AT A GLANCE

- Severe weather and logistical constraints are pushing fertilizer to record levels, a development that has big implications for farming input costs.

- Estimates suggest that approximately 20% of the cost to raise corn can be attributed to fertilizer.

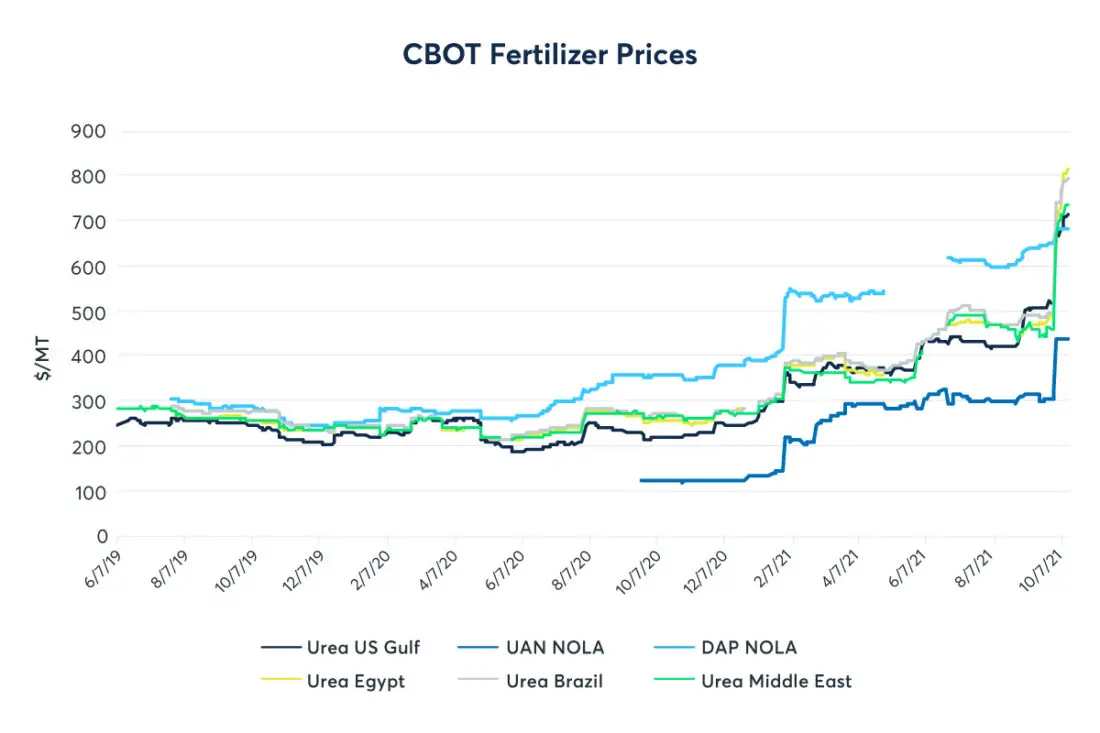

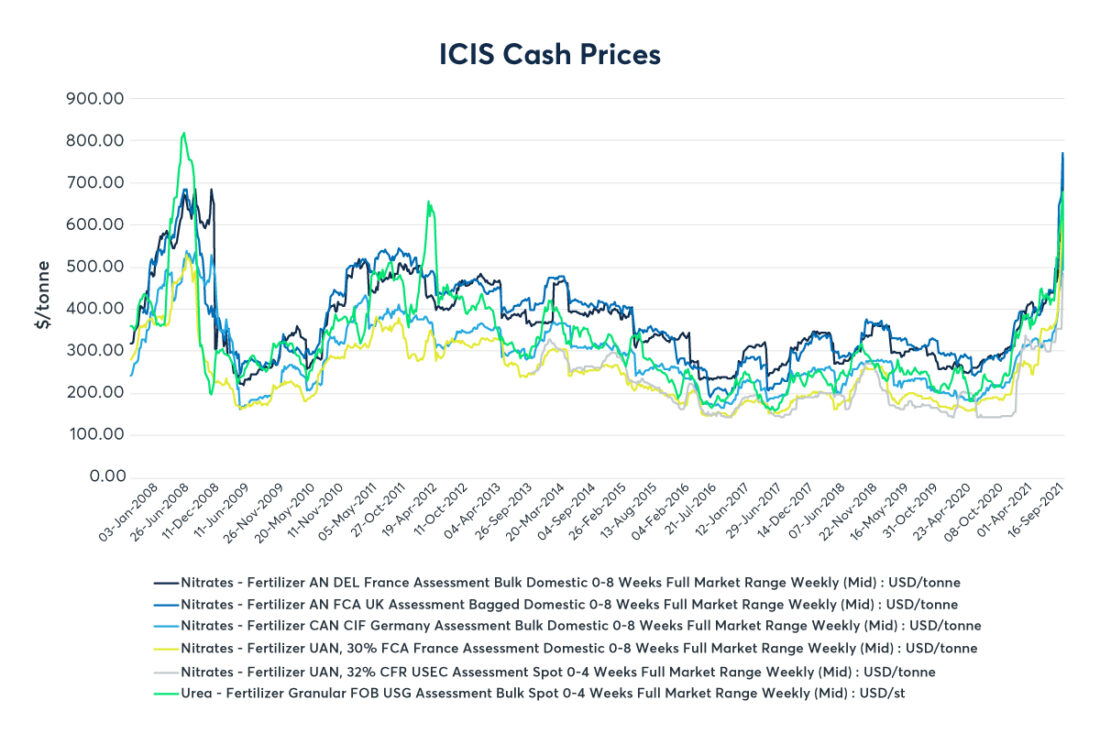

The fertilizer market is seeing prices at or near record levels due to a variety of supply and demand factors. Prices are rising so quickly that, by early October fertilizer futures at CME Group were witnessing prices hit and exceed pre-financial crisis 2008 levels.

Source: Bloomberg

Source: ICIS

Several supply issues are contributing to the growth in fertilizer prices. First, short-term capacity or logistical constraints have hampered some plants’ ability to supply the market. Severe weather has also hit some producing regions. Hurricane Ida forced shutdowns in Louisiana near the Gulf, where a significant amount of fertilizer is produced and transported. Labor shortages are being felt by transportation companies, meaning even the fertilizer that is produced is costing more to move.

Second, government involvement has reshaped the global trade in many fertilizer products. A countervailing duty (CVD) petition was filed in the United States against phosphate suppliers in Morocco and Russia, and entities in those countries stopped selling into the U.S. market. The U.S. government is currently reviewing a petition submitted by CF Industries into UAN imports from Russia and Trinidad and Tobago. China and Belarus have also faced government interference that has hampered their ability to produce fertilizer at previous levels.

