The new EU fiscal rules and the recently updated ECB monetary policy framework are tangible signs of the region’s improving macro policy backdrop.

Last September, we outlined reasons why investors should revisit their long-standing underweight exposure to European assets. One piece of our argument was the improving macro policy backdrop in the EU. The new EU fiscal rules and monetary ECB operating framework, both announced in the first quarter, are tangible signs of this.

With these reforms, fiscal and monetary policy actions that had previously been implemented as one-off responses to crises, have now become forward-looking features of Europe’s macro policy toolbox . Neither reform is a game changer; however, they are steps in the right direction, enhancing the bloc’s ability to manage crises and strengthening its internal cohesion. They improve the sustainability of the Euro and, indeed, the European project as a whole.

The New Fiscal Rules Are Simpler and Account for Country-by-Country Differences

In early February, EU member countries agreed on long-awaited reforms to the EU fiscal rules.1 The reforms are fundamental insofar as they change both the rules themselves and how they are governed.

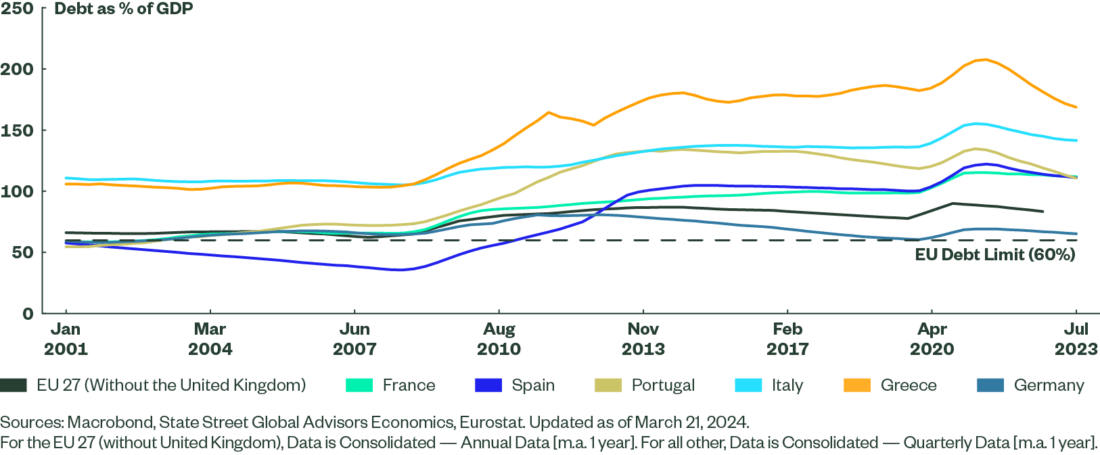

The prior rules emerged from the eurozone crisis of the early 2010s. Although observers still frequently refer to them by the two nominal limits set for EU members —a 3% of GDP budget deficit, and a 60% debt to GDP ratio—in practice, they were highly complex (both the rules themselves, and how they were applied). Their inability to deliver on the ultimate goal of ensuring fiscal convergence (or even preventing further divergence) made it clear that change was needed.

The top criticisms of the old rules were that they were too procyclical, too complex and too formulaic.2 The new rules are simpler, less procyclical, and therefore more credible and more effective than the old ones. However, building consensus around the new rules took almost a decade, partly because varied debt levels among EU countries meant that one size of reforms did not fit all (Figure 1).

Figure 1: Higher Debt Levels Post COVID-19 Coud Spur Fiscal Consolidation

The Specifics of the Revised Rules

The fiscal reforms make two fundamental changes:

- Individual countries have more ownership of their specific fiscal consolidation paths. While previously, countries had to follow a one-size-fits-all path defined by the Commission, the new rules recognise that what is fiscally sustainable can differ among countries. The new fiscal paths will therefore be individually negotiated on the basis of a debt-sustainability assessment that takes a holistic view of a country’s circumstances.

