Investors are flocking to the safety of U.S. Treasuries after Moody’s Investors Service reduced credit ratings for 10 small and mid-size banks and issued a warning for the overall banking sector last night, which sparked concerns about a liquidity crunch and the potential for additional failures of financial institutions. The development, which comes approximately five months after a handful of regional banks hit the skids, has sparked renewed concerns about the potential for additional bank failures and consolidations as investors parse through recent comments from policymakers to ascertain if another rate hike will occur this cycle. To that end, CPI data to be released this Thursday could be a significant driver of investor sentiment and the outlook for the Fed’s monetary policy.

Moody’s Paints Target on Banking Sector

In announcing credit rating downgrades last night for M&T Bank, Old National Bancorp, Northern Trust and other institutions, Moody’s said it may also downgrade other banks, including U.S. Bancorp, State Street Corp., Bank of New York Mellon Corp. and Truist Financial Corp. Moody’s said it is also concerned about the strength of the overall banking sector. Moody’s cited the following concerns:

- Higher funding costs.

- The potential for capital weaknesses falling short of regulatory requirements.

- Exposure to commercial real estate loans as demand for office space weakens and strains the finances of property owners.

Earlier this spring, a handful of banks facing a surge in withdraws were forced to sell held-to-maturity assets at significant discounts due to higher market interest rates. In one example, Silicon Valley Bank went bankrupt and was acquired by First Citizens Bank. Moody’s is also concerned about a potential recession hitting early next year, weighing on delinquency rates as consumers and businesses buckle.

Investors Focus on Fed Policymakers’ Comments

While bank issues are likely to curtail liquidity and stymie economic growth, investors have turned their attention to recent comments from the following policymakers:

- Federal Reserve Governor Michelle Bowman yesterday repeated her past statements that the Fed needs to continue raising interest rates to fully restore price stability. Inflation has declined, she said, but it’s still significantly above the Fed’s 2% target. Additionally, the labor market is still tight with job vacancies exceeding the number of available workers by a wide margin.

- New York Fed President John Williams, who holds a permanent voting right on the FOMC, told the “New York Times” that the strong labor market is likely a result of the post Covid-19 pandemic surge in consumer spending and probably isn’t sustainable. If inflation continues to decline without the Fed cutting its benchmark interest rate, real interest rates would increase, which is contrary to the Fed’s goal. He speculated that a rate cut may occur next year or in 2025.

- Philadelphia Fed President Patrick Harker this morning said he thinks the Fed can patiently wait for the full impact upon the economy of past rate hikes, and he indicated that an additional rate hike is unlikely in the near term unless alarming new data surfaces that would justify additional monetary tightening. Harker, who appears to have tilted slightly to a less hawkish stance, also maintained that the fed is unlikely to cut rates in the foreseeable future.

Credit Crunch Fears Escalate

A squeeze is occurring, compelling financial institutions to pay more via higher interest rates to boost liquidity while banks’ existing loan quality deteriorates amidst an environment of less lending opportunities.

