Paul O’Connor, Head of the UK-based Multi-Asset Team, considers the prospects for financial markets over the next few months, as governments and central banks struggle to deal with a more complex tangle of macro influences.

Key takeaways:

- The recent turbulence in financial markets reflects the difficulty in incorporating some fast-changing developments on the global economic and policy fronts.

- Widespread supply shortages have not just forced a reappraisal of growth and inflation expectations but have also raised some awkward questions for central banks.

- The global economy looks to be transitioning from a strong recovery phase into a more complicated economic environment, presenting new risks and opportunities for investors.

As the year has progressed, financial markets have shifted away from being dominated by the simple “reopening reflation” theme that set the tone in early 2021, to instead reflecting the impact of a more complex tangle of macro influences. As the dominant themes have changed so has market performance. While the “everything” rally of the first half of the year saw most asset classes delivering healthy returns, the third quarter was a different story, with investors making nothing from owning US Treasuries, corporate bonds and developed market equities, and generally losing money in emerging market assets.

The recent turbulence in financial markets reflects the difficulty in responding to fast-changing developments on the global economic and policy fronts. The economic recovery from the pandemic has been highly idiosyncratic, reflecting unprecedented policy interventions, big changes in consumer spending patterns and unusual labour market dynamics. While bottlenecks and economic frictions had been widely expected when economies began to reopen, some central banks and many investors have begun to question in the past few months whether such shortages of labour, commodities and goods will be more persistent than originally expected. Earlier confidence that the upswing in wage and inflation would be transitory has faded, as concerns have grown of stagflationary scenarios, involving sustained high wage increases and inflation alongside weak economic growth.

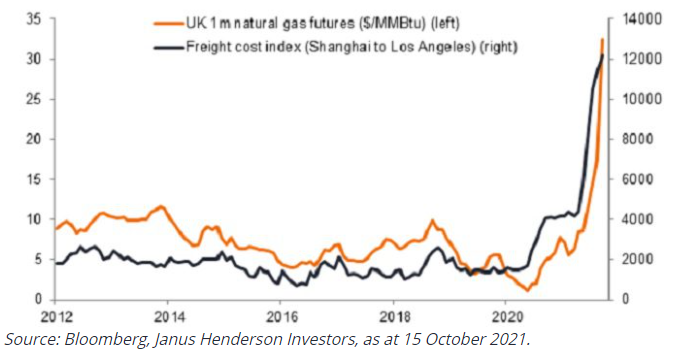

Such concerns are understandable, given the breadth and intensity of supply problems now evident in many global sectors. While the first stage of the recovery from the pandemic saw notable shortages and price surges in specific areas like lumber, shipping and semiconductors, these sorts of supply problems have recently become a much broader global phenomenon. There are now many striking global examples of important industrial sectors where supply is clearly struggling to keep up with demand. Notable examples include electricity shortages in China, fuel shortages in the UK and labour shortages in the US and elsewhere. These bottlenecks are not just squeezing up prices and wages, but they are also now beginning to restrain growth, through enforced production shutdowns, labour shortages and demand destruction.

Shipping costs and natural gas prices

The tide is turning

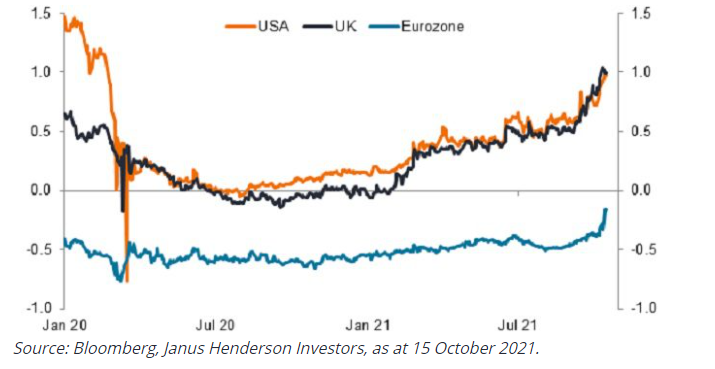

For financial markets, these widespread supply shortages have not just forced a reappraisal of growth and inflation expectations but have also raised some awkward questions for central banks. Diminishing confidence in the “transitory inflation” scenario has nudged many monetary policy makers to move more decisively towards ending asset purchase programmes and raising interest rates. Although actions on both fronts are still expected to be cautious relative to past monetary cycles, the dovish messages from central banks earlier in the year have now been overwhelmed by the sense that the great post-pandemic tide of central bank funding is beginning to turn. Central bank asset purchase programmes injected about $8.5tn into financial markets in 2020, but that number is expected to fall to about $2.3tn this year and $0.3tn in 2022.

Market pricing of interest rates in two years’ time (%)

It seems reasonable to conclude that the easy part of the coronavirus recovery is behind us and the global economy is now transitioning from a strong recovery phase into a more complicated economic environment. Many of the prevailing economic strains look set to persist for months to come, particularly in the UK where Brexit-related economic frictions have accentuated global supply disruptions. Still, while we have little visibility on how global supply shortages will be resolved, we would be wary of extrapolating the recent recalibration of wages, prices, and policy settings too far. Seasonal factors might well see supply shortages get worse before they get better in the final quarter, but we would expect a meaningful easing of tensions to begin to materialise in the first half of 2022, as demand and supply adjust to higher wages and prices in goods and labour markets.

Click here to read the full article: https://www.janushenderson.com/en-us/advisor/article/its-complicated/

Glossary:

Reopening reflation: Government policies intended to stimulate the economy as pandemic lockdown measures are eased/come to an end.

Idiosyncratic risk: factors that are specific to a particular company and have little or no correlation with market risk.

Listed alternatives: Investment vehicles or companies that own and manage real assets. While holding the underlying assets directly may be slow or expensive to trade (illiquid), by investing in a listed vehicle, investors can gain exposure to a particular asset or investment theme, at a relatively low cost, and with the flexibility to buy or sell more easily.

—

Originally Posted in October 2021 – It’s Complicated

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.