- Rules are simplified. If compliance was previously judged on multiple fiscal indicators, the new rules focus on just one – net expenditure.3 The chief benefit of using this one metric is that it is observable and thus easier to monitor. The overarching idea is that a simpler, looser, and more flexible approach is a better way to manage fiscal risks within the Union.

This is not to suggest that the conservative “Nordics” have capitulated to the profligate “South”. The new rules include a wide range of limits, for example, on the minimum size of the annual fiscal adjustments. What is different is the shift in emphasis. The intent is clearly to reduce the extent of micromanagement by the European Commission. However, the limits prevent the path-setting exercise from becoming a fiscal free-for-all.

Market and Economic Impacts

In the short term, a drag on growth is inevitable, but not because of the new rules; rather, despite them. Since the EU suspended its fiscal rules in 2020 due to the COVID-19 crisis, member states have run fiscal deficits far in excess of the new rules. A fiscal adjustment would have at some point occurred regardless.

In the long term, the effect is more uncertain, but net positive. Most importantly, the reforms strengthen the integrity of the euro and, by extension, the EU itself. They do so in three ways: (1) by modernising the rules to reflect current political priorities; (2) by reaffirming the political commitment to fiscal prudence; and (3) by making it more likely that in a crisis, calls to support the integrity of the bloc will trump concerns over moral hazard.

All else equal, we expect this reform to soften regional business cycles and reduce the likelihood that countries will drop the euro. This is good for both European assets and the euro in the long run.

Gaps to Be Aware Of

Even though we see positive impacts on long-term growth, we note the following headwinds to the effectiveness of the rules:

- Year 2027 may have a cliff effect. Starting from 2028, countries must include interest expenses in their calculations of net expenditure. This leaves fiscal space for highly indebted governments today, but it could result in a fiscal shock later on, particularly if rates stay high.

- Power politics will continue to play an important role. The new rules do not change the political balance of power within the EU. Larger members will still be able to get away with more exemptions.

- Greater politicisation of the fiscal paths. Greater national ownership of fiscal paths implies greater influence from the shifting nature of national politics. Incoming governments have low incentives to follow through on fiscal commitments of the government they replace.

Moreover, there is a mismatch in timing. The fiscal paths negotiated with the EU will last for four years or seven years—longer than the two years that governments in Europe stay in power, on average.4 The problem could be worse in countries with a frequent government turnover. The fact that the new rules exclude national fiscal councils from meaningfully participating in the process is a missed opportunity to reduce this risk.

Click here to read the full article

—

Originally Posted April 22, 2024 – A Better Macro Policy Framework for Europe

Footnotes

1 The Council of the European Union (the political body made of minister-level politicians) and the European Parliament agreed the final outline of the rules. This was the last step of the negotiation on the specifics of the new rules. They are expected to be ratified in the current form shortly. See: st06645-re01-en24.pdf (europa.eu).

2 The rules were considered procyclical because they encouraged countries to implement more fiscal stimulus when the economy was improving (and tax revenues increased), while they may have caused countries to enact more fiscal consolidation during weaker economies.

3 Net expenditure is defined as government expenditure, excluding one-off revenues, expenditure funded by the EU, and cyclical unemployment claims.

4 There is a wide range, from less than a year in Belgium, Finland, and Italy to over four years in Malta and Luxembourg. Source: Pew Research. “Many countries in Europe get a new government at least every two years.” January 2023.

5 See: ECB announces changes to the operational framework for implementing monetary policy (europa.eu).

Important Risk Disclosure

State Street Global Advisors Worldwide Entities

Marketing Communication.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

The views expressed in this material are the views of the State Street Global Advisors Economics and Macro teams through the period ended April 20, 2024 and are subject to change based on market and other conditions.

This document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

All information is from State Street Global Advisors unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Past performance is not a reliable indicator of future performance.

Investing involves risk including the risk of loss of principal.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

© 2024 State Street Corporation – All rights reserved.

Tracking Code: 6566921.1.1.GBL.RTL

Expiry Date: 04/30/2025

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.