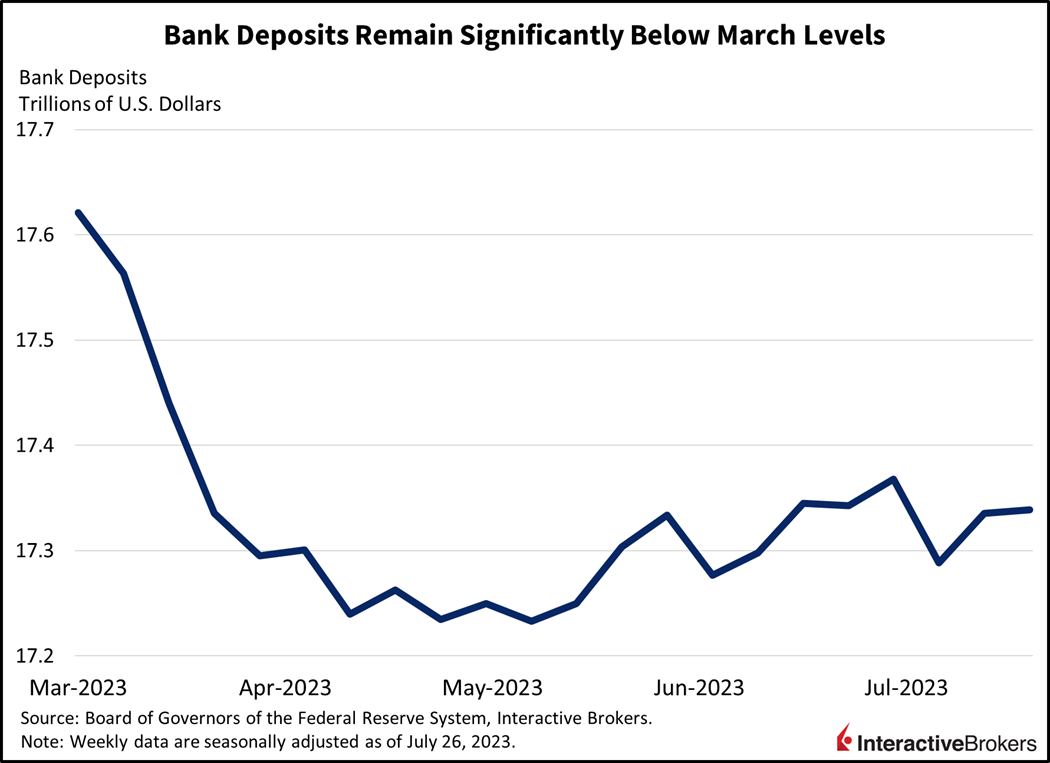

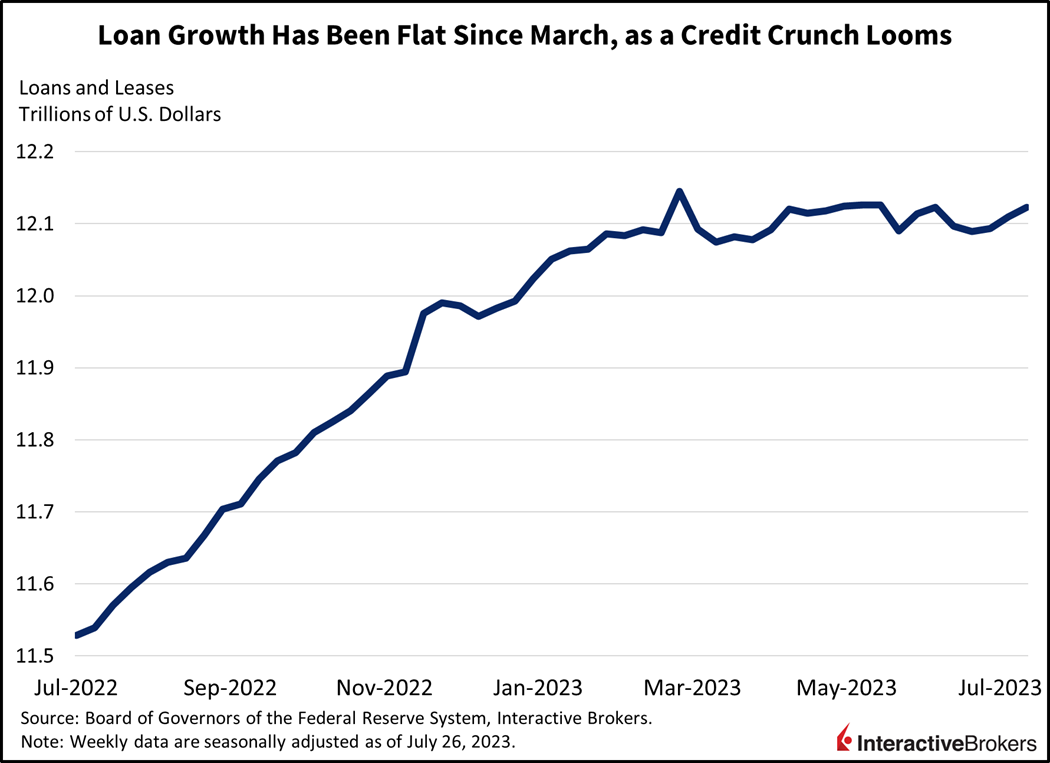

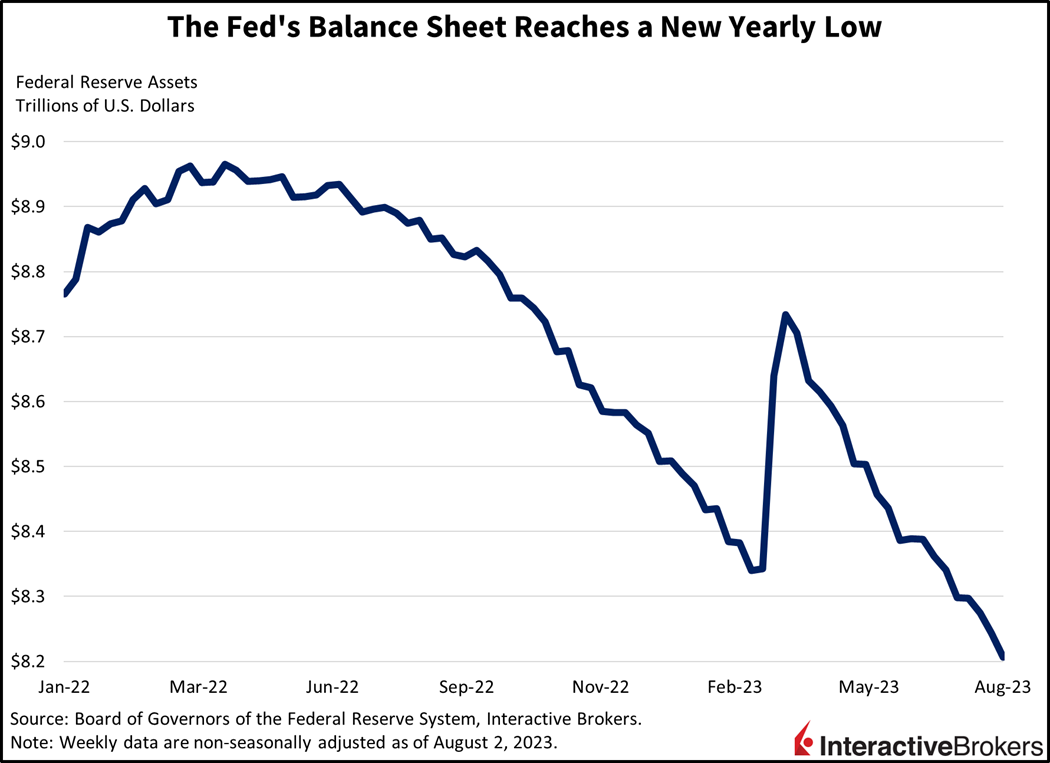

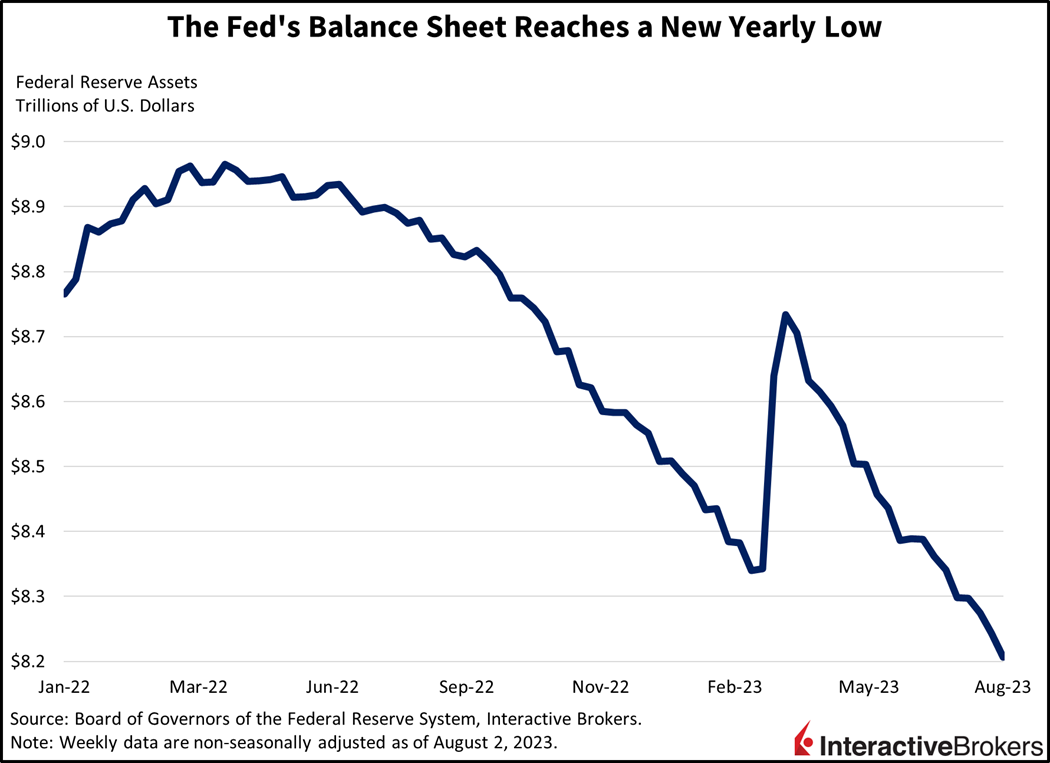

Indeed, a credit crunch would do some of the Fed’s work for it, limiting capital to households and businesses and serving to quell inflationary pressures via reduced demand. Despite the Fed’s actions to firm up the banking sector in March, loan growth has been flat while deposits in the banking sector remain significantly below pre-failure levels. Furthermore, quantitative tightening, which serves to shrink the Fed’s balance sheet and reduce bank reserves in the system, alongside rate hikes, is weighing on bank health, leading to a deterioration in liquidity and capital ratios. A squeeze is occurring, compelling financial institutions to pay more via higher interest rates to boost liquidity while banks’ existing loan quality deteriorates amidst an environment of less lending opportunities. An economic downturn would present further problems as bad loans add up, forcing banks to further consolidate with each other.

Investors Flock to Safety

