Marginal progress during yesterday’s highly anticipated debt ceiling negotiations on Capitol Hill is relieving investors’ fears of a possible government debt default. The improving investor sentiment appears unphased by negative developments concerning consumer spending, the ailing real estate sector and loftier Fed tightening expectations.

Recent comments from top Democrats and Republicans regarding improvements in the structure of the debt ceiling debate, bipartisanship and a low likelihood of the government defaulting on debt are sparking an equity rally after stocks sold off yesterday on fears negotiators appeared to make little progress on the issue.

However, even as markets advanced this morning, recently released real estate data and weakening corporate earnings point to sluggish economic activity against the backdrop of tighter credit, high interest rates and slowing consumer spending.

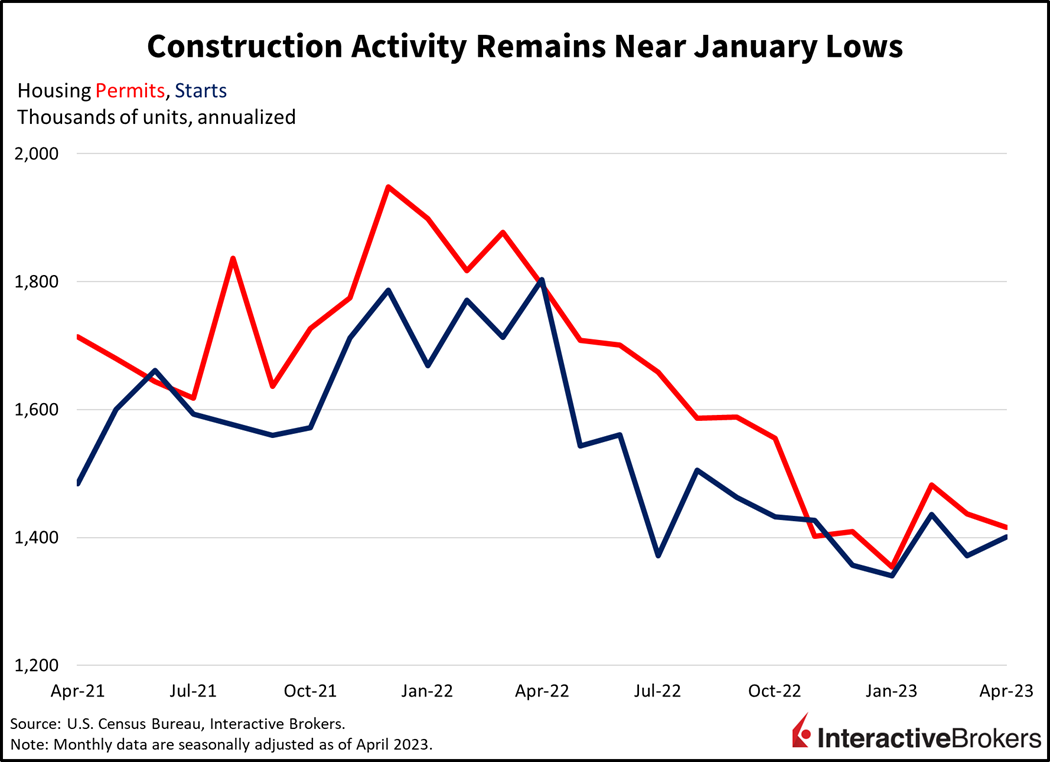

The pace of building permit applications fell 1.5% on a month-over-month (m/m) basis in April, below expectations calling for an unchanged reading. April marks the second consecutive month of contraction and the third decline out of four months of the year. The 1.416 million seasonally adjusted annualized units (SAAU) are inching closer to the January cycle low of 1.354 million, sparking concerns that the real estate sector hasn’t troughed yet. Housing starts, on the other hand, grew 2.2% m/m, exactly as expected and recovering some of the previous month’s 4.5% decline. Similar to permits though, the 1.401 million SAAU remains near its January bottom of 1.340 million units.

Weighing on plans for future construction most were the Northeast and Midwest regions, declining sharply during the month. Northeast regional permits declined 23.6% m/m while the Midwest dropped 15.2%. The South and West grew, however, gaining 4.3% and 3.8%, respectively. The multi-family asset class, which is heavily funded by regional banks, was the primary area of concern, dropping 9.7% m/m while single-family served to alleviate some of the damage, gaining 3.1% during the period. Within starts, modest gains were hampered by weakness in the Northeastern and Southern regions and Midwest single-family, which dropped 23.4%, 6.3% and 20.5%. Areas of strength were found in the Western region and in Midwestern multi-family.

