Just days after OPEC+ sparked widespread fears of higher energy prices by announcing additional oil production cuts, updates on the job market, U.S. manufacturing data, and weakening trade indicate increasing risks of recession. Moreover, OPEC +’s decision shows the oil cartel is serious about restricting supply to maintain, or even increase, oil prices, which could create a scenario of weakening economic growth while energy costs fuel persistent inflation.

This morning’s unemployment claims report is an example. Lines at unemployment offices lengthened during the last five weeks as initial unemployment claims rose to the highest levels since January 2022. For the most recent week, the 228,000 unemployment claims shattered expectations, which called for a 200,000 increase. For the four weeks prior to that period, data was revised sharply higher from an average of around 195,000 to 240,000. While these revisions are particularly alarming, it’s the combination of data released this week that is adding to rising odds of recession and fueling worries.

Yesterday’s ADP data also confirmed that the labor market is cooling. Private sector hiring increased by just 145,000 in March, down sharply from 261,000 in February and missing the consensus estimate of 200,000. Wage gains also slowed, climbing 6.9% year-over-year (y/y) in March compared to 7.2% the prior month.

Large companies with more than 249 employees weighed on the headline the most, with the 1-249 segment driving gains. Without the contribution from small and medium-sized businesses (1-249) which added 176,000 jobs, we would’ve lost jobs in March as the segment with more than 249 employees lost 32,000 workers.

In the aftermath of stay-at-home orders and social distancing measures intended to slow the spread of Covid-19, consumers with pent-up desires for entertainment and travel have been spending more on services while cutting back on goods. Demand for those pastimes appears to have continued, with the leisure and hospitality sector adding 98,000 hires and leading job creation in March. Trade, construction, mining, education and other services also contributed, gaining 56,000, 53,000, 47,000, 17,000 and 8,000, respectively. However, finance, business services, manufacturing and information weighed on results, shedding 51,000, 46,000, 30,000, and 7,000 employees. Large companies with more than 249 employees weighed on the headline the most, with the 1-249 segment driving gains. Without the contribution from small and medium-sized businesses (1-249) which added 176,000 jobs, we would’ve lost jobs in March as the segment with more than 249 employees lost 32,000 workers.

