By: Tim Gibson, Guy Barnard, & Greg Kuhl

The global supply chain crisis is creating further tailwinds for industrial real estate, according to the Global Property Equities Team.

Key Takeaways

- The U.S. industrial property market is benefitting from the global supply chain crisis, which is driving industrial real estate toward a record year of leasing activity.

- The shift from just-in-time to just-in-case supply chains is a multi-year structural trend creating stronger demand for warehouses, accelerated by the structural rise of ecommerce.

- Transportation and labor costs are rising at a much faster pace and are a much larger cost than commercial real estate rents. This means landlords possess considerable pricing power, which bodes well for industrial real estate.

The U.S. industrial real estate market is on pace for a record year of leasing activity. Year-to-date 2021 net absorption (the sum of square feet that became physically occupied, minus the sum of square feet that became physically vacant during a specific period) reached an astonishing 366 million square feet through September – 98% above the same period one year ago1 and already the most ever recorded in a single year, with another quarter remaining in 2021.

Prologis, the world’s largest owner of warehouse space, said in a recent earnings release the company is now “effectively sold out of space” with “vacancies at unprecedented lows.” Prologis’ record-setting results are in part fueled by supply chain issues throughout the U.S. and across the world, characterized by severe disruptions that do not appear likely to recede anytime soon. Prologis is now signing new leases at rates 28% higher than prior leases.2

While the supply chain crunch may be a perfect storm for many sectors of the economy, industrial real estate owners have been one of the largest beneficiaries. We explain why.

Shift to Just-in-Case Inventory Caused by the Global Supply Chain Crisis

For decades, supply chains have been globalizing, taking advantage of cost differentials across countries, and shifting to a just-in-time model. Developed by Toyota in the early 1970s, and popularized by Dell in the 1990s, the just-in-time supply chain method is the process of minimizing static inventory levels by only moving goods right before they are needed. But the pandemic exposed supply chain risks, leaving companies with minimal on-hand inventory, and lengthy lead times preventing products reaching consumers in an acceptable timeframe and causing retailers to miss out on potential sales. These problems have only been exacerbated in recent months, with several trends combining to make the current supply chain crisis even more acute.

Major U.S. ports, including the ports of New York/ New Jersey, Los Angeles and Long Beach are experiencing severe delays in ship arrivals. Globally, there are now more than 600 container ships stuck outside ports, nearly double the number at the start of the year, according to global leading logistics group Kuehne+Nagel as at 15 October 2021. And the problems are more deep-seated than just the ports, with supply chains suffering from shortages of port workers, truck drivers as well as escalating fuel prices.

With the U.S. industrial real estate vacancy rate hitting a record low of 4.1% in the third quarter of 2021,3 occupiers have been left with no choice but to try and outbid their competitors for any warehouse space that becomes available. The shift from just-in-time to just-in-case supply chains (keeping large inventories on hand) is a multi-year structural trend that’s still in its early stages. For now though, companies are simply scrambling to secure space ahead of the upcoming holiday season.

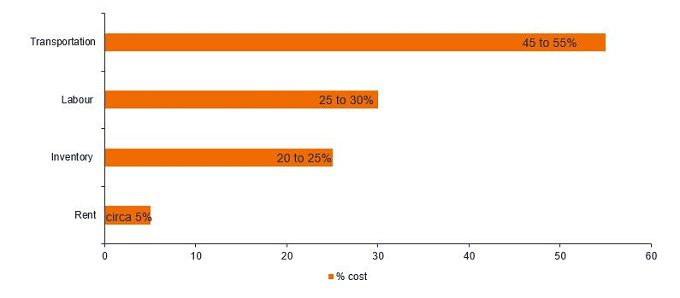

Commercial Real Estate Rents Are Only a Fraction of Total Supply Chain Costs

The knock-on impact to industrial real estate fundamentals has been stark, with operating metrics surpassing all historical records. Real estate rent is the smallest component among major cost categories in the supply chain, accounting for less than 5% of an occupiers’ total costs to supply.4 This pales in comparison to transportation and labor costs, which typically account for 55% and 30% respectively, but can rise substantially higher in an inflationary environment. “Commercial real estate costs are just a rounding error,” according to Adam Roth, Director of Global Logistics at NAI Hiffman.

Typical Distribution of Supply Chain Costs

Source: Prologis Research as at Q3 2021.

Despite ongoing record growth in rental rates, transportation and labor costs are rising at a much faster pace. Prologis estimates that for every $1 spent on rent, users of logistics real estate spend $5 to $7 on labor and $10 on transportation. The relatively low cost of ‘mission critical’ industrial warehouse space highlights the underlying pricing power that landlords possess and can continue to benefit from, while at the same time helping offset snowballing costs elsewhere in the supply chain.

It is also worth highlighting that the ownership of real estate is not a labor-intensive endeavor, and therefore industrial landlords, in addition to typically benefiting from significant pricing power, tend to be largely insulated from the rising labor costs impacting their tenants.

Large Demand-Supply Imbalance Is Driving Warehouse Rents

As customers endeavor to secure leases in facilities within major population centers, the willingness to pay higher rents has also increased, pushing rental rate growth to record highs. U.S. industrial market rent growth reached 8.3% in 3Q,5 and rents in supply constrained coastal markets have risen considerably more. Average rents for Class A space in New Jersey are 24% higher than twelve months ago. Bidding wars among prospective tenants are no longer uncommon. A seemingly incurable demand-supply imbalance in markets such as Southern California is likely to drive rents even higher. Rexford, one of the leading industrial landlords in the region, recently announced that its portfolio mark-to-market (the gap between average in-place rents and average market rents) now stands at around 27%, providing a substantial revenue growth opportunity.

Prior to the ongoing pandemic-induced global supply chain disruptions, industrial real estate was already enjoying a renaissance of sorts as the critical importance of a robust ecommerce capability had become a well acknowledged fact, acknowledged by even the stodgiest of retailers. The current situation has merely thrown fuel on the fire. This bodes extremely well for continued healthy demand for industrial real estate.

Industrial real estate includes buildings used for manufacturing, processing, storing or shipping products.

1,3,5 Cushman U.S. Industrial Market Beat Q3 2021.

2 Prologis 3Q 2021 earnings report.

4 Prologis: Spending More on Logistics Real Estate in an Era of Changing Supply Chains, October 2021.

—

Originally Posted on November 11, 2021 – Supply Chain Crisis Fuels Insatiable Demand for Warehouses

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.