Despite the significant weakness in construction activity, homebuilder sentiment has improved with the May National Association of Home Builders/Wells Fargo Housing Market Index climbing to 50, its first time above 50 since July. The residential market is struggling with low inventory as many homeowners are reluctant to sell because they don’t want to give up mortgages with low interest rates. While interest rates for new mortgages are still high compared to a few years ago, they have declined slightly this year, which may encourage more individuals to buy homes. This combination of lower mortgage rates and tight inventory is shoring up homebuilder sentiment.

The possibility of another 25-bp hike when Chairman Powell takes the mound on June 15 has risen from the ashes and is now up to 24%. A tougher and tighter Fed is buoying the dollar, with the Dollar Index up 38 bps to 102.95.

As the bond market’s expectations of higher-for-longer short-term interest rates shift into better alignment with the Fed’s, the equity market has been relieved by President Biden emphasizing this morning that he will continue discussions with top Republicans until an agreement is made. Equity markets are recovering off of yesterday’s losses, with the S&P 500 Index up 0.3%. The cyclically tilted small-cap Russel 2000 is leading the way this morning, buoyed by regional banks with the former up 1.2% and the latter up 5.3%. The yield curve is moving higher led by the shorter-end, this time due to Fed tightening expectations moving higher as debt ceiling concerns weaken. The 2-year Treasury yield is up 7 basis points (bps) to 4.14% while the 10-year is up 2 bps to 3.57%. Traders have digested recent Fed commentary and rate hike expectations have shifted from expecting a cut in September to now being split between a cut and a pause. Also, the possibility of another 25-bp hike when Chairman Powell takes the mound on June 15 has risen from the ashes and is now up to 24%. A tougher and tighter Fed is buoying the dollar, with the Dollar Index up 38 bps to 102.95. While U.S. oil inventories rose sharply for the second consecutive week as reported by the U.S. Energy Information Administration this morning, oil traders are focusing on the positives which include U.S. purchases of crude to refill its Strategic Petroleum Reserve alongside a forecast of record global demand of 102 million barrels per day in 2023, driving WTI crude oil up 1.8% to $72.10.

Recent earnings reports illustrate how inflation is crimping consumer spending. Consider the following examples:

- TJX Companies, Inc., an off-price retailer of home furnishings and apparel with store brands such as T.J. Max and Marshalls, posted first-quarter earnings per share (EPS) of $0.76, beating the consensus estimate of $0.71 and the EPS of $0.49 for the year-ago quarter. The company generated revenues of $11.8 billion, up 3% from $11.4 billion in the first quarter of 2022. Inflationary-weary shoppers are increasingly searching for lower-priced items and TJX has been a beneficiary of that trend, with increased traffic to its retail locations driving a same-store sales increase of 3%. TJX operates stores in nine countries and experienced a 1.3% negative impact on net sales growth due to adverse currency exchange rates on the back of a strong dollar. With a strong quarter completed, the company upgraded its fiscal-year EPS guidance to $3.49 to $3.58. It previously estimated fiscal-year EPS of $3.39 to $3.51. Its shares were up 3.5% earlier in the session but are now unchanged on the day.

- Target, which operates retail stores that offer apparel, home items and groceries, posted first-quarter EPS of $2.05, exceeding the consensus estimate of $1.74, but down from $2.16 for the year-ago quarter. Its sales revenues, however, climbed slightly year-over-year (y/y) from $24.8 billion to $24.9 billion and same-store sales were virtually flat y/y, which was consistent with analysts’ expectations. Target reported that budget-conscious customers have cut back on discretionary spending, which caused its online sales to decline y/y. However, in-store purchases, which tend to consist of non-discretionary items such as food and diapers, increased 0.7% on a y/y basis. The company has responded to the shift in spending patterns by reducing its inventory of discretionary items by 25%. The company is also implementing measures to combat shoplifting and theft from organized crime. The issue has been trimming about $500 million from its profits annually as violent incidents in its stores have been increasing. Target maintained its fiscal 2024 earnings guidance of $7.75 to $8.75 per share while analysts estimate an EPS of $8.27 a share. The company says it expects comparable same store sales to either decline or produce a low-single-digit increase. Its shares are up 2.5% on the day.

Real Estate Headwinds Challenge Economy

As investors anxiously wait for updates on the debt-ceiling negotiations, the real estate market continues to face significant headwinds. Higher interest rates and declining liquidity sparked the first leg down of the real estate slump. The next leg down will be led by the same pressures and a new hurdle: the recent regional banking debacle is constraining credit availability. With regional banks carrying a large chunk of commercial real estate lending, the decline in loan growth will continue to negatively impact the sector. I anticipate that the labor market will continue to soften and inflation will remain sticky, propelling higher interest rates, which taken together will weigh on real estate construction, transactions and prices. As we likely descend into recession in the second half of this year, construction activity, real estate transactions and prices will decline further and reach new lows. Visit Traders’ Academy to Learn about Building Permits and Other Economic In

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Very good article thanks