This has been a long and eventful week. It seems like ages ago, but it was less than seven days since we saw a 10% downward weekend move in bitcoin. Though it was quite significant at the time, the second down move in two weekends proved only to be a precursor for the eye-watering down move and partial recovery that we saw in cryptocurrencies on Wednesday. We all know that bitcoin has been a recent underperformer this month, but the following graph illustrates just how much:

SPX, NDX, Bitcoin and GLD Normalized Month-to-Date

Source: Bloomberg

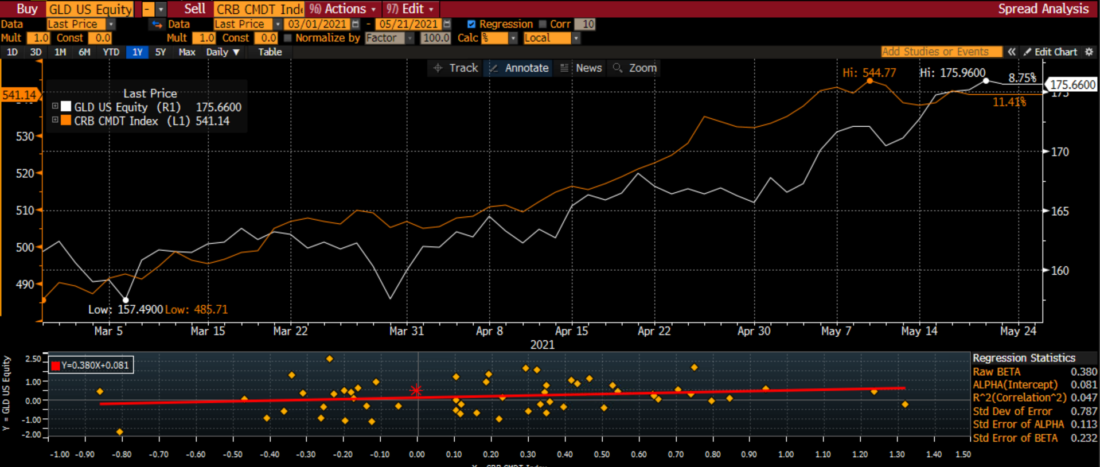

We see that major indices like the S&P 500 (SPX) and NASDAQ 100 (NDX) are relatively stable this month, bitcoin has been a significant underperformer. It is down by about 1/3 this month! Interestingly, while “digital gold” has been under significant pressure, gold prices (using the GLD ETF as a proxy) have been ticking higher. For the past few weeks, gold has started to follow the CRB index, which measures commodity price inflation, more than acting as the “anti-dollar”. This is a change from when we checked in about 6 weeks ago. That was around the time that investors began to get concerned about inflation, and gold had only just begun to follow the key inflation measure after ignoring it for the prior months. The chart below shows how the general trends have begun to follow each other, though the correlation of daily percentage moves remains low:

GLD vs CRB Index with Linear Regression

Source: Bloomberg

A few weeks of general trend following with a low actual correlation is hardly a foolproof trading signal, but it is notable that investors may be focusing on gold as an inflation hedge after looking elsewhere. Certainly those who looked to bitcoin as an inflation hedge in recent weeks have been severely disappointed. That said, even after the recent declines, bitcoin remains a star performer year-to-date:

SPX, Bitcoin, GLD, CRB Normalized Year-to-Date

Source: Bloomberg

Bitcoin is still up about 30% this year. That would normally be considered stellar performance, but it pales somewhat when we consider its volatility. The problem is especially acute when we consider that many crypto investors were late to the game. I wrote about this phenomenon on April 19th, just after bitcoin peaked:

… my wife’s explanation … “on Wednesday, my financially illiterate trainer finally heard about Bitcoin and recommend that I should invest in it because she heard was impossible to lose money doing so.” That was roughly the top of bitcoin, at least for now. A similar recommendation from a shoeshine boy allowed Joseph Kennedy to largely avoid the stock market crash of 1929.

As of now, my wife’s trainer top-ticked bitcoin and proves inversely prophetic. I don’t want to blame her, though. She was repeated what she heard from other excited clients who had recently bought bitcoin and had been profiting from the crypto’s rise until then.

Also bear in mind that while gold has been performing better lately, it is still down marginally this year and has not kept pace with a CRB Index that is over 15% higher. There is no perfect hedge for commodity price inflation other than buying the commodities themselves. But that’s not a hedge, that’s either investment or speculation.

As of now, the steady year-to-date 11% appreciation in SPX has been a solid winner for many, even despite this month’s flattish performance. It may seem dull relative to other investment choices, and there may be bumps in that index ahead, but it is proving to be a winner so far.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.