Inflation continued to inflict punishing blows upon European consumers in August with retail trade volumes in the euro area declining 2% compared to the previous year. The release sparked additional jitters among investors today, but on an encouraging note, curtailed consumer spending may help combat the strongest inflation in decades plaguing Europe and other economies.

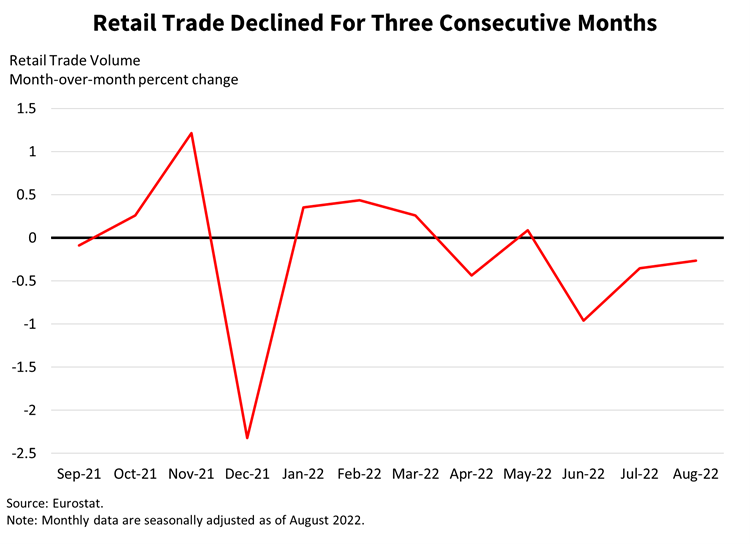

The August year-over-year result was weaker than the 1.7% decline anticipated by the market and an acceleration from the 1.2% year-over-year July decline. On a month-over-month basis, however, the loss decelerated to 0.3% from the 0.4% loss in July. On both year-over year and month-over-month bases, August was the third consecutive monthly decline in retail trade volumes, pointing to a significant weakening of consumer demand.

Ecommerce led the August losses with a 3.8% decline from July. Food, drinks and tobacco volumes also weighed on the headline number with a month-over-month loss of 0.8%. In contrast, softer oil prices relative to June and July contributed to an impressive 3.2% gain in automotive fuel sales during August. Non-food products excluding fuel also helped to offset losses, climbing 0.2%. On a year-over-year basis, all segments declined except for automotive fuel—anemic travel activity last year due to the pandemic created a low threshold for August 2022 fuel sales to generate a year-over-year gain.

In addition to European consumers curtailing spending in response to inflation jacking up prices, other challenges hurt retail trade, including the following:

- Tighter monetary policy has contributed to higher financing costs, weighing on sales of capital-intensive goods and services.

- A weaker euro has dampened sales of imported goods and services because Europeans need to pay more on a relative basis to offset their currency’s decline.

Europe, like most of the world, is facing the biggest inflation problem in decades, and this report is positive on the inflation front. Slower consumer demand is key to keeping price pressures in check as businesses lower prices to achieve sales. On the GDP front, this report is negative. Europe depends on domestic consumers to spend money to fuel the economy as their spending provides incomes for other establishments. Weakening consumer demand to this degree hurts incomes across the board. Additionally, business activity has weakened at its sharpest rate since January 2021, according to yesterday’s eurozone PMI release. Continued weakness of retail trade and PMI data against the backdrop of high oil prices and tighter monetary policy suggest a flat to negative third quarter GDP reading on Halloween, October 31. Investors have reacted. European equities are down, yields are up, and the euro is down today.

Watch Videos About Key Economic Indicators at Traders’ Academy – Click Here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.