National People’s Congress (NPC) Update

Premier Li delivered the Government Work Report to start the National People’s Congress. Please see the key points of his address below:

- GDP target “around 5%” – expectations and street expectations: 5.5%; Is the NPC trying to under promise and over deliver? China beat its GDP growth beat in 2021 but missed it in 2022. The lack of strong stimulus was surprising, though indicates that the economy could be recovering on its own.

- CPI Target: 3%

- Deficit to GDP Target: 3% – An increase from December’s CEWC estimate.

- Pro-consumption language reaffirms our belief that the consumer could be front-and-center this year.

- No change in Taiwan policy.

- Employment Target: 12 million new urban jobs, 5.5% unemployment

- Defense Budget: Up +7.2% to $225 billion, compared to US’ $801 million defense budget in 2021.

Key Language on…

- PBOC policy: “proactive fiscal policy and implement a prudent monetary policy”

- Opening Up: “We should expand market access and continue to open up the modern services sector.” “With a vast and open market, China is sure to provide even greater business opportunities for foreign companies in China.”

- Trade: “We should take active steps to see China join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and accede to other high-standard economic and trade agreements.”

- Leverage: “prevent and defuse local government debt risks”

Note on Mark Mobius’ China Comments Overnight

Mark Mobius, founder of Mobius Capital Partners, made comments about not being able to get his money out of China. We have no such issues moving money into and out of mainland Chinese stocks via the Stock Connect program. Furthermore, daily data on cross-border flows is available on the Hong Kong Exchanges website. His comments were strange comments, though I suspect he was referencing moving money from a Shanghai bank account to a Hong Kong or other overseas bank account.

HSBC said that “…it needs to be clarified that we have not received any request from the Chinese regulatory authorities to restrict the remittance of funds, nor have we been informed of any recent policy changes in the remittance of cross-border funds by the Chinese government.”

The State Administration of Foreign Exchange (SAFE) said that “There has been no change in China’s cross-border foreign exchange access policy.”

