I just returned from Bucharest, Romania where I spoke at a grain conference focused on Black Sea grain production, transportation, logistics, and trading.

Many of those in attendance were from Ukraine, including a representative from one on the largest producers, which farms 150,000 hectares (370,658 acres). A portion of that company’s output is from an area near the deepest penetration of the Russian invasion. The producer indicated that the land was infested with land mines, some located on the surface, some just under the surface, and others at plow depth.

Prior to the war, Ukraine reportedly had 3 million mines in possession, and it was under an agreement to begin destroying them. Ukraine denied using mines as a defensive measure at the start of the war, but military experts believe that both sides have used them. There are estimates Russian had 26 million mines at the start of the war.

There are estimates that as many as 70,000 square miles have been planted with mines. Many of which are the “butterfly” variety that are easily scattered across wide range. An area the size of Austria is believed to be affected.

So far, the US has donated $89 million to locate and destroy the mines. There have been reports of them being removed at the rate of 2,000 per day, with a total of 200,000 extracted to date. There have also been reports that 10 farmers have been killed when their tractors touched off the mines.

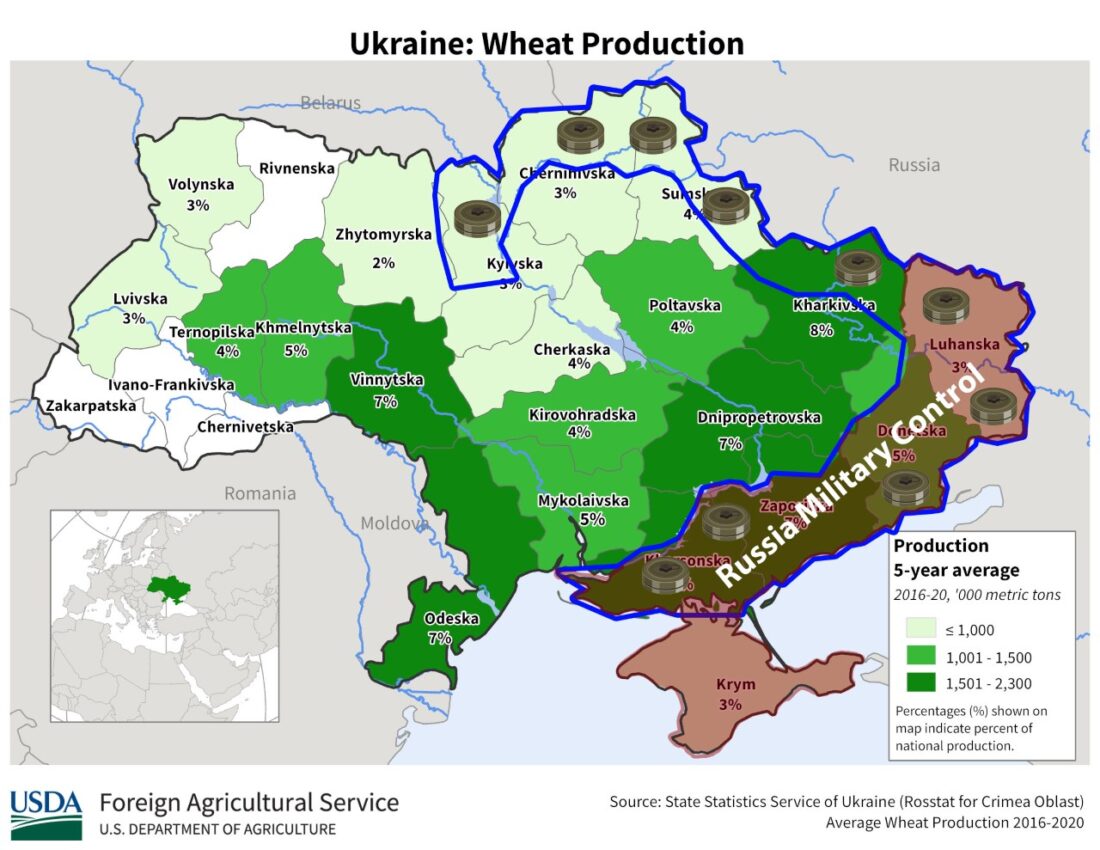

The producer mentioned above expects Ukraine’s grain production to fall more than the official forecast, which calls for a 25% decline from last year’s 25% decline from the record level in 2021. In addition to the lost acreage, there is a severe shortage of fertilizer. Prior to the war, Russia was a major supplier.

Ukrainian exporters are having to pay demurrage charges that are triple the normal level or more. Instead of 5 euro per tonne, rates have periodically reached as high as 50 euro. A major problem is that grain trucks have sometimes have to wait for weeks to cross borders, and then once the grain reaches the Danube, the delays become even longer. In some areas the river is less than 3 meters deep, and long barge chains must be broken apart and pulled beyond the low water zone separately.

There are also worries that dredging efforts, which were poor last year, may not make satisfactory progress this season. According to an official at the Danube River commission, there is a 50% chance that movement will be significantly less this year and a 50% chance that it will be slightly higher.

—

Originally Published March 31, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.