Jennifer James, Emerging Market Credit Portfolio Manager, considers how policies enacted by China’s government toward COVID, consumption and credit are likely to shape China’s near-term trajectory.

Key Takeaways

- China’s current COVID policy is contributing to supply chain issues.

- Consumption growth in China is proving weaker than expected, potentially reflecting COVID’s economic impact on low earners and the shift in political attitudes toward reining in debt expansion.

- The crackdown on debt levels in China’s economy is likely to have domestic and global repercussions given the strong relationship between debt expansion and economic growth within China.

The policies enacted by the government to address these three broad categories – COVID, consumption and credit – help explain China’s current situation and will likely shape its near-term trajectory. Longer-term, China is seeking to evolve its economy through innovation; to thread the needle between profits and protecting the welfare of its people. The sheer scope and challenge involved in evolving such a large economy is formidable; no other country has the ability nor the ambition to undertake what China is doing. However, these efforts can lead to unintended consequences. Indeed, the simultaneous policy shocks across different sectors that we have seen thus far have likely caused an acceleration of an otherwise natural economic slowdown, eroding consumer sentiment, and contributing to recent market instability.

COVID

China has pursued a zero-tolerance strategy towards COVID-19. Entire metropolitan areas have been locked down following the detection of cases. It has been indicated that an 80-85%1 vaccination target would need to be fulfilled before any changes to this strategy. Manufacturing activity has not been shielded from this approach, with severe restrictions imposed on the industrial hub of Guangdong. Such an approach, which can instantly choke economic activity, only to turn the economy back on like a light switch when cases subside, is disruptive. This is because activity is often easier to cease than to restart. Soaring global freight rates are indicative of the congestion caused by China’s COVID intolerance, which included the closure of Ningbo-Zhoushan, the world’s third busiest port, reportedly over one positive case.

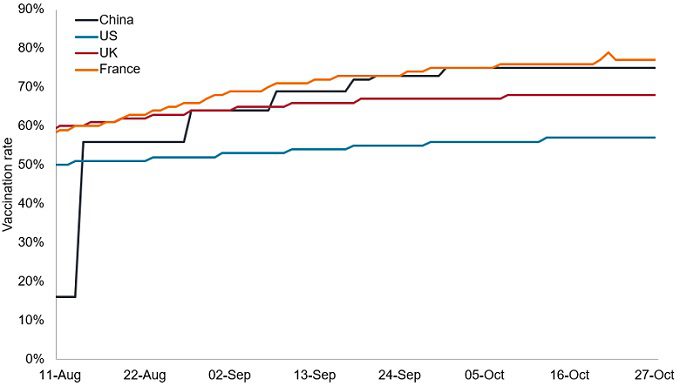

Figure 1: China’s Vaccination Rate Exceeds that of the UK and U.S. but is Short of its 80-85% Condition for Reopening

Source: Bloomberg, NCOVCNPV Index (China), NCOVGBPV Index (UK), NCOVUSPV Index (US), NCOVFRPV Index (France), 8 August 2021 to 27 October 2021.