Key News

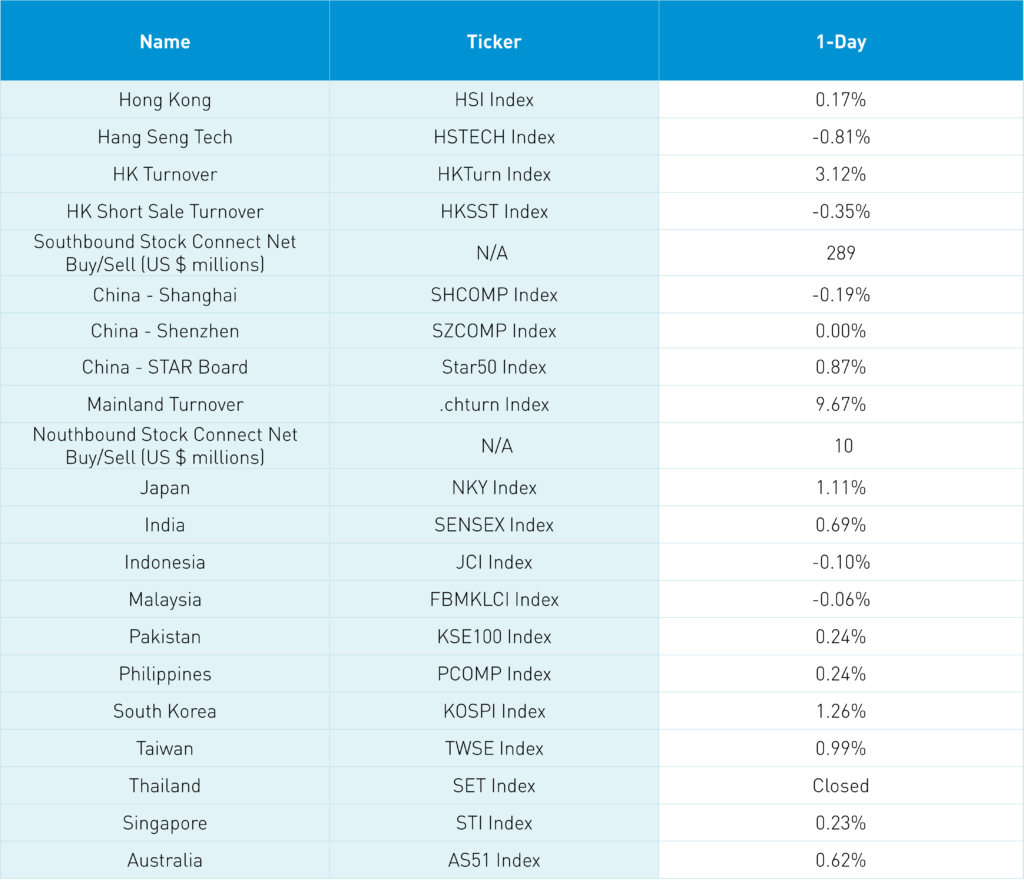

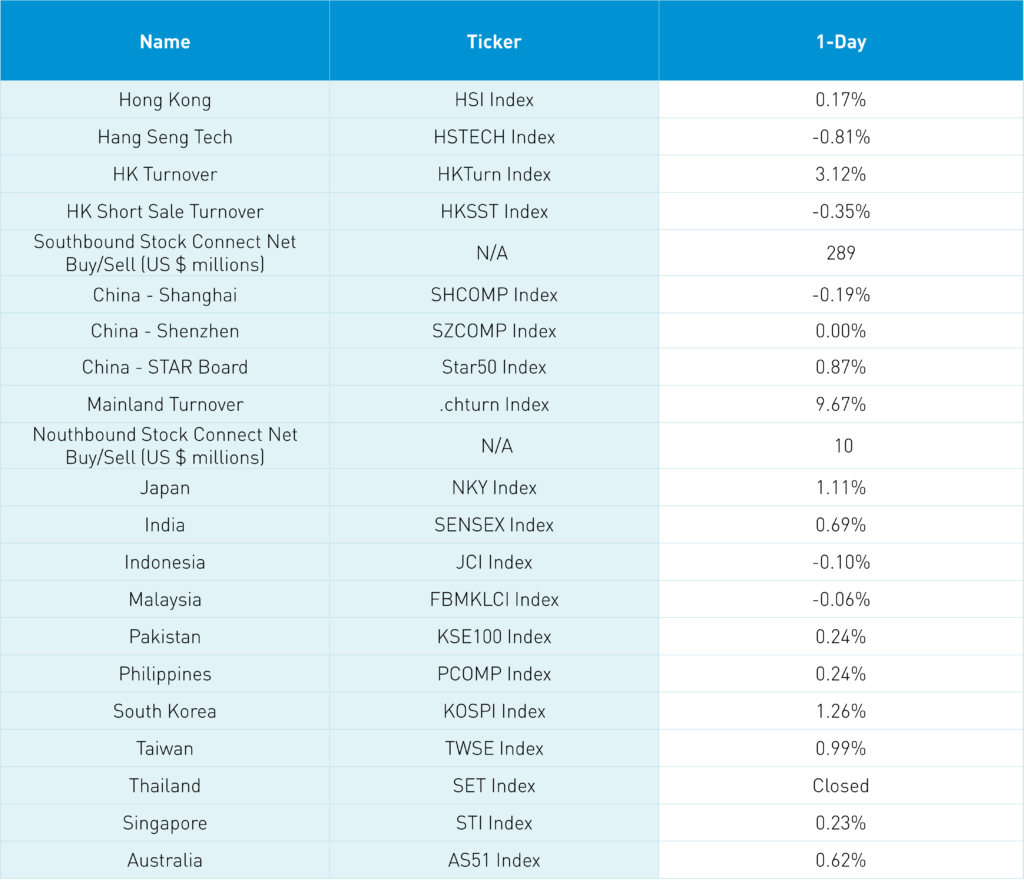

Asian equity markets were mixed overnight as South Korea outperformed. Thailand was closed due to a market holiday. Mainland China and Hong Kong were off slightly as the GDP target of 5% underwhelmed, compared to an expected 5.5%.

