I’m going to guess that few of you are familiar with the early ‘70’s hit of that name by the long-ago teen idol Bobby Sherman. Guess what – if you aren’t familiar with that song, you aren’t at all familiar with living with inflation either. The song pre-dates the worst of the price pressures that would follow a few years later, but not unlike the shiny. polyester, fringed shirt gracing the singer, inflation had been relegated to the dustbin of unfortunate trends of the 1970’s.

Sadly, I have to admit that the song is buried somewhere in the recesses of my brain, and it came to mind when I muttered the phrase in relation to this morning’s drop in US indices that is retracing much of yesterday’s rally – not the inflationary backdrop that is driving investment trends. Yesterday morning, as futures were plunging in the immediate wake of the CPI report, I engaged in a discussion about how few current investors have any experience investing in an inflationary climate. I was around in the ‘70’s, but not investing. I need to consult my father if I want a first-hand view from that era. For that matter, few if any central bankers have much experience with inflation either. Jerome Powell graduated from law school in 1979, for example. He was a law clerk and junior associate when his predecessor Paul Volcker was wrestling inflation into submission. We’re all feeling around in the dark.

For that reason, I remain inclined to take a “glass half empty” approach to market moving news. As many of the world’s central banks fight inflation, the main tools at their disposal are rate hikes and balance sheet reduction (aka quantitative tightening, or QT). The historical results of utilizing those tools do not set a wonderful precedent.

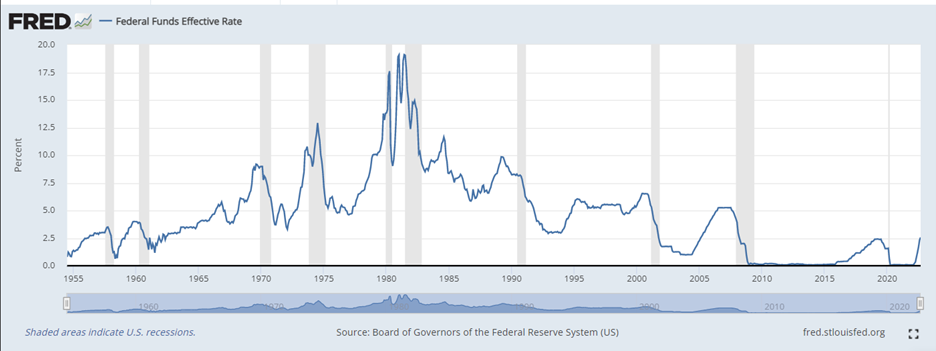

Although the current pace of rate hikes has been quite abrupt, the Fed Funds rate is still at a historically low level. We only recently matched the rates hikes of late 2018 – which led to a nasty swoon in the fourth quarter of that year – and we are well below the 2000 and 2006-07 peaks. Both of those periods ended in recession, as the graph below shows.

Effective Fed Funds Rates Since 1954

Source: Federal Reserve Bank of St. Louis

Bear in mind that even if we hit 5%, which is roughly the current high predicted by Fed Funds futures, we would be below the levels seen throughout the entire decade of the ‘80s and the bulk of the ‘90s. The funds rate slipped below 5% for brief periods in the mid-late ‘70s when inflation temporarily abated, only to reemerge like a vengeful horror-movie villain. It took decades for rates to return to the levels that prevailed prior to the leisure-suit era.