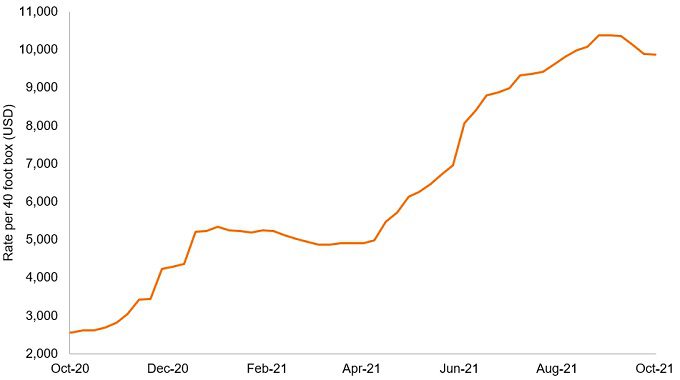

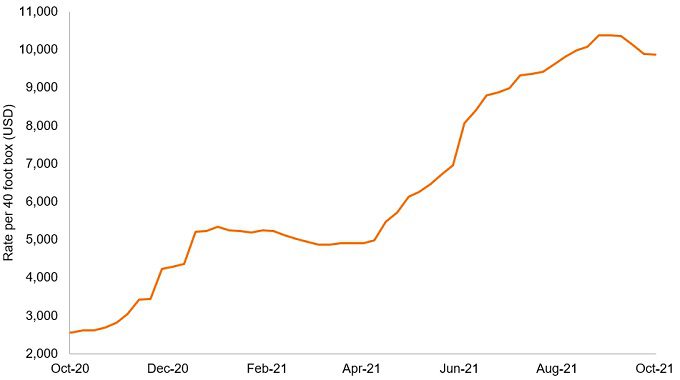

Figure 2: Rising Container Freight Rates

Source: Bloomberg, WCI (World Container Index) Composite Container Freight Benchmark Rate (WCIDCOMP), 21 October 2020 to 21 October 2021.

Consumption

Chinese retail consumption remains weak. It has fallen far short of expectations that it would improve as restrictions eased. Evidence of a rebound has been negligible, with China’s post-COVID retail sales growth remaining well below the 8%2 pre-pandemic growth rate, recorded in December 2019.

Anemic consumption may reflect the greatest burden of the COVID economic fallout being shouldered by those most susceptible to it. Low earners represent 40%2 of the population and labor market data suggests their income has not increased in line with more lucrative professions such as technology and financial services.

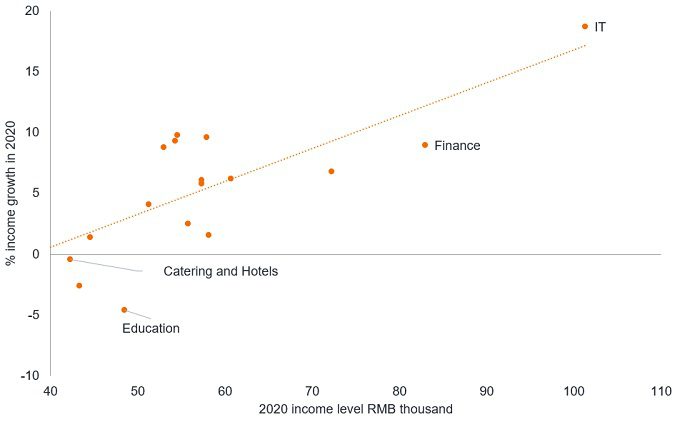

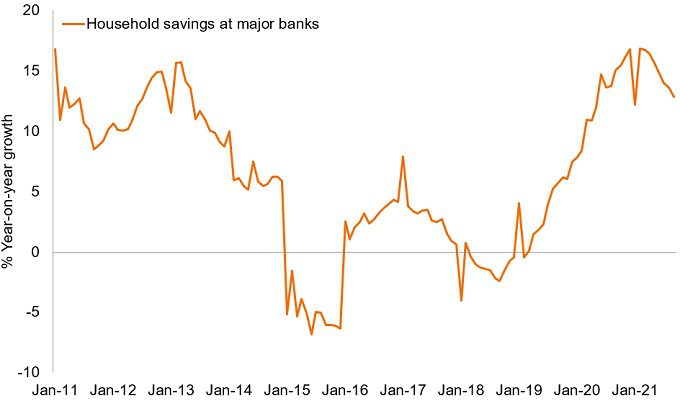

Figure 3: Income Inequality Worsened as Low-Income Groups Bore Brunt of COVID

Source: Barclays Research, Special Topic: China, Policy Evolution, September 2021.

