Key News

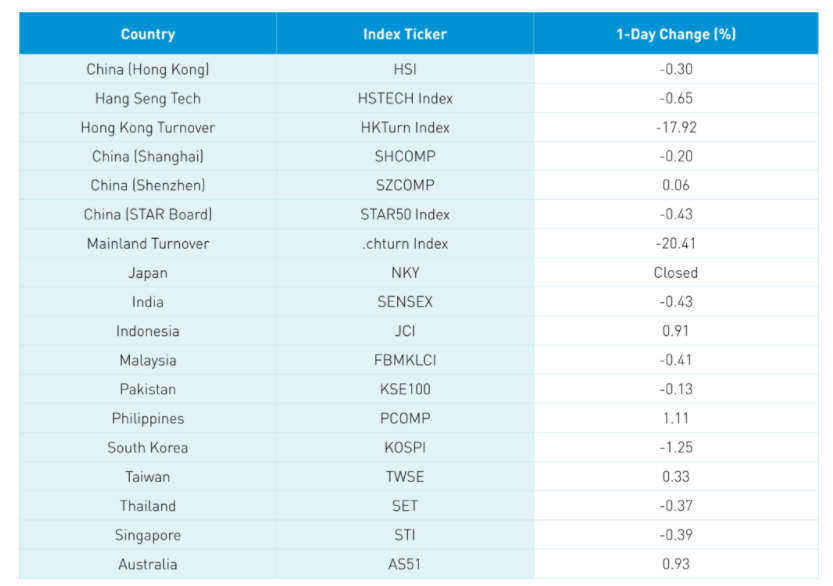

Asian equities were largely off today on light volumes as investors wait on the Fed’s tapering outlook with Japan on holiday and the Philippines outperforming.

Going into today’s session we had several negative headlines including Premier Li stating that China’s economy faces “downward pressure” though he offered a solution via tax and fee cuts for small and medium companies, which we saw at the end of October as companies in manufacturing were allowed to defer taxes until next year.

We also had PBOC head Yi Gang remind fintech companies to abide by the new user data protection law. Meanwhile, concerns that the Biden administration could ban Chinese-made solar panels weighed heavily on solar names overnight. The irony is that there has been talk of rolling back China tariffs in order to curb inflation.

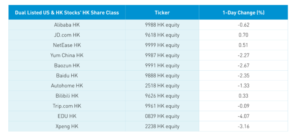

We also had a Bloomberg article widely circulated on Alibaba’s US listing seeing sales based on SEC 13F filings stating investors “dumped over 16 million shares”. The article failed to look at Alibaba’s Hong Kong listing, which showed that many of the “sales” in Alibaba’s US listing were conversions into the Hong Kong share class. There was some chatter about management changes at Bytedance, though it is a private company. We also had reports on China’s efforts to curtail the Delta virus.