Overnight, the US dollar appreciated as the Asia Dollar Index fell -0.19% and CNY fell -0.41%. The US dollar weighed on performance for foreign investors.

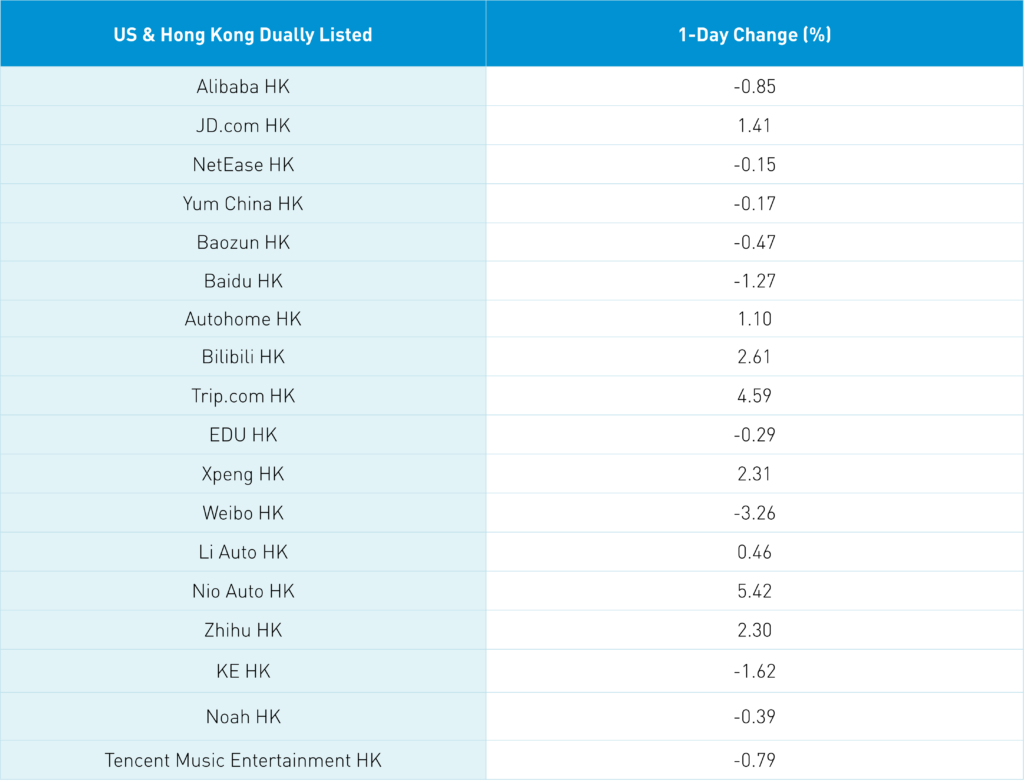

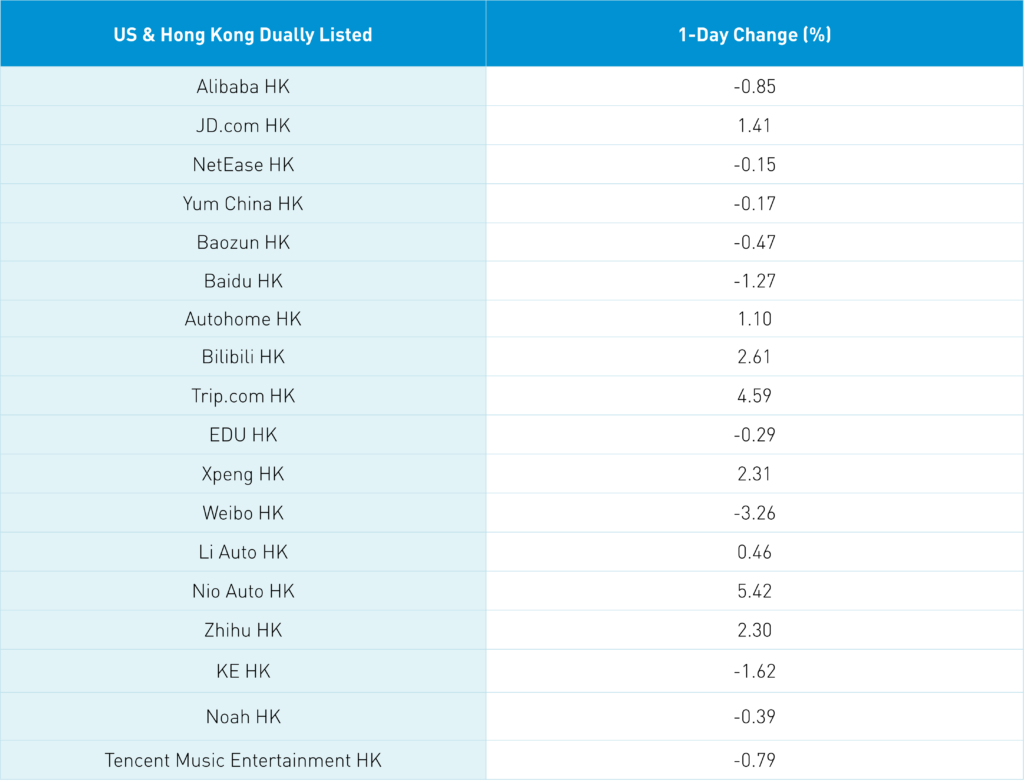

Value factors and sectors outperformed in Hong Kong. Hong Kong’s most heavily traded stocks by value were Alibaba, which fell -0.85%, Tencent, which fell -1.25%, China Mobile, which gained +3.23%, Meituan, which gained +0.42%, and JD.com, which gained +1.41%.

