Yay, it’s Fed Day! OK, that might be a bit much, but after weeks of speculating what the FOMC may or may not announce, we’ll know for sure at 2PM EDT.

As I write this, it is almost certain that the FOMC will raise its Fed Funds target by 0.75% to 3.75-4%. Fed Funds futures actually show a very slight probability for a full 1% hike, but it would be highly uncharacteristic for this Fed to deviate after weeks of telegraphing a 75-basis point hike. The larger questions involve the pace of future hikes and the so-called terminal rate – the level at which the Fed stops raising rates in this cycle.

It is difficult to imagine that either the FOMC statement or Chair Powell’s press conference will definitively answer either of those crucial questions, but investors will nonetheless be assiduously hunting for clues. Though it is useful to search for changes in messaging between the current and prior statements, the meeting statement is normally anodyne. The FOMC typically updates its “dot plots” once a quarter, and this is not the time in the meeting cycle when a fresh plot would be expected. That means we are unlikely to be able to rely on that source of information.

As usual, then, all eyes and ears will be on Chair Powell’s press conference. Unfortunately, even that might be less helpful than what we’ve become accustomed to. Although I’ve repeatedly referred to Chair Powell as “Goldilocks in a suit”, I may need to retire that construct. Remember the July meeting, when investors became enamored with his use of the term “neutral”, only to be reminded in a few weeks later – in no uncertain terms — that the Fed was committed to using rate hikes to fight inflation, even if they reduced overall demand in the economy. It seems hard to imagine him deviating too much from that stance.

Furthermore, there have been rumblings that the Fed might become a bit less transparent in their messaging. Some Fed watchers believe that a bit more mystery might actually be helpful for the central bankers. If there is ambiguity in their messaging, then there is less risk that they will be perceived as turning about face. Stating a higher reliance on data dependency while committing less to specific targets would be a clue a shift to translucence, if not opacity.

Bear in mind that central bank ambiguity is likely to result in more intraday volatility, however. If it is difficult to establish a consensus, then markets must spend more time finding one. We have seen a trend towards higher volatility in the post-meeting periods after recent FOMC meetings, and a less clear Fed could continue that trend.

