TLDR:

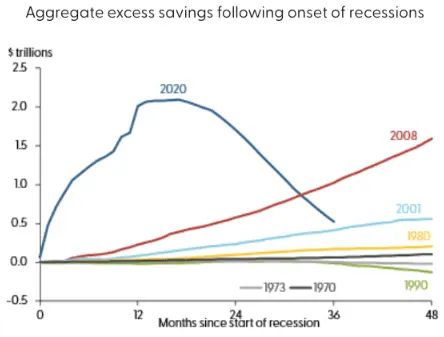

Ok, not entirely yet but the big cash cushion the US consumer built in the post-pandemic world is almost entirely gone. Gone. And if you’re the US economy, this is akin to running low on jet fuel mid-air. Why?

In his blog, John Authers highlights some recent research from the Federal Reserve of San Francisco that basically argues the US consumer has burned through much of the pandemic savings. Still a bit left – $500BB or so – but it’s definitely on track to run out by year end.

Source: FRBSF Economic Letter

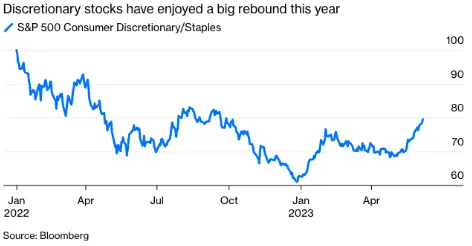

Not as if the market really worried about that, though. Consumer discretionary stocks have outperformed their duller staples brethren by an astounding margin since the start of the year.

As Authers writes:

Retail sales growth can be charitably called anemic. Orthodox surveys of consumer sentiment, such as the long-running polls run by the University of Michigan and by the Conference Board, agree that expectations have subsided since the start of the year. Consumers are still more hopeful than they were at the worst of 2022, but this doesn’t look like material for a rally. Indeed, the Michigan survey shows expectations almost as low as in the aftermath of the Lehman bankruptcy.

So what’s happening? What are markets seeing that the data is not showing (or what data are we missing)?

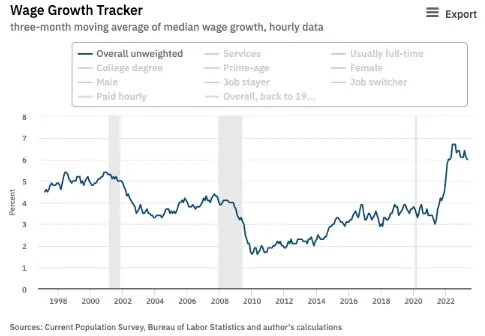

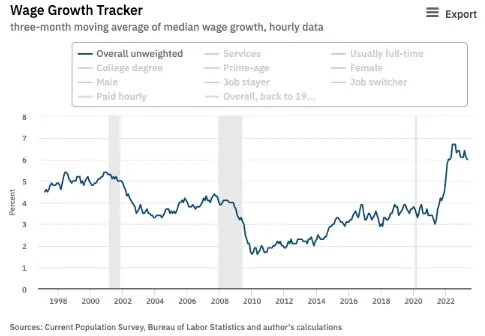

One big source of support is the labor market. Although it’s slowed from the peak, the monthly job creation remains very robust and wage growth and wage growth far above inflation.

Markets are implicitly betting inflation will come down faster than wage growth. Based on the recent data, they might be right.

What stocks are doing well today?

This section is powered by Open AI connected to TOGGLE AI

Thanks for all your feedback! This section is still paused, but an enhanced version is on the way (we promise)!

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

Earnings Update: KB Home reports tomorrow

High mortgage rates and persistent inflation could result in a softer demand environment for the homebuilding company. Click here to observe how the stock could perform after earnings.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Big move up in Infosys

TOGGLE observed 10 similar occasions in the past where there was a big move up in Infosys stock and historically this led to a median increase in the stock price over the following 3M.

General Interest: Apple wants to copyright apples

Elon’s brain implants were not the first step towards cyberpunk dystopia.

The award probably belongs to Apple for attempting to copyright the image of an apple. And succeeding.

In their path to Evil Co. status, Apple has filed a motion in Switzerland claiming copyright of the image of the apple. Local apple farmers are scratching their heads.

In 2017, Apple applied to the Swiss Institute of Intellectual Property (IPI) asking for the rights to what Wired describes as a realistic black-and-white depiction of a Granny Smith apple. Note that Fruit Union Suisse appears to exclusively use a red logo, but it’s possible that it may use it in documentation done with only two-color printing, rendering it black and white.

The 2017 IP application had to specify usage, and Apple submitted an extensive list centered on digital and electronic consumer goods.

The IPI reportedly gave Apple a partial win in late 2022, saying that the company could have the rights to only certain of the submitted categories. Apple is now appealing to win the rest of the rights.

Read more here on Wired.

—

Originally Posted June 20, 2023 – Running out of cash?

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: TOGGLE Relationship with IBKR

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.