In the July 10 week the focus will be on the reports related to inflation – the consumer price index (CPI), final-demand producer price index (PPI), and the import and export price indexes. All three are for June and will be released at 8:30 ET on Wednesday, Thursday, and Friday, respectively.

These are the last major reports on inflation that the FOMC will have in hand when Fed policymakers meet on Tuesday and Wednesday, July 25-26. With data related to the labor market showing still tight conditions despite some reductions in job openings and slowing in hiring, the inflation data will determine if the FOMC decides to hike rates again at this next meeting. While the Fed’s preferred measure of inflation is the PCE deflator, this June report will not be available for the FOMC. It will not be released until 8:30 ET on Friday, July 28.

So-called “headline” inflation – for all items in the index basket – has been coming down steadily due to relief in commodities prices where demand has eased and supply chains improved. It is price pressures at the “core” – all items excluding food and energy – where central bankers see inflation as more persistent and therefore more likely to need restrictive monetary policy for some time to come.

Fed policymakers are also keeping a close eye on inflation expectations. Failure to control inflation could unsettle expectations with the result of inflation becoming entrenched and making it more difficult for policymakers to credibly act to fight inflation. So far, though inflation expectations for the medium term have only risen modestly since the beginning of the current inflation episode, they remain above the Fed’s 2 percent flexible average inflation target. The FOMC wants to ensure that expectations do not lose their anchor.

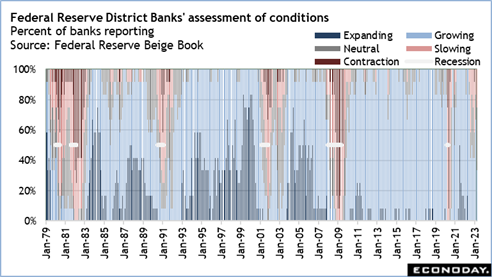

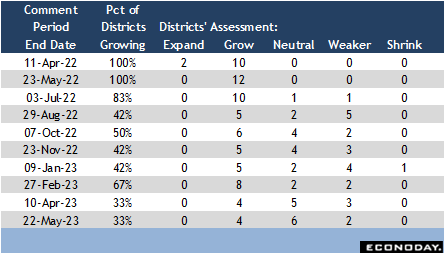

Also important for the upcoming FOMC meeting is the release of the Fed’s Beige Book compilation of anecdotal evidence about conditions across the 12 District Banks. Recent Beige Books have been consistent with the sort of “subpar” or underperformance that Fed officials have talked about in consequence of the aggressive series of rate hikes begun in March 2022 to tame inflation. The next report is set for release at 14:00 ET on Wednesday.

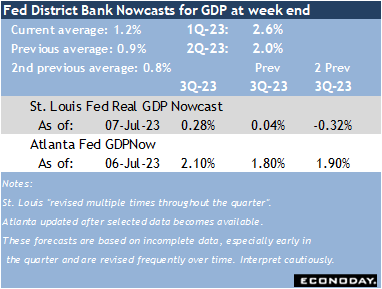

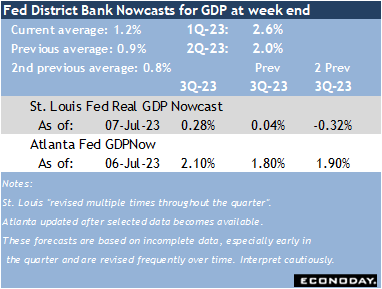

GDP Nowcasts from the St. Louis and Atlanta Feds both anticipate a below-trend increase in third quarter GDP. The St. Louis Fed’s Real GDP Nowcast looks for meager growth of 0.28 percent when the advance estimate is released at 8:30 ET on Thursday, July 27. The Atlanta Fed GDPNow forecasts an increase of 2.1 percent, quite similar to the up 2.0 percent in the second quarter.

—

Originally Posted July 7, 2023 – High points for economic data scheduled for July 10 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.