Thursday, 30th September, 2021

1/ Indexes close on lows triggering Dow Theory signal

2/ Is the PAYX price action forecasting more jobs?

3/ Supply chain woes slow car buying

4/ The bottom line

1/ Indexes Close on Lows Triggering Dow Theory Signal

Invesco’s Nasdaq 100 ETF (QQQ) posted a small gain, with State Street’s S&P 500 Index ETF (SPY), Dow Jones Industrial Average ETF (DIA) and iShares’ Russell 2000 ETF (IWM) all tracking lower. Markets did recover mid-session from an opening slump, but not enough to quell fears over a myriad of issues ranging from a potential U.S. debt default, inflation, and ongoing supply chain woes. Instead, the selling accelerated into the close as indexes wound up closer to the lows for the day.

Based on this close, investors have a few reasons to remain optimistic, however, because October is the start of a new quarter, tomorrow could turn the tide. Although October has a reputation for some violent selloffs, it is typically viewed as the start of a better seasonal performance heading into the holidays and new year.

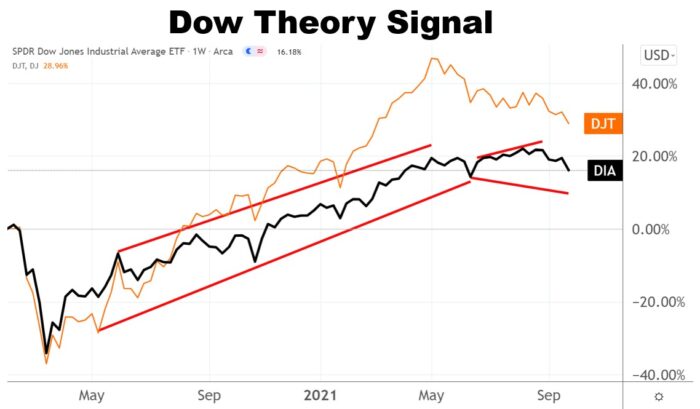

Below is a comparison of DIA against the Dow Jones Transportation Average (DJT). According to Dow Theory, comparing these indexes can provide some insight into the overall direction of the market. They had a relative divergence in mid-June, with DIA trending higher and DJT trending lower. This kind of a divergence is typically a strongly bearish signal. It could mean that the overall uptrend is due for a reversal.

2/ Is the PAYX Price Action Forecasting More jobs?

Paychex Inc. (PAYX) rose more than 5% after reporting fiscal first-quarter earnings results. PAYX reported earnings per share (EPS) of $0.89 and $1.08 billion in revenues, exceeding analyst expectations of $0.80 in EPS and revenues of $1.04 billion. Investors expressed confidence in the payroll and human resources company, bidding the PAYX share price well above its 20-day moving average. PAYX has gained more than 42% in the past year.

Below is a comparison between the recent performance of PAYX and its largest competitor, Automatic Data Processing (ADP). The two companies have been relatively neck and neck, with PAYX having a slight edge. Today’s earnings results put PAYX squarely in the lead and could be indicative of strong employment growth as offices continue to reopen.

3/ Supply Chain Woes Slow Car Buying

Investors of CarMax (KMX) had sticker shock after the company missed profit expectations in its fiscal second-quarter earnings announcement. Analysts had forecast $1.89 in EPS and $6.91 billion in revenues—KMX reported $1.72 EPS and $7.99 billion in revenues. The EPS miss was a result of lower-than-anticipated gross profit per unit from the company’s used and wholesale vehicle segment. As a result, KMX shares slid more than 10%.

As chip shortages have slowed production on new vehicles, the used car market has been scorching hot. Even with today’s earnings-induced drop, KMX has risen 40% year-to-date. It has still lagged competitor AutoNation (AN), as seen on the chart below. AN has gained 80% year-to-date. Supply chains remain bottlenecked, which has intensified the chip shortage, and automobile prices remain elevated. This environment should bode well for both KMX and AN going forward. However how each company manages their profit margins could dictate future performance.

4/ The Bottom Line

Indexes close on the lows as investors feel some nervousness heading toward the weekend. Payroll companies seem to be giving an optimistic forecast for the economy.

—

Originally posted on 30th September, 2021

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.