Commodity prices have had a strong run (up 32%)1 driven in part by the recent surge in energy prices. Commodity price surges can redefine the fortunes of major commodity exporters, most of which are present in Emerging Markets (EM). According to a paper drafted by the International Monetary Found (IMF)2 in 2016, most emerging markets had experienced a high period of growth during the commodity price boom. We have seen many emerging and developing economies prosperity rise and fall in tandem with global prices of their leading commodity exports. EM is a net commodity exporter to the tune of 2.6% of gross domestic product (GDP) while developed markets are a net commodity importer to the tune of 1.6% of GDP3. Russia is a case in point. Not only is Russia a major exporter of oil and natural gas (accounting for nearly 40% of Europe energy supply) but it is also an important exporter of nickel, palladium and aluminium. The ongoing energy crisis has taught us that there is still a considerable period until when global reliance on fossil fuels will be phased out and green energy is phased in. And so, Russia stands to benefit amidst this current energy crisis. Brazil is another key exporter of oil, iron ore, soybeans, and coffee from the Latin American region is poised to benefit from the surge in commodity prices. The energy transition will also drive consumption of the raw materials required to generate and consume energy in a cleaner way such as – aluminium, copper, nickel, cobalt and lithium. In addition to being a key copper producer, Chile remains an important source of wind and solar power and is expected to emerge as a low-cost producer and exporter of green hydrogen. China dominates global production of rare earth minerals (around 66%)3 which are required for the manufacture of new energy goods. Amidst the ongoing commodity price increase, a new trend is taking root evident from the outperformance of value versus growth stocks within the EM landscape over the past year.

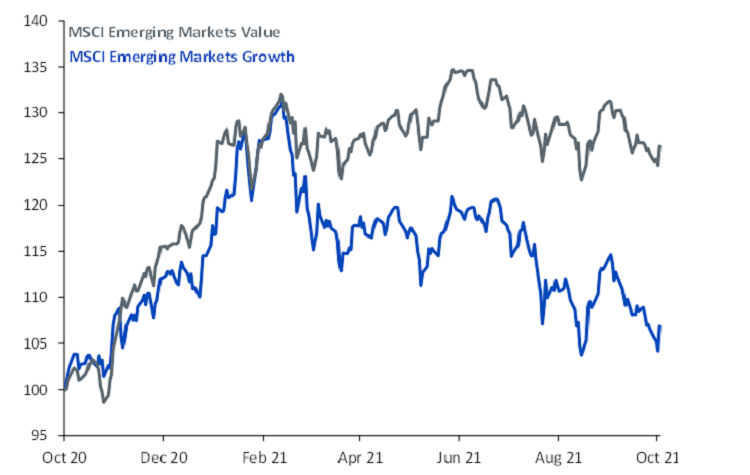

Figure 1 – Outperformance of value versus growth in EM

Source: Bloomberg, WisdomTree, data available as of close 08 October 2021.

You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Many would argue that the composition of EMs has changed dramatically over the decade and EMs are less reliant on commodities. However, in commodity exporting nations, the commodity intensive value sectors remain an important source of public sector revenues and state subsidies. Commodities account for 44% of EM trade compared to just 29% in DMs2. As prices of most of these commodities have risen, alongside improving terms of trade – it should lend a tailwind for these economies. EMs have faced a sharp setback owing to the regulatory onslaught in China alongside the Evergrande crisis rendering their valuations at a significant discount to developed markets. Keeping in mind where we are in the economic cycle, with inflation concerns rising and growth starting to plateau and monetary conditions starting to tighten, investors would benefit by taking exposure to dividend paying commodity exporting EM economies.

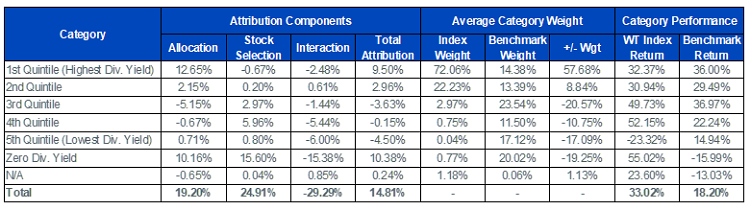

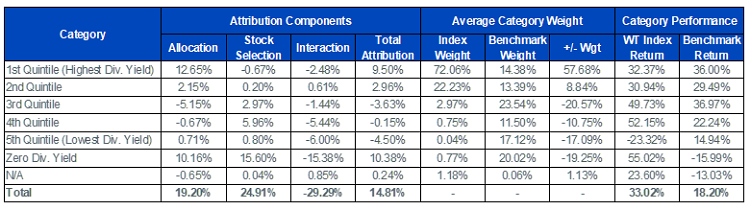

Figure 2: Dividend Yield Attribution

Source: Factset, WisdomTree from 30 September 2020 to 30 September 2021.

You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 Price performance of Bloomberg Commodity Index from 31 December 2020 to 7 October 2021

2 IMF 2018 Annual Data

3 IMF Working Paper – Trading on their terms? Commodity Exporters in the Aftermath of the Commodity

4 Statista

5 Factset performance from 30 September 2020 to 30 September 2021

—

Originally Posited on October 28, 2021 – Value Trumps Growth In Emerging Markets

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.