By now, you likely know that Federal Reserve Chair Powell spoke at 1:30 EST yesterday, and that his comments spurred a massive rally. Traders seemed to love his commentary, with major equity indices rising by 3-4%. The question is why?

Let’s unpack what he said. Among the highlights from his speech are:

- “It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy.”

- “Restoring that balance [of supply and demand] is likely to require a sustained period of below-trend growth.”

- “Despite some promising developments, we have a long way to go in restoring price stability.”

Those points, and most of the others that he made during his address and the subsequent Q&A, took a similar tone. Seeing them in black and white makes it clear that the Chair, and by extension the Fed as a whole, remain committed to restoring inflation to a 2% rate even if it results in poor economic growth – perhaps at the risk of a recession.

But as we’ve seen before, traders often hear what they want to hear and disregard the rest. Can we blame them when they seized upon these sentences:

- “Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting.”

This certainly has a bullish ring to it. The Chair wants to slow the pace of rate hikes. Yay! Except that this had been priced into market expectations. On Monday, we wrote about the notion that a slower pace of rate hikes had been reflected in Fed Funds futures price even before last week’s release of the November FOMC minutes. A 50-basis point hike in December has been priced in even prior to November, with no more 75-basis point hikes on the horizon. That is clearly a slower pace of rate hikes!

I also believe that the Chairman’s measured, soothing, “Goldilocks-ish” tone had much to do with the sudden enthusiasm. We noted that much of the recent commentary from Fed luminaries sounded like annoyed parents telling their kids to stop asking “are we there yet” from the back seat. Monday’s comments from regional Fed Presidents Bullard and Williams had that sort of ring to them, when they were quite assertive in saying that the Fed was not likely to cut rates during 2023, despite the Fed Funds market predicting two 25-basis point cuts by that year’s end. This line of discussion was absent from Mr. Powell’s speech yesterday.

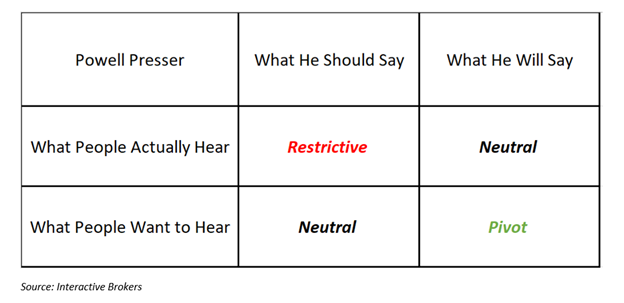

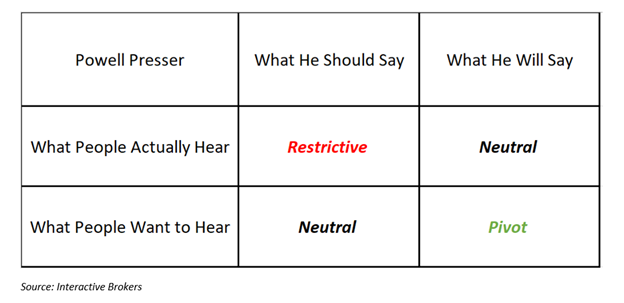

Something similar occurred when Powell used the term “neutral” in his post-FOMC press conference in July. Stocks rallied sharply for the ensuing weeks – until he abruptly ended the enthusiasm with his comments at Jackson Hole in August. Yesterday’s reaction seemed reminiscent of late July. In a piece we published just before the Jackson Hole address — one of several that referred to Chair Powell as “Goldilocks in a Suit” – we offered the following rubric shortly, and the logic certainly applied yesterday – except that “pacing” replaced “pivot” in the bottom right:

Nonetheless, despite the positive interpretation, there were some other factors that accelerated yesterday’s rally. First, as we noted almost three weeks ago, it is not uncommon to see sharp upward moves during bear markets. Even though the S&P 500 (SPX) crossed above its 200-day moving average for the first time since August (just before that fateful Jackson Hole event), we remain in a period of lower highs and lower lows – hence a downtrend.

That said, we are seeing some longer-term moving averages, like the 50 and 100-day, flattening out and perhaps curling up slightly. We saw the 50-day trend upwards before, even briefly crossing the 100-day in August. We know what happened next. Instead of banking on a pivot, however, traders are locked in on seasonal factors, particularly hopes that institutions would like to ensure a solid end to an otherwise difficult year. The fact that yesterday was the last day of November – a positive month for most US indices — possibly motivated some buying as well.

A specific catalyst may have been a significant options trade as markets began to lift when Powell spoke. Someone bought 20,000 SPX calls with a 4175 strike expiring on December 30th. Someone was clearly speculating on, or hedging against, a 5% move higher by the end of the year. As usual, call buying begat other call buying, both in nearby strikes and in the newly popular ultra-short-term options. A flood of call buying will inevitably lift stocks and markets in their wake. We are not seeing follow-through buying this morning, which helps explain the muted tone of today’s trading despite a much-weaker dollar.

Finally, I would like to shift gears and discuss crypto for a brief moment. I watched Sam Bankman-Fried’s interview with Andrew Ross Sorkin for a New York Times Dealbook event. I found it shocking that he claimed little knowledge about the goings on at Alameda and the sparseness of risk management throughout FTX. As someone who spent the bulk of his career managing portfolio risk at a firm that takes risk management VERY seriously, I was stunned. Is it possible that the firm outgrew its ability to control its risks? Perhaps. But for a CEO to seem oblivious to it struck me as self-serving at best. My interpretation of his comments – after wondering why someone with such potentially enormous legal exposure would do an interview of this type – was that he seems now to be deliberatly promoting a buffoonish image. Fraud (which I’m not alleging) is criminal. Stupidity is not – though it’s not a defense. Either way, I urge readers to carefully consider with whom they do business. Know your customer is a crucial consideration for brokers, but know your broker should be an equally important consideration for customers.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.