A concise weekly overview of the U.S. equities and derivatives markets

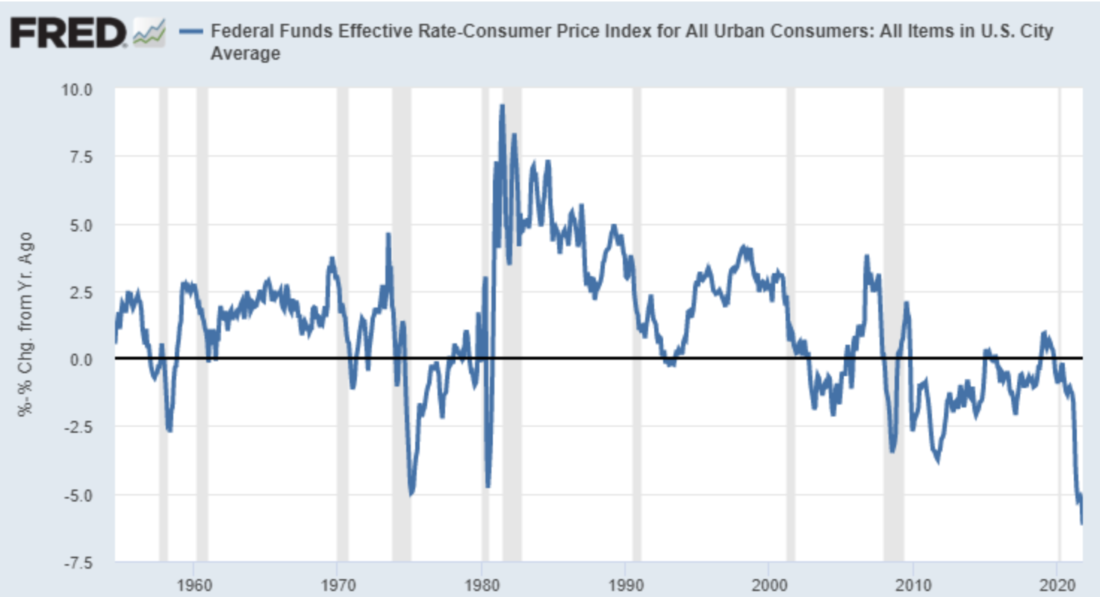

Last week (November 8 – November 12), inflation was the word of the week in U.S. equity markets. The large and small cap indices all fell incrementally but remain near all-time highs. On Wednesday, new Consumer Price Index (CPI) data showed an annualized increase of 6.2%, the highest annual inflation reading since 1990. Additionally, Producer Price Index (PPI) data was up 8.6%, the highest reading in 11 years. Core CPI has been above the Federal Reserve’s target of 2.0% for seven months. Between late 2011 and early 2020 (pre-pandemic), CPI averaged an increase of 1.6% annually. The narrative underpinning the inflation data remains centered on strong demand, supply chain issues, higher commodity prices and labor imbalances.

U.S. Treasuries sold off (yields higher) following the release of PPI and CPI data. The probability of more than one hike in the Fed Funds rate next year climbed. The Fed’s tapering of its monthly asset purchases is expected to conclude around June 2022, when the prospect of hikes will become more likely. Reports that President Biden interviewed Federal Reserve Governor Lael Brainard, a perceived “dove,” as well as Federal Reserve Chair Jerome Powell last week, indicate that the administration is making progress toward nominating the next Federal Reserve chair.

The University of Michigan Consumer Confidence Index data released on Friday was weak, falling to the lowest level since 2010. In terms of S&P 500 Index sector performance, the Health Care and Industrials sectors led with slight gains, while the Consumer Discretionary and Energy sectors lagged, declining 3.6% and 1.6% respectively.

Quick Bites

Indices

- U.S. Equity Indices traded lower in the first half of the week and rallied at the tail end.

- S&P 500 Index (SPX®): Decreased 0.31% week-over-week.

- Nasdaq 100 Index (NDX): Decreased 1.0% week-over-week.

- Russell 2000 Index (RUT℠): Decreased 1.1%. week-over-week.

- Cboe Volatility Index™ (VIX™ Index): Measured between 19.90 and 16.15 last week.