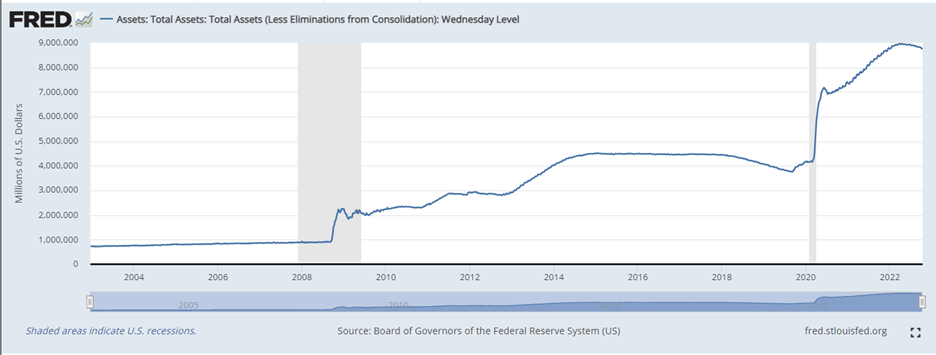

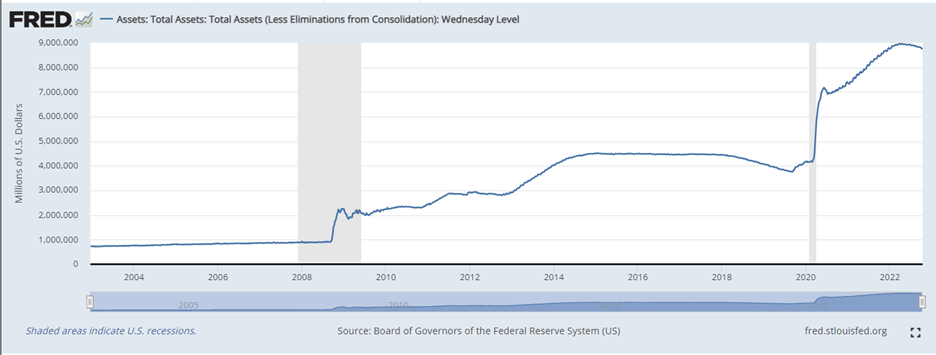

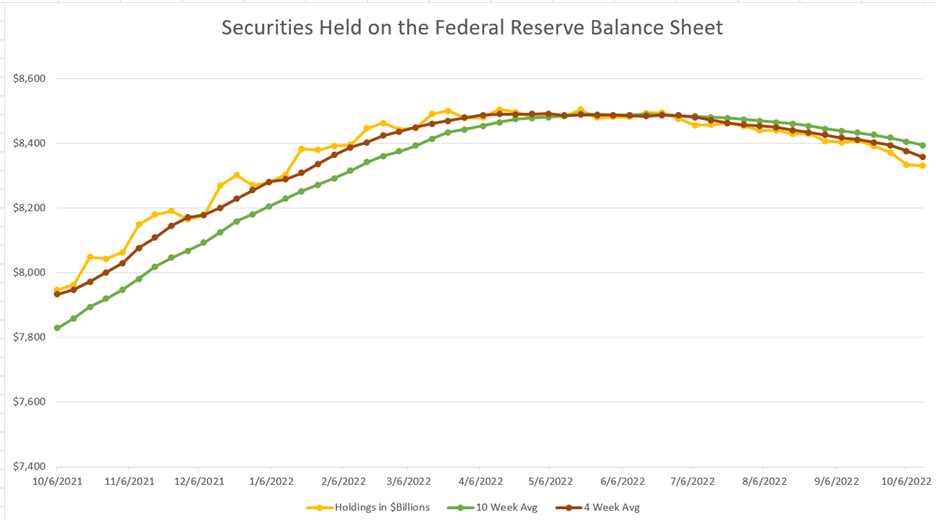

It is also important to remember that we are in a more highly levered economy than we were in the ‘70s. Companies and governments routinely carry more debt than they did in that era, and the Fed’s balance sheet is magnitudes larger. The available data from the Fed doesn’t go back far enough, but the following graph shows that the Fed’s balance sheet is up about 9X since early this century and about 2X in two years:

Federal Reserve Balance Sheet, Since 2002

Source: Federal Reserve Bank of St. Louis

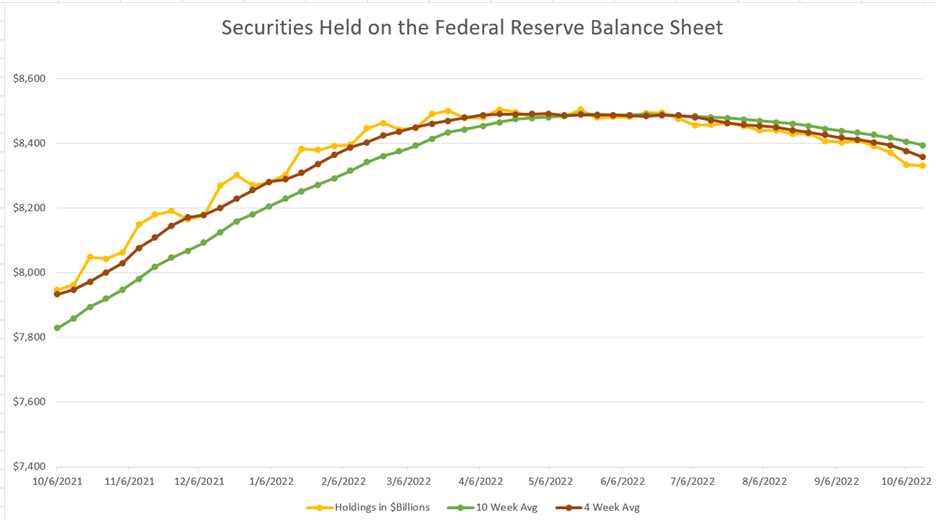

It would be quite a feat for central bankers to de-leverage the economy without any hiccups. Heck, we saw one just last month. The UK pension system that required an intervention by the Bank of England and led to the demise of the Chancellor of the Exchequer. Just as we have precious little experience with inflation, we have almost none with a period of QT. We see a little blip lower in 2018-19. When combined with rate hikes, it led to the aforementioned late-2018 bear market. The Fed stopped raising rates, but continued to shrink its balance sheet until the repo market started to dry up. At that time, inflation was not a worry, so the Fed was free to reverse course quickly. Now they are likely to feel more constrained.

This doesn’t mean that I think we’re heading to zero or expecting catastrophe. But it does mean that I continue to expect volatility – of which yesterday’s move was an extreme example – and remain vigilant about the possibility — the likelihood – that the fight against inflation will not be won without some casualties.

Source: Federal Reserve H.4.1 releases, Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.