Last summer we wrote that the market seemed to be pricing in a scenario that was essentially a long-shot parlay bet. This morning’s CPI report is a sign that it appears to be paying off.

On August 17, 2022 we wrote:

My concern is not about a minor downtick today, but a fear that investors have placed a huge parlay bet on the markets. The recent rally in equities implies that we will thread a very tight needle – that we will be able to maintain solid earnings growth amidst moderating inflation that will occur with neither aggressive Fed action nor a recession.

Can that happen? Sure. Is it likely to transpire in exactly that manner, well, that’s another story. There’s a reason that sports betting companies advertise parlays relentlessly. They have long odds against paying off, and the house is much more likely to price the odds effectively than the gambler. Yet this long-odds bet seems to be the base case at the moment.

Let’s check the results:

- Have we maintained solid earnings growth? For the most part, yes.

- Has inflation moderated? Today’s CPI report is most certainly another data point in that direction.

- Neither aggressive Fed action nor a recession? We’ll need to unpack this one further.

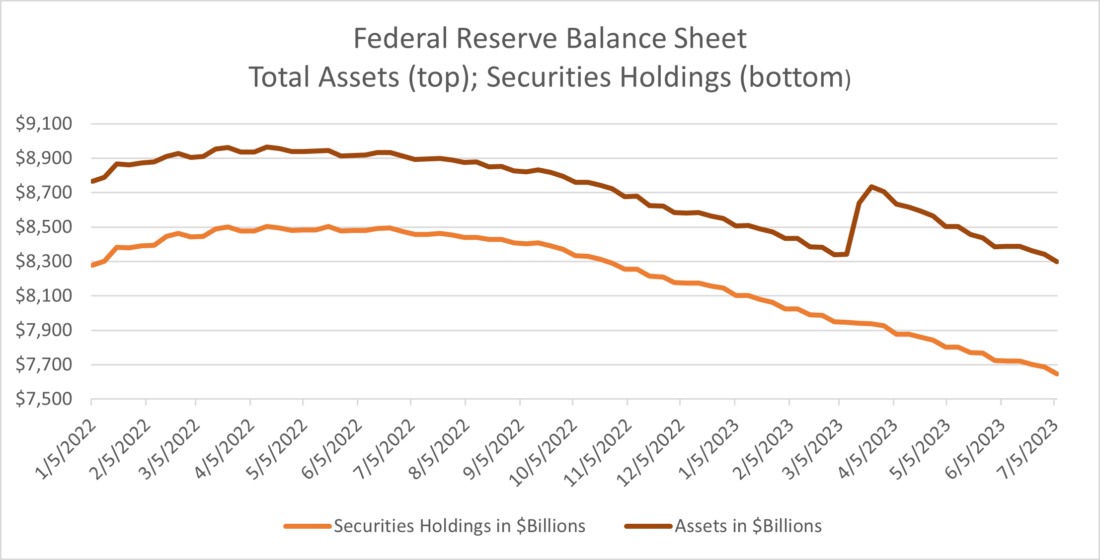

It turns out that we saw the most aggressive Fed action in a generation, but it so far hasn’t really mattered. When we wrote that piece, the upper bound of the Fed Funds target was 2.5%, up from 0.25% before the hiking cycle began in March 2022. We’ve since more than doubled that target rate in the ensuing 11 months. Meanwhile, the timid steps to reduce the size of the Fed’s balance sheet that began after it peaked in April 2022 had begun to accelerate by the end of last summer – though they were notably reversed in March of this year in response to the banking crisis:

