By: Daniel J. Graña, CFA & Matthew Culley

While the pandemic has increased near-term risk, the rise of innovative and value-added industries should place the future trajectory of emerging markets on more stable footing, Daniel Graña and Matt Culley argue.

Key Takeaways

- Disparate responses to the global pandemic are resulting in varying near-term outlooks for emerging market (EM) countries.

- Increasingly, the legacy EM drivers of offshoring and economic convergence are being eclipsed by innovation.

- Despite changes to tech sector regulations in China, we believe authorities continue to recognize the role that tech companies play in increasing efficiencies and providing needed services.

Over the course of 2021, emerging markets (EM) have had the trajectory of their economies and financial markets dictated, to a degree, by developments in the COVID-19 pandemic. Anticipation of increasing economic activity pushed EM equities benchmarks to record highs in February. Later, the spread of the Delta variant exerted downward pressure on the asset class. These public health developments should serve as a reminder that EM equities are not monolithic; EM countries’ unique responses to the pandemic will likely be an important determinant in their near-term economic progression and ability to generate attractive returns for investors.

More recently, an important segment of the asset class – China technology – has come under pressure due to a shifting regulatory landscape. While the situation merits monitoring, we recognize what hasn’t changed, which is the innovation being carried out by a host of Chinese companies as they leverage technology to drive productivity gains across the broader economy.

Shifting Drivers

We believe that future advancement of EM economies will be driven by innovative, private companies seeking to address the unique needs of these regions’ consumers and business customers. The growing role of innovation in many EM economies is owed to the greater economic stability brought about by years of outsourcing and convergence-led growth across the EM landscape. With clear policy support, we are now witnessing the establishment of what are rapidly becoming essential industries and the ascent of digitally native, middle-class consumers.

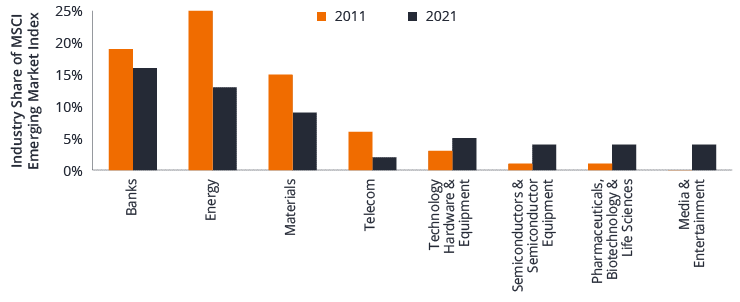

Innovative Industries Have Gained Market Share in Emerging Markets

Source: Bloomberg, Janus Henderson Investors. Industry weightings as of 19 August 2011 and 19 August 2021.

Economic decoupling between China and the U.S. is gaining traction, and the role played by global trade in powering economic growth is likely to diminish. Similarly, state-owned enterprises (SOE) that often lag the private sector in efficiency and can be called on to perform acts of “national service” are likely to play a smaller role in delivering marginal economic growth. Given these developments, actively managing exposure to legacy exporters and SOEs will likely be an important tool for managers seeking to maximize returns and managing risk in EM equities going forward.

A Playbook for Navigating a Complex Landscape

While we believe the private sector holds the keys to EMs’ future prosperity, other factors are at play. Policy casts a long shadow in countries still creating sound economic structures and regulatory frameworks, and corporate governance is an issue that often requires close examination. Given this, we think EM investors should be guided by a multi-lens approach that considers company fundamentals, corporate governance and the direction of macroeconomic policy.

Looking forward, within the macro context, we see reasons for optimism as the availability of COVID-19 vaccines and other therapeutics may help address the pandemic and lead to a broadening of investment opportunities. At the same time, we see divergence in how individual countries are dealing with the crisis. While some governments have been proactive in distributing vaccines and addressing outbreaks, others have struggled with logistics, new variants and reduced vaccine efficacy.

We believe these challenges could create a wide-ranging spectrum of trajectories for different countries. Those that succeed in combating the pandemic may return more quickly to their pre-2020 economic path. Countries that are slow to roll out vaccines or address uncontrolled viral spread may face longer-term health, economic and fiscal repercussions.

An Eye Toward the Future

What makes this a compelling time within EM investments is the degree to which these regions – especially heavyweight China – find themselves on the cutting edge of global trends. One trend we continue to follow is the long-term move toward decarbonization. President Xi Jinping has laid out ambitious plans for China to reach carbon neutrality by 2060. By many measures, China is at the forefront of developing novel technologies related to decarbonization and deploying them at scale.

We continue to see opportunity in China’s technology sector, especially companies tied to the digitization of its economy as this aligns with broad government objectives of increasing productivity and economic growth and helping to mitigate rising social inequalities. Recent developments with respect to more stringent regulation merit close observation, but we believe the central government recognizes the important role played by the tech sector in creating needed services and wringing out efficiencies in the economy.

—

Originally Posted on October 7, 2021 – Emerging Markets: Near-Term Uncertainty Matched with Long-Term Opportunity

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.