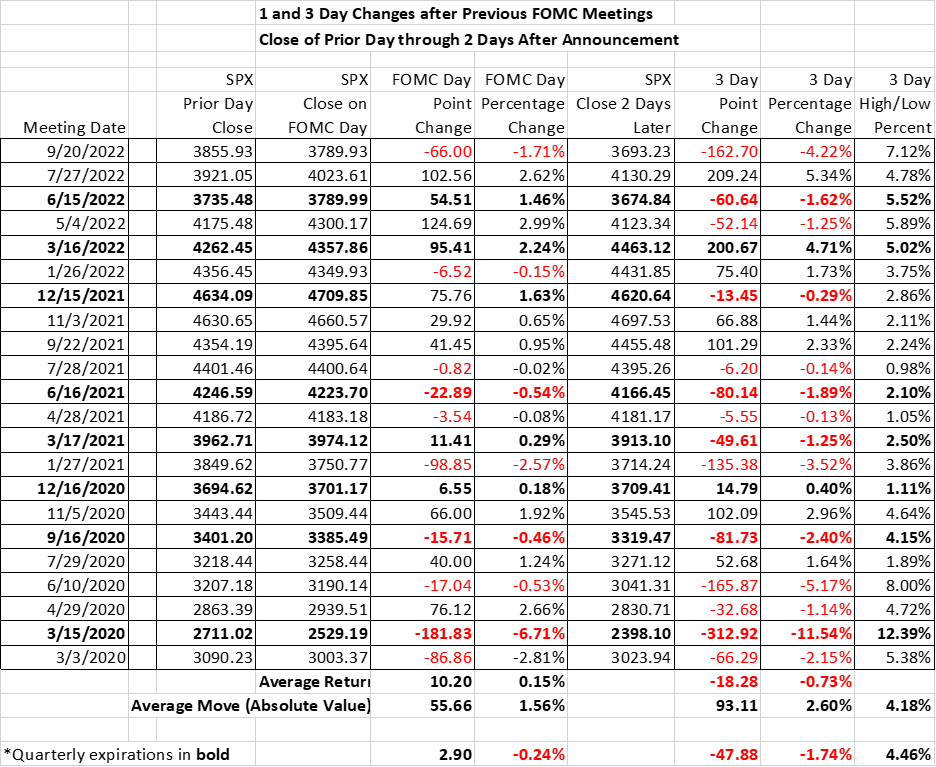

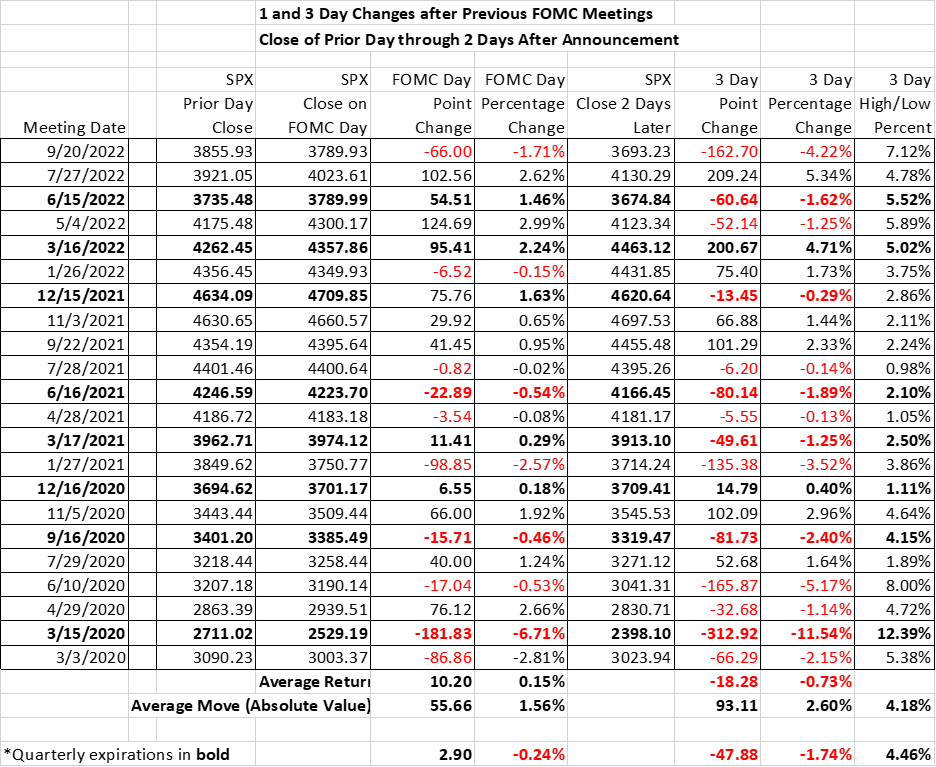

Pay close attention to the two rightmost columns in the table below. We pay attention to the three-day period that includes the FOMC announcement and the subsequent two sessions. The rationale is that traders often react abruptly while investors usually need some time to fully digest the news. Because meeting results are typically announced on Wednesdays, that means we usually end up measuring the Wednesday through Friday period, with Tuesday’s close as the starting point.

The last two meetings have brought high volatility, with -4.22% and 5.34% moves respectively. Note also that the high-low moves during the three-day period[i] have ranged from 4.78% – 7.12% after the past five meetings. Notice also how both the moves have been steadily much higher than the ones we experienced during the late-2020 through 2021 period. We have been asserting that monetary stimulus suppresses volatility while a restrictive policy tends to exacerbate it. This is yet another example.

There will be much to consider this afternoon. At 2PM EDT we’ll know what will come from today’s FOMC meeting, and over the next hour and a half we’ll be considering the ramifications of Chair Powell’s press conference. There is only one certainty: by about 2:30 we’ll already be speculating about what will come six weeks from now, at the next meeting.

Source: Interactive Brokers

—

[i] The three-day high/low move is measured from Wednesday’s open through Friday’s close, while the three-day percentage change is measure from Tuesday’s close to Friday’s close. If markets have a gap open on Wednesday it can cause the high/low to be smaller than the closing move.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.