AT A GLANCE

- Since the beginning of October, the CME FedWatch Tool has indicated an increased probability of a second rate hike by the end of 2022.

- As recently as October, Eurodollar volume significantly moved into Quarterlies and 1-Year Mid-Curve options, traditionally a sign of near-term rate moves.

Once started, events often happen much faster than expected. This is particularly true with changes in interest rate hike expectations and changes in the structure of interest rate markets themselves which both appear to be trending towards 2022.

Over the prior weeks the markets have priced in hikes in several regions; volatility and options volumes on Eurodollar futures have jumped higher; and regulators are continuing to guide markets to shift from LIBOR to SOFR futures and options.

FOMC Rate Hike Expectations Have Shifted Higher

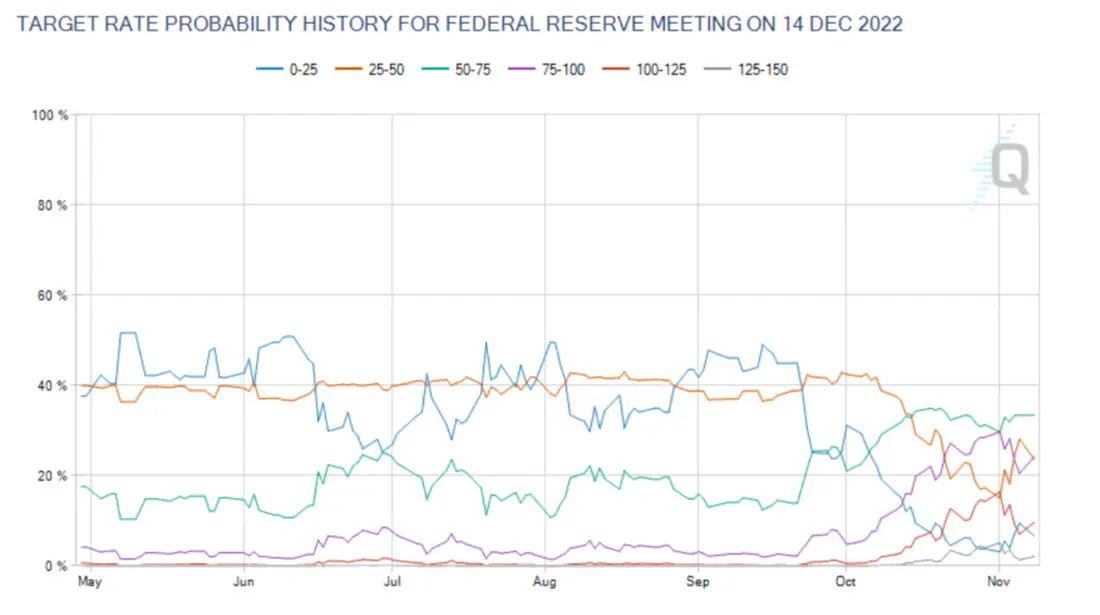

Since the beginning of October, the CME FedWatch Tool has indicated an increased probability of a second hike by the end of 2022. The purple line in Exhibit 1 shows how expectation of a second hike has leapt higher. Concurrently the market has priced a very low probably of no hikes (blue) and the probability of one hike (orange) has fallen off the table from 40% to less than 20%.

