S&P spike turned pattern into microphone, described below.

Where does the bloodbath stop for Gold? Weekly chart.

Russell 2000 backtesting bull-flag breakout. Critical.

Crude Oil rare major four-star support holding.

Market Activity

Fed Chair Powell gets the nod. We fully agree with giving him the ability to see through the historic policy decisions he has captained. Let him land this plane.

– Brainard was appointed to Vice-Chair and is seen as much more dovish, aligning with strong progressive views.

– Markets hate uncertainties. This has been a theme of ours over the years. The S&P surged to a new record of 4740 as Powell brings more certainties. However, market is frothy and supply-demand technicals became maxed; everyone who wants to buy had bought.

– Unprofitable Tech started the session on weak footing. Rising yields began cratering parts of the market, ultimately leading to a large-scale reversal.

– Yields firmed on the appointment. 10-year tapping 1.65%, a one-month high. 30-year retesting 2.0%.

– 7-year auction at noon CT today.

– European Flash PMIs showed a robust increase and helped stabilize selling overnight. However, allude to price pressures and also a tailwind to yields.

– U.S. Flash PMIs due at 8:45 am CT.

– Crosswinds in the Energy sector; White House announced it will release 50 million barrels from the SPR in an effort to contain the rise of gas prices. Japan, India, and South Korea are expected to follow suit, but China will not in an effort to align with Saudi Arabia and Russia.

– Crude Oil spiked on the announcement. Remember, the RBA’s experience with yield curve control.

– OPEC+ has threatened to halt its monthly planned increase of 400,000 bpd.

E-mini S&P (December) / NQ (December)

S&P, yesterday’s close: Settled at 4679.75, down 14.75

NQ, yesterday’s close: Settled at 16,382, down 193.00

– From yesterday: Week 3 option expiration in the rearview mirror, and no bats of true volatility given elevation. Remember 50 points in the S&P is now 1%! However, weakness now may find less footing from dealers’ defense.

– Major three-star support at 4667-4669 is buoying the tape; decisive action below here will leave the door open for bears.

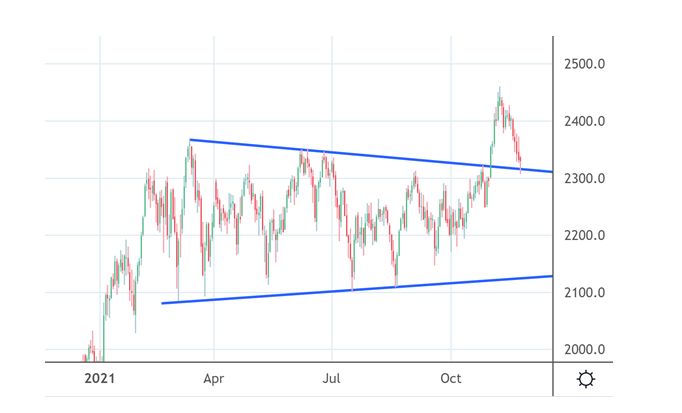

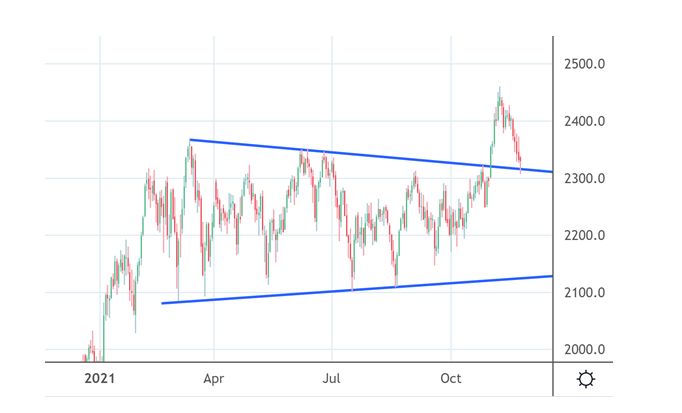

– From yesterday: S&P currently playing out a rising triangle pattern (chart above), typically resolves higher and the direction of the underlying trend. However, rising triangles that drag out can become rising wedges. These have a higher probability of resulting in a reversal. Key takeaway; the sooner the resolution, the more likely it is a bullish one.

– Update: Surge higher yesterday created a rising megaphone pattern. This typically results in a bearish move. (Chart above)

– Momentum indicators are now slopping lower and align with recurring levels to create strong resistance overhead at … Click here to get our (FULL) daily reports emailed to you!

Crude Oil (January)

Yesterday’s close: Settled at 76.75, up 0.81

– Rare major four-star support holding extremely well, it is doing its job.

– Price action trading around our momentum indicator at 76.15.

– Potentially, very bullish setup technically against rare major four-star support and fundamentally with White House capitulation.

– Keep an ear on OPEC’s reaction.

– API after the close, early estimates are for a composite draw of about 2 mb.

– First key resistance at… Click here to get our (FULL) daily reports emailed to you!

Gold (December) / Silver (December)

Gold, yesterday’s close: Settled at 1806.3 down 45.3

Silver, yesterday’s close: Settled at 24.297, down 0.484

– One could describe us as eternal Gold and Silver bulls. However, we are also realists. Gold officially broke out on November 10th. We had a very Bullish Bias as this played out but called for a necessary back and fill for nearly two weeks.

– The trend has been clearly bullish; therefore, we have held a very watered-down Bullish Bias (Neutral/Bullish), despite our expectations for a back and fill.

– Gold more than backtested its breakout. This is an example why trying to catch a falling knife can hurt.

– Tremendous overhead damage, unless there is a major fundamental shift, Gold and Silver are likely toast until bullish seasonal second half of December.

– Silver is breaking major three-star support aligning with a trend line at 23.93-24.04; continued action below here is bearish and could point as low as $23.

– Gold heading for a test of major three-star support at … Click here to get our (FULL) daily reports emailed to you!

—

Originally Posted on November 23, 2021 – Do These Reversals Have Legs?

Charts Source: Trading View

Disclosure: Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results. The information contained within is not to be construed as a recommendation of any investment product or service.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Blue Line Futures and is being posted with its permission. The views expressed in this material are solely those of the author and/or Blue Line Futures and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.