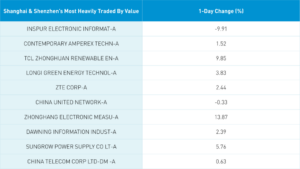

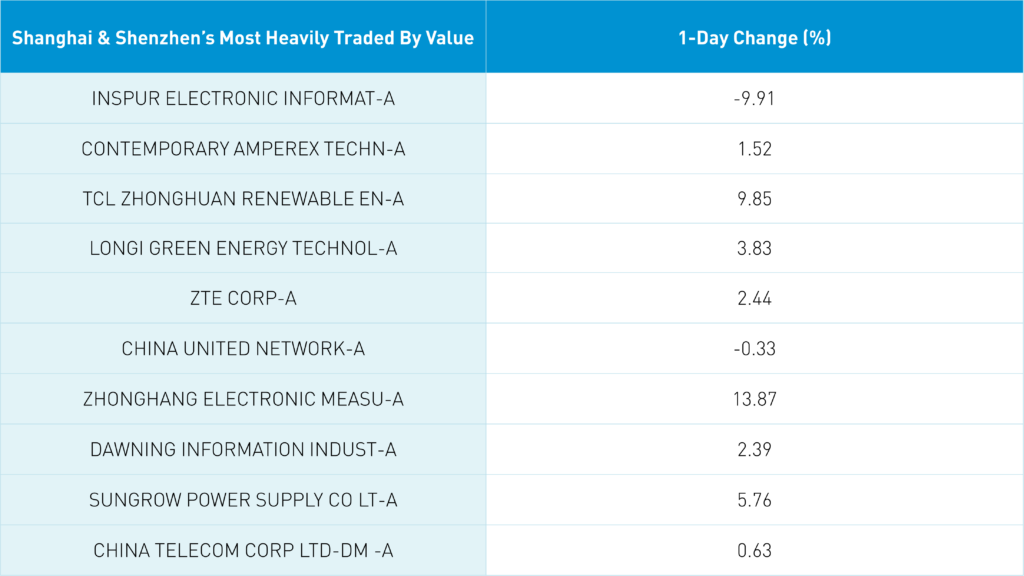

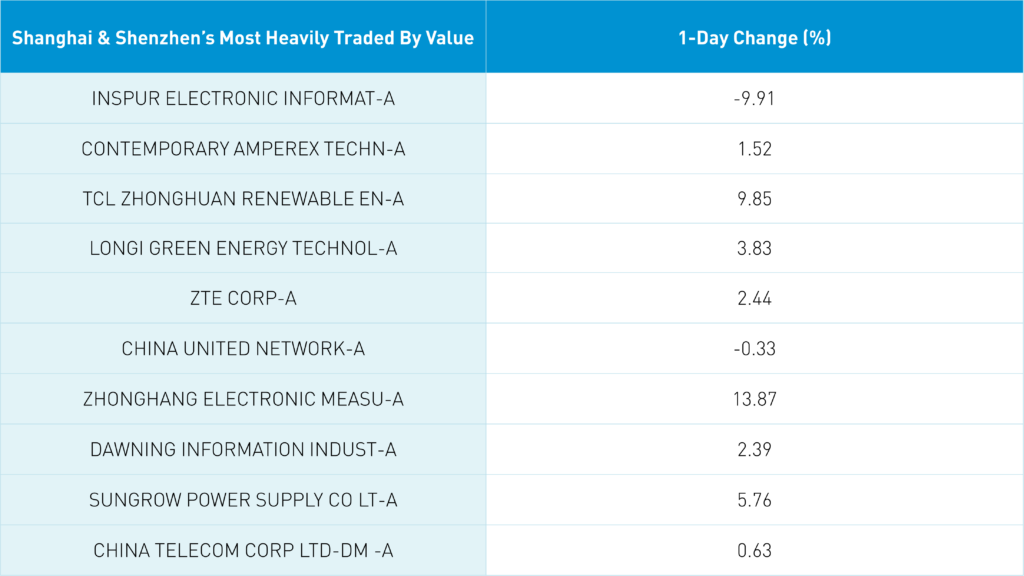

It is worth noting that Mainland investors were net buyers of Hong Kong stocks today via Southbound Stock Connect. Mainland markets were off as Inspur fell -9.91% after being added to a US export control list.

Internet earnings roll on this week. Trip.com will report after the US close today and JD.com will report on Thursday.

