ZINGER KEY POINTS

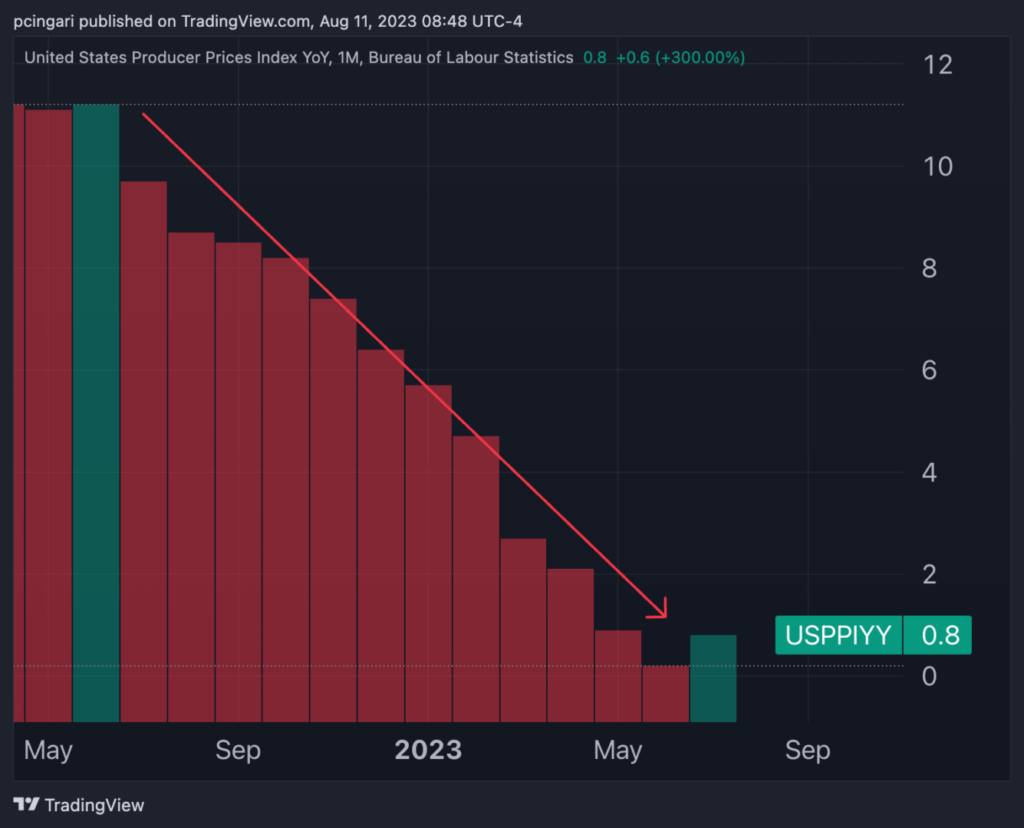

- Producer inflation rose 0.8% year-on-year in July, topping forecasts of 0.7%.

- The dollar surged, while stock futures tumbled as inflationary fears resume.

The U.S. economy faces renewed concerns about inflation as the Producer Price Index (PPI) for final demand has shown an unexpected surge in July, outpacing market expectations.

Producer Inflation Rebounds

The PPI recorded a 0.8% annual rise, bouncing back from a revised higher 0.2% in June and surpassing the projected 0.7% increase, the Bureau of Labor Statistics said Friday. It marks the first increase in the annual producer inflation rate following 12 straight months of declines.

On a monthly basis, the PPI’s pace of increase also quickened, growing by 0.3% in July, a notable increase from the revised flat reading seen in the previous month.

The core PPI index, which excludes the more volatile components of food and energy, maintained a year-on-year increase of 2.4% for July, matching the previous month’s figure but exceeding market expectations, which were at 2.3%.

Similarly, the core PPI’s monthly increase edged up to 0.3%, compared to the revised 0.1% drop seen in June.

The index for final demand services soared 0.5% month-on-month in July, marking the highest increase since August 2022.

The rise in the PPI index for final demand goods advanced at a 0.1% monthly pace, driven by the index for final demand foods, which rose 0.5%.

This higher-than-expected increase in the PPI inflation comes just a day after the Consumer Price Index (CPI) report for July, which indicated a moderate increase in the headline annual inflation rate from 3% to 3.2%, albeit below the predicted 3.3%.

Chart: PPI Inflation Rises To 0.8% YoY In July, Snapping 12-Month Losing Streak

Market Reactions: Stocks Tumble, Dollar Jumps As Investors Revise Fed Outlook

Futures on the S&P 500 and Nasdaq 100 tumbled, 0.5% and 0.3%, respectively, following the release of the higher-than-expected PPI in July, as traders slightly revised their expectations on Fed’s interest-rate outlook.

The U.S. dollar index rose 0.2%, driven by an increase in Treasury yields, with the 10-year jumping to 4.14%. The greenback is on track to close its fourth straight week of gains.

—

Originally Posted August 11, 2023 – Producer Price Index Surges 0.8% in July, Exceeds Expectations, Reigniting Inflation Concerns

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.