Source: Interactive Brokers, Federal Reserve H.4.1 Releases

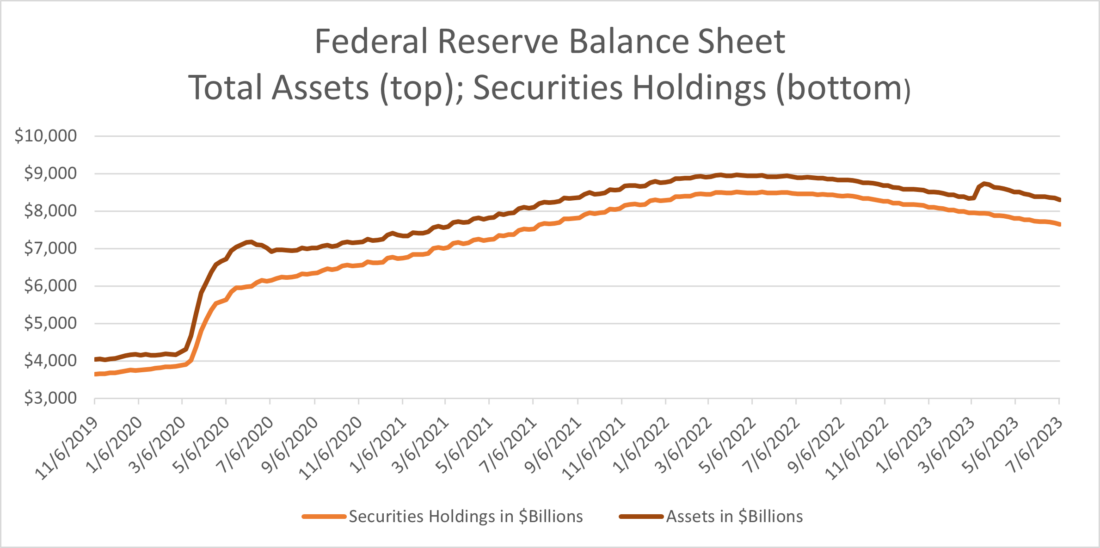

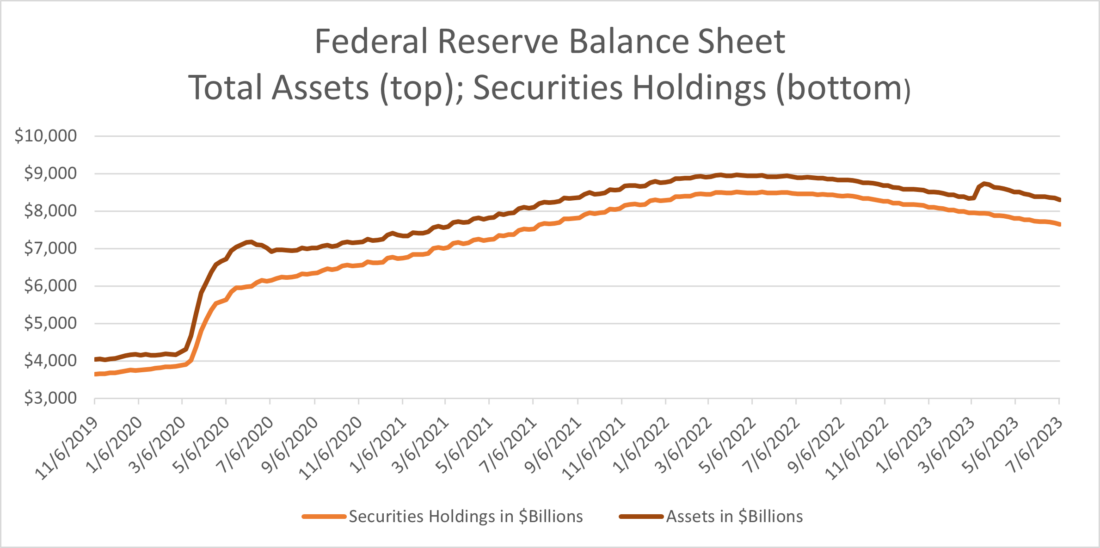

Despite the recent balance sheet shrinkage, however, the pace of quantitative tightening has barely made a dent in the quantitative easing that was launched in response to Covid:

Source: Interactive Brokers, Federal Reserve H.4.1 Releases

The answer to the “aggressive Fed action” seems to be a qualified yes. Rates are now well above the pre-Covid 1.75%, but while the Fed’s balance sheet has shrunk significantly from its peak, it is still over double its level from early 2020. Yet it would be unrealistic to expect the Fed to move even more aggressively than it has. Remember, the banking system nearly broke just a few months ago – and counterintuitively became a temporary source of monetary expansion that ended up benefiting stocks.

As for the recession part of that parlay: it’s too early to say, but it is reasonable to wonder where it is. The bond market, through an inverted yield curve, has been pricing in recession fears for months. After today’s positive reaction to CPI, the 2-10 inversion is now about 88 basis points. Even though it is below the recent highs, it remains at levels that still show significant economic concerns.

Yet the relationship between unemployment and interest rates that is theorized by the Phillips Curve appears to be tenuous at best. Using conventional economic theories, the combination of rapid rate hikes and a record low unemployment rate would have been a long-odds parlay on its own. It is indeed possible that there is a delay in the transmission mechanism between rates and employment, but it is also quite possible, if not likely, that the relationship between the two is simply insignificant.

A recession might arrive if, as noted, the relationship between rates and unemployment is simply delayed. Another factor could be the impending end of the student debt repayment moratorium. Younger people (for the most part) have enjoyed the freedom to spend or invest money that would otherwise have gone to debt repayment. That, unfortunately, ends within a couple of months. And that money must come from somewhere, either out of discretionary spending, or savings and investments. The former would have economic ramifications, the latter would have market ramifications.

So it is too early to proclaim that the equity market’s major parlay bet has fully realized. But it doesn’t matter. Those who put it on can collect their winnings if they so choose, or let it continue to ride if they’d prefer.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

10,000 people are retiring every day. This pace of retirement will continue until 2030. The demographic changes in the economy are still not appreciated.

Thank you for sharing your opinion, Jonathan.

I disproved the Phillips Curve in 1973, as a middling grade grad student at middling level URI. Strange that it’s still around.

@Bob – I did a similar project in the early ’80s as an undergraduate. The Phillips curve is indeed an undead zombie idea. (btw, my professor was Dr. Summers, the former Treasury Secretary’s father)