Daniel Sullivan, Head of Global Natural Resources, discusses what COP26 means for natural resources investors and the opportunities arising from a climate-conscious world.

Key Takeaways

- The transition from fossil fuels to renewable energy is the most impactful change for the industrial economy and is expected to accelerate into 2030 and continue to at least 2050.

- Among the key long-term growth opportunities are copper for economic electrification, raw materials used in battery and electric vehicle production, renewable energy, and agricultural and food science.

- The accelerating adoption of recycling, the circular economy concept and the shift towards hydrogen as a source of clean energy add to the diverse opportunity set offered by natural resource companies.

The first United Nations Climate Change Conference of the Parties, also known as COP was held in Berlin in March 1995, and twenty years later, the Paris Agreement was adopted in December 2015. At this year’s meeting, COP26, 197 countries participated in the discussions and negotiated climate change commitments. Massive changes are reshaping the industrial economy, with the transition from fossil fuels to renewable energy being the most impactful. Expectations are for this to accelerate into 2030 and continue to at least 2050 in line with the Paris Agreement’s aim of achieving a climate neutral world by mid-century.

An Important Role to Play Across Multiple Resource Sectors

Starting with coal and now oil, soon natural gas will also be given diminished investment attention due to higher carbon abatement hurdles. The oil and gas sector and businesses in general need to dramatically change their businesses to thrive in the long term. We are already seeing diesel and petrol vehicles being phased out, while electric vehicle manufacturing and sales are ramping up.

In agriculture, carbon emissions also require management, while in our cities and buildings, society can collectively have a large impact through the widespread adoption of energy-efficient inclusions, using renewable power sources and breaking wasteful habits, such as lighting, heating or cooling office blocks unnecessarily.

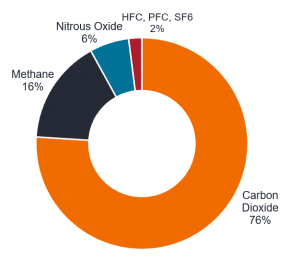

CO2 accounts for about 76% of total global greenhouse gas emissions. Methane, primarily from agriculture, contributes circa 16%, while nitrous oxide, mostly from industry and agriculture, contributes approximately 6% of emissions, according to the U.S. Environmental Protection Agency.

Global Man-Made Greenhouse Gas Emissions

Source: United States Environmental Protection Agency (EPA), Center for Climate and Energy Solutions as at 2017. All figures expressed in CO2-equivalents. HFC, PFC and SF6 are included in a family of man-made gases used in a range of industrial applications.

Across the globe, there must be increased efforts not just to recycle, but to integrate industries into a truly “circular economy” where products can be recycled at the end of their life by channeling them back into production, thereby reducing waste disposal and raw material extraction requirements.

Megatrends Creating Multi-Decade Opportunities

We are closely monitoring the developments in the transition and engaging with resource companies on the same. In our view, the key long-term growth opportunities across the global natural resources sector include copper for economic electrification, raw materials used in battery and electric vehicle production, renewable energy and the services that support them, as well as agricultural and food science in the production of healthy and sustainable food. More broadly, these industries are supported and benefit from synergies created by the accelerating adoption of recycling, the concept of the circular economy and the shift towards hydrogen as a source of clean energy. All these areas add to the diverse opportunity set offered by natural resource companies.

Carbon won’t disappear quickly, but as consumption falls considerably and energy gradually transitions to net zero carbon, additional costs or taxes will progressively make these industries less attractive to investors.

It is hard to imagine, but pollution must be paid for, prevented and remediated. Other industries have gone down the road of disruption before – in entertainment we have witnessed VHS videos being superseded by DVDs, BlueRay and ultimately the cloud via streaming – the key difference here is that ESG adoption is the catalyst, rather than new technology making older ones redundant. Established industries that negatively affect the planet are now in decline as more sustainable alternatives come to the fore and COP26 commitments force countries to make meaningful, coordinated change.

—

Originally Posted on November 18, 2021 – COP26: The Global Natural Resources Perspective

Carbon abatement enables fossil fuels to be used with the capture of Co2 to reduce total emissions.

Net zero refers to the aim of achieving a balance between the greenhouse gases (GHG) put into the atmosphere and those taken out, the most significant being carbon dioxide.

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.