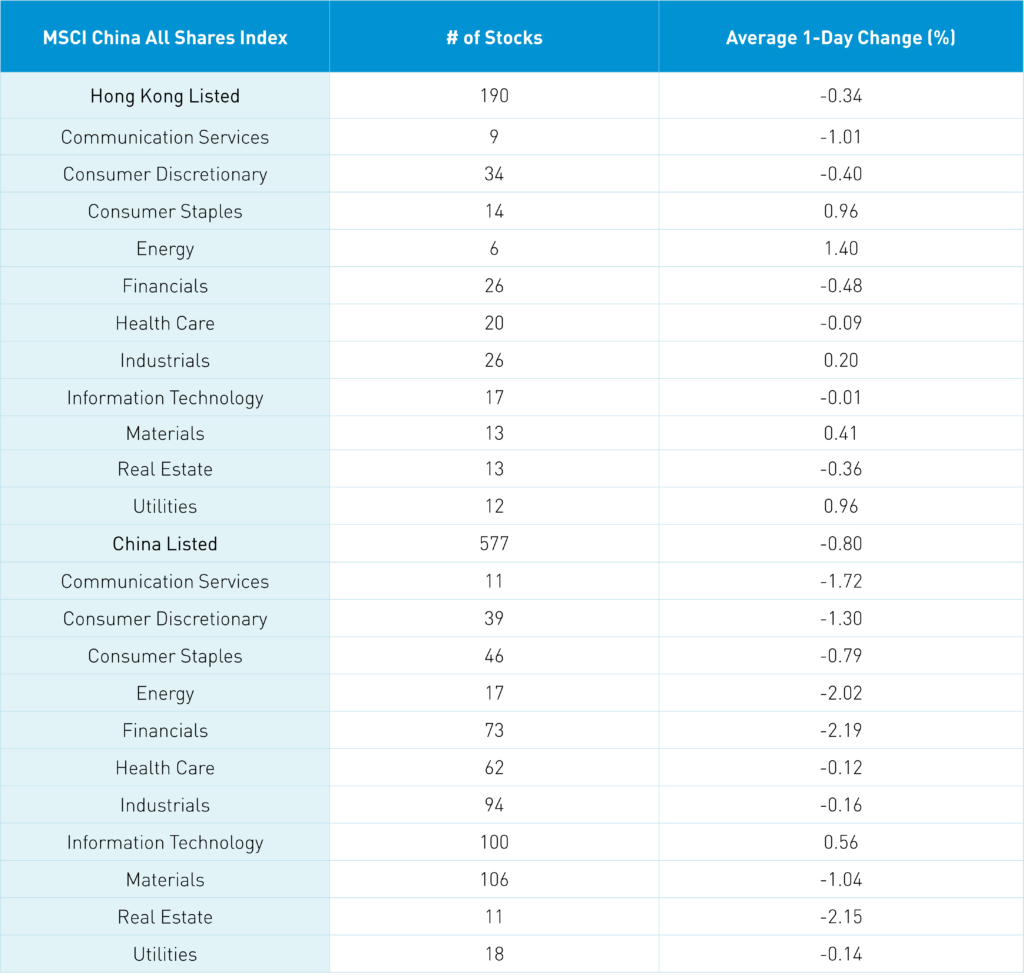

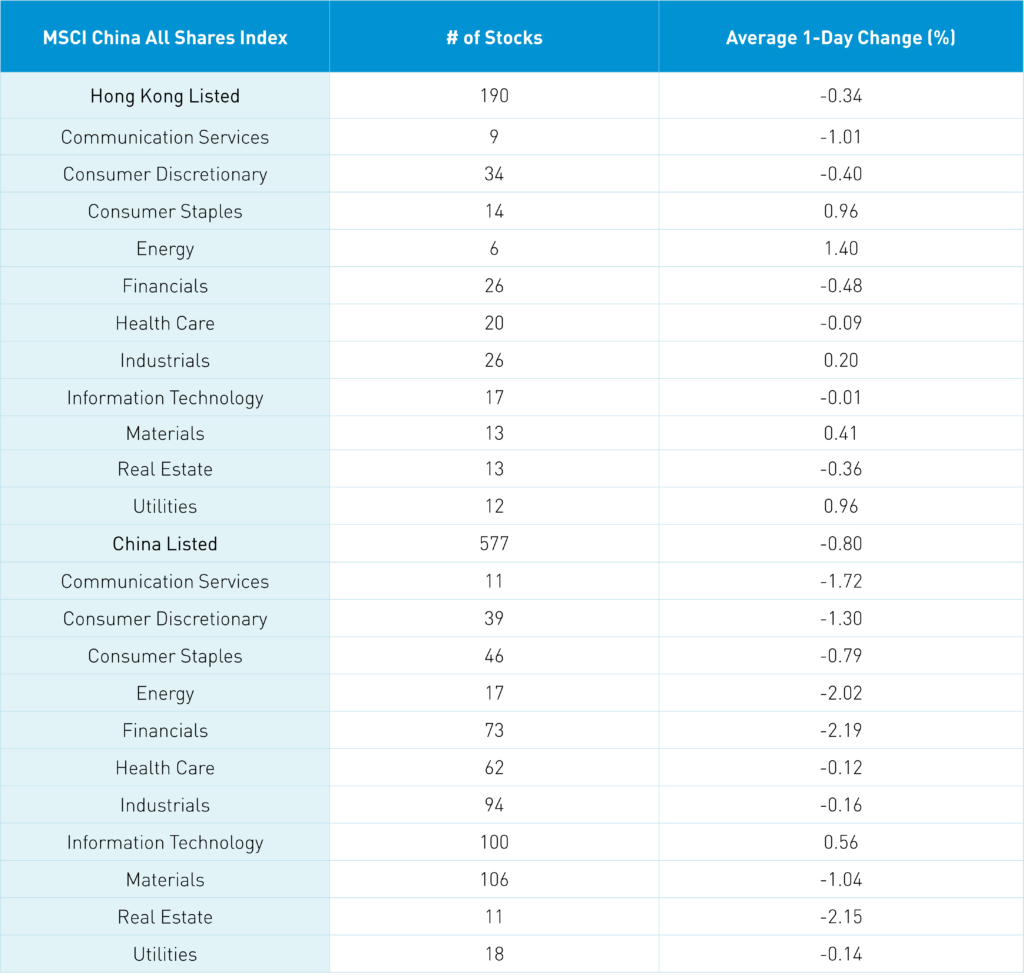

The Hang Seng and Hang Seng Tech diverged to close +0.17% and -0.81%, respectively, on volume that increased +3.12% from Friday, which is 87% of the 1-year average. 221 stocks advanced while 250 stocks declined. Main Board short turnover declined -0.35% from Friday, which is 83% of the 1-year average as 17% of turnover was short turnover. Value factors outperformed growth factors as large caps outpaced small caps. The top-performing sectors were energy, which gained +1.4%, consumer staples, which gained +0.96%, and utilities, which gained +0.96%. Meanwhile, communication services fell -1.01%, financials fell -0.48%, and consumer discretionary fell -0.4%. The top-performing subsectors were food, telecom, and semiconductors. Meanwhile, software, consumer durables, and healthcare equipment were among the worst. Southbound Stock Connect volumes were light as Mainland investors bought a net $289 million worth of Hong Kong stocks as Tencent, Meituan, and Kuaishou were all small net buys.

Shanghai, Shenzhen, and the STAR Board diverged to close -0.19%, 0.0%, and +0.87%, respectively, on volume that increased +9.67% from Friday, which is 105% of the 1-year average. 2,181 stocks advanced, while 2,441 stocks declined. Growth factors outperformed value factors as small caps outpaced large caps. Technology was the only positive sector, gaining +0.57%, while financials fell -2.18%, real estate fell -2.14%, and energy fell -2.01%. The top-performing subsectors were power generation equipment, semiconductors, and telecom. Meanwhile, education, insurance, and coal were among the worst. Northbound Stock Connect volumes were moderate as foreign investors bought $10 million worth of Mainland stocks overnight. CNY fell -0.41% versus the US dollar to 6.93 CNY per USD, while Shanghai-traded copper and steel both fell.