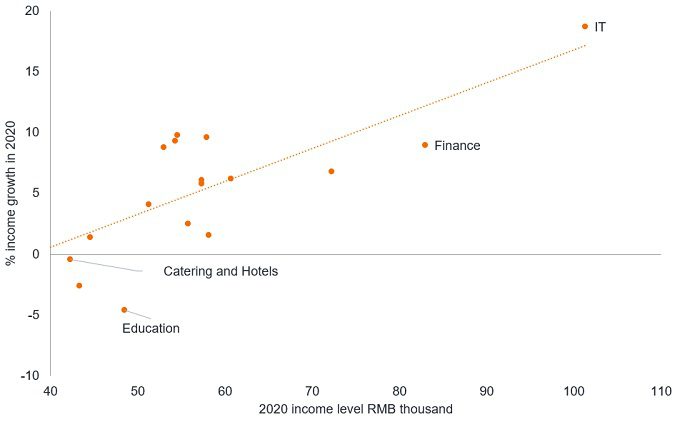

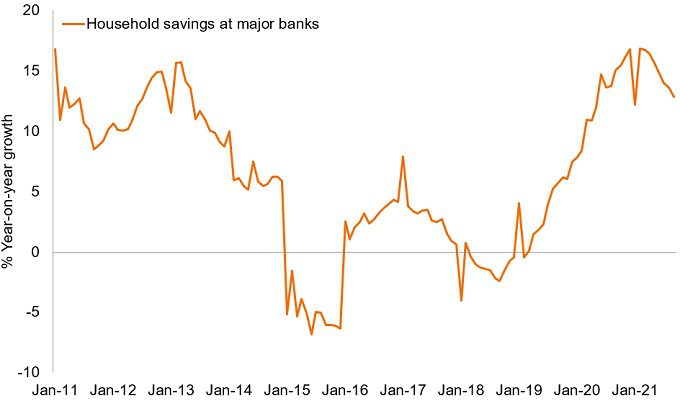

Similarly, household saving rates rose in response to COVID lockdowns but have not been used by savers to fuel a consumption-based recovery as the economy reopened. This may reflect the disruption and uncertainty resulting from the zero-COVID approach, where sudden restrictions being imposed make it difficult to plan for leisure spending. Additionally, it could indicate that consumers are cautious about their future employment prospects.

Figure 4: Fast Rise in Household Deposits

Source: Barclays Research, Special Topic: China, Policy Evolution, September 2021.

Credit

Another factor potentially weighing on consumers’ appetite to spend is the government’s crackdown on property. The government has stated that they do not wish housing to be a speculative market. Property is of societal significance in China, representing 23.3% of GDP3. Policies implemented to stabilize the housing market are beginning to bear fruit, albeit they appear to have overshot and are dampening this engine of growth.

