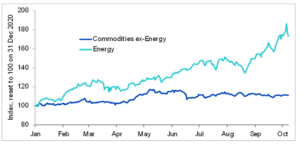

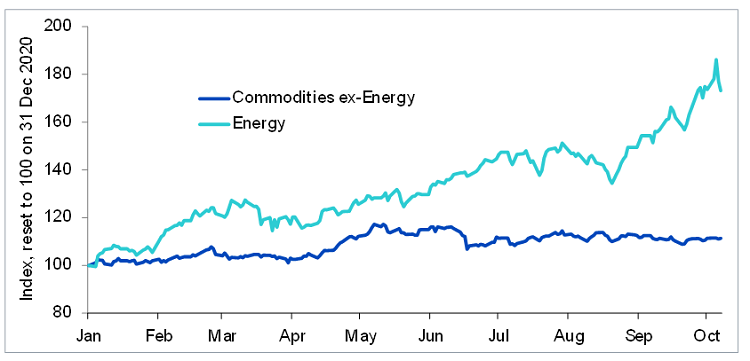

Energy markets are creating headlines. As of 07 October, the Bloomberg Energy Subindex is up around 73% year to date1 (see figure below), with contributions from across the basket. What’s driving the individual commodities, how are their stories intertwined, and what might be the risks on the horizon?

Figure 1: Energy prices have diverged meaningfully from other commodities this year

Source: WisdomTree, Bloomberg. Data as of 07 October 2021. Energy is the Bloomberg Energy Subindex, and Commodities ex-Energy is the Bloomberg exEnergy Subindex. Total Return Indices in USD used.

Historical performance is not an indication of future performance and any investments may go down in value.

Following their meeting on 04 October, the Organisation of the Petroleum Exporting Countries and its partners (OPEC+) have decided against increasing the rate of supply additions. Earlier in the summer, the group agreed to increase production by 400,000 barrels per day (b/d) each month between August 2021 through 2022 – the aim being to bring production back to pre-pandemic levels by the end. The initial reaction in oil markets was that Brent surged past $80/barrel – its highest level since October 2018, while WTI also came close to $80/barrel, its highest level since 2014.

OPEC+ do not see a clear case for increasing the rate of supply given the risk of Covid derailing demand recovery over the winter. If this risk does not manifest, however, and demand growth is faster than the current rate of supply growth, oil prices may gain further momentum. The initial reaction of oil prices to the group’s decision suggests a broad expectation for the supply rate to be increased. Additional supply would not only have served to plug the gap created by Hurricane Ida, which took 1.9 million barrels per day (mb/d) offline from US supply in August2 but would also have helped quench the higher fossil fuel demand given lower output from wind and solar in many parts of the world, including Europe.

What about natural gas? Prices have been on a tear this year. It started with high electricity demand from fossil fuels over the summer. This is because renewables have not received optimal conditions, particularly in Europe and China this year. As a result, the two regions have competed for liquefied natural gas in international markets. When Hurricane Ida struck the US in August, more than 90% of natural gas production in the Federal Offshore Gulf of Mexico (GOM) went offline3. And while European natural gas prices have retreated since President Putin’s suggestion that Russia could solve Europe’s gas problem, a very cold winter could create further upside risk for natural gas prices.

Key developments to look out for in the energy space would be:

1. Will Russia alleviate Europe’s gas shortages;

2. Might the OPEC+ meet before their next scheduled meeting in November and increase supply to control prices; and

3. Will we see more extreme weather conditions leading up to and during winter?

It would, therefore, not be unreasonable to expect more volatility in energy prices in the coming weeks.

Sources

1 Bloomberg. Based on USD total return.

2 International Energy Agency

3 US Energy Information Administration

—

Originally Posted on October 8, 2021 – Surging Energy Prices Further Catalyzed By OPEC+

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.