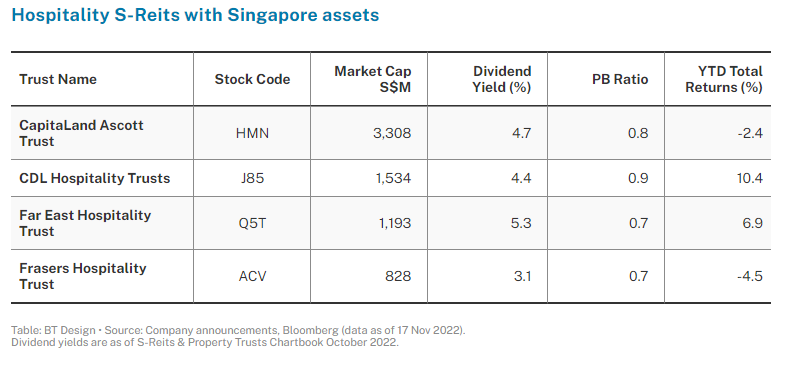

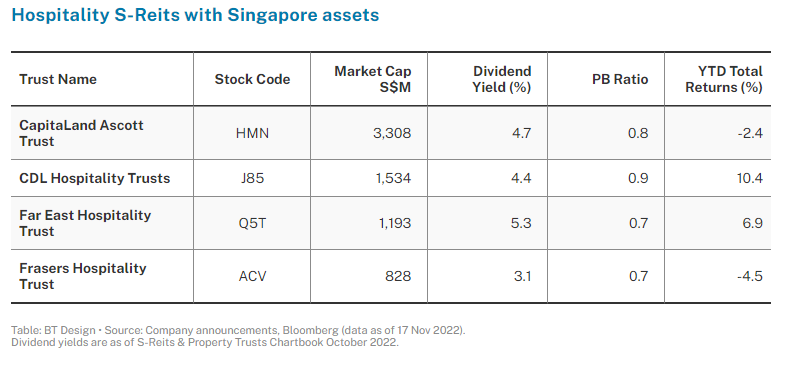

International tourist arrivals to Singapore rose for a ninth straight month in October and this is expected to continue to grow at a gradual pace in the coming months.

All hospitality trusts with Singapore assets observed significant improvements in occupancy and RevPAR (revenue per available room) in the last quarter, driven by the return of large-scale events and the Mice (meetings, incentives, conventions and exhibitions) industry, alongside pent-up demand for overseas travels.

CapitaLand Ascott Trust updated that revenue and gross profit for Q3 2022 were higher year on year (yoy). Gross profit rose to approximately 90 per cent of Q3 2019 pro forma levels due to contributions from several new properties and full quarter contribution from Wildwood Lubbock, as well as stronger operating performance of the existing portfolio.

Even without these contributions, gross profit rose 70 per cent yoy. Portfolio RevPAU rose 88 per cent yoy to S$132 with Australia and USA continuing to perform at close to pre-Covid levels. The trust’s stable income portfolio, which contributes 56 per cent of Q3 2022 gross profits, recorded improvements across its master leases, longer-stay properties, and management contracts with minimum guaranteed income (MCMGI).

CDL Hospitality Trusts updated that its net property income (NPI) for 9M 2022 improved 43.7 per cent to S$82.6 million, with the most significant contributors being Singapore and Australia properties which collectively increased by S$15.4 million yoy for Q3 2022. In Q3 2022, RevPAR for 12 hotels (out of 18) exceeded Q3 2019 levels.

In its Singapore hotels, occupancy rate has improved from 72.3 per cent in Q3 2021 to 88.1 per cent in Q3 2022, driven by the recovery of Singapore’s Mice industry and events. The trust remains positive in the outlook for demand recovery in Singapore as visitor arrivals and events continue to pick up, and it also believes there is potential for pent-up demand to take place in Japan following the reopening of borders in October 2022.

Far East Hospitality Trust recorded that its Q3 2022 gross revenue increased 2.0 per cent yoy, led by growth from the hotel segment which increased 4.7 per cent. Income available for distribution grew 12.0 per cent yoy from higher NPI and interest income.

During Q3 2022, RevPAR and average daily rate for its hotels continued to improve (101.9 per cent and 107.6 per cent yoy, respectively) and surpassing that of the first two quarters of 2022. For its services residences segment, RevPAR and average daily date grew 66.7 per cent and 32.4 per cent yoy in the quarter, respectively, achieving two consecutive quarters of growth this year.

Frasers Hospitality Trust reported full year results for FY2022. Gross revenue improved 12.1 per cent yoy due to relaxed travel restrictions and higher vaccination rates. NPI and income available for distribution increased 20.7 per cent and 66.3 per cent yoy, respectively, from lower property tax expenses arising from lower assessed annual values of Singapore properties and recovery of receivables previously impaired.

The improvement across its portfolio lifted its distribution per stapled security (DPS) in FY2022 by 66.4 per cent yoy to 1.6355 cents. Improvements in RevPAR were recorded across most of its operating markets. In Singapore, RevPAR grew 75.7 per cent yoy in H2 2022 from the resumption of events and tourist arrivals.

REIT Watch is a weekly column on The Business Times, read the original version

Originally Posted November 21, 2022 – REIT Watch – Hospitality S-REITs ride on pent-up travel demand and the return of events in 3Q22

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.