Over the past 18 months, we’ve all learned a thing or two while adapting to quarantine life. I, for one, mastered using a headset designed for professional gamers on work calls, while also using time I had previously spent on the Metro-North figuring out how to grow vegetables in Connecticut.

In financial markets, investors have had to do some adapting as well. Equities are back to all-time highs, inflation is jumping higher, the political and regulatory climate is a source of uncertainty, and an unprecedented amount of liquidity in the system alongside huge global demand for high quality bonds has pushed yields to rock-bottom levels.

In a way, the last 18 months haven’t been entirely different from the last 10 years of managing diversified income portfolios. The market ebbs and flows, but ultimately drives higher over time. But there are a few things that have surprised me over the decade I’ve managed the Multi-Asset Income Fund that will likely shape how we think about finding attractive income and returns in the next decade.

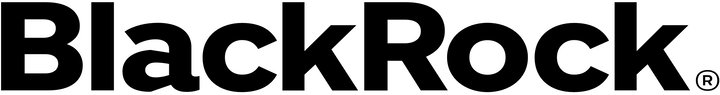

First, back in 2011, I would have never thought the Fed’s zero interest rate policy would still be in place 10 years later. Furthermore, it’s pretty wild that we have record equity levels and strong global growth coming out of the pandemic, yet the 10-year Treasury yield sits about 40bps lower than the 1.97% level when we launched the fund. And even looking ahead to the 10-year forward curve today, the market’s anticipating the 10-year yield will be at 2.3% in five years – certainly not what many investors thought a decade ago. We’ve run big deficits, more than doubled the market value of outstanding Treasury debt, and yet the market views the growth outlook as stubbornly fragile.

Market expectations for interest rates remain muted

So, what does this mean for investors? Don’t expect much from core fixed income in the years ahead. There has been a close historical relationship between starting yields and forward-looking returns. Meaning, if the market believes the 10-year Treasury yield is still only at 2.2% in 5 years, you’re unlikely to expect much more than that in total return from core bonds. This is why we continue to embrace areas like high yield bonds, bank loans, high quality dividend stocks, and covered calls. This diversification and willingness to take more risk in search of income and returns may be more crucial going forward than it has been the last 10 years

The second thing that has surprised me is the outperformance of the U.S. over Europe. While I thought U.S. equities would lead, the S&P 500’s more than 350% return over the last ten years easily beats the EuroStoxx’s roughly 125% move.* Throwing emerging markets into the mix gives an even more pronounced picture – broad emerging market stocks (as measured by the MSCI Emerging Market Index) are up roughly 70% over that time, with most of that return coming from dividends, not price movement. While this level of outperformance going forward may not be sustainable, I think it tells investors that winners can continue winning, even in the face of elevated valuations and myriad of headwinds and uncertainties they may face. Does this mean equity diversification is dead? No, quite the contrary, as some of these losers may transition to outperformers moving forward. But it does highlight the diversified nature of the U.S. market and its ability to outperform over time.

Third, yields across virtually all fixed income sectors have experienced a tremendous drop – one I didn’t necessarily think was possible. For example, the average yield on high yield bonds (represented by the BBG US HY 2% Issuer Cap TR Index) has gone from ~9% to around ~4% today. Investment grade bond yields (represented by the BBG US Corp Bond TR Index) touched an all-time low of ~1.7% and today don’t sit much higher. Why is this important? With inflation running hotter, the real yield on virtually all high-quality bonds is negative. Furthermore, a record level of bonds are now rated triple-B – the lowest grade to qualify as investment grade. This is a sign, in my opinion, that investors are not getting compensated for the risk they are taking. While we’re not calling for a massive threat to high quality bonds, we’re simply pointing out unless investors are willing to take a bit more risk within their fixed income allocations, there is a significant risk the yield won’t even offset inflation in the years ahead.

The short takeaway from these observations is that delivering attractive investment outcomes may be more challenging and more complicated moving forward. Which leads me to my last point – one thing I’ll never compromise despite trickier market dynamics: a risk-first approach.

In many ways, the last 10 years were a time of profound change for the financial system, during which many of the conventional wisdoms of investing were up upended. We’ve had to adapt but we continue to uphold our responsibilities to our investors, understanding their financial goals are the same and more important than ever.

—

Originally Posted on November 18, 2021 – Three Things That Have Surprised Me – And One Thing I Wouldn’t Change

© 2021 BlackRock, Inc. All rights reserved.

*The performance quoted represents past performance and does not guarantee future results. Figures quoted are total returns from 12/1/11 through 10/31/21. All performance data is sourced from Bloomberg. For illustrative purposes only. You cannot invest directly in an index.

You should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling 800-882-0052. The prospectus should be read carefully before investing.

Investing involves risk, including possible loss of principal. Asset allocation and diversification may not protect against market risk, loss of principal or volatility of returns. Actual investment outcomes may vary. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. No representation is being made that any account, product, or strategy will or is likely to achieve profits. International investing involves special risks including, but not limited to political risks, currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change. The opinions expressed are those of the fund’s portfolio management team as of November 2021, and may change as subsequent conditions vary. Information and opinions are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy.

Prepared by BlackRock Investments, LLC, member FINRA.

©2021 BlackRock, Inc. All rig

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