Key News

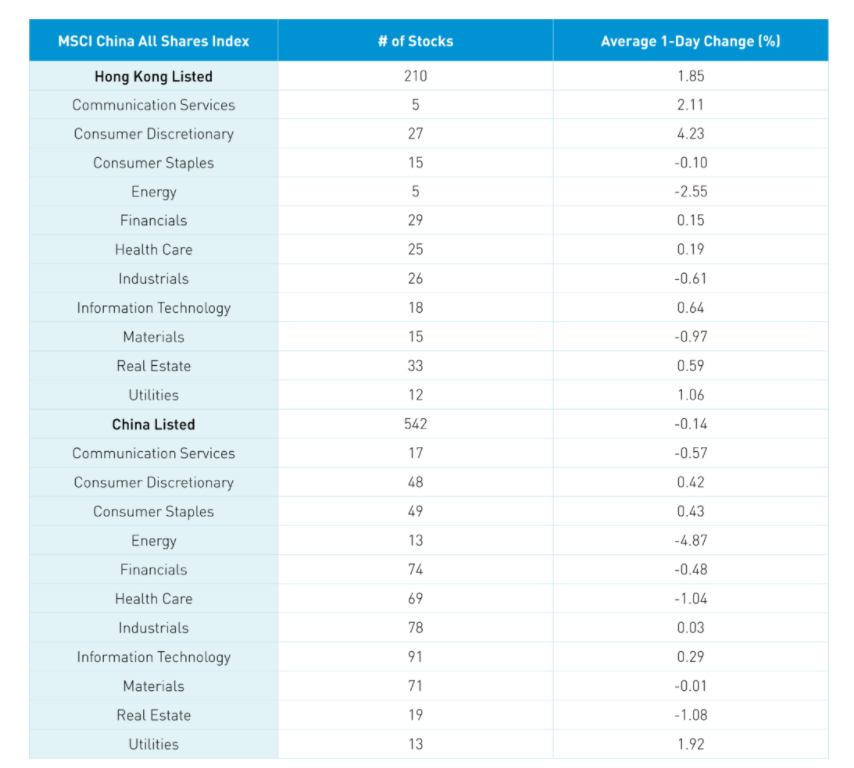

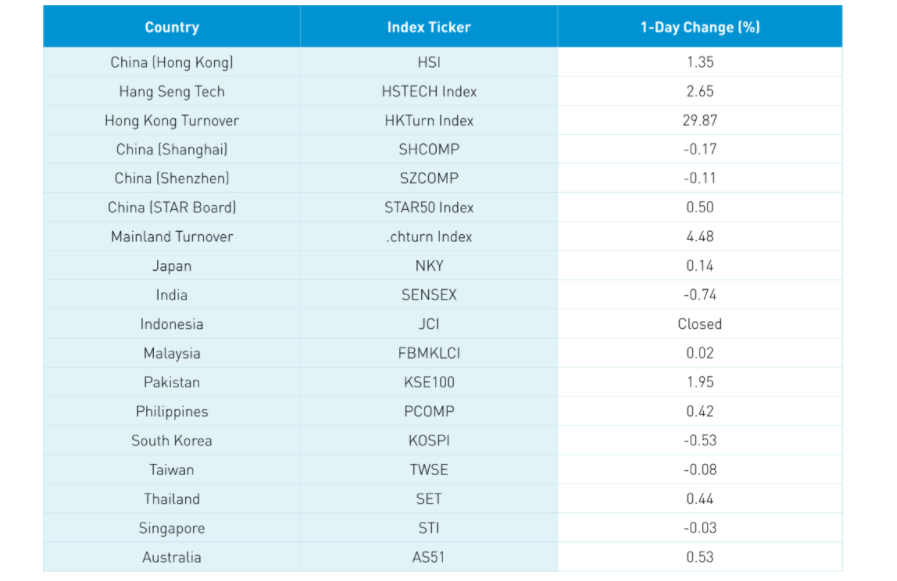

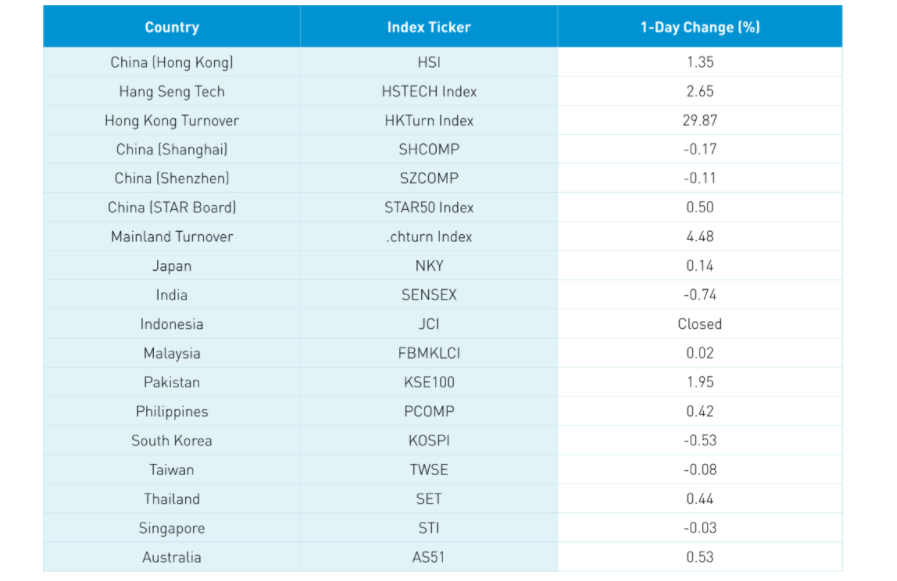

Asian equities had a mixed day, as Hong Kong and Pakistan outperformed while India and China were off small. Hong Kong was once again led by internet stocks as the Hang Seng Tech jumped +2.65% versus the Hang Seng Index’s +1.35%. Today’s rally was accompanied by strong volume, up +29% from yesterday, which is a good sign though off from the 1-year average.

Jack Ma’s vacation in Spain is being cited as a sign regulation is loosening, though the company’s new chip for its cloud computing business is a more realistic sign. We also have Alibaba’s Singles Day sales event, the largest e-commerce event globally, in a few weeks. The biggest factor is investors’ significant underweight to the space based on our air pocket thesis: investors have moved to the sidelines and not tried to catch a falling knife until there is more regulatory certainty. Overnight a global investment bank made China an overweight in the Asia Pac country model for the first time since last summer. If this rally gets some legs we are apt to see more strategists do the same.