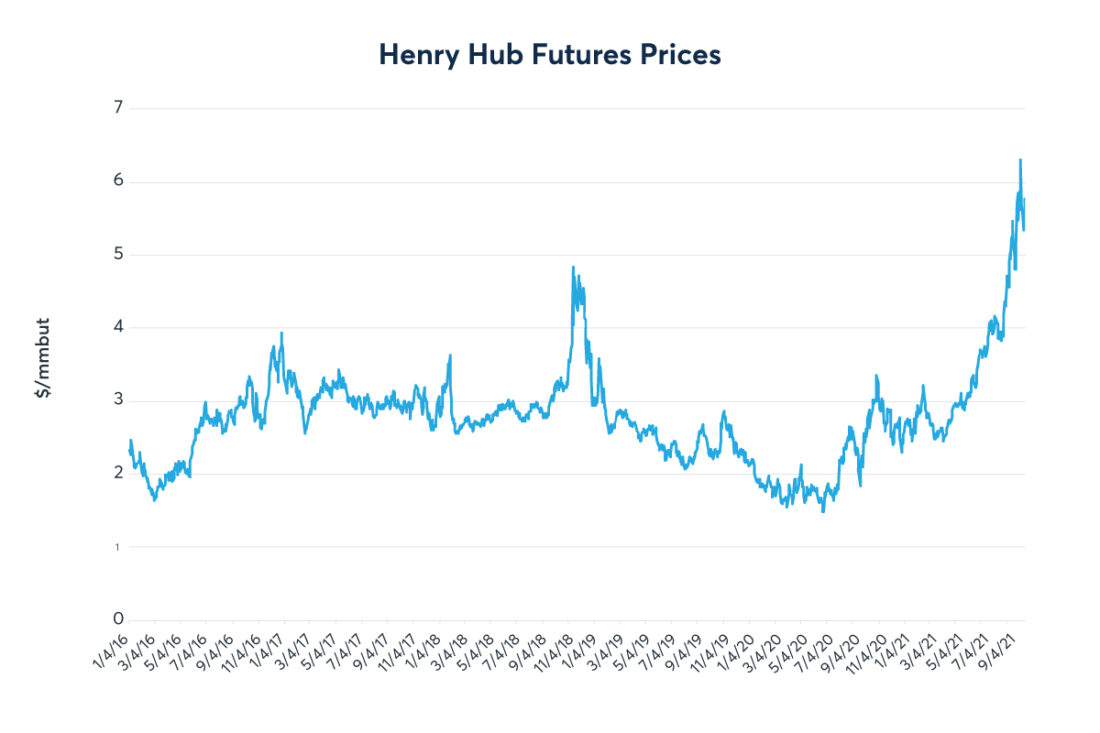

Lastly, and most importantly, input costs for fertilizer production have risen so much that some fertilizer plants have simply decided to shut down. Most producers have stopped or curtailed production across Europe. Natural gas is a main component in nitrogen fertilizers like urea and UAN, and the price of natural gas accounts for the significant majority of the cost of nitrogen fertilizer production. Henry Hub Natural gas prices have skyrocketed in 2021 to over $5.30/mmbtu, levels unseen in at least five years.