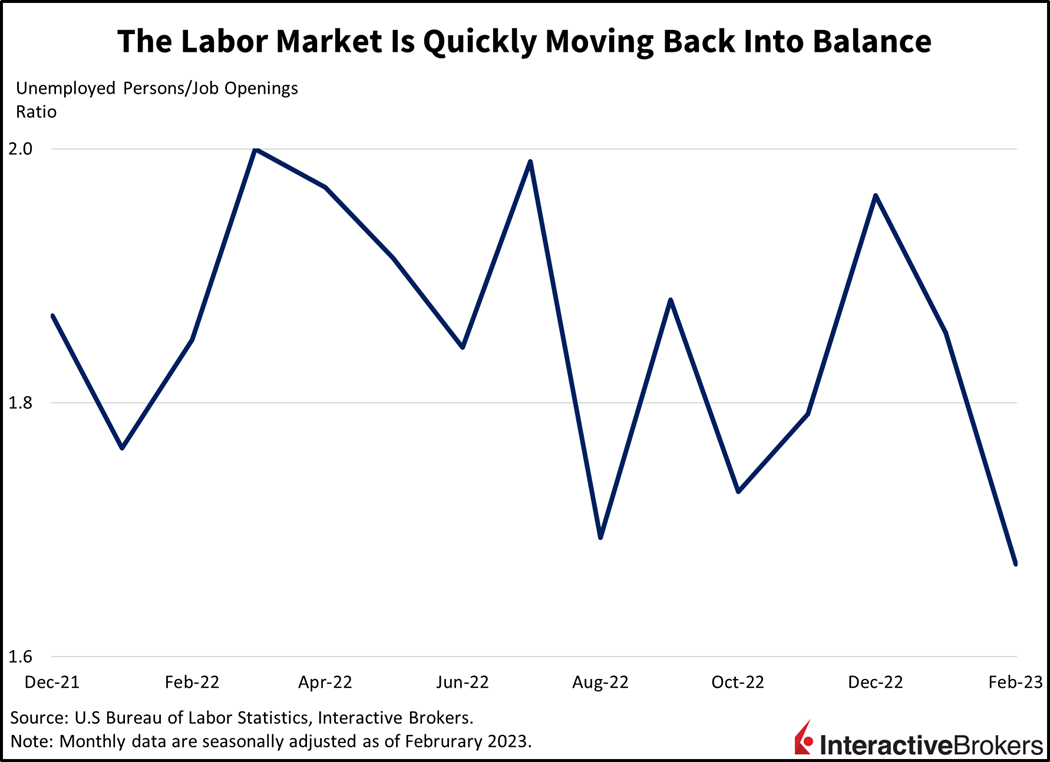

Two days ago, the U.S. Department of Labor reported that February job openings declined from 10.6 million in January to 9.9 million. It was the first time since May of 2021 that the number dropped below 10 million, signaling further that the labor market and wage pressures are cooling as corporate hiring appetites weaken and prospective workers sport fewer opportunities. The number is also down notably from March 2022, when job openings hit a historic peak of 12 million. Job openings are now down to 1.7 per unemployed person, down from a high of 2. Labor dynamics are becoming more balanced as companies offer fewer jobs while more Americans seek work.

The professional and business services category, which shed 278,000 openings, was the biggest loser, followed by the health care and social assistance group, which lost 150,000 openings, and transportation, warehousing and utilities, which surrendered 145,000.

