Everyone is quitting their jobs. In September, 4.4 million Americans – 3 percent of all employed workers in the nation – quit their jobs according to the latest data from the Labor Department survey. After a record August, this was another 164,000 more people calling it quits.

What’s going on?

The rate of “quitting” is a barometer of workers’ ability or willingness to leave jobs. The higher the number, the greater the implied confidence people have in their ability to find other jobs.

Some of it, to be sure, can be explained through government largesse. If you’re getting paid more to not work in a job you hate, the rational thing is to stay at home. However, those hefty aid checks and government assistance have largely run their course.

Job hunters have plenty of breathing room to be picky about who they work for. The number of job openings (positions to be filled) in September clocked in at 10.4 million. By comparison, the pre-pandemic high stood at just over 7 million.

Why should I (or the Fed) care?

The Fed is currently going all in on the transitory nature of the CPI spike observed in the latest data. The disrupted supply chain has struggled to come back to its pre-pandemic efficiency, resulting in rising prices of goods that have been difficult to get. This is hardly surprising. Anyone that stayed awake through the introductory course in economics will have remembered this basic mechanism to balance supply and demand.

Normalization of the supply chain, therefore, should bring inflation back to the boring sub-2% levels the Fed is banking on.

Except, that is, if wage inflation starts to pick up. One baffling fact is that, while job openings are staggeringly high, the US labour market is still 4.2 million jobs short of where it stood in February 2020. This suggests that employers are fighting over a much smaller pool of willing workers than were available before the pandemic. Like with goods, supply and demand in the labor market is starting to get balanced with higher wages.

Unlike goods prices, however, wages are downwardly sticky. When labor is more widely available, workers do not “go on sale.” Wages generally stay the same or continue to rise at a similar rate. This could give inflation the kind of momentum that the Fed doesn’t wish to see.

A nervous Fed means higher short term rates, and stock market anxiety over just how long the “inflation is transitory” line will hold up against the rising tide of inflation.

Spotlight: HGV: NYSE

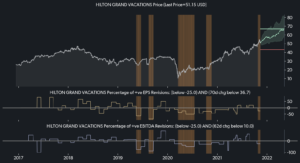

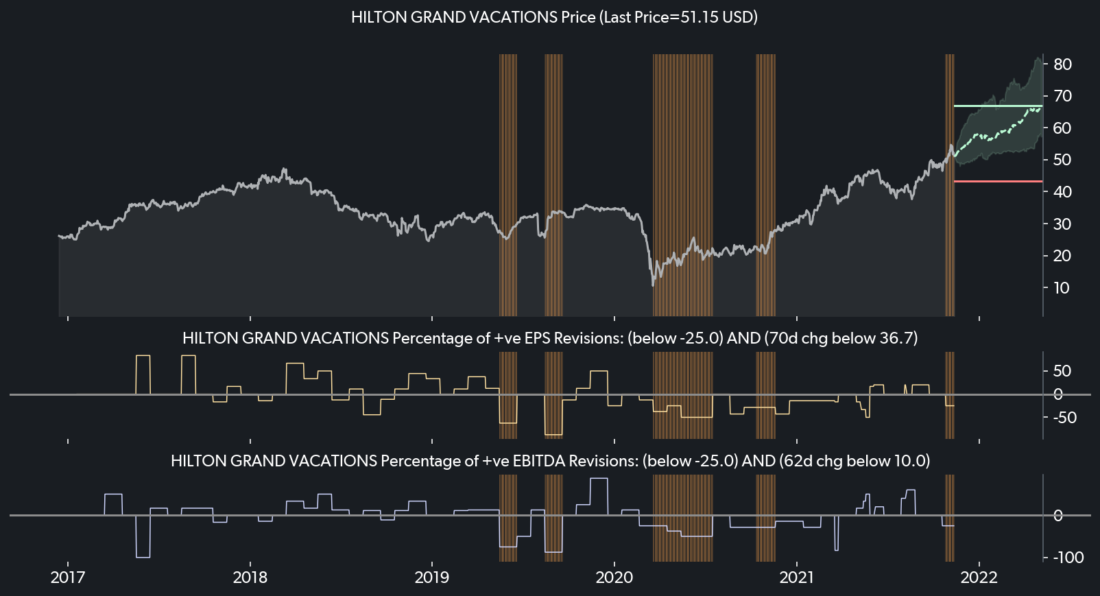

With the holidays around the corner, street analysts are by-and-large bearish on Hilton Grand Vacations and in the past this has led to a 31% increase in the price over the following 6M.

TOGGLE analyzed 5 similar occasions in the past to produce the median outlook and this insight received 5 out of 8 stars in our quality assessment.

Source: TOGGLE

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.