TLDR:

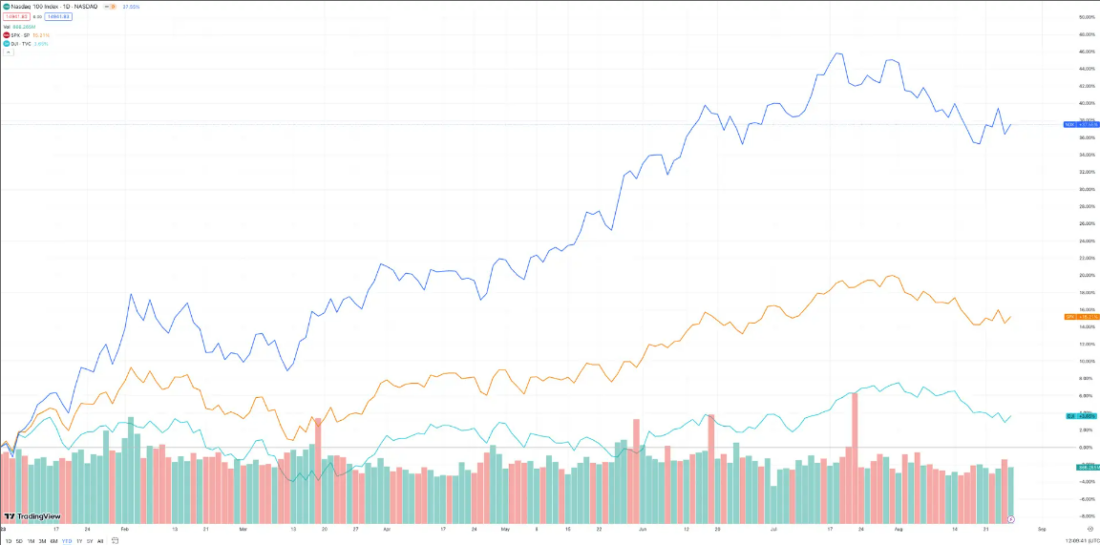

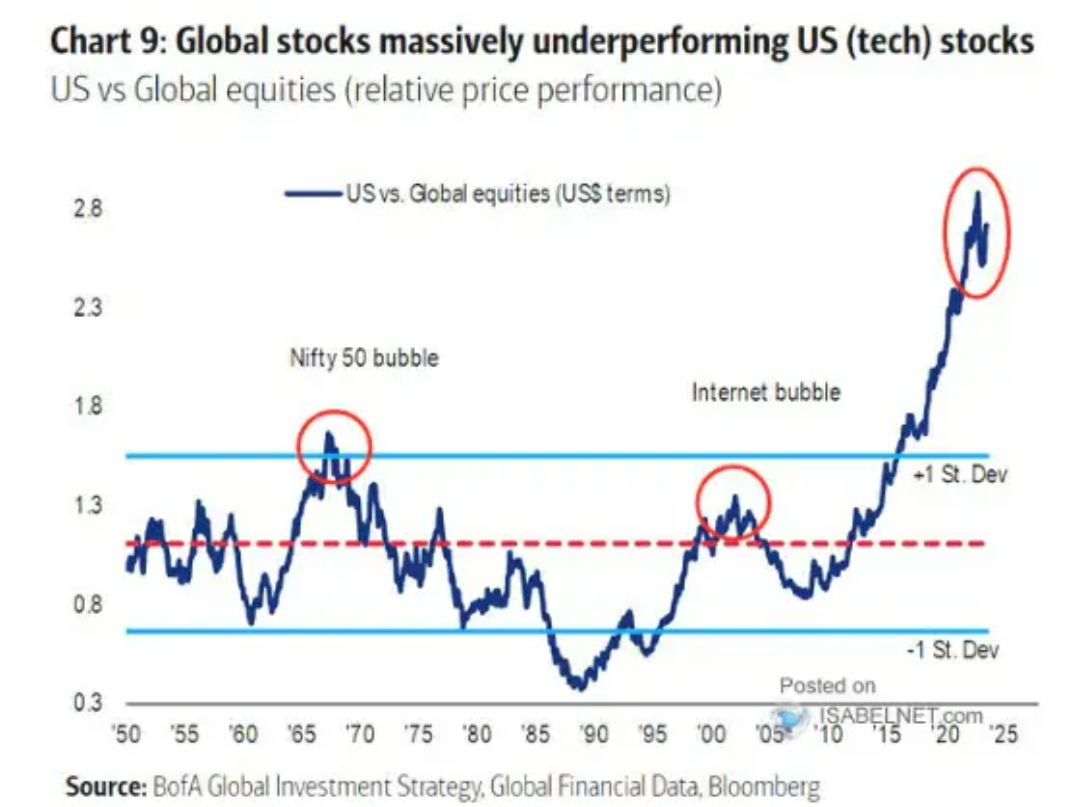

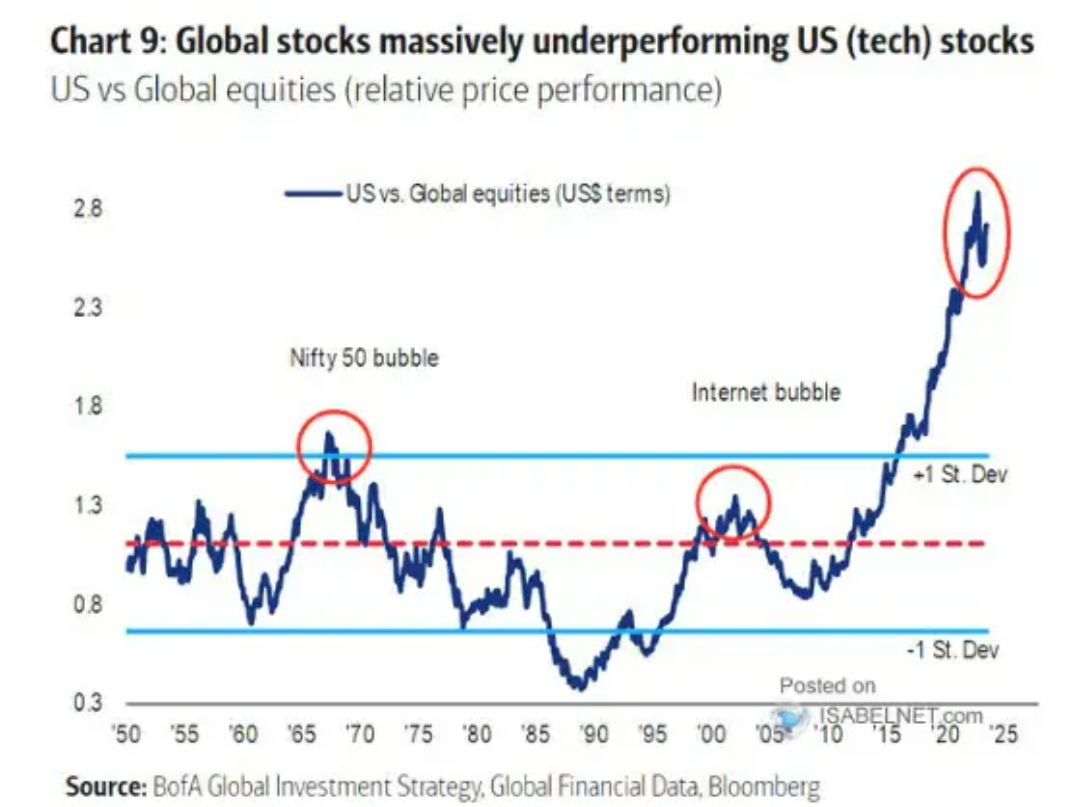

The “teflon rally” we have seen in the US, swatting aside concerns about recession, Fed tightening, geopolitics etc. has been impressive. Even more impressive is the US stocks’ performance relative to the rest of the world – it’s not even a contest. This has been the most dramatic outperformance we have ever witnessed. What is going on?

This is not at all what the forecasters predicted as you can see here and here. And yet, here we are. Is there anything to support this outperformance, or was the US simply pumping in more liquidity than everyone else?

