Economic data released this morning reflected continued strength in the services sector amidst persistent weakness in the goods sector. Markets are responding in cheerful fashion, however, as investors weigh stubborn inflation in services against cooling goods prices. Meanwhile, the passage of the debt ceiling bill through the House of Representatives reduces a significant headwind from investors’ mindset.

With legislation that would suspend the country’s $31.4 trillion debt ceiling for two years having passed the House, investors are now turning their attention to the Senate, which is expected to give the matter a thumbs up quickly and in time for President Biden to sign the legislation into law, which would allow the U.S. to avoid a default on debt and continue to pay other obligations, such as Social Security. The deal suspends the debt ceiling in exchange for cuts in future spending. While some Republican leaders say the deal cuts spending by $2 trillion, Biden maintains it will reduce spending by half that amount.

On a heavy day on the economic calendar, ISM’s Manufacturing Purchasing Managers’ Index (PMI) depicted a sector that has contracted for the seventh consecutive month in May. May’s reading of 46.9 came in close to expectations calling for 47 and reflected deterioration from the previous month’s 47.1 reading. Fewer orders from buyers and lower commodity prices led to a contraction of 44.2 in the prices paid component, the lowest reading all year, which is supporting lower inflation expectations as reflected by the yield curve. The reduction in demand, however, didn’t stop manufacturers from adding workers, with the employment segment of the index rising to 51.4, firmly in expansion territory for the month and gaining from April’s 50.2.

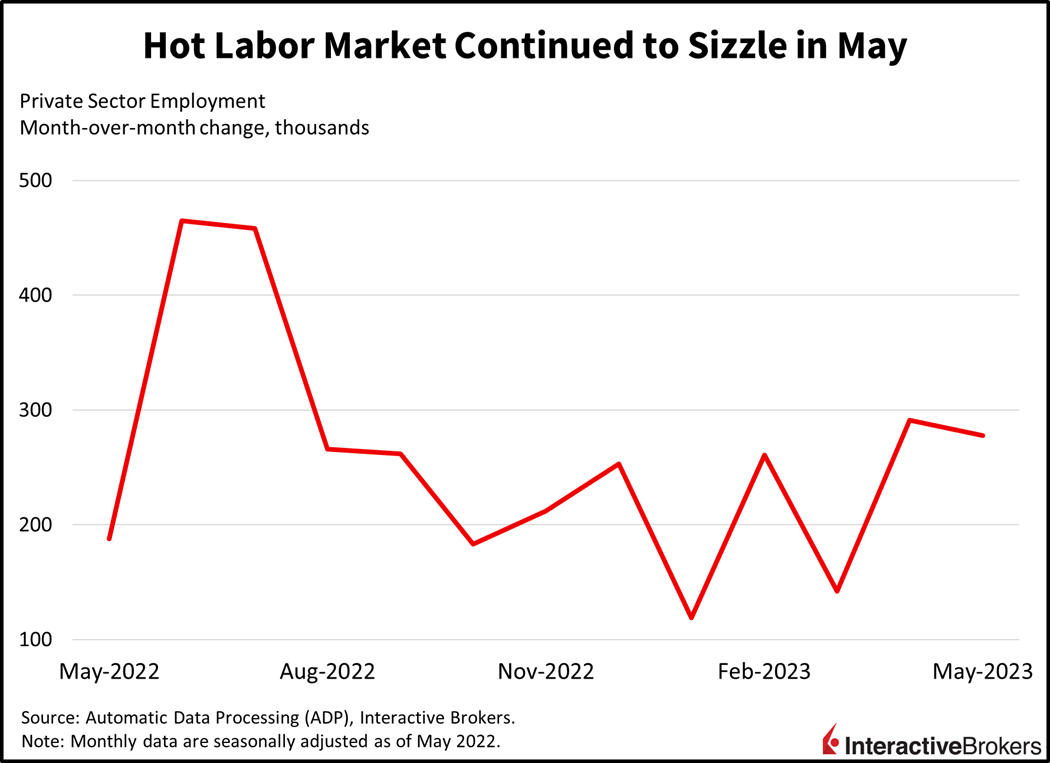

The tight labor market wasn’t just reflected in the ISM; ADP’s employment report was boiling hot, with employers adding 278,000 workers in May. Excluding April’s 291,000 additions, May’s job gain was the highest since last July and trounced expectations calling for monthly growth of 170,000. Small and mid-sized businesses between 1 and 499 employees generated all of the gains, with large companies comprised of 500 workers or more losing 106,000 during the period. Bifurcations were also observed among sectors, with leisure and hospitality representing a large share of the gains, having added an impressive 208,000 workers. Other sectors boosting the headline were natural resources and mining, construction, trade transportations and utilities, and other services. Sectors that weighed on the headline were manufacturing, finance, education and health services, information and business services.

This morning’s Unemployment Claims data came in higher than the marketplace would like but lower than May highs and not an immediate cause for concern. The 232,000 workers filing for unemployment benefits during the week ended May 27was lower than the consensus expectation of 235,000 but marginally higher than the previous week’s 230,000. Meanwhile, continuing claims of 1.795 million for the week ended May 20, less than the 1.8 million expected but higher than the 1.780 million from the previous week.