Construction Demand Ensues

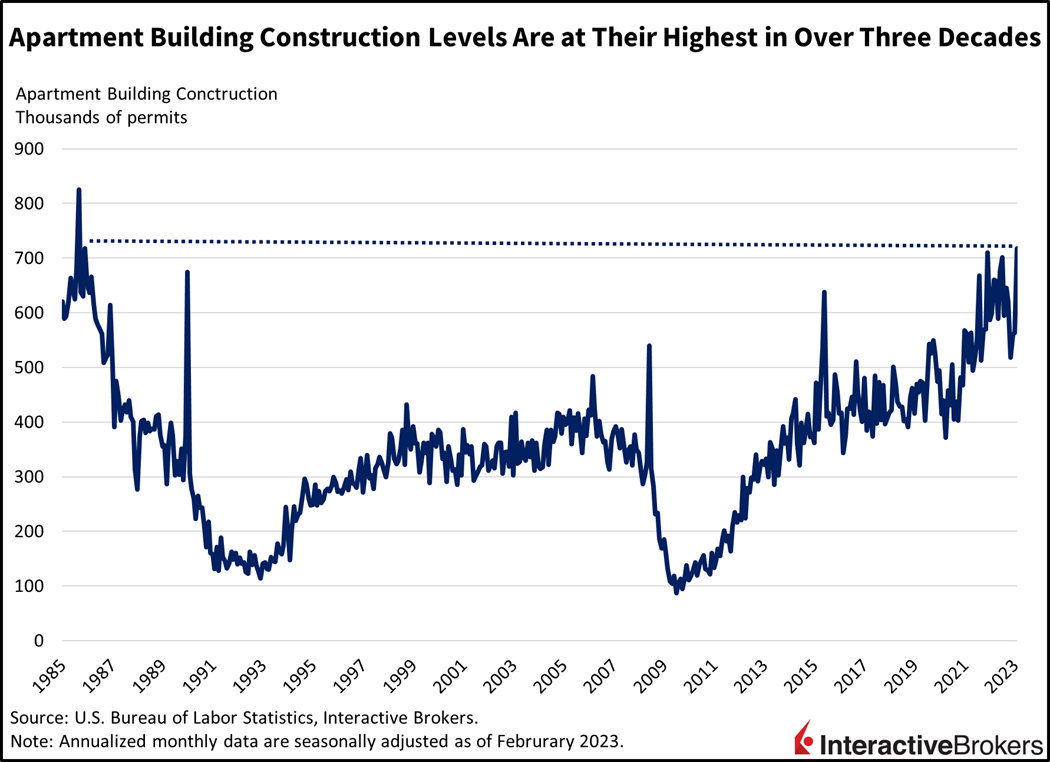

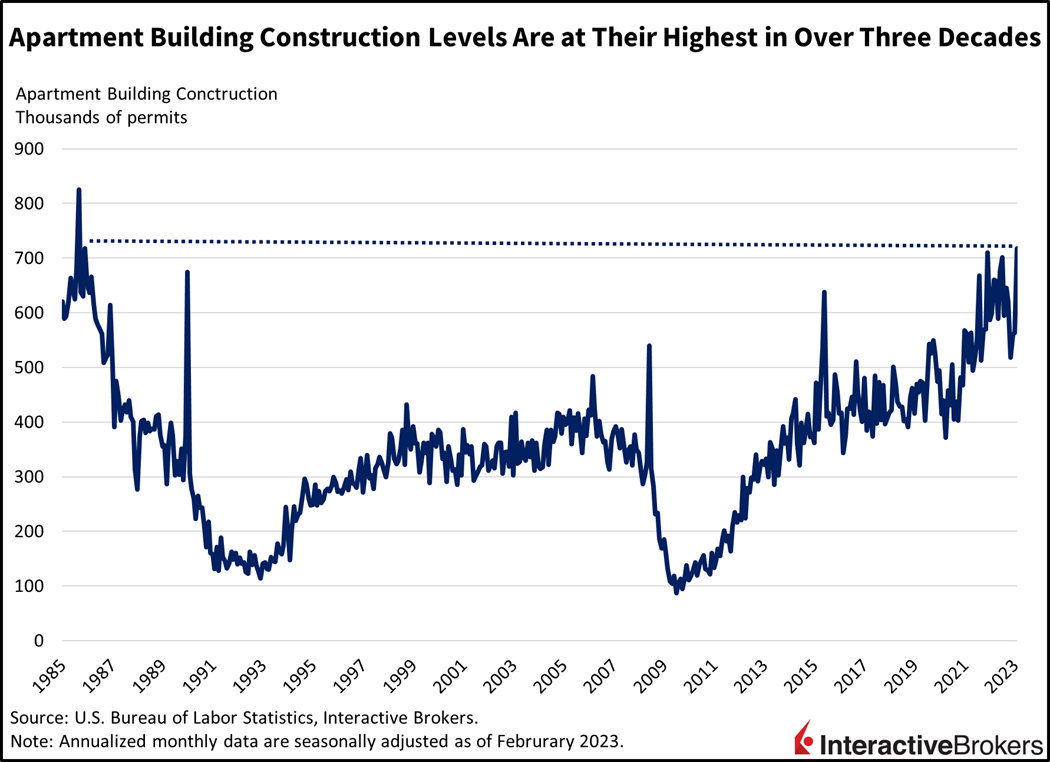

On a positive note, despite higher financing costs creating a real estate headwind, strong demand for construction workers continued in both this week’s JOLTS data and yesterday’s ADP report, a trend that could potentially continue through this year. In a recent research paper, Associated Builders and Contractors Chief Economist Anirban Basu noted that the industry will need an estimated 546,000 workers in addition to the more normal pace of hiring new workers this year. Higher mortgage interest rates have caused single-family home construction to contract, but strong demand exists for mega factories such as Taiwan Semiconductor Manufacturing Company’s $40 billion plant in Arizona, and apartments, with construction levels for rental housing at the highest level since September 1985, as interest rate and affordability pressures push more Americans out of the for-sale market and into the rental market. Construction of clean energy facilities and infrastructure projects is also supporting demand for workers.