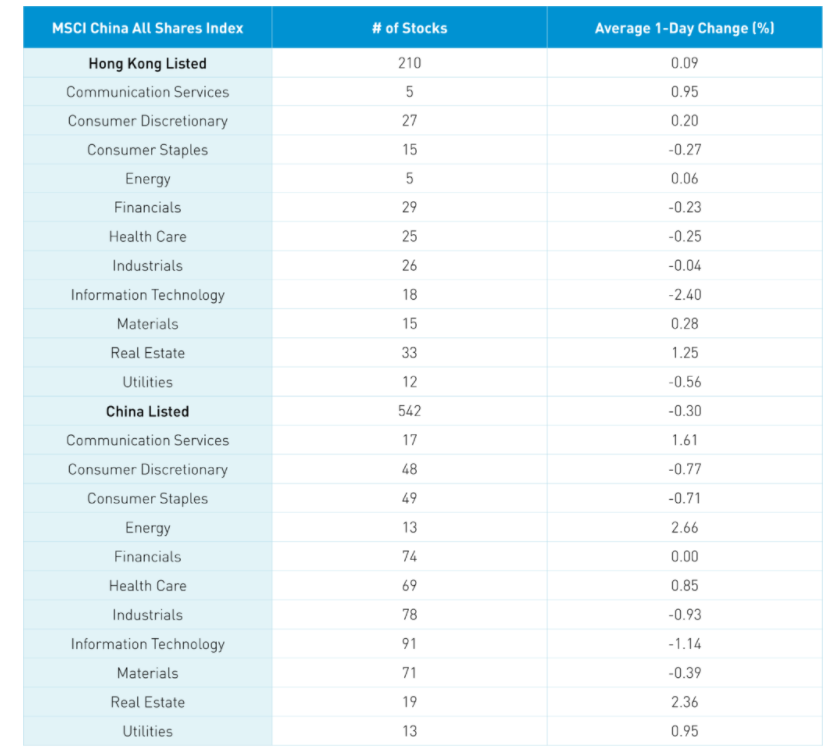

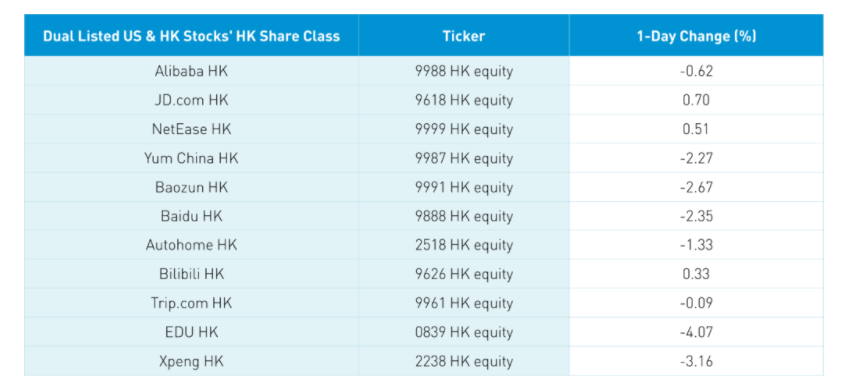

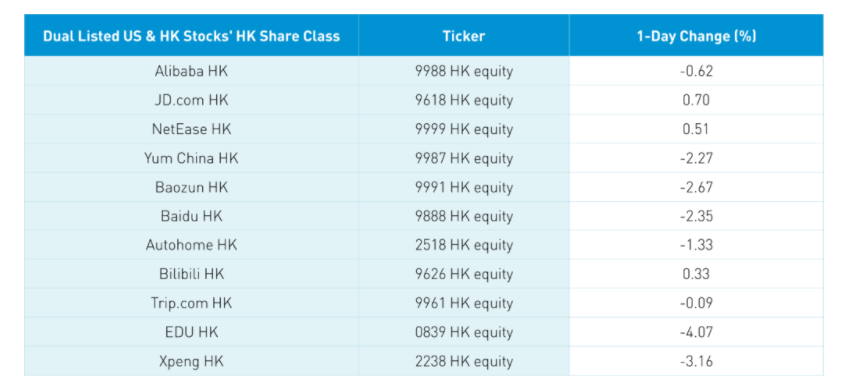

The Hang Seng was off -0.3% though Hong Kong’s volume was only 70% of the 1-year average. The index managed to close above 25k at 25,024. The October Caixin China PMI Services, which had its survey done by IHS Markit, beat estimates at 53.8 versus estimates of 53.1 and September’s 53.4. Hong Kong-listed internet stocks were mixed though companies with a US dual listing were not down nearly as much as yesterday’s US price action which should lead them to pop today.