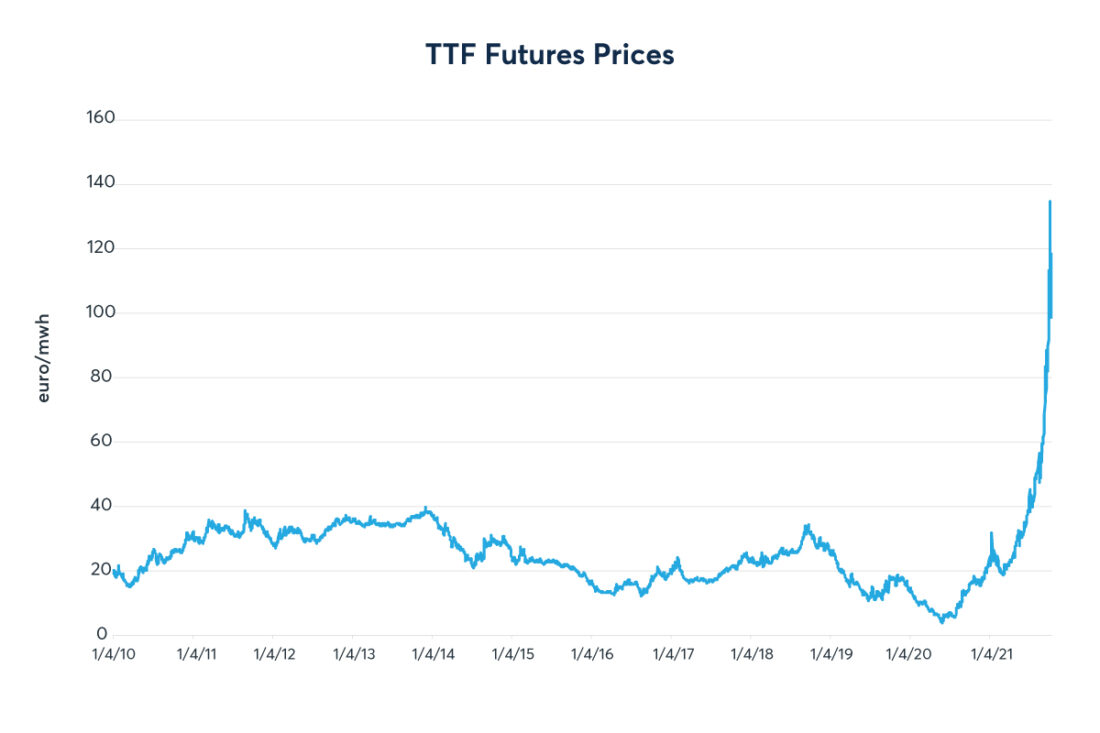

More strikingly, Dutch TTF Gas prices – the European benchmark– have more than tripled between 2020 and 2021. European natural gas prices have led fertilizer plants to completely suspend operations and shut down. CF Industries shut down two of its UK plants and Yara announced that its European ammonia production would be significantly curtailed. The market is anticipating closures in the Netherlands, the UK, Spain, and even Ukraine. Julia Meehan, Managing Editor of Fertilizer at ICIS, opines “There is no sign of gas prices coming off any time soon. I think this is just the start of a very big and serious story for the fertilizer community.”

Source: Bloomberg

Source: Bloomberg

Demand for fertilizer can shift depending on the time of year and on the crop pricing outlook. In the United States, phosphates, potash, and anhydrous ammonia are generally purchased and applied in the fall, though application can continue throughout the spring. Nitrogen is applied post-planting. However, because Brazil and other South American countries have become significant producers of grain, and their growing season is distinctly different than that in the U.S., there is essentially year-round demand for many fertilizer products.

According to Chris Yearsley, Director at Profercy, Ltd., “Supply uncertainty and disruption has come at a terrible time for the market. While in the offseason, both Europe and the USA have been running on low inventories of nitrogen and both have been looking to build stocks ahead of next year. At the same time, India and Brazil are in their major purchasing phase. The former has struggled to secure major volumes of urea through purchasing tenders and China’s potential withdrawal from the international market will be causing some nerves.”

Fertilizer accounts for one of the biggest non-fixed input costs for grain and oilseed farmers, and coming into 2021, domestic grain and oilseed prices were showing signs of strengthening. New crop 2021 prices for corn, soybeans, and wheat were up significantly year over year. Through the spring and mid-summer, when planting is in full swing, nearby corn futures were trading above $6 per bushel and nearby soybean futures were trading above $14 per bushel.

Strong commodity prices allow for larger input prices, so farmers can be relatively less concerned when they expect a high return on harvest. Significant government payments due to Covid-19, and improved farm balance sheets, meant there was room in the budget for increased input costs. Some producers, however, fear the higher costs could stay for a while. In the September Ag Barometer from Purdue University and CME Group, producer concerns about rising input costs rose sharply with over one-third of respondents saying they expect input prices to rise by more than 12% in the coming year, six times the average farm input inflation rate of the last decade.

Tough Decisions for Farmers

These key supply and demand factors have helped push fertilizer prices to their present high levels. Current prices are critical for farmers making decisions for the next crop, and high fertilizer prices may indicate a smaller corn crop in the next marketing year. Corn yields are impacted by fertilizer application, but those higher per acre yield numbers come at a cost: the industry suggests that approximately 20% of the cost to raise corn can be attributed to fertilizer.

Acreage may shift away from corn and to other crops like soybeans. Alternatively, farmers could choose to simply apply less fertilizer regardless of what grains or oilseeds they plant, potentially leading to significantly diminished production numbers.

—

Originally Posted on October 15, 2021 – As Fertilizer Prices Grow, Farmers Could Face Tough Decisions

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.