To be fair, currency movements have exacerbated the performance divergence. From 2010 through 2022, the U.S. dollar appreciated a cumulative 33%—or 2.2% annualized—relative to a broad basket of foreign currencies. But even after accounting for currency movements, U.S. equities have reigned supreme.

But the divergence is supported by fundamentals, too. US companies have meaningfully outraced their global peers on earnings per share.

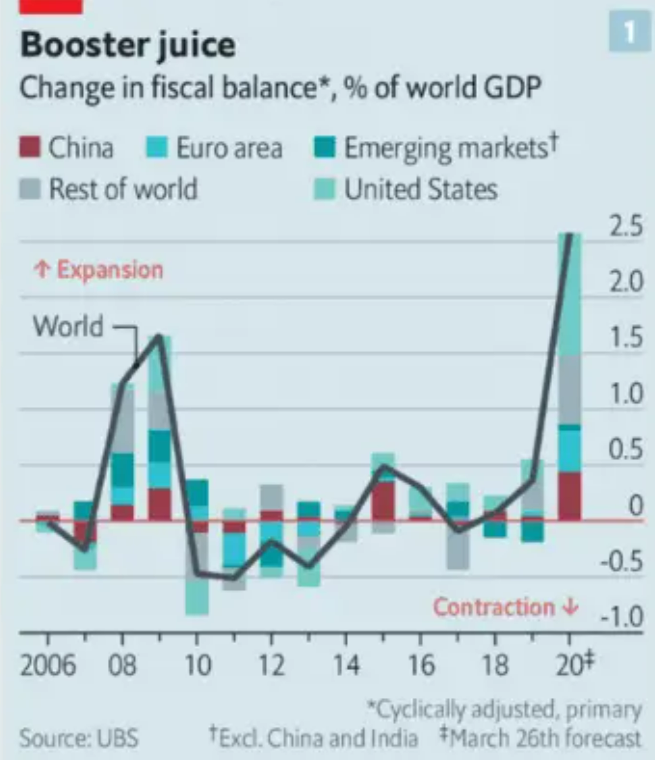

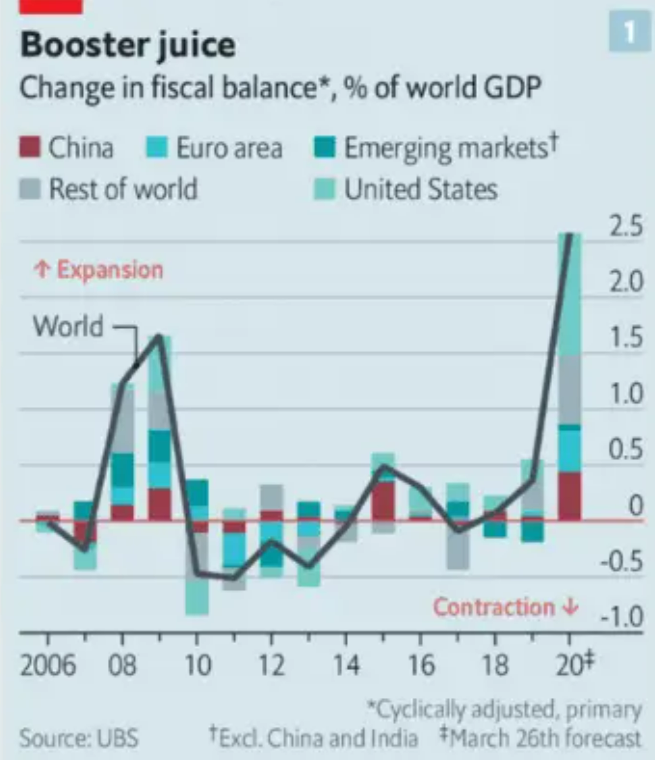

Since the pandemic, US companies have managed to recover far more strongly than the rest of the world. This isn’t entirely just due to US exceptional dynamism: the US government – like during the 2008 financial crisis – acted far more interventionist than just about any other.

So while it’s true that the outperformance may be in part due to government largesse, it’s real. Fiscal checks that percolated through the economy ultimately accrued to the shareholders, and the stock price performance reflected it.

What’s happening in the markets?

This section is powered by Open AI connected to TOGGLE AI

After an almost two-year lull, there are signs of revival in the IPO market.