Investors are overweight India which is now the most expensive market by valuation in Asia Pacific. While China’s coal issues garner apocalyptic attention, there is no attention to the reality that 71% of India’s electricity is generated by coal according to Bloomberg New Energy Finance (BNEF puts China at 61%). As I’ve stated in the past, I’m just jealous of the money investors throw at India.

Southbound Stock, the trading venue that allows Chinese institutional investors to buy Hong Kong stocks, had a very strong inflow day with Tencent seeing small net buying while Meituan had a very strong inflow day. Coal stocks took a beating in both Hong Kong and China while the clean technology sector had a strong day led by EV, wind, and solar.

Both Vice Premier Liu He and PBOC head Yi Gang spoke about controlling the Evergrande situation and not allowing it to become a financial crisis. Yi Gang spoke about not letting Evergrande take out other real estate developers in addition to preventing it from becoming a financial crisis.

Yesterday’s rise was attributed to a loan prime rate cut which didn’t happen overnight. As we mentioned yesterday, the loan prime rate (LPR) hasn’t been cut since April 2020. The PBOC has been active in pumping liquidity into the financial system over the last several days. Coal prices were a big topic as the government tries to ramp up production while jawboning down prices.

Foreign investors were active buyers of mainland stocks overnight while the renminbi took a breather versus the dollar while staying below the 6.40 level.

