Wednesday, December 16, 2020

1/ Your tank will soon be more expensive to fill

2/ So who was the winner here?

3/ Bitcoin versus Gold or Google

4/ The bottom line

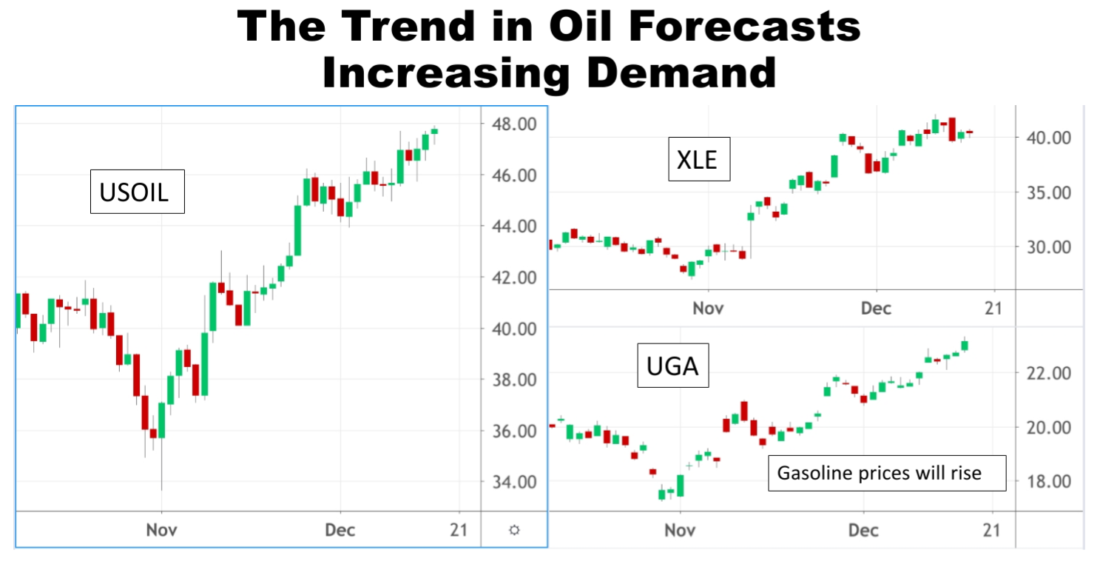

1/ Your Tank Will Soon Be More Expensive to Fill

The price of oil has been steadily rising since November, despite concerns about the economic impact of shutdowns in large U.S. cities. The strong trends appear to indicate that the market anticipates not just a mild rebound in aggregate demand, but a strong one throughout 2021.

There are at least three reasons investors might justify that expectation: first, COVID-19 vaccinations will undo the economic impact of the pandemic; second, people have already learned to adjust to a new normal and will thrive going forward; and third, energy prices were simply oversold anyway.

The chart below compares the price of Crude Oil futures (USOIL) since November 1st with Exxon Mobil shares (XOM) and USCF’s United States Gasoline Fund ETF (UGA). UGA isn’t very liquid, but it does do a good job of giving chart watchers about a two-week look-ahead on the price of gas. Spoiler alert: it’s going higher.

Regardless of the reason for these upward trends, it is important to take note that investors really do think the economy’s prospects are bright. That is a bullish signal all by itself.

2/ So Who Was the Winner Here?

The latest episode in a legal drama between tech behemoths Microsoft (MSFT) and Amazon (AMZN) unfolded after the markets closed yesterday. The impact spilled into today’s trading in a particularly interesting way. Here’s the salient background: a little over a year ago, the Pentagon awarded a 10 billion dollar contract to Microsoft over competing contractor Amazon. Amazon called for this contract not to be allowed to go forward until the selection process could be further reviewed, and between continuing review efforts and legal challenges, the back-and-forth over the matter has been going on for months. Yesterday a court filing by Amazon that has been under seal since October 23rd was made public.