ISM Shows Economy is Cooling

Meanwhile, both Services and Manufacturing ISM reports this week point to a slowing economy. Yesterday’s Service ISM index release showed that the services sector is still growing, but at a slower pace, with the index decelerating sharply from 55.1 for February to 51.2 in March. Even though the number declined, it was the third consecutive month above the expansion/contraction border of 50. Backlog of orders, new export orders and imports, which were in growth territory in February, dropped into contraction territory. The sharp decline in demand was evident as inventories increased at a faster rate while price pressures slowed, with a score of 59.5, down from 65.6 in March. Price pressures in services, however, remained significantly elevated and much higher than the contraction-expansion threshold of 50, problematic for the Fed.

Earlier this week, the Manufacturing ISM report for March was reported as 46.3, substantially missing the expectation of 47.2 and down from February’s 47.5 level. It showed a decline in new orders and backlogs amidst contracting manufacturing employment.

Trade Outlook Dims

Yesterday, the World Trade Organization announced that it expects world trade growth to slow to 1.7% this year, down from 2.7% in 2022. The organization cites the lingering effects of Covid-19, geopolitical risks and the impact of rising interest rates in developed economies as reasons for the downgrade. Trade growth next year is forecast to increase to 3.2%. Also earlier this week, Bloomberg reported that cargo volumes for the Port of LA, Singapore and Hong Kong were substantially below normal levels for February. The front-loaded demand for goods during the pandemic is also contributing to weakness as consumers have shifted their spending to services.

Investors React to Recession Fears

The recessionary outlook is reflected on the yield curve, with rates significantly below cycle highs. Traders are expecting the Fed to begin loosening as an economic downturn could potentially bring down inflation. Despite significant headwinds, bulls have a strong lead in the equity market, with stocks up 6% year-to-date as darling tech company stocks drive the S&P 500 Index up. This morning, yields, the dollar and equities are roughly unchanged. The past few trading sessions have featured short bouts of volatility as recession fears mounted but those barriers were easily conquered by the ferociousness of the “buy the dip crew”. While earnings are likely to suffer, investors are maintaining a half-glass-full view against the backdrop of valuations that look marginally attractive in the aftermath of cratering bond yields. Stomaching recession and earnings volatility while owning the best companies in the world is a strategy in itself.

A Tough Road Ahead

As the Fed seeks to engineer a soft landing, it faces an increasingly difficult challenge of tightening monetary policy to curtail inflation without tipping the economy into recession. Ideally, but perhaps unrealistically, the economy would show resilience as disinflation kicks in. However, this week’s OPEC + announcement combined with labor, ISM and trade developments implies that stagflation—or elevated inflation and contracting GDP—is a more likely scenario than a soft landing. Earlier this week, OPEC+ announced production cuts exceeding 600,000 barrels a day in addition to the 2 million barrels a day reduction announced last October. The recent announcement sent the price of oil to above $80 a barrel from approximately $70 and many analysts believe the price could hit $100 if recession is avoided. While improved energy efficiency has allowed the U.S. to decrease the amount of energy it consumes for each dollar of GDP, the higher oil prices are likely to support sustained inflation by increasing businesses’ operating costs, including shipping and transportation expenses. Higher oil prices may also slow economic growth as consumers cutback on discretionary spending as gasoline and heating oil consume an increasingly larger portion of their disposable income. Services, on the other hand, continue to push prices higher as corporate hiring appetites remain strong and consumers are more than willing to pay up to enjoy themselves. While goods prices have softened considerably, services and commodities are still a considerable threat to the inflationary outlook, a point I made last January during a Yahoo Finance interview.

Visit Traders’ Academy to Learn More about Unemployment Claims, ISM Manufacturing and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.