CME FedWatch Tool Historic Probabilities of Various Hikes. Source: CME Group

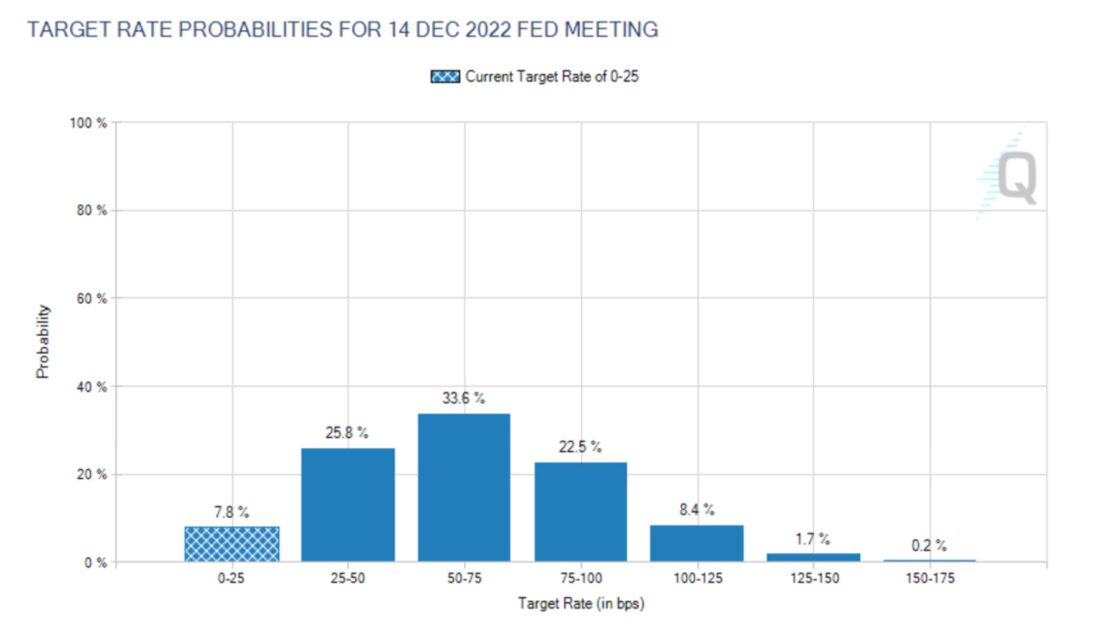

The distribution profile of December 22 rates is shown in Exhibit 2 and it looks somewhat like a normal distribution with the highest probability of a target rate of 50-75 basis points. Importantly, the distribution is somewhat skewed to the higher side with the market pricing a rate regime of 100-125 basis points at nearly 18%.

CME FedWatch Tool for December 2022. Source: CME Group

Eurodollar Options on Futures Volumes Have Jumped

Beginning with the zero-interest rate policy in 2008 and continuing through the following decade, volumes in Eurodollar Quarterly and Mid-Curve options have been solid indicators on when the market expects rate hikes to occur. When the market does not expect rate hikes for two or three years, one can see larger volume in the 2-, 3- and 4-year Mid-Curves. Alternatively, as Fed expectations move into the near term, a shift with volume concentrated in the shorter-dated quarterlies along with the 1-year Mid-Curve options can be seen.

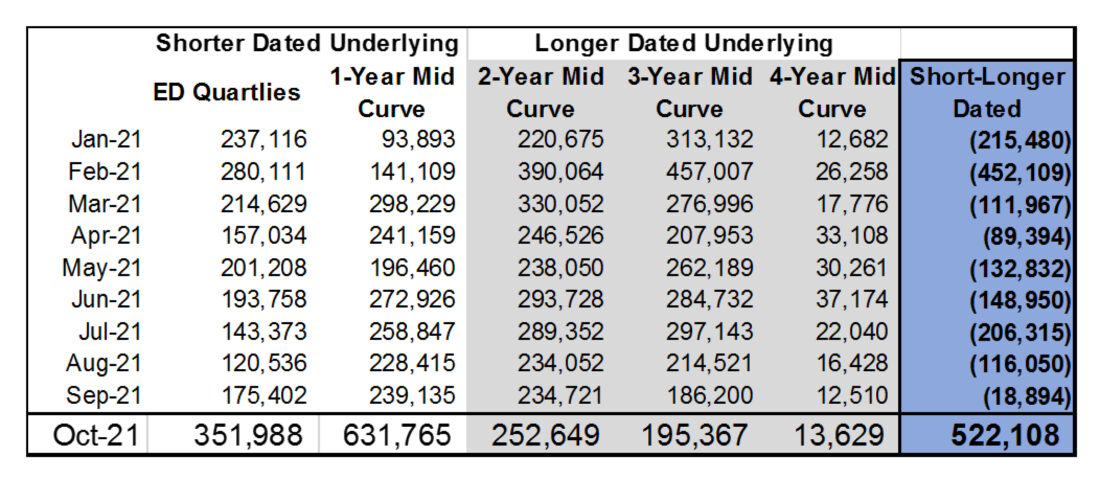

As recently as October, markets responded to these changes in Fed expectations with average daily volume (ADV) significantly moving into both Quarterlies and 1-Year Mid-Curve options. Through the first three quarters, the market was focused on positioning the underlying 2023, 2024 and 2025 futures contracts illustrated by the negative numbers in Chart 1. Based on historical trends, this indicates that the market saw more potential for curve movement in the longer dated part of the curve beginning with 2023.

Selected Eurodollar Options on Futures ADV. Source: CME Group

This changed significantly in October. Short-end volumes outperformed the long end by over 500,000 contracts ADV. This shows the market is much more focused on rate risk in the next 6-18 months. As for volatility in the 1-year Mid-Curve, highs have been reached at 54.6 bps. This is the volatility of a 90-day option and in the December 22-March 23 time frame.

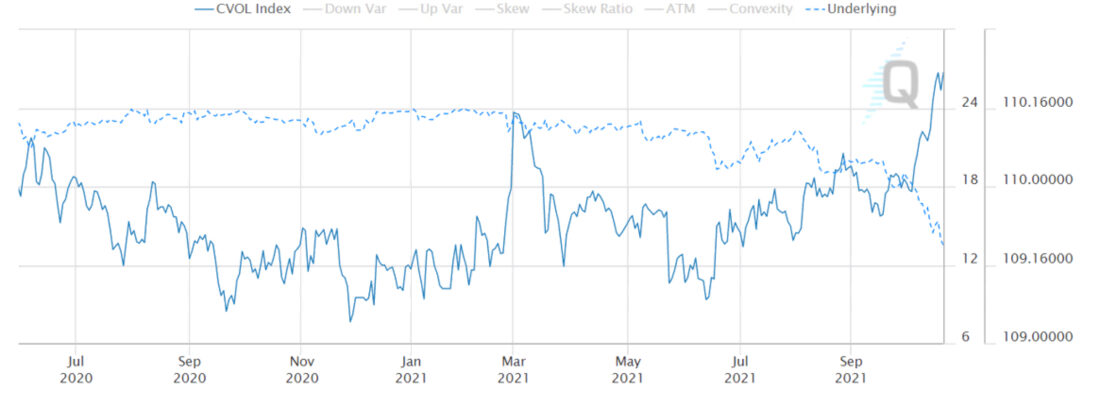

The jump in volatility has permeated other rate markets as well. CME Group Volatility Indexes (CVOL) for the 2-Year Treasury future also show a significant breakout on 30-day implied volatility.