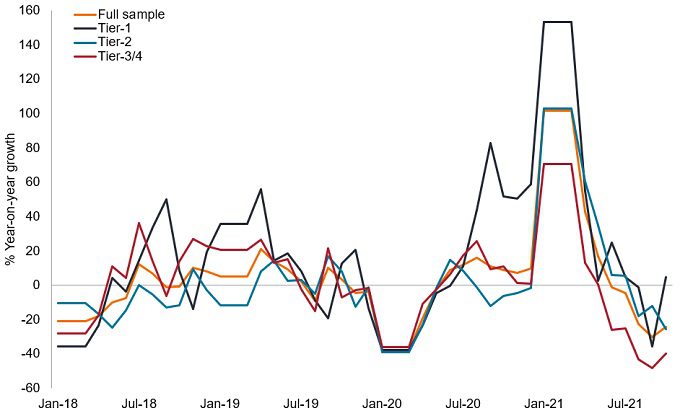

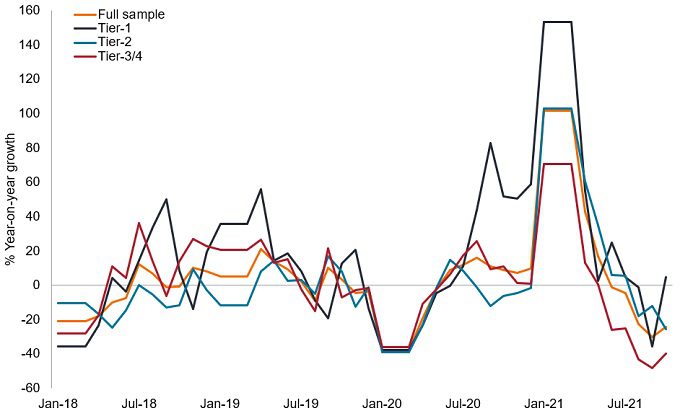

Figure 5: Year-on-year Growth in New Home Sales and its Breakdown by City Tier

Source: Nomura Global Research, China: Property-related indicators broadly worsened in September, October 2021. A city’s tier is calculated from an average of its political standing, population and GDP. Tier 1 reflects the biggest cities.

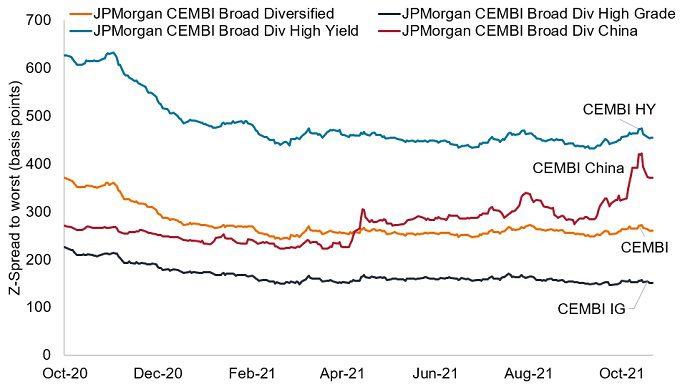

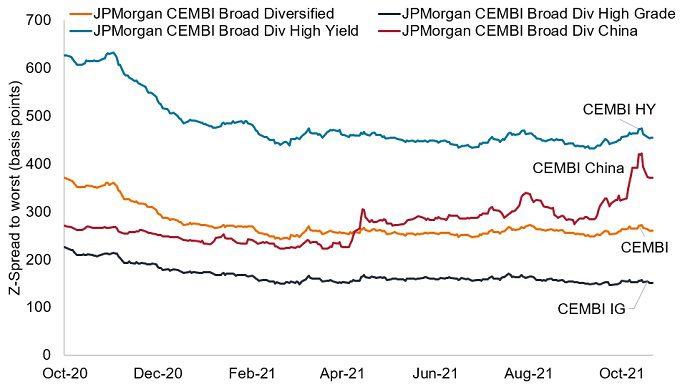

We have already seen some of the risk from a slowdown in the property sector, combined with stricter government policy on debt levels, manifest itself in the troubles at Evergrande, the huge Chinese property developer. Systemic risk from the Evergrande saga is likely to be low given that banks have limited direct exposure to property-related loans and China is likely to contain any fallout from being excessive. Nevertheless, support is more likely to be aimed at homebuyers than company bailouts per se, so equity and credit markets may have to absorb some losses. We can see the reaction in credit markets, with China’s credit spreads gaping wider. So far, there has been limited contagion beyond China, with broader emerging market high yield and investment grade spreads barely changed.

Figure 6: Muted Response by Credit Markets Outside China

Source: Bloomberg, JPMorgan CEMBI = JP Morgan Corporate Emerging Market Bond Index, JBCDCBZW Index (Broad Diversified); JBCDIGZW Index (High Grade or Investment Grade); JBCDHYZW Index (High Yield); JBCDCNZW Index (China). 1 October 2020 to 21 October 2021.

Attempts to tackle high debt levels in property form part of an overall drive to rein in credit growth. Major policy actions have been enacted to support the leadership’s credit tightening agenda, including2.

- The People’s Bank of China (PBoC) tightening property credit (encompassing trust and bond financing for developers and mortgages for consumers).

- The Ministry of Finance (MoF) imposing stricter curbs on both local government financing vehicles (LGFV) and bond issuance. The State Council also condoned the default of LGFVs.