Options

- SPX options average daily volume (ADV) was 1.42 million contracts per day, slightly below the previous week’s average of 1.6 million contracts per day. The one-week at-the-money (ATM) SPX options straddle (4685 strike with an 11/19 expiration) implies a +/- range of about 1.1%.

- VIX options ADV was about 420,000 contracts last week, which was above the previous week’s ADV of 380,000 contracts. The VIX options call-put ratio was 1.52:1.

- RUT options ADV was 56,500 contracts, down from the previous week’s ADV of 91,200.

Across the Pond

- The Euro STOXX 50 Index decreased 0.9% on the week.

- The MSCI EAFE Index (MXEA℠) decreased 0.37% week-over-week and the MSCI Emerging Markets Index (MXEF℠) gained 1.6% week-over-week.

Charting It Out

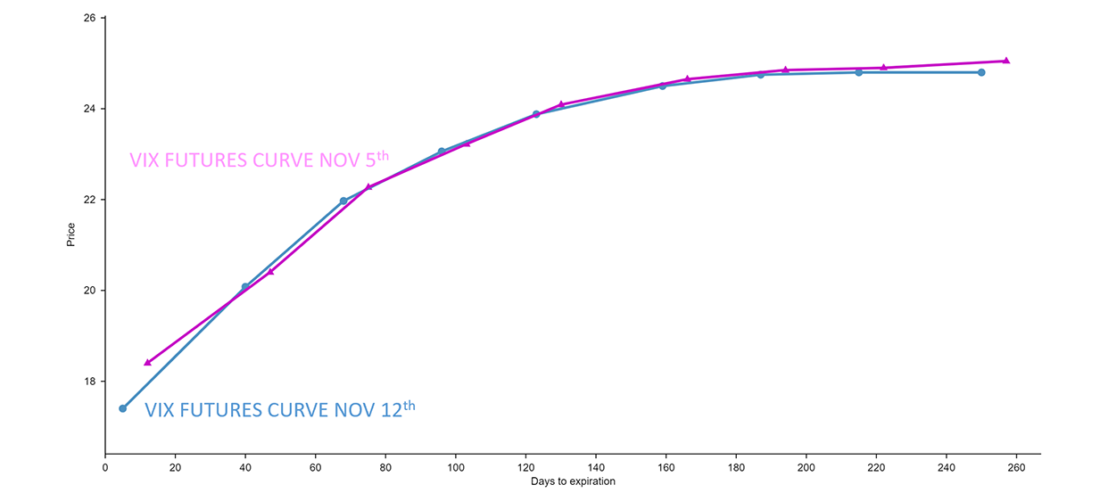

Observations on VIX futures term structure

- The VIX Index was slightly lower week-over-week and closed very near the 16.50 level for the third straight week.

- The VIX futures curve steepened, with the November VIX futures contract declining by 0.90 and the December VIX futures falling 0.45. The Month-1/Month-2 spread settled at 2.60 wide, compared to 2.15 the week prior.

- The standard November VIX futures and options will expire and cash settle on Wednesday, November 17.

Source: LiveVol Pro

Macro Movers

- The U.S. 10-year Treasury Yield fell to 1.42% early in the week. Yields shot higher Wednesday, following the release of Consumer Price Index (CPI) data. By Friday, the 10-year yield was up to 1.59%.

