In North America and the U.S. specifically, the hunt for lithium, a key component of batteries used in electric vehicles (EVs), has historically trailed a handful of other countries.

Is your portfolio positioned for a “white gold” rush?

In North America and the U.S. specifically, the hunt for lithium, a key component of batteries used in electric vehicles (EVs), has historically trailed a handful of other countries. That includes Australia, which mines more “white gold” than all other countries combined, and China, the leader in both lithium refining and lithium-ion battery production.

But with last week’s announcement that the White House is deploying nearly $3 billion to boost domestic output of EV batteries and the minerals used to make them, it may be time for investors to take notice.

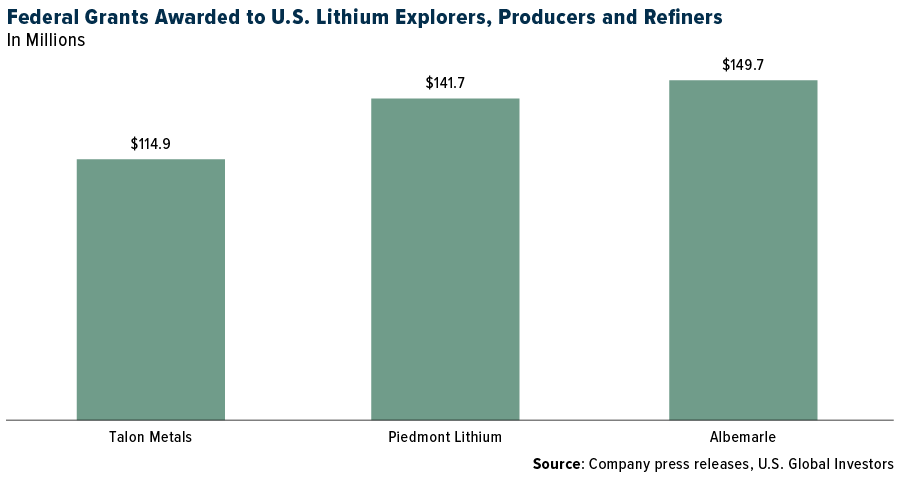

In an October 19 press release, the Biden Administration said it was awarding $2.8 billion in grants to as many as 20 U.S.-based companies to “expand domestic manufacturing of batteries for electric vehicles and the electrical grid.” The lion’s share of the investment—part of the $1.2 trillion Bipartisan Infrastructure Law, signed in November 2021—will go to three companies involved in the production of critical minerals including lithium.

More than $114 million is set aside for Talon Metals, which will use the grant to support the construction of a battery minerals processing facility in North Dakota. In January of this year, the Minnesota-based company entered into an agreement with Tesla to supply 75,000 metric tonnes of nickel concentrate from its Tamarack Nickel Project in Minnesota.

Piedmont Lithium, one of our favorite industry plays, was selected to receive $141.7 million. The North Carolina-based company says the investment will go toward the construction of a new lithium project in Tennessee, which aims to supply up to 30,000 metric tonnes of lithium hydroxide per year.

Also based in North Carolina, Albemarle is the recipient of a $150 million grant. The company says this will help support the construction of a new lithium concentrator facility at its Kings Mountain location in North Carolina. Albemarle hopes to eventually have the capacity to produce up to “100,000 metric tonnes of battery-grade lithium per year to support domestic manufacturing of up to 1.6 million EVs per year,” the company said in a press release.

As context, the entire global lithium industry produced 100,000 tonnes in 2021, according to the U.S. Geological Survey (USGS).

Shares of all three companies traded sharply up on the news last week, with Talon Metals both more than 16%, Albemarle 13% and Piedmont Lithium an incredible 22%.

Weaning The U.S. Off Chinese Lithium Products

To impress upon you how much of a game-changer these investments are expected to be, the U.S. has been a virtual non-player in the global lithium game until now, with production limited to a single brine project in Nevada. Besides Australia and China, other big suppliers include Chile and Argentina, with Zimbabwe, Brazil and Portugal gaining ground.