Instacart, the largest online grocery delivery company in the US, has taken steps toward an initial public offering. In a recent filing, the company revealed that PepsiCo is set to invest $175 million in preferred convertible stock.

Meanwhile, Arm Holdings, a prominent chip designer, has also filed for an IPO, projected to be one of the largest this year with an anticipated valuation ranging from $60 billion to $70 billion.

While recent IPO history indicates a trend of billion-dollar listings facing valuation challenges, with 60% of such listings in 2021 and 78% in 2022 falling below the billion-dollar mark, the current IPO landscape appears more favorable.

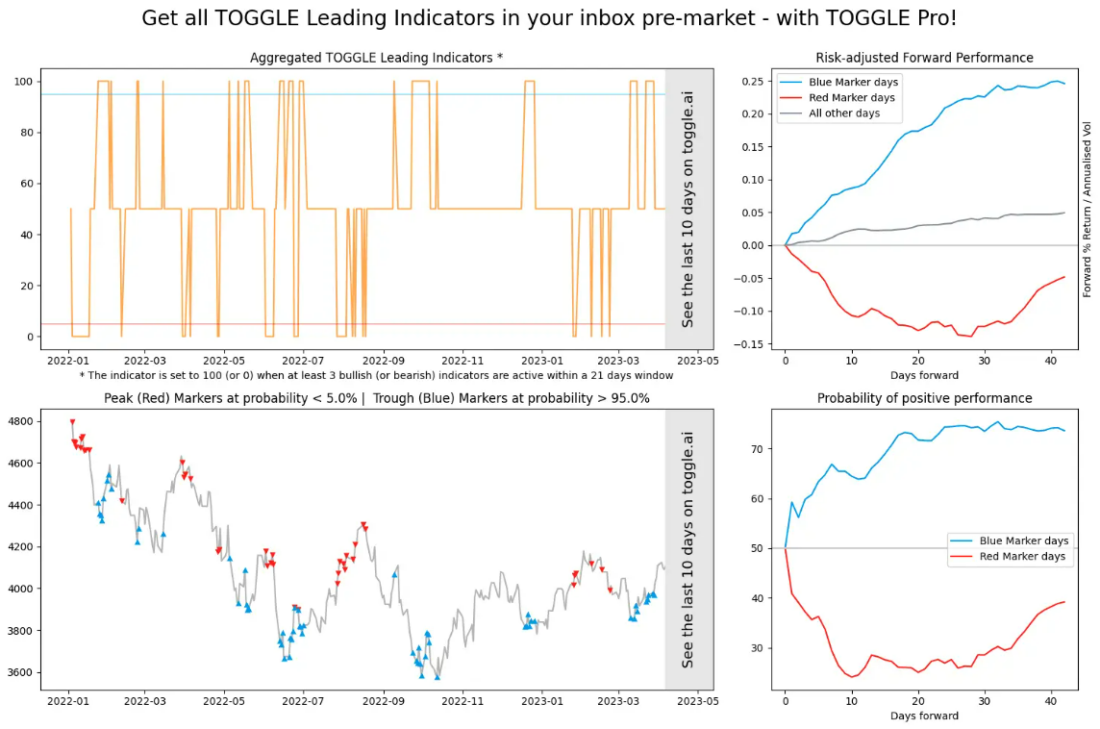

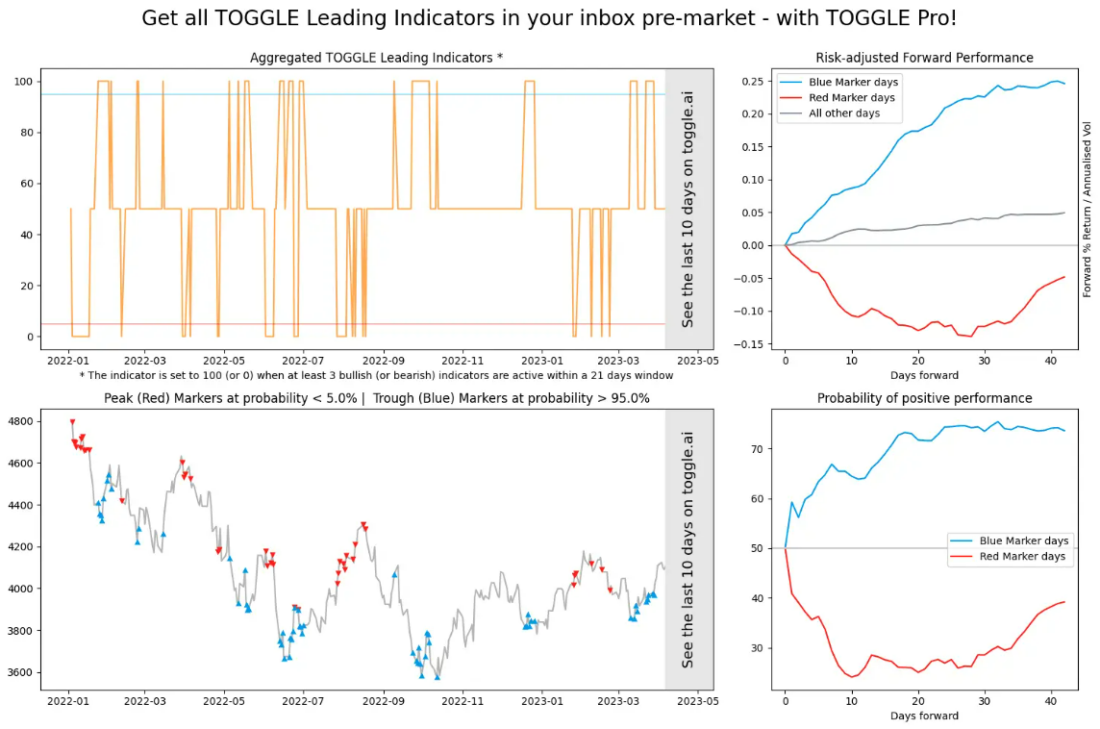

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

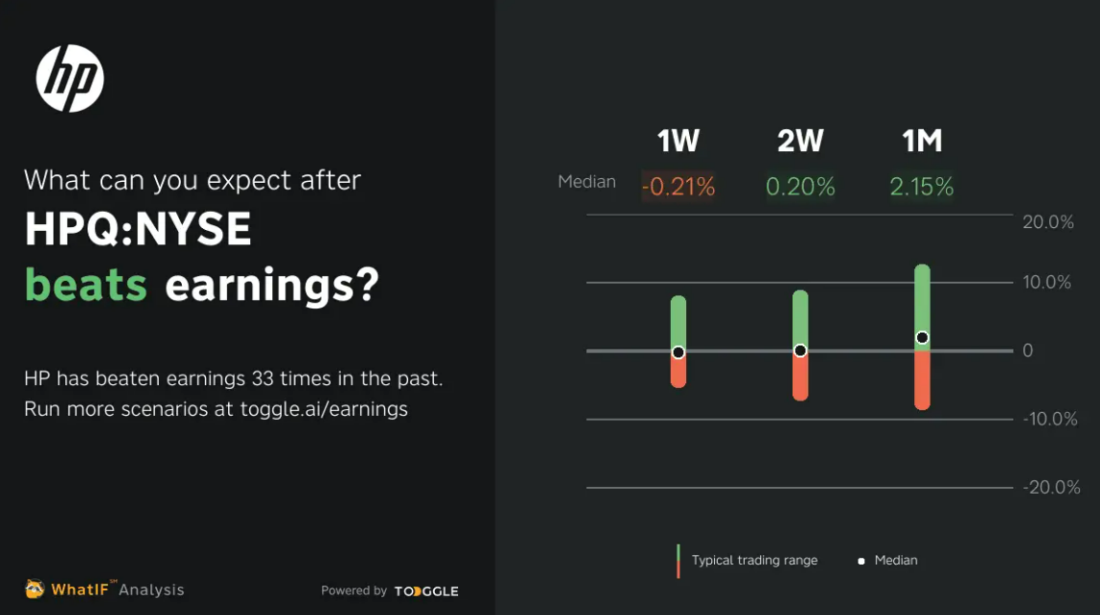

