2021, constraining consumer spending on a relative basis. Persistent inflation has also emerged as a new headwind pressuring consumers and they’ve responded by purchasing less. During times of monetary policy tightening and higher interest rates, consumption tends to slow because goods and services become more expensive to finance. If retail sales continue to slow or contract in certain periods, it points to lower consumption, lower demand, lower inflation, lower long-term interest rates and slower GDP growth. If retail sales growth ramps up again due to monetary policy easing, consumption will rise, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on December 15th. It is currently expected to be a -0.1% month-over-month contraction, weaker than the previous month’s 1.3% gain. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

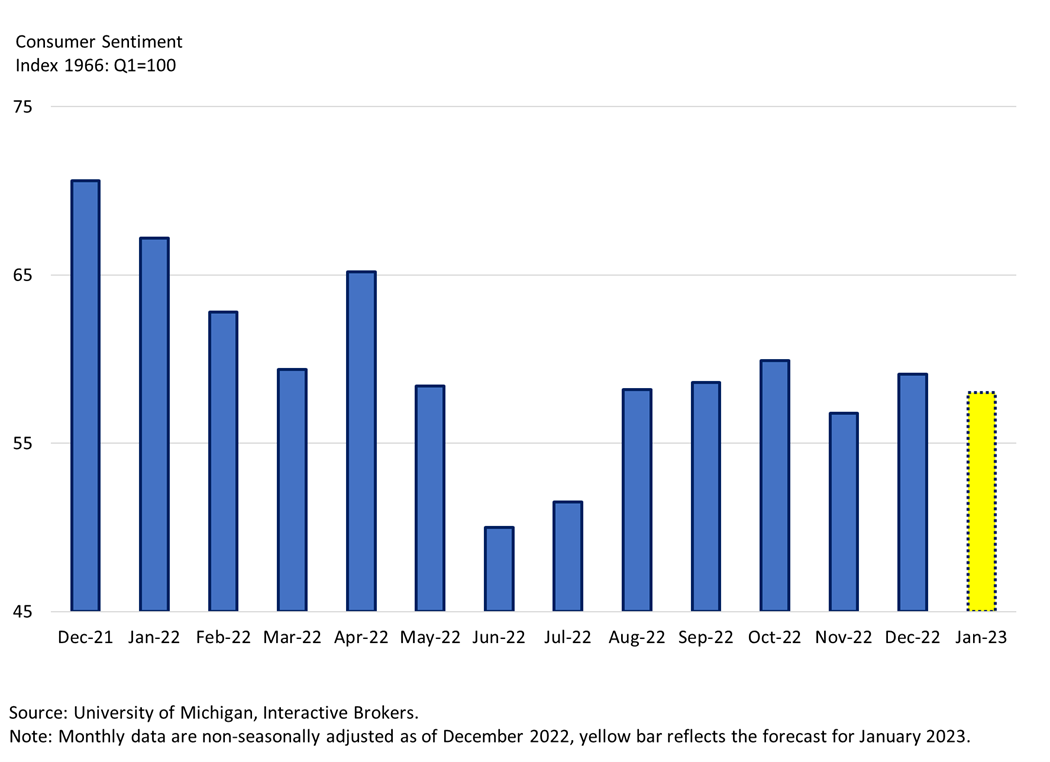

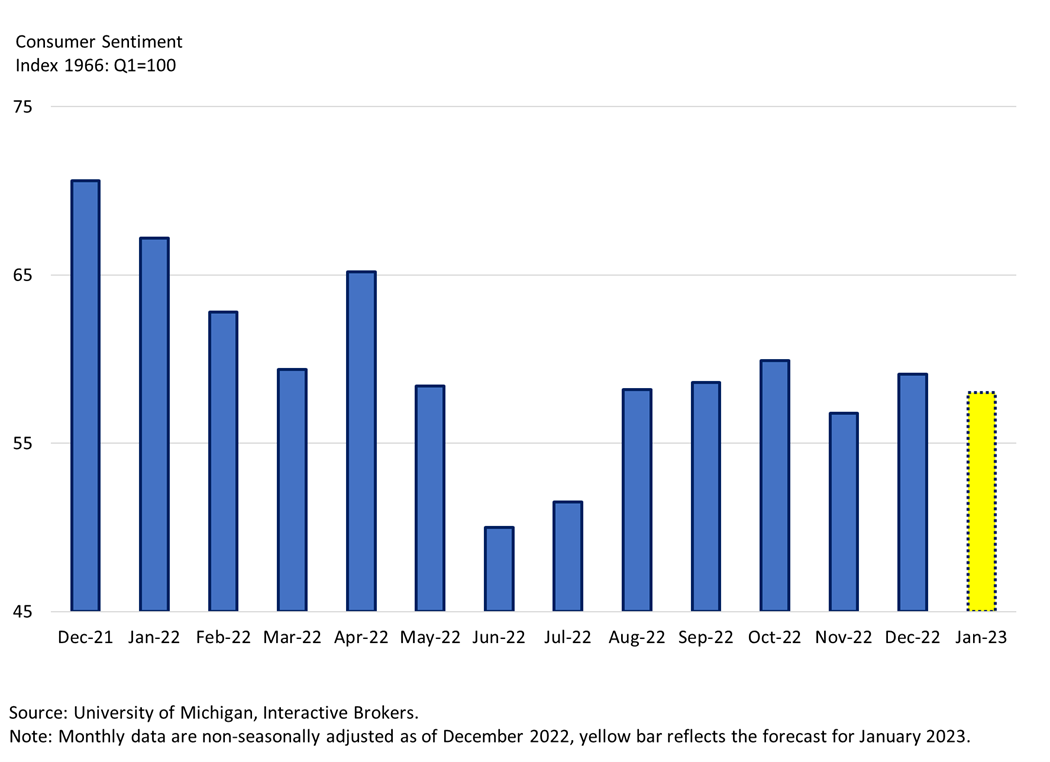

Consumer Sentiment

Consumer sentiment is weakening against the backdrop of tighter financial conditions and high inflation. After remaining at a strong level for most of the past two years supported by strong monetary and fiscal stimulus, consumer sentiment has slowed significantly. Expectations of continued slowing is expected as the Fed continues to tighten credit conditions and raise rates, slowing demand. Fiscal stimulus has been absent in 2022 unlike 2020 and 2021, constraining consumer sentiment on a relative basis. Persistent inflation has also emerged as a new headwind pressuring consumers and they’ve responded by purchasing less. During times of monetary policy tightening and higher interest rates, sentiment tends to weaken because employment conditions and business revenue growth generally soften while goods and services become more expensive to finance, hampering consumers. If consumer sentiment continues to weaken, it points to lower consumption, lower demand, lower inflation, lower long-term interest rates and lower GDP growth. If consumer sentiment ramps up again due to monetary policy easing, consumption will rise, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on January 13th. It is currently expected to be 58, a slight decrease from the previous month’s reading of 59.1, sustaining the downward trend from the past few months. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

