Global Economics – October 8, 2021

Introduction

Decent maybe. Not indecent certainly. Splitting hairs will now be the tedious task for the Fed which, after having dug its own single-indicator trap, will now doubtlessly begin talking up the strength of the September employment report. Though tapering in the US may well be on its way, some central banks are already raising interest rates as global monetary policy begins its post-pandemic shift. But we’ll pick up on that theme later.

The Global Economy

Employment

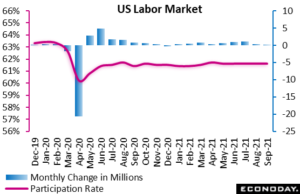

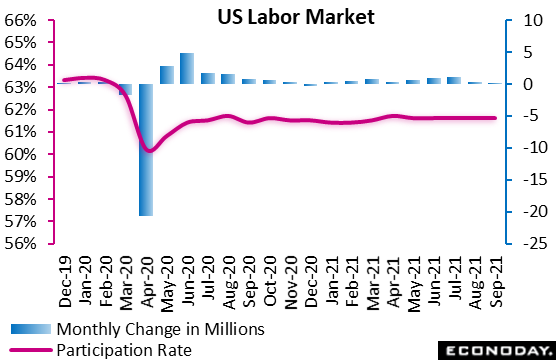

Nonfarm payrolls rose by just 194,000 in September, another disappointing performance versus Econoday’s consensus for 475,000. However, the headline overstates the weakness. Upward revisions to August and July totaled 169,000 putting the average monthly gain for the third quarter at a sizable 550,000. Importantly, a 123,000 drop in government payrolls skewed September’s headline lower, excluding which private payrolls rose 317,000 to put this 3-month average at 488,000. These levels should be sufficient to convince Fed policymakers that conditions have been met to begin tapering asset purchases, especially since other aspects of the report are convincingly solid. Wages were higher, up 0.6 percent on the month and 4.6 percent on the year, as was the workweek, up 2 tenths of an hour to 34.8. These are positives for household balance sheets. A tapering announcement seems all-but-assured for the November 2-3 FOMC meeting.

Goods-producers’ payrolls gained 52,000 in September with ongoing strength in manufacturing (up 26,000) and construction (up 22,000). Service-providers added 265,000 new jobs in September, with sizeable hires in retail (56,100), wholesale (16,900), and transportation and warehousing (47,300). Gains in leisure and hospitality (74,000) are also reassuring, suggesting that even with September’s worsening Covid rates, businesses continued to hire in response to consumer demand for goods and services. Government payrolls fell mostly on a drop in local government education workers (down 144,200) which may reflect some shutdowns in school districts where there was a rise in Covid cases among students, teachers, and staff. Seasonal adjustments, which are always tricky for September, may have also pulled down education.

And there was another detail that was also decidedly downbeat: the participation rate fell back a tenth to 61.6 percent reflecting a decline in the labor force, specifically a 710,000 monthly drop in the number of people actively looking for work. Though the number of employed rose by 526,000, the 184,000 balance disappeared in the month — which is not good news for businesses struggling to find workers nor for Fed Chair Jerome Powell who has been stressing the necessity of a balanced jobs recovery and the need to lift the participation rate.

—

To read the remainder of Global Economics, please subscribe via Amazon Kindle or email info@econoday.com to get set-up today!

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.