Risk-off sentiment is conquering markets today, with all major U.S. equity indices down 1% or more while yields plunge. The drawdown is only sparing the defensive health care and utilities sectors, with all other sectors declining. Financials and materials are leading the way lower with declines of approximately 1.5%. Yields are declining in bull-flattening motion, with the 2-year maturity down 3 basis points (bps) to 4.74% while the 10-year is down a staggering 10 bps to 3.99%. Lower yields aren’t weighing on the dollar, however, with weak data out of China weakening the nation’s currency while supporting the greenback. The Dollar Index is up an impressive 60 bps to 102.67, appreciating against the euro, yen, yuan, pound sterling, frank and the Canadian and Aussie dollars. Energy markets are concerned this morning about the outlook for demand and are ignoring bullish supply conditions, with WTI crude oil down 1.1% to $81.06 per barrel.

CPI and Consumers to Drive Rate Hike Outlook

The Fed’s Jackson Hole presentations and September meeting has taken on increased significance as further tightening could worsen banking issues and liquidity. Investors may gain insight into likely Fed actions when the CPI report is released on Thursday. On one hand, consumers are continuing to splurge on dining out, entertainment, traveling and services while the Fed tries to dampen demand within the economy. Consumer demand for such services was evident in July when wages climbed 0.4%, a rate that is incompatible with the Fed’s 2% inflation target. On the other hand, consumers are tapped out on purchasing goods, a trend that is likely to continue, as lofty prices, expensive financing, and credit accessibility weigh. Commodity prices, meanwhile, grew roughly 7% in July, presenting upside risks to the CPI via gasoline, jet fuel, utilities and food at the supermarket and dining establishments. With services and shelter remaining hot, commodities inflecting higher and goods prices declining, this Thursday’s CPI is likely to come in at 0.4% for headline and 0.3% for core, above the consensus expectation of 0.2% on both fronts.

Visit Traders’ Academy to Learn More about Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

What’s the easiest way to set up a joint account with you? I am currently at Schwab

Hi John, thank you for your interest in IBKR! To open a joint account, please start an application on our website: http://spr.ly/OpenAccountfromIBKRCampus. You can view detailed application requirements on this page: http://spr.ly/IBKR_ApplicationReqs. If you would like to transfer your positions from another broker, you can review the available methods – also on our website (http://spr.ly/IBKR_FundAccount). I hope this helps!