Key takeaways

Inflation is declining

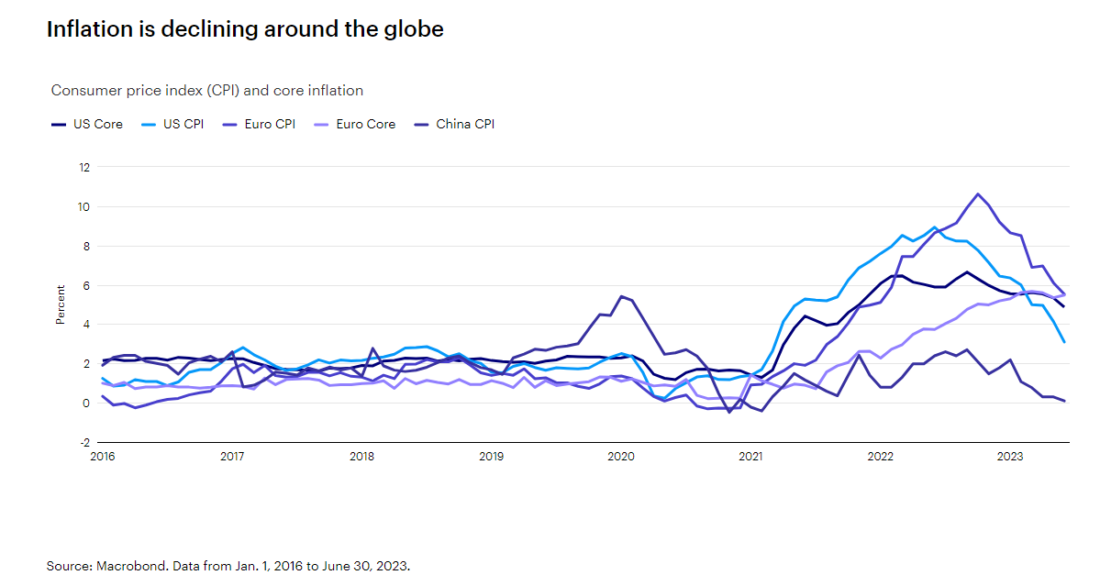

The disinflationary trend continues, and core inflation appears to be in retreat across Western economies.

Central banks are hiking rates

Global central banks continued to raise interest rates, despite what looks to be clear disinflation evidence.

An opportunity in bonds

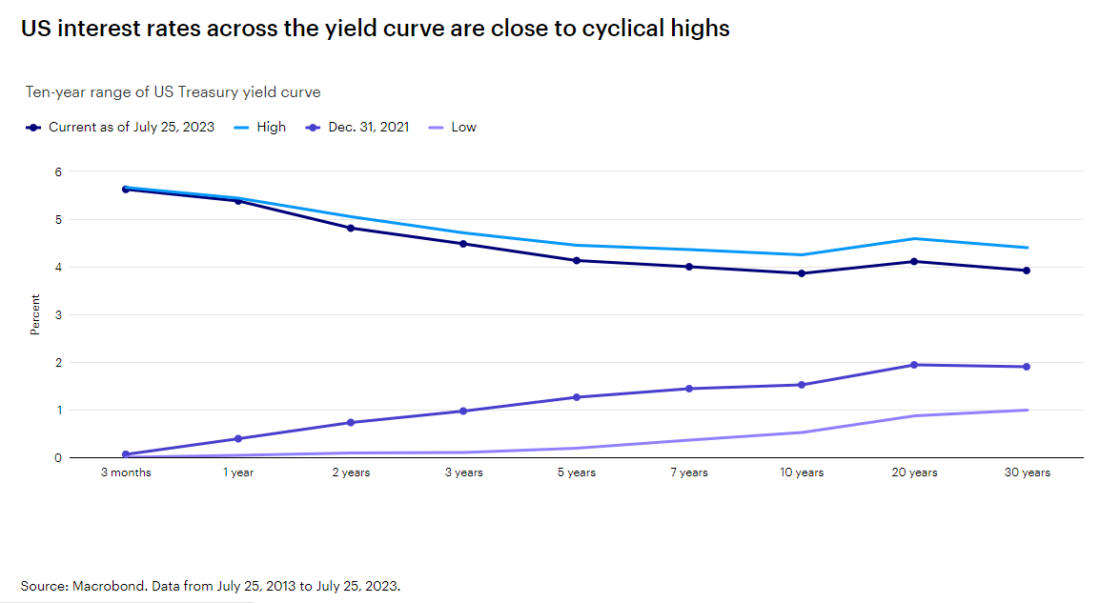

Whether or not central banks keep hiking, we believe interest rate structures across most developed markets offer value.

As the market patiently waits for global central banks to wind down their rate hiking cycles, we wonder, is the journey really this long, or have we gotten lost along the way?

Recent economic data have been favorable for markets. The disinflationary trend that’s been in place for several quarters continues, and core inflation appears to be in retreat across Western economies. Even China is showing signs of deflation, with recent reports of falling producer prices and steady consumer prices compared to a year ago. It would appear to be time to put fears of rising inflation to rest.

On the other hand, global growth is progressing at an unexciting but non-recessionary pace, near our estimates for potential growth. We believe slow positive growth and disinflation is a good backdrop for market risk takers and should be generally associated with strong risky asset performance. Recent market performance is most likely related to investors’ growing confidence in the slow growth, disinflationary environment and their positioning accordingly.

Central banks hew to their inflation fight

The doubters continue to be led by global central banks, who have continued to raise interest rates, despite what looks to be clear evidence of disinflation. Inflation proved to be higher and more persistent than central banks anticipated coming out of the pandemic lockdowns, and their reaction to this miscalculation seems to be to consciously err on the side of caution now. While the disinflationary trend has been clear, and central banks could plausibly pause to observe the impact of significant rate increases, they’ve continued to hike rates. Central banks also are signaling that rates will likely stay elevated for an extended period. If rates stay high, while inflation continues to decline, the chances of a policy overshoot increase. This could arise through lower-than-desired inflation or a recession. Either of these outcomes would likely damage the current favorable investing environment.

Rate cuts could be a long way off

The question is, how will central banks manage going forward? If evidence of disinflation continues to build, as we expect it will, how will central banks respond? As the risk of lower-than-desired inflation builds, rate cuts would appear to become more appropriate. On the other hand, central bank rhetoric and expectations implied by markets argue that rate cuts may be a long time coming. Higher-than-necessary interest rates will likely increase downside risks in the coming quarters, which is something we, as investors, will need to pay attention to.

An opportunity in bonds

Either way, we conclude that interest rate structures across most developed markets offer value. With interest rates across yield curves close to cyclical highs, disinflation well established, and central banks leaning very hawkishly, we believe investors have a very compelling opportunity in bonds. With the risk of an inflationary spiral off the table, we believe both the base case and risk cases involve solid potential total returns in bonds.

Originally Posted August 8, 2023

The end of rate hikes: Are we there yet? by Invesco US

Important information

NA3038184

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

The Consumer Price Index (CPI) measures changes in consumer prices. Core CPI excludes food and energy prices.

An investment cannot be made directly in an index.

Tightening monetary policy includes actions by a central bank to curb inflation.

The yield curve plots interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates to project future interest rate changes and economic activity.

The opinions referenced above are those of the author as of July 17, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.