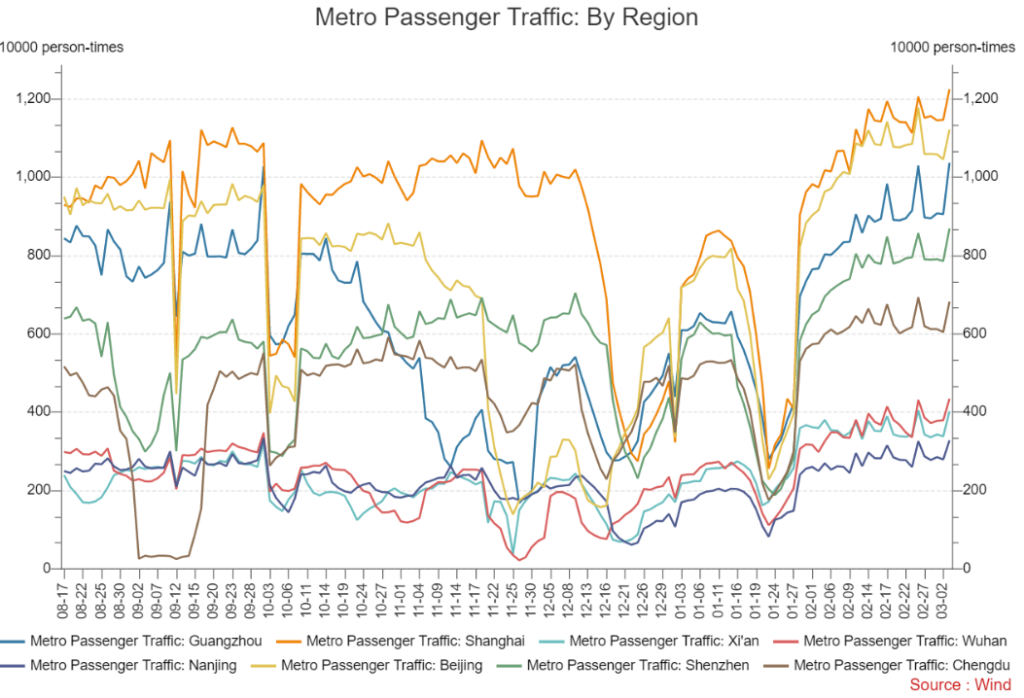

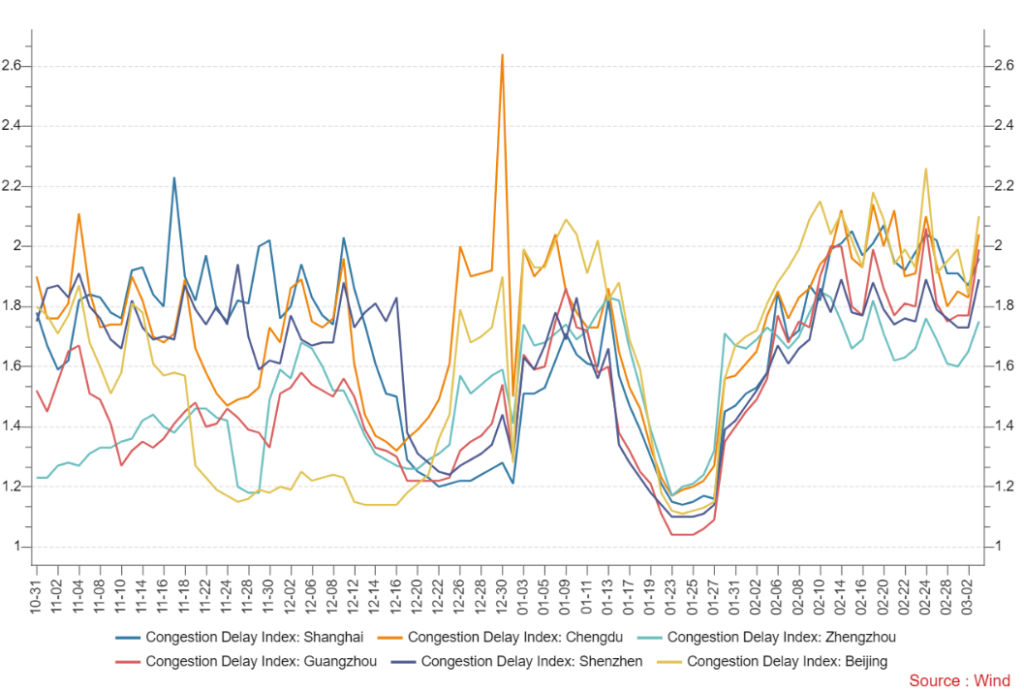

Major Chinese City Mobility Tracker

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.93 versus 6.90 Friday

- CNY per EUR 7.40 versus 7.34 Friday

- Yield on 1-Day Government Bond 1.68% versus 1.68% Friday

- Yield on 10-Year Government Bond 2.88% versus 2.90% Friday

- Yield on 10-Year China Development Bank Bond 3.07% versus 3.10% Friday

- Copper Price -0.12% overnight

- Steel Price -0.21% overnight

—

Originally Posted March 6, 2023 – NPC Begins, Premier Li Indicates China’s Economy Might Not Need Stronger Stimulus

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.