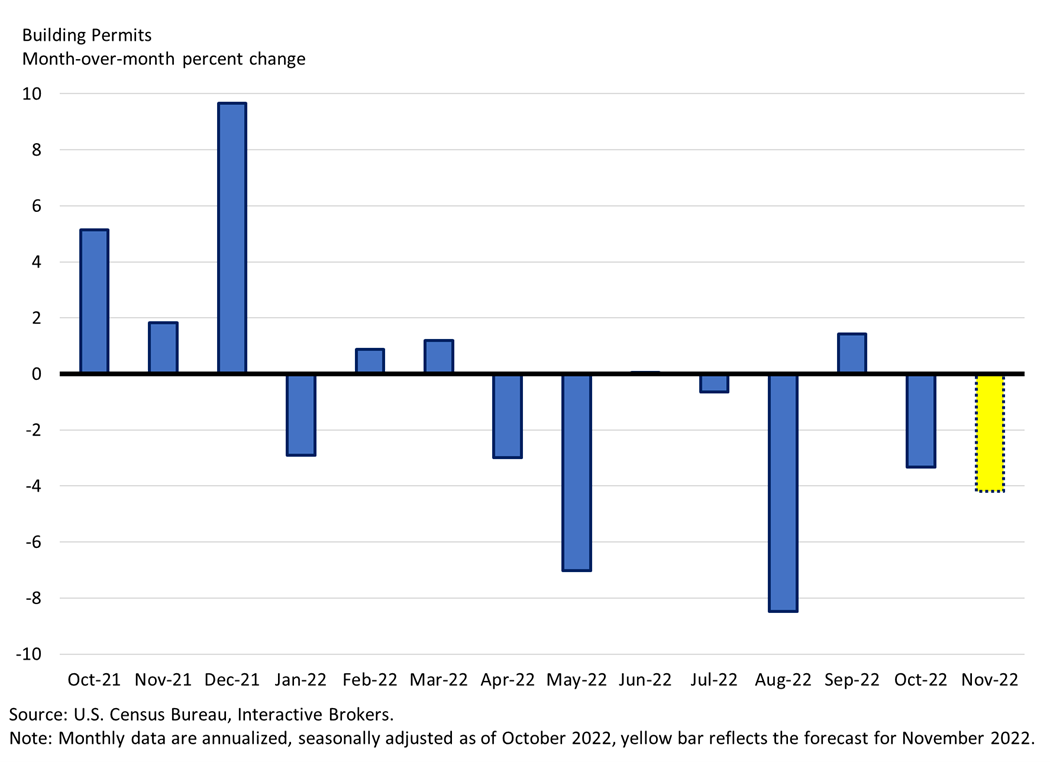

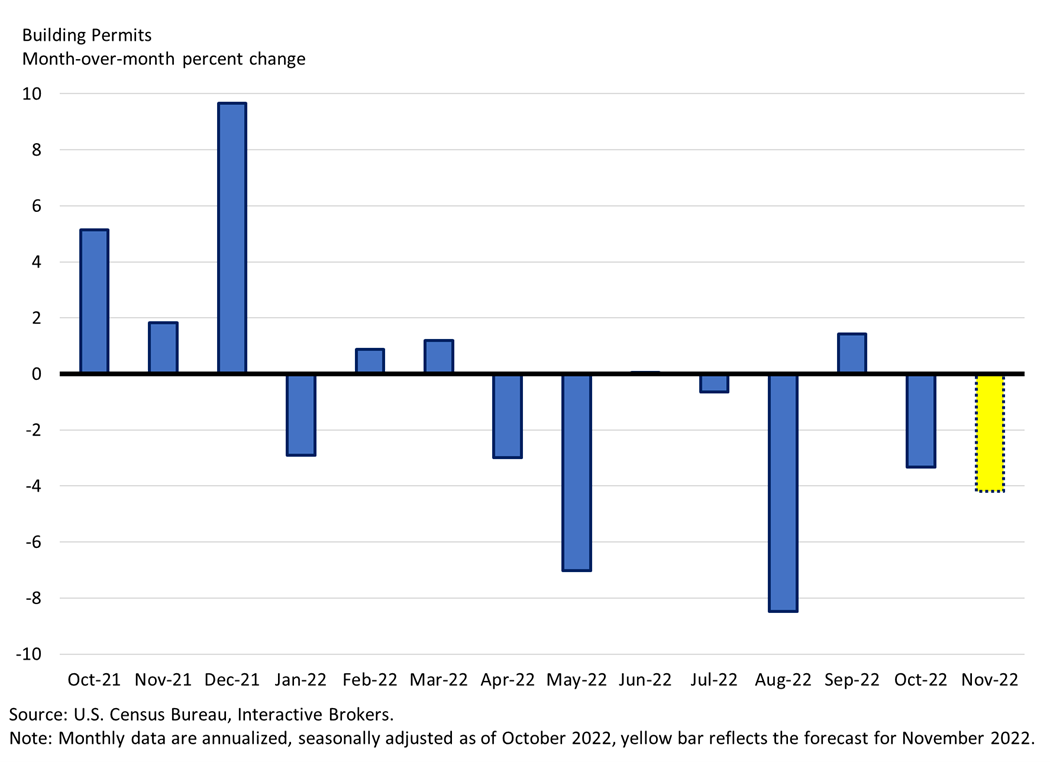

Building Permits

Building permits are falling against the backdrop of tighter financial conditions and a lack of homebuyers. After growing at a strong level for most of the past two years, supported by strong monetary policy stimulus and an increased demand for housing due to the pandemic, building permits have slowed and are now in contraction territory. Expectations of continued slowing is expected as the Fed continues to tighten credit conditions and raise rates, slowing demand in this capital intensive, economically cyclical, interest rate sensitive industry. Significant home price growth has pressured affordability to near its worst level in history, leading to significant contractions in mortgage applications. During times of monetary policy tightening and higher interest rates, building tends to slow because real estate becomes much more expensive to finance. If building permits continue to contract, it points to lower consumption, lower demand, lower inflation, lower long-term interest rates and lower GDP growth. If building permit growth ramps up again due to monetary policy easing, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on December 20th. It is currently expected to be a -4.2% month-over-month decline, an acceleration from the previous month’s contraction of -3.3% and sustaining the downward trend from the past few months. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