H-Share Update

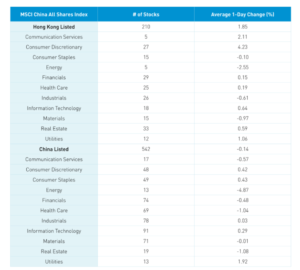

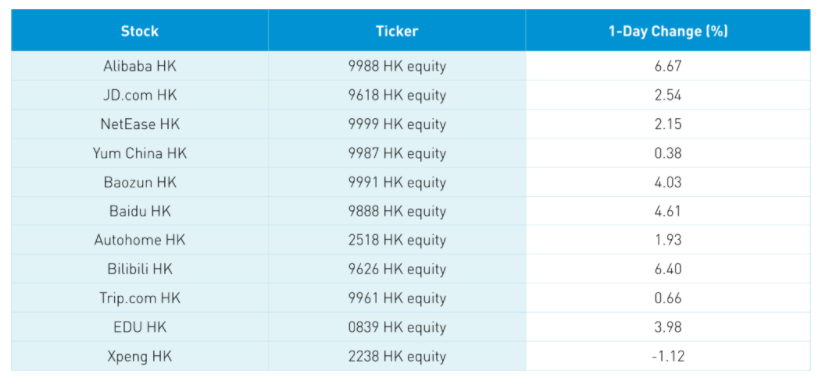

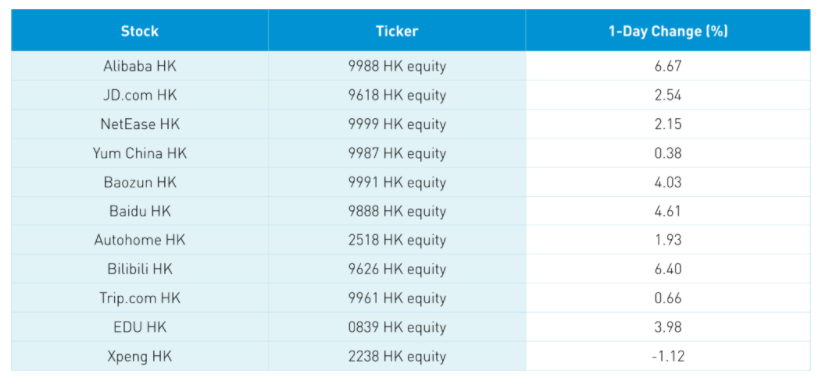

The Hang Seng opened higher, took a mid-morning swoon before rallying back to close +1.35% as volume jumped +29.87% which is 91% of the 1-year average. The 210 Chinese companies listed in HK within the MSCI China All Shares gained +1.85% led by discretionary +4.23%, communication +2.1%, utilities +1.06% and tech +0.64% while energy -2.55% and materials -0.97%. HK’s most heavily traded by value were Tencent +2.1%, Alibaba HK +6.67%, Meituan +2.87%, Kuaishou +4.28%, Xiaomi +1.33%, HK Exchanges +1.66%, Geely Auto +4.93%, Anta Sports-1.07%, JD.com HK +2.54% and AIA +1.4%. Southbound Stock Connect volumes were moderate/light as mainland investors bought $503mm of HK stocks as Southbound trading accounted for 11% of HK turnover.

A-Share Update

Shanghai, Shenzhen and STAR Board bounced around the room closing -0.17%, -0.11% and +0.5% as volume increased +4.48% which is 103% of the 1-year average. The 542 mainland stocks within the MSCI China All Shares were off -0.12% with utilities +1.94%, staples +0.45% and discretionary +0.44% while energy -4.85%, real estate -1.06% and healthcare -1.02%. The mainland’s most heavily traded stocks were Longi Green Energy +3.38%, China Northern Rare Earth +4.48%, CATL _0..19%, Tianqi Lithium flat, Jiangxi Special Electric Motor +8.98%, BYD +2.04%, Kweichow Moutai +1.59%, Tianjin Zhonghuan Semiconductor +3.84%, Zijin Mining -4.07% and Jiangsu Hengrui Medicine +3.97%. Northbound Stock Connect flows were light as foreign investors bought $638mm of mainland stocks today as Northbound trading accounted for 5.4% of mainland turnover.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.39 versus 6.39 yesterday

- CNY/EUR 7.43 versus 7.45 Yesterday

- Yield on 10-Year Government Bond 3.00% versus 3.01% Yesterday

- Yield on 10-Year China Development Bank Bond 3.33% versus 3.33% Yesterday

- Copper Price -02.19% overnight

—

Originally Posted on October 20, 2021 – Hong Kong Internet Rally Gets Legs as Jack Ma Enjoys Spain

Author Positions as of 10/20/21 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.