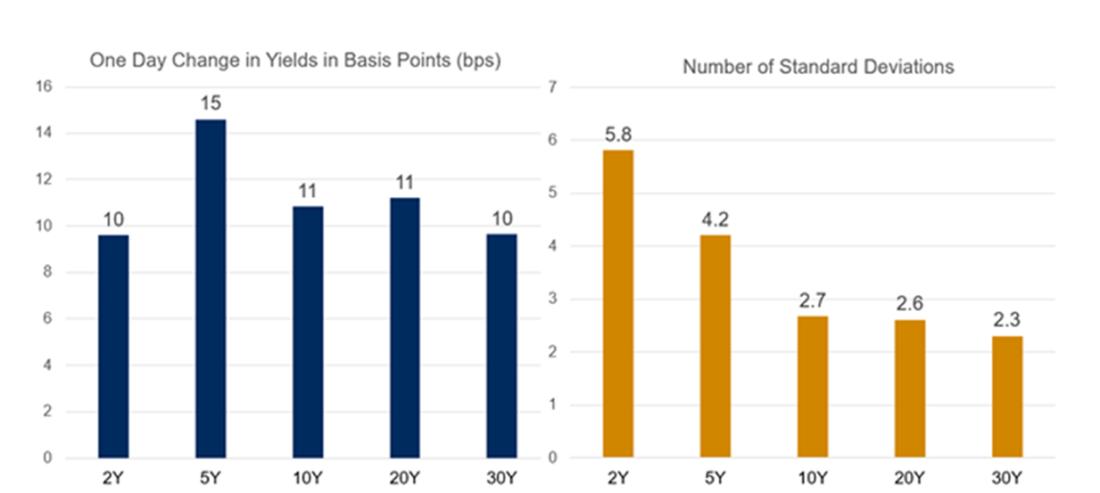

- From a volatility standpoint, Wednesday’s decline in U.S. treasury prices (increase in yields) were two to six standard deviation shifts, depending on tenor. The probability of two or more interest rate hikes in 2022 moved yields higher on the week.

- The S&P GSCI was effectively unchanged last week. Natural Gas futures continued to decline, falling about 13% on the week. Crude Oil lost 0.5%. The Grain Complex rebounded after the previous week’s selloff. The soft markets, including Coffee, Cocoa, Sugar and Orange Juice, rallied.

- The leaders in the S&P 500 Index and Technology sector were little changed on the week, except for Tesla. Shares of the electric vehicle automaker fell approximately 16%, which was the worst weekly performance since March 2020.

- According to public filings, Elon Musk recently sold more than $5 billion worth of Tesla shares but still owns more than 165 million shares of the company.

Major Cryptos

Bitcoin

- Last week Bitcoin (BTC) traded to new all-time highs around $69,000 and ended the week at $64,400, up 5.4% week-over-week.

Ethereum

- Ethereum (ETH) traded between $4,900 and $4,330 last week and ended the week at $4,700, higher by 4.2% week-over-week.

Digital Asset Industry

- Several altcoins made significant moves last week. Avalanche (AVAX) jumped 32.3%, NEAR Protocol (NEAR) gained 26% and Algorand (ALGO) climbed 24.3%.

- The Infrastructure Investment and Jobs Act catalyzed bullish sentiment in the digital asset sector. The bill also includes provisions that expand the tax reporting rules for digital asset firms. The proposed regulation lends credence to digital asset legitimacy and reduces the risk of outright bans in the U.S.

- On Tuesday, the total digital asset market cap value surpassed $3 trillion. A year ago, the market cap was $580 billion.

- Australia’s biggest bank (CBA) became the country’s first bank to allow end users to buy, sell and hold digital assets through its app.

- JP Morgan’s wealth management clients now have access to digital asset funds.

Coronavirus

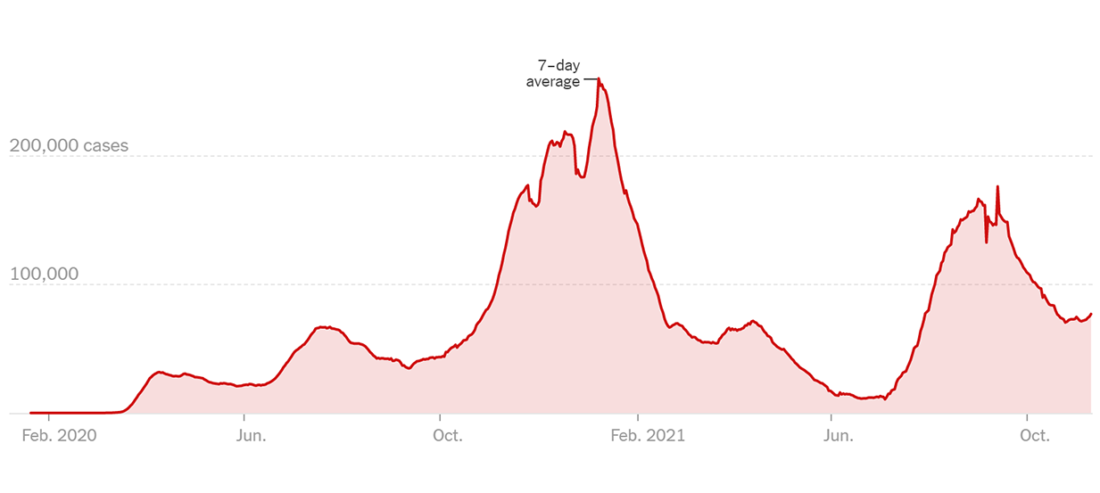

- The 7-day average COVID-19 infection rate in the U.S. was slightly higher week-over-week, moving from approximately 72,000 to approximately 76,000.