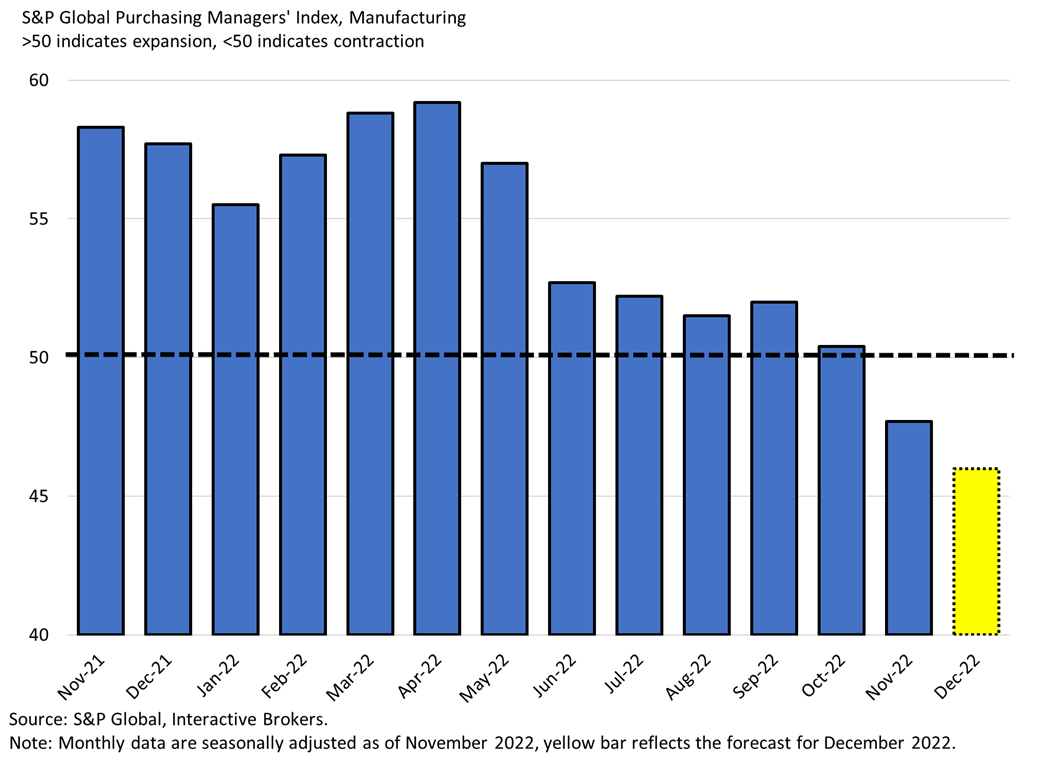

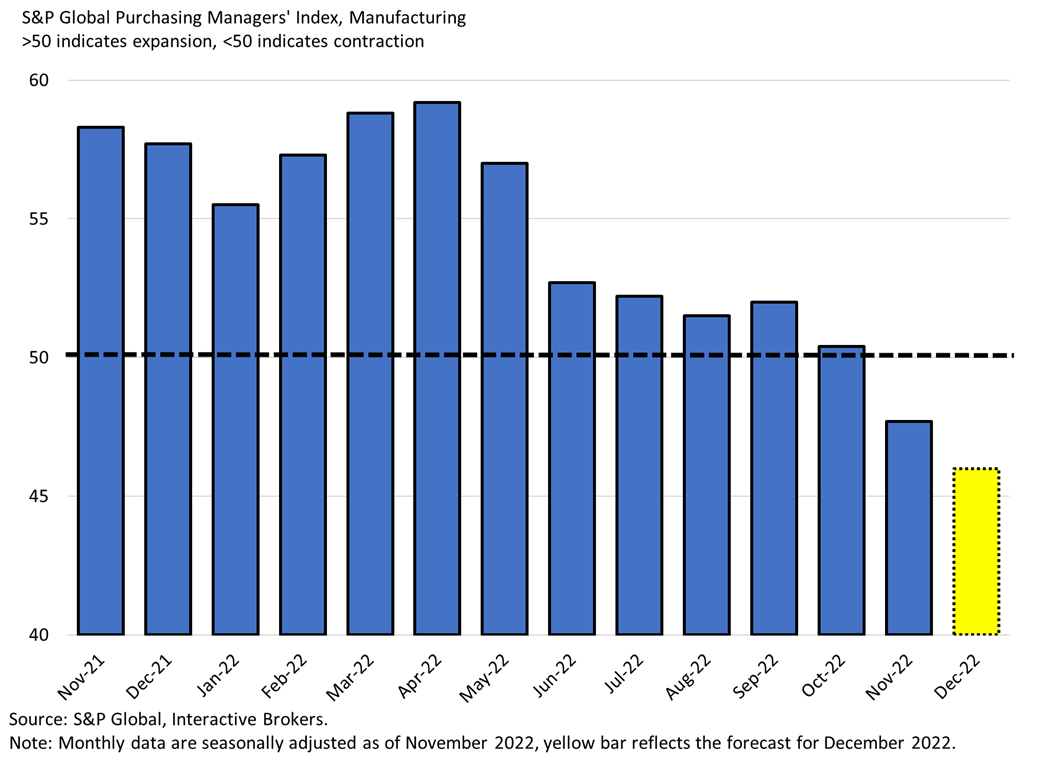

PMI-Manufacturing

Manufacturing activity is slowing against the backdrop of tighter financial conditions and slowing consumption. After expanding at a strong level for much of the past two years, supported by strong monetary and fiscal policy stimulus and an increased demand for manufactured goods rather than services due to the pandemic, manufacturing activity has slipped into contraction territory. New orders, the largest component of the index, has been in contraction territory for a few months, signaling depressed demand, historically a leading indicator of not just the manufacturing sector, but of the entire economy. Expectations of continued slowing is expected as the Fed continues to tighten credit conditions and raise rates, slowing demand in this capital intensive, economically cyclical, interest rate sensitive industry. During times of monetary policy tightening and higher interest rates, manufacturing tends to slow because manufactured, durable goods like furniture, automobiles, airplanes and factory equipment become much more expensive to finance. If manufacturing activity continues to slow, it points to lower consumption, lower demand, lower inflation, lower long-term interest rates and lower GDP growth. If manufacturing activity ramps up again due to monetary policy easing, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on December 23rd. It is currently expected to be 46, a decrease from the previous month’s reading of 47.7, sustaining the downward trend from the past few months and dipping further into contraction territory. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

