Energy prices moderated in September, but relief at the gas pump wasn’t enough to offset other inflationary pressures with the Consumer Price Index (CPI) registering a hotter-than-expected 8.2% year-over-year increase. The news sparked an early morning selloff of equities as expectations of further Federal Reserve (the Fed) tightening grew and pointed to a potentially rocky road ahead with concerns that energy price gains in the past few weeks may contribute to even more painful inflation in the coming months.

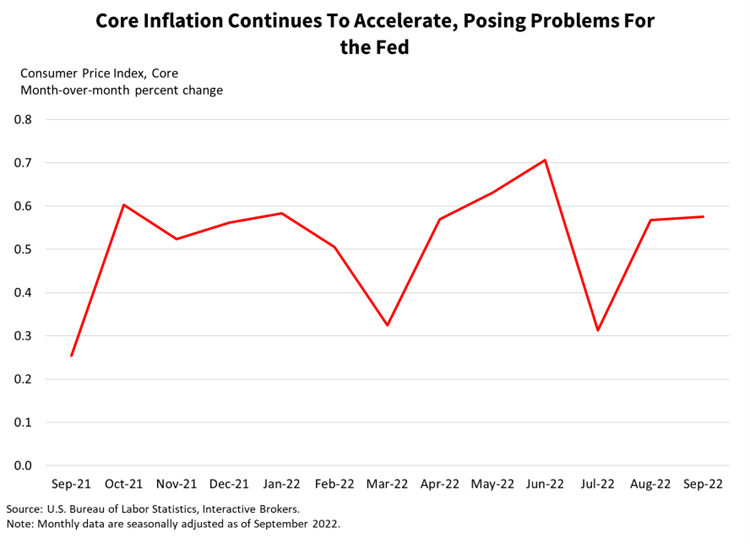

The core CPI, which excludes food and energy due to their volatile price characteristics, also increased, climbing 6.6% in September. On a month-over-month basis, the overall CPI and the core CPI climbed 0.4% and 0.6%, respectively. Price pressures were broad based across goods, services, food and energy services while declines in gasoline and fuel oil prices resulting in part from U.S. Strategic Petroleum Reserve releases helped to soften the overall inflation turmoil. Medical care commodities, apparel and used vehicles were also exceptions to the broad-based price increases. Similar to what we wrote last month, Lower Gasoline Prices Are No Longer Saving The Day.

What’s worrisome about near-term inflation prospects is that gasoline and fuel prices are up in October from September, driven by OPEC’s decision to cut output by 2 million barrels per day. If lower gasoline prices haven’t produced satisfying inflation readings in August and September, how damaging might they be in October? A challenging winter ahead for Europe and the possibility of the relaxation of Chinese lockdowns may drive additional energy demands and propel prices further. On the other hand, additional releases from the US Strategic Petroleum Reserve may help moderate energy price increases. Despite potential future releases from the reserves, higher gasoline and fuel oil prices may once again become strong drivers of inflation.

Additionally, food prices at home and at restaurants continue to be pressured by a strained commodity complex, geopolitical tensions, unfavorable climate conditions and increasing wages resulting from high labor demand. The strong demand for labor and high liquidity levels will continue to push up prices in the services segments as companies try to sustain margins by raising final prices on consumers. In the real estate market, rents are likely to continue increasing as housing affordability remains stretched against the backdrop of rising mortgage rates, pushing prospective buyers out of the for-sale housing market at a time of a structural housing shortage. Due to extra savings from the pandemic, rising wages and record levels of credit card spending, consumers can continue paying higher prices, further supporting inflation.

Price pressures were led by increases in transportation services, energy services (electricity and utilities), medical care, and food which rose 1.9%, 1.1%, 1.0% and 0.8% from the previous month. Shelter and new vehicles also contributed to accelerating inflation by rising by a lesser amount of 0.7%. Gasoline and fuel oil, used cars and trucks, and apparel helped offset some pain with price declines of -4.7%, -1.1% and -0.3% respectively. Medical care commodities also registered a marginal price decline.

Markets are reacting very negatively to the report. The S&P 500 Index is down 2% while yields are up to new highs across the curve with the 2-year and 10-year Treasuries eclipsing important resistance levels of 4.5% and 4.0%. Expectations of Fed tightening rose significantly, as the market now expects the Fed to deliver another super-sized 75 basis point rate hike not just at the November meeting, but at the December meeting as well. That will place the rate of 4.63% by year-end while the market prices in one more 25 basis point rate hike in 2023 to leave the terminal rate at 4.88%. There’s also a decent chance of one more hike that would end the cycle at 5.13%. As we wrote in our IBKR economic landscape and yesterday in A US Recession is Likely in 2023 commentary, inflation is proving stickier and more resistant than the market expects. It will prove tough and painful, to place the genie back into the bottle.

Watch Videos About Key Economic Indicators at Traders’ Academy – Click Here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.