Markets are happy today as we start June and recovering from yesterday’s bearish sentiment. Stocks were negative near the open on the hot ADP number but turned positive on lower prices paid as depicted by the ISM’s report at 10:00 am Eastern Time. The S&P 500 Index is recovering from yesterday’s losses and is up 0.8% to 4217 with broad participation from all other major indices. Yields are down across the curve with the 2- and 10-year Treasury maturities down 3 basis points (bps) each to 4.36% and 3.61%, respectively. The dollar is lower as well, on lighter Fed tightening expectations amidst modestly lower long-term inflation expectations. The Dollar Index is down 56 bps to 103.74. WTI Crude oil is recovering some of its losses from its recent downtrend, gaining 1.5% to $69.12 per barrel.

Recent earnings reports show that technology companies are continuing to grow their earnings, but at slower rates, while higher costs of living are continuing to crimp consumers’ discretionary spending. These trends are illustrated by the following examples:

- Salesforce, which provides cloud-based software for marketing, sales, e-commerce and client services, reported net income of $199 million, or $0.20 a share, for the quarter ended April 30 compared to $28 million, or $0.03 a share, for the year-ago quarter. The company’s adjusted earnings of $1.69 a share exceeded the consensus analyst estimate of $1.61 and increased year-over-year (y/y) from $0.98. Revenues climbed y/y from $7.41 billion to $8.25 billion and exceeded the consensus expectation of $8.18 billion. The company raised its full fiscal-year 2024 adjusted earnings per share (EPS) forecast to a range of $7.41 to $7.43 from prior guidance of $7.12 to $7.14. Salesforce shares fell more than 5.5% in premarket trading this morning in part because capital expenditures during the quarter climbed 36% y/y to $243 million, exceeding the analyst consensus forecast of $205 million. Additionally, revenue increased at the slowest rate in approximately 10 years. The company initiated layoffs earlier this year and also reduced its office space to cut costs and preserve profits. Chief Operating Officer Brian Millham noted that customers are taking longer to finalize deals than in the past and they are seeking technology that can provide value quickly. The change in customer behavior is creating headwinds for the company. During the recent quarter, Salesforce expanded its AI services by adding Einstein GPT, which among other functions will allow clients to respond to message with chatbots.

- CrowdStrike, which provides cloud-based cybersecurity, reported adjusted EPS of $0.57 for the first quarter compared to $0.31 in the year-ago quarter and above the analyst consensus estimate of $0.51. Its profit of $500,000 was up from a loss of $31.5 million for the first quarter of 2022. CrowdStrike’s revenue also increased, climbing from $487.8 million to $692.6 million and exceeding the consensus expectation of $676.4 million. The y/y 42% revenue growth rate, however, moderated from the y/y 61% rate CrowdStrike reported for the first quarter of 2022, which caused the company’s share price to initially drop 11% after the recent earnings announcement. On a positive note, a slowdown in hiring employees supported profits, according to Chief Financial Officer Burt Podbere. Like many other companies, CrowdStrike also announced using AI to improve its technology. CrowdStrike estimates it will generate revenue ranging from $717.2 million to $727.4 million during the current quarter while the analyst consensus estimate is for a range of $698 million to $742 million.

- Macy’s, which operates department stores with brands such as Macy’s and Bloomingdale’s, reported net income of $155 million for the first quarter of this year, down substantially y/y from $286 million. Its diluted EPS of $0.56 declined from $0.98 y/y while adjusted diluted EPS dropped from $1.08 to $0.56. Analysts anticipated an adjusted EPS of $0.46. For the first quarter, revenue of $5 billion declined 7% y/y as inflation weary consumers who are struggling with higher costs of living continued to cut back on discretionary spending. In a sober development, Macy’s Chief Executive Officer Jeff Gennette said the company anticipated challenging conditions but in March it became clear that the downward trend in discretionary spending was accelerating. Same-store sales for Macy’s branded locations tanked 8.7% y/y while sales at Bloomingdales, which is a higher-end brand, dropped 3.9%. Gennette said the bigger decline in sales at Macy’s reflects that more than half of the stores’ customers have household incomes of $75,000 or less so they are more suspectable to inflation. The company also reported an 8% y/y decline in digital sales. In early March, Macy’s estimated its full-year net sales would range from $23.7 billion to $24.2 billion. It has lowered that estimate to a range of $22.8 billion to $23.2 billion. Macy’s guidance reflects anticipated markdowns in merchandise and continued macroeconomic pressure on consumer spending. It also reflects $200 million in cost savings. Its shares were down as much as 5% but are now near the flatline.

As ISM and ADP data conflict regarding manufacturing employment, with one showing a gain and the other showing a loss, tomorrow’s Jobs Report from the Bureau of Labor Statistics shall provide the tiebreaking vote. Nonetheless, the report is likely to come in hot as I’m expecting a 220,000 monthly job gain driven by services, as consumers just can’t get enough of airplanes, cruise ships, restaurants, drinking parlors, amusement parks and more. Tomorrow’s number and June 13’s Consumer Price Index (CPI) are pivotal, and will likely be the driving forces influencing another 25-bp hike or pause from Federal Reserve Chairman Jerome Powell and committee members. I’m expecting hot numbers for both Jobs and CPI, driving the central bank to reach its terminal rate of 5.38% in thirteen days.

Visit Traders’ Academy to Learn More about ISM-Manufacturing, Payroll Employment and other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.