- 59% of the U.S. population is fully vaccinated against COVID-19 and 68% have received at least one dose of a COVID-19 vaccine. For just those 12 years and older, the numbers are 69% and 79% respectively.

- Parts of California, Colorado, and New Mexico are currently struggling with outbreaks.

- Globally, the 7-day average climbed from approximately 443,000 to approximately 463,000.

- Britain became the first country to authorize Merck’s antiviral pill for treating COVID-19.

COVID-19 Cases in the U.S.

Source: The New York Times

Tidbits from the News

- Data released Wednesday showed the Consumer Price Index (CPI) is up 6.2% year-over-year. Expectations called for 5.9% increase, the hottest inflation number since 1990.

Federal Funds Effective Rate Less 12-Month Change COVID-19 Cases in the U.S.

Source: St. Louis Federal Reserve

- The bond market reacted swiftly to the inflation data released Wednesday. Yields climbed across maturities. Relative to volatility levels, there was a nearly 6 standard deviation change in 2-year treasuries. There’s also been a divergence between interest rate implied volatilities and equity index implied volatilities.

S&P U.S. Treasury Bond Indices

Source: The Daily Shot

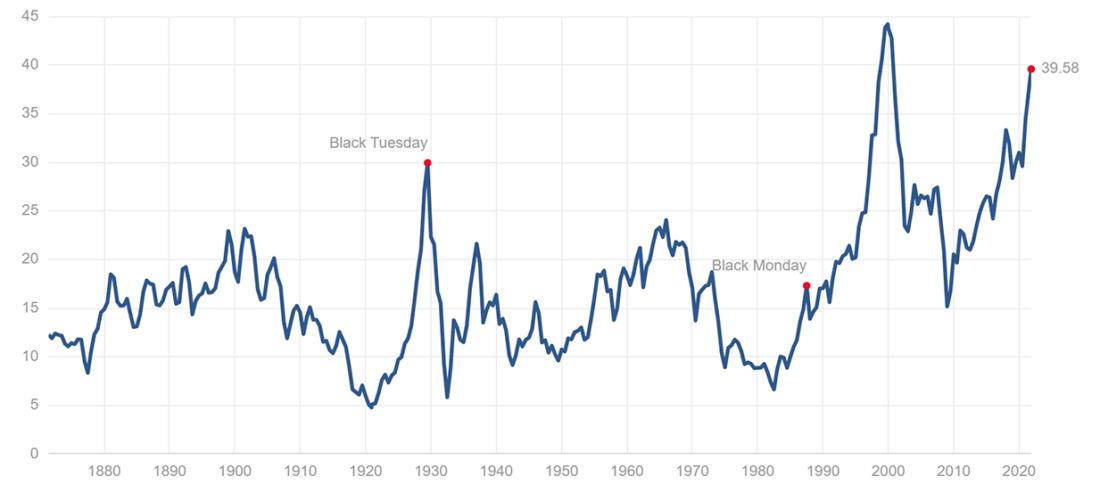

- The Cyclically Adjusted Price-Earnings (CAPE) ratio is back at 40 for the first time in 21 years. The S&P 500 Index valuation metric looks at average earnings over a 10-year period, adjusted for inflation, relative to the “price” level for the index. The one-year forward S&P 500 Index PE ratio is a more muted 21.5, according to Yardeni Research. In 2000, that measure was approximately 26.

Cyclically Adjusted Price-Earnings (CAPE) Ratio

Source: Multpl/Robert Shiller

The Week Ahead

- Data to be released this week: Empire State Manufacturing on Monday; Retail Sales, National Association of Home Builders (NAHB) Home Builders Index on Tuesday; Building Permits on Wednesday; Initial Jobless Claims and Philly Fed on Thursday.

—

Originally Posted on November 15, 2021 – The Week that Was: November 8 to November 12

There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at https://www.cboe.com/options_futures_disclaimers

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.