- The China Banking and Insurance Regulatory Commission (CBIRC) tightening trust and shadow financing, with a 2021 reduction target of CNY1 trillion.

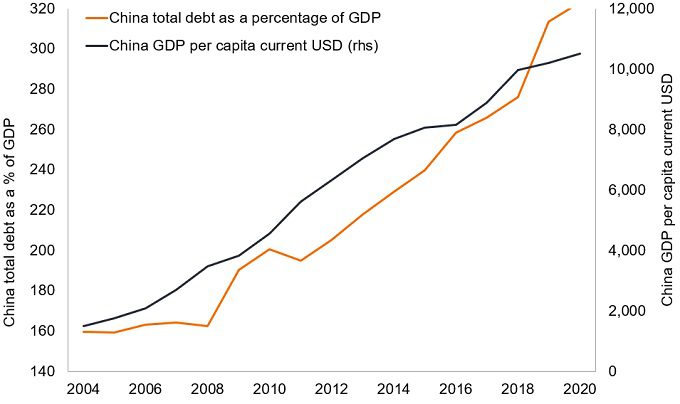

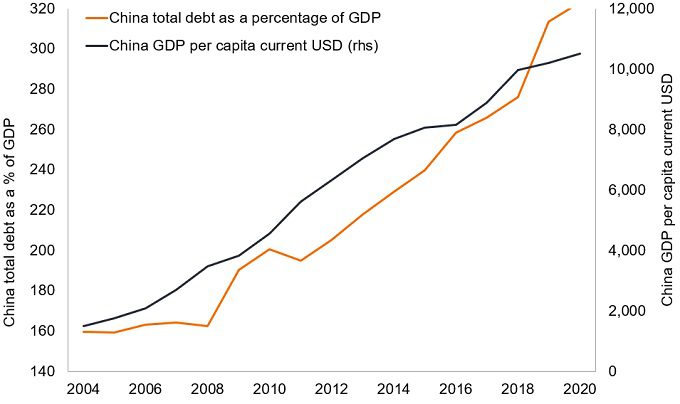

China has enjoyed decades of impressive debt-fueled growth. Rising debt as a percentage of gross domestic product (GDP) has had a positive relationship with Chinese GDP per capita. The risk to the wider world is that China’s desire to deleverage leads to slower domestic growth, with knock-on effects to global growth.

Figure 7: China’s Debt-Fueled Growth

Source: Bloomberg, CHBGDTOP Index (R1), GDCCPCHN Index (L1),31 December 2004 to 31 December 2020.

1Source: Deutsche Bank, Exit Strategy Policy Tracker, October 2021

2Source: Barclays Research, Special Topic: China, Policy Evolution, September 2021

3Source: Goldman Sachs Economics Research, China Data Insights: How big is China’s property sector, October 2021

Deleveraging: A company reducing its borrowing/debt as a proportion of its balance sheet. Within an investment fund, it refers to the fund reducing its level of leverage.

GDP: Gross domestic product – a measure of the size of the economy.

Systemic risk: The risk of a critical or harmful change in the financial system as a whole, which would affect all markets and asset classes.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon (interest payment) to compensate for the additional risk.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, so are given a higher credit rating by credit rating agencies.

Spread: the difference in yield between a bond (or a group of bonds in an index) and the risk-free rate, the US short term Treasury bond. It is typically expressed in basis points (100 basis points = 1%)

Z-spread: Zero-volatility spread is the spread that must be added to each spot interest rate on the US Treasury yield curve to cause the present value of the bond’s cash flows to equal the bond’s price.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields.

—

Originally Posted on October 28, 2021 – China’s Three Cs: COVID, Consumption and Credit

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: OTC Securities

An investment in an OTC security is speculative and involves a high degree of risk. Many OTC securities are relatively illiquid, or "thinly traded," which tends to increase price volatility. Illiquid securities are often difficult for investors to buy or sell without dramatically affecting the quoted price. In some cases, the liquidation of a position in an OTC security may not be possible within a reasonable period of time.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.