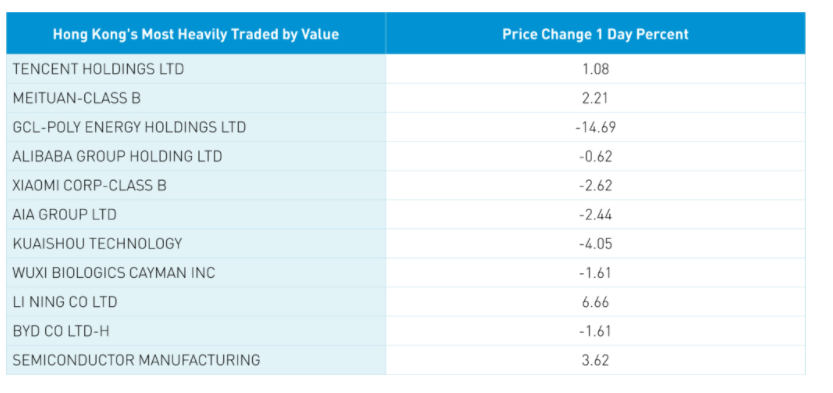

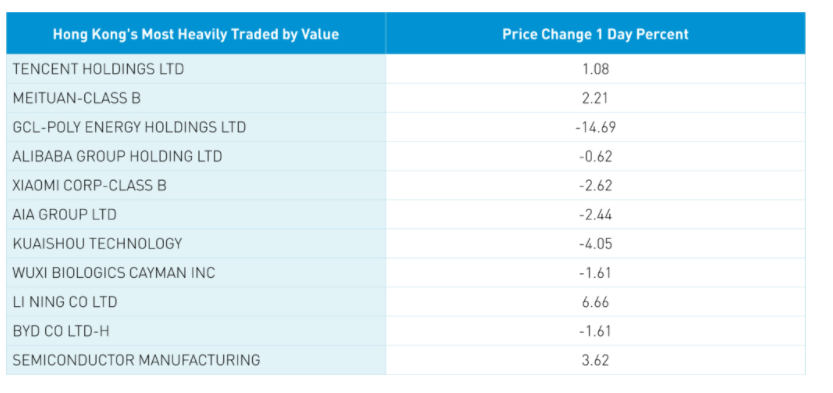

Tencent and Meituan gained +1.08% and +2.21%, respectively, as Mainland investors were net buyers via Southbound Stock Connect. Tencent announced the rollout of several new semiconductor chips, highlighting the company’s ingenuity.

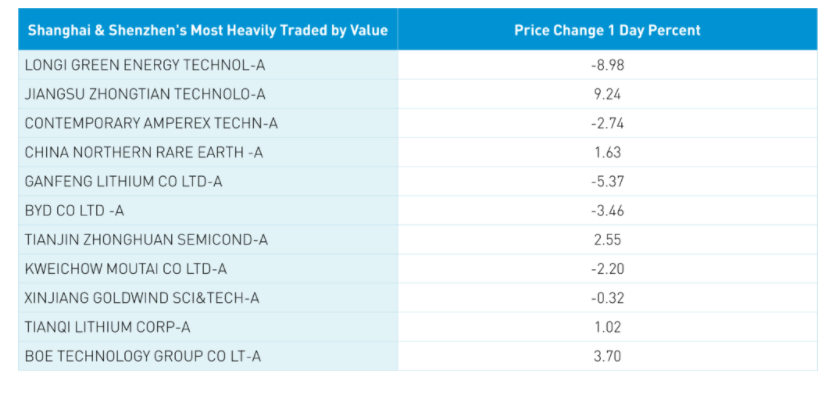

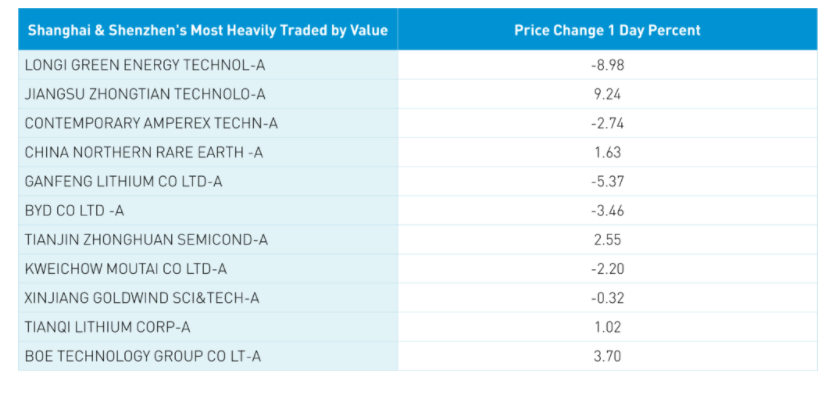

Mainland markets diverged as Shanghai fell -0.2%, Shenzhen gained +0.06%, and the STAR Board fell -0.43% on volumes that were equal to the 1-year average. It is interesting to note that real estate was a top-performing sector in the Mainland and Hong Kong. Energy was led higher by coal stocks as China needs to stockpile ahead of the winter while clean energy names were off today. Foreign investors bought $114 million worth of Mainland stocks today via Northbound Stock Connect. Chinese Treasuries were off while CNY and copper rallied a touch.

I stumbled upon the below article written by a US truck driver on his take on the supply chain problems. Unfortunately, the problem has multiple causes which likely means it isn’t going away. A worthwhile read! https://medium.com/@ryan79z28/im-a-twenty-year-truck-driver-i-will-tell-you-why-america-s-shipping-crisis-will-not-end-bbe0ebac6a91

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.40 versus 6.40 Yesterday

- CNY/EUR 7.41 versus 7.42 Yesterday

- Yield on 10-Year Government Bond 2.94% versus 2.93% Yesterday

- Yield on 10-Year China Development Bank Bond 3.23% versus 3.23% Yesterday

- Copper Price +0.60% overnight

—

Originally Posted on November 3, 2021 – Growth Concerns & Fed Tapering Uncertainty Weigh on Asian Equities

Author Positions as of 11/3/21 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.