The unsealed complaint from Amazon’s legal team was that the original decision was politically motivated and financially and technologically unsound. How (yawn) shocking to hear such things stated. But what is actually worth noting, as seen in the chart below, was that shares for both companies rose by more than two percent. Especially on a day when the S&P 500 index (SPX) closed barely a quarter-percent higher.

If you try to interpret these results as producing a winner or a loser in this battle, it doesn’t seem to add up. Looking instead for an interpretation that might benefit both companies would make more sense. Perhaps analysts opined that if Amazon doesn’t have any better case than this, it will surely soon be over—thus less legal costs for both companies. Or perhaps they reasoned that there will be a lot more government contracts to follow on from this project. Whatever the reason, this strong upward move for both companies is a bullish signal because it means the legal battle was clearly weighing on investor sentiment for both companies.

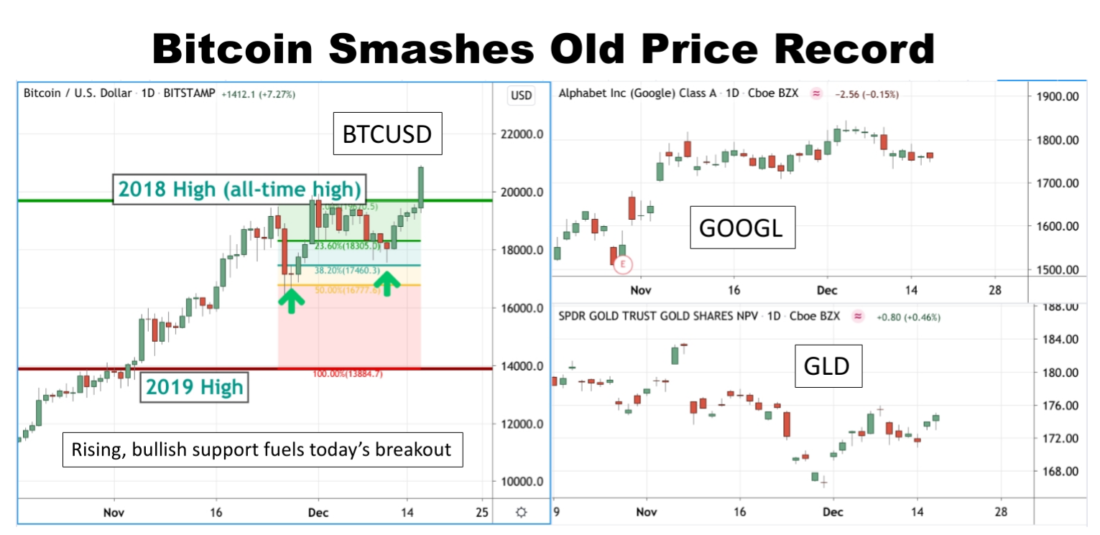

3/ Bitcoin Versus Gold or Google

In a fascinating drama that unleashed itself on the internet last night around midnight UTC, Google servers went down. Parent company Alphabet (GOOGL) stock fell today in line with market indexes, thus indicating that investors weren’t bothered by the event. However, according to some opinions, perhaps they should be.

The 30-minute outage sparked a bit of comparison between Google’s centralized internet operations and Bitcoin’s decentralized blockchain technology. The chart below compares Bitcoin (BTCUSD), Alphabet and State Street’s Gold Trust ETF (GLD). It doesn’t look like much of a battle. Bitcoin’s price rocketed to all-time highs as investors took the occasion to celebrate the cryptocurrency’s resiliency.

A few weeks ago, when Bitcoin’s price pattern was mentioned here in the Chart Advisor newsletter, the key detail would be whether the price held itself above the 50% retracement between the 2018 high and the 2019 high. That happened, and a bullish trend has begun since then.

4/ The Bottom Line

Oil and energy prices continue trending higher confirming the notion that investors expect consumer demand to continue strengthening. The Amazon and Microsoft court battle has likely kept some investors on the sidelines with these two companies, but yesterday’s unsealed filing seemed to trigger buying on both stocks indicating investors don’t really care about the legal battle. Bitcoin’s new high may have bigger meaning than its price trend.

—

Originally Published on December 16, 2020

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.