CME Group 2YR CVOL Index (TVUY).

While option volumes and interest rate volatility have been increasing, so has the attention that the regulators are giving non-linear (option) products based on LIBOR.

Regulatory Decree Encouraging Move from LIBOR to SOFR

Slightly over three months ago, the Commodity Futures Trading Commission (CFTC) Market Risk Advisory Committee (MRAC) in a release “adopted a market best practice known as SOFR First.” In the words of the MRAC, “SOFR First represents a prioritization of trading in SOFR rather than USD LIBOR for particular market segments and products, which is designed to help market participants decrease reliance on USD LIBOR in light of supervisory guidance that such activity should cease as soon as practicable and in any event by December 31, 2021.”

The timeline is clear and is in four phases:

- Phase 1 – Linear Swaps (Complete)

- Phase 2 – Cross Currency Swaps (Complete)

- Phase 3 – Non-Linear Derivatives (November 8, 2021)

- Phase 4 – Exchange Traded Derivatives

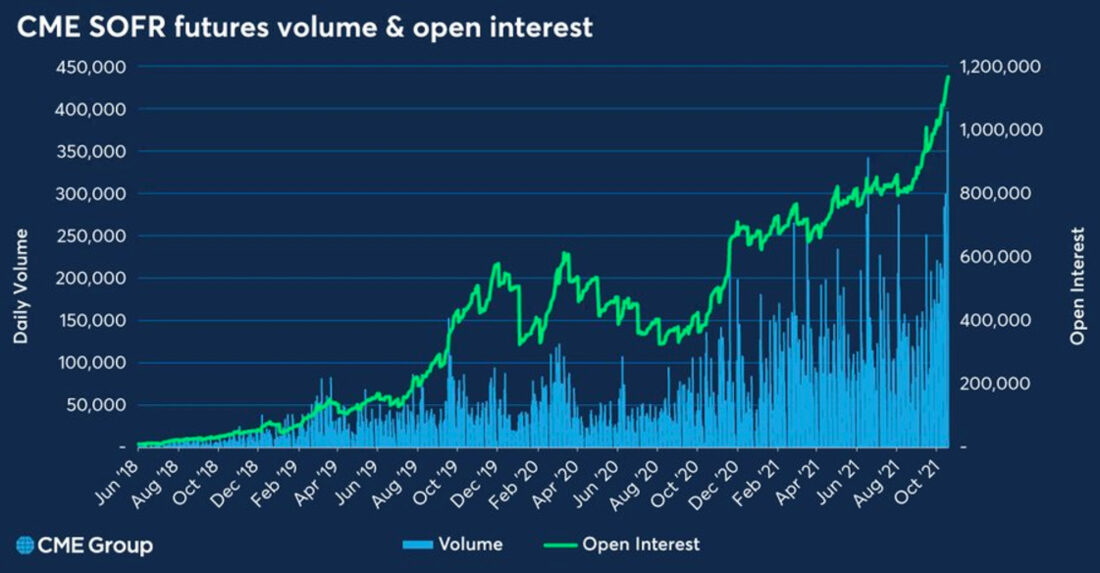

Since the completion of Phase 1, volumes on SOFR futures have skyrocketed.

Source: CME Group

With November 8 passed, dealers are now focused on moving from LIBOR-based swaptions to SOFR-based swaptions. Indeed, with the March 2021 inclusion of SOFR-based fallbacks in the Eurodollar futures rulebook, contracts with an underlying greater than June 2023 are effectively SOFR-linked contracts.

In early 2020, CME Group launched 3-Month SOFR options duplicating the entire Eurodollar and Mid-Curve options complex. The trends in linear products suggest that the coming SOFR First guidance, along with Fed guidance on the use of LIBOR, could encourage additional uptake in SOFR-based swaptions and options on SOFR futures.

The Times, They are a Changing

The market has quickly changed its forecasts for the path of future interest rates. Eurodollar options have responded in kind. The CFTC’s SOFR First initiative is rapidly moving non-linear risk taking to SOFR-based products. CME Group Watch Tools can show the changes in market expectations, but market participants will do well to heed upcoming phases of SOFR First and prepare now for non-linear SOFR products.

—

Originally Posted on November 12, 2021 – Change is Upon the Interest Rate Markets

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance, economics and politics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience.

Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade.

BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.

In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority.

CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl).

CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.