This presents a national security issue, especially if the U.S. is to meet the Administration’s goal for EVs to make up half of all new passenger vehicle sales by 2030. Lithium is quite literally poised to become “the new gasoline.”

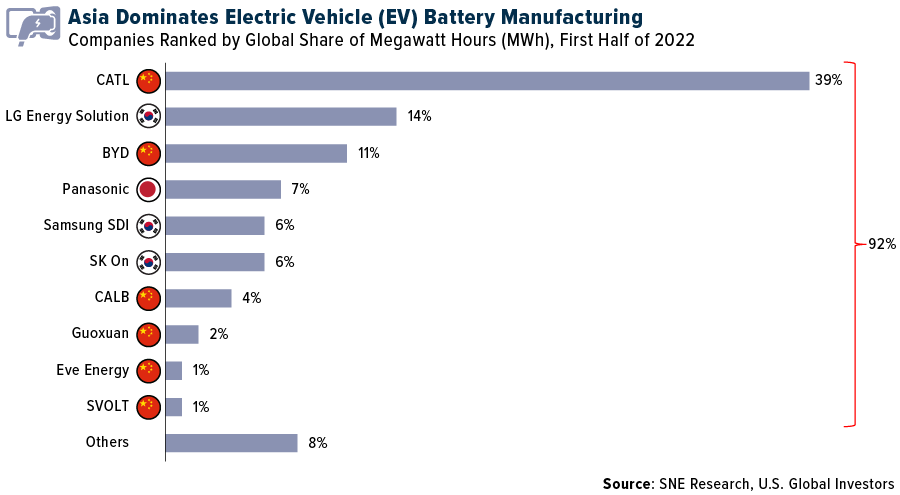

As for batteries, Asia is hands down the global leader in manufacturing, with only 10 companies accounting for 92% of the world’s supply. Close to two-fifths of all batteries are produced by a single Chinese company, Contemporary Amperex Technology Co. Limited, or CATL. Earlier this year, CATL introduced its EVOGO system, which allows Chinese EV drivers to swap out batteries at special stations in a fraction of the time it takes to charge them. The company now has plans to expand to international markets.

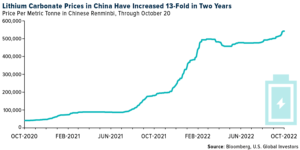

Driven by increasing global demand, lithium carbonate prices have exploded worldwide. But in China, where the renminbi has plunged to near-record lows against the dollar, a tonne of the stuff now trades at more than half a million yuan, or approximately $75,000. That’s up 13-fold in just two years.

What this means is that Chinese inflation is being exported alongside the physical batteries that CATL and its peers supply to Tesla, Ford and other U.S. carmakers. Bringing end-to-end production to the States would not only bolster national security but also stabilize prices. It might also give investors better investment options in more favorable jurisdictions.

Tesla Confirms Plans To Refine Its Own Lithium In Texas

During Tesla’s earnings call last Wednesday, CEO Elon Musk commented on lithium prices, calling them “crazy expensive.” He also confirmed that the company was moving forward with plans to build its own battery-grade lithium hydroxide refinery facility near Corpus Christi, Texas, just three hours south of Tesla’s headquarters in Austin.

I’ve often said that corporate investment and innovation should be the main driving force behind finding solutions to lower emissions, and I hope that Musk can deliver.

Although Tesla vehicle deliveries in the third quarter came in below expectations, largely due to logistics and shipping snarls, Musk expressed confidence in an “epic end of year.” He also shocked listeners by saying he believed that Tesla’s market cap would one day eclipse the combined market caps of Apple and Saudi Aramco, the world’s two most valuable companies. As I write this, Tesla’s valuation stands at around $661 billion, while Apple and Saudi Aramco’s is $4.5 trillion. No one’s ever accused Musk of lacking ambition.

—

Originally Posted October 24, 2022 – Is Your Portfolio Positioned For A Lithium “White Gold” Rush?

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/22): Tesla Inc., Talon Metals Corp., Piedmont Lithium Inc.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.