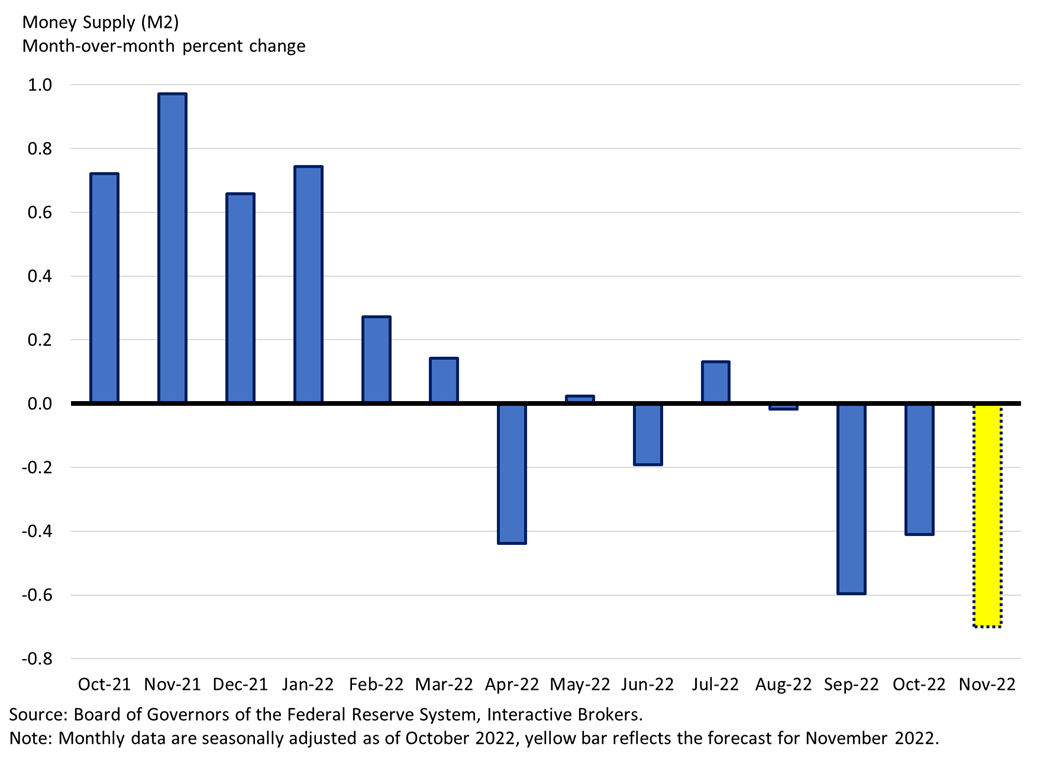

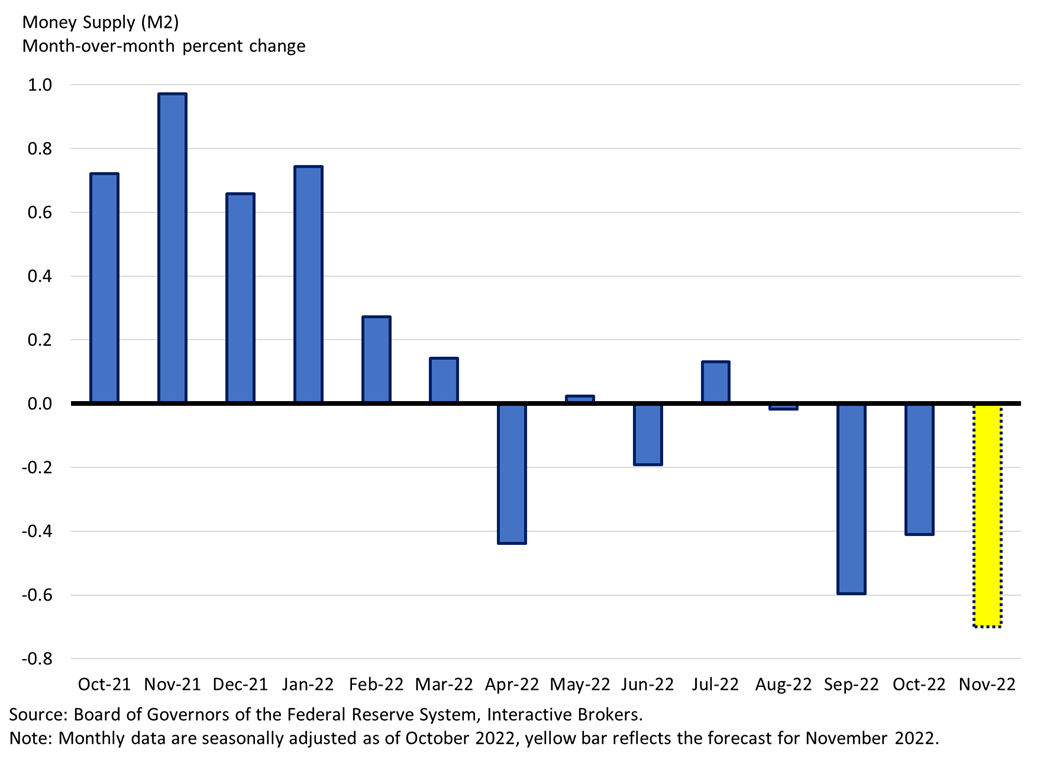

Money Supply

The rate of inflation and economic growth are weakening against the backdrop of a contracting money supply. The money supply, inflation and economic growth shift a great deal due to the Fed’s monetary policy. After increasing drastically since the emergence of COVID-19 to help businesses and households cope with pandemic disruptions, the money supply is currently contracting from its April 2022 peak. The Fed has pivoted from an accommodative monetary policy stance towards a restrictive one because it recognizes that money supply growth during years 2020 and 2021 contributed to today’s high inflation. In addition, reduced fiscal spending from Congress due to similar concerns about inflation also limit money supply growth. As credit becomes less available, the Fed continues to raise rates and reduce its bond holdings, and Congress doesn’t spend as much on a relative basis, the money supply is expected to continue contracting. The more persistent inflation ends up being, the longer the Fed will have to maintain a restrictive position and therefore, place a cap on money supply growth. At this point in time, trends of money supply contraction are speeding up because the Fed has a long road of tightening ahead in order to achieve the 2 percent inflation target. The Fed has embarked on an aggressive rate hiking campaign and has increased the pace of balance sheet reduction to a monthly cap of $95 billion from $47.5 billion in the months prior, further hampering money supply growth. If money supply growth ramps up again due to monetary policy easing, consumption will rise, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. If the money supply continues to contract, consumption will decline, demand will decline, inflation will decline, short-term interest rates will rise and GDP growth will slow. The next month’s release will be on December 27th. It is currently expected to be a -0.7% month-over-month decline, an acceleration from the previous month’s -0.4% reading, sustaining the downward trend from the past few months. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

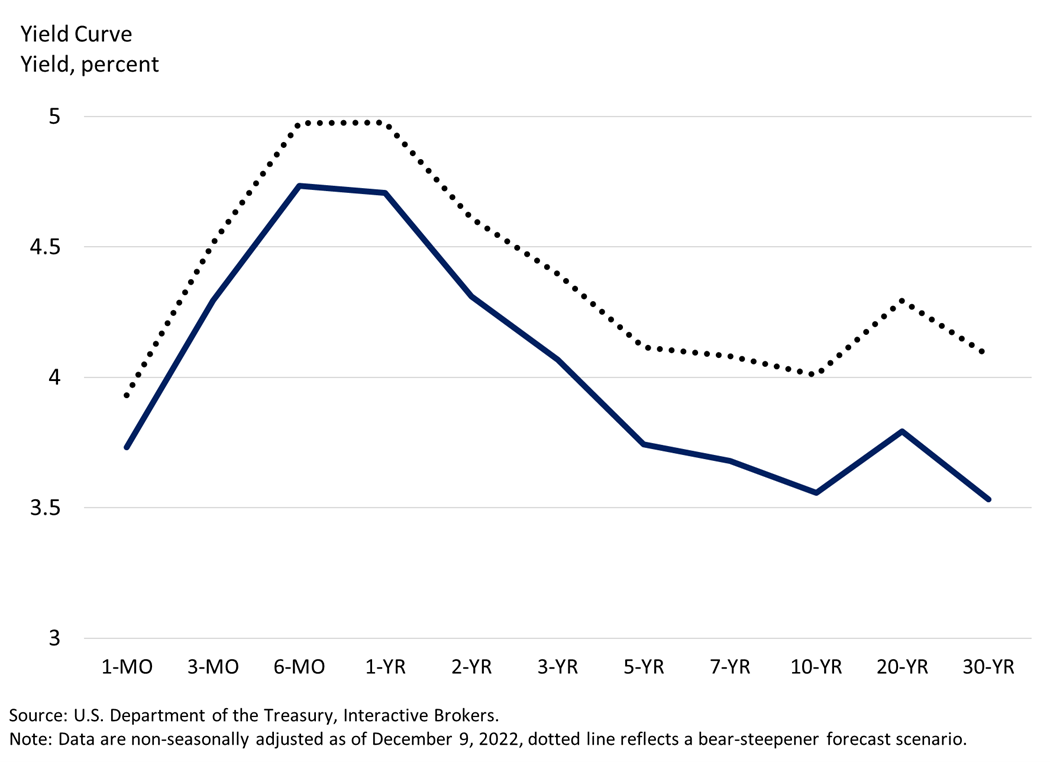

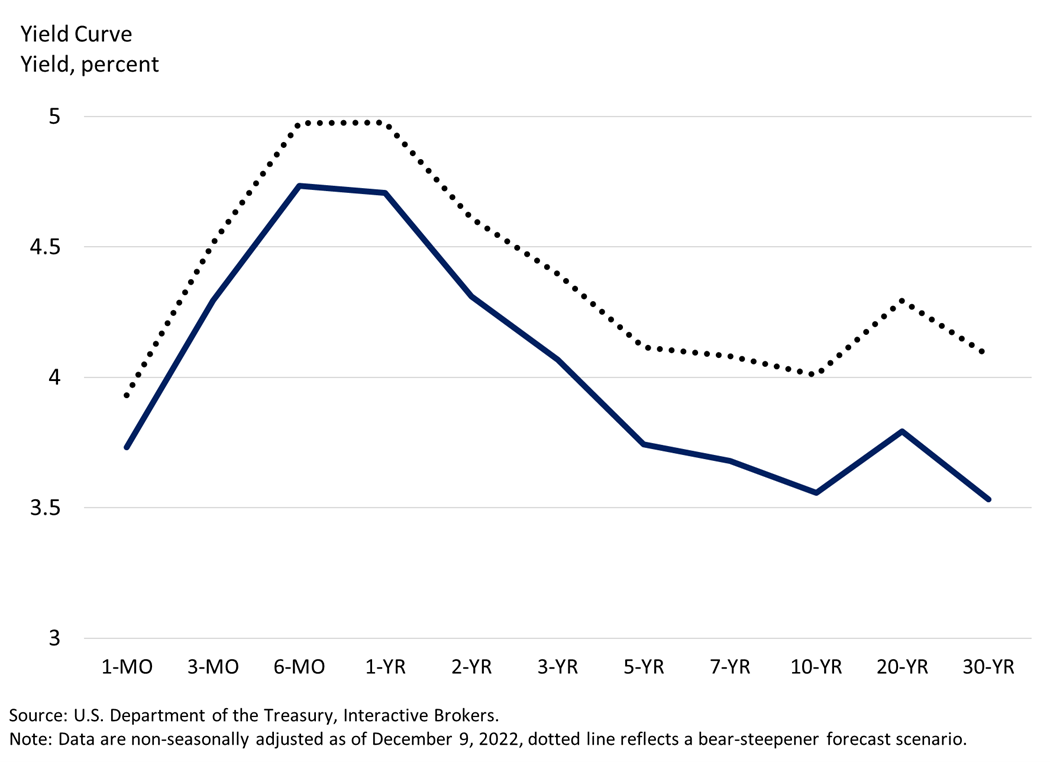

Yield Curve

The yield curve is severely inverted against the backdrop of tighter financial conditions and weak economic prospects. As the 2-year yield rose much faster than the 10-year since January, a bear-flattening move from a much steeper level over the past two years, the yield curve is now in deep inversion territory (-75 bps), signaling economic contraction ahead. The money supply increase led to a rise in inflation which compelled the Fed to raise short-term rates significantly. The longer end of the curve, the 10-year maturity, didn’t rise as fast because longer term economic growth and/or inflation isn’t expected to rise as strongly as short-term rates did. The yield curve inversion is telling us that there’s little chance the U.S. economy can handle the monetary policy tightening that’s in the pipeline without a recession. In this case a bull-flattener, where the 2-year would fall slower than the 10-year would be desirable but that would require inflation and inflation expectations to come down further, which will likely occur towards the end of Fed tightening. Although inflation expectation figures are off their peaks, we believe inflation will prove stickier and more resilient than the market thinks. Against the backdrop of persistent core inflation and a tight labor market, the expectation in the coming months is to see a bear-steepener where the 10 year rises faster than the 2-year due to an increase in inflation expectations. The main drivers of higher inflation in the medium to long-term are the shift from globalization towards regionalization, geopolitical tensions, relative inefficiencies regarding supply chains and the commodity complex, continued deficit spending and labor shortages. If the yield curve remains severely inverted, it points to lower consumption, lower demand, lower inflation, lower long-term interest rates and lower GDP growth. If the yield curve steepens again due to monetary policy easing, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The yield curve inversion (2s, 10s) has predicted the last 6 out of 6 recessions.

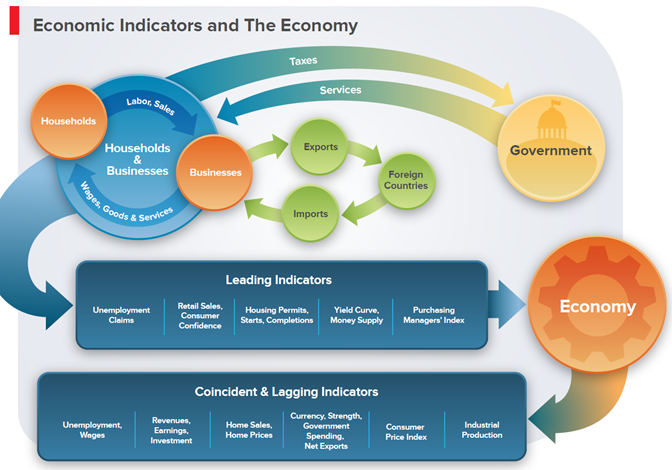

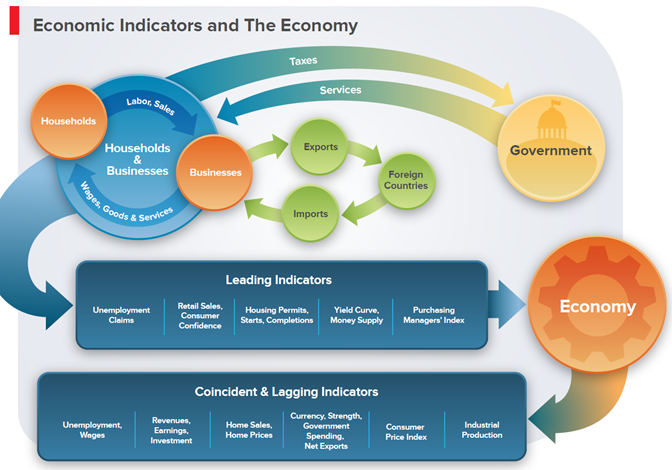

Economic Indicators & The Economy

Below is a picture showing how leading, coincident and lagging economic indicators reflect household, business and government activity. Leading indicators provide early signals of future economic health while coincident and lagging indicators confirm the economic trend in later periods.

Source: Interactive Brokers

Content: Jose Torres – Design: Lucas Deaver

Watch Videos About Key Economic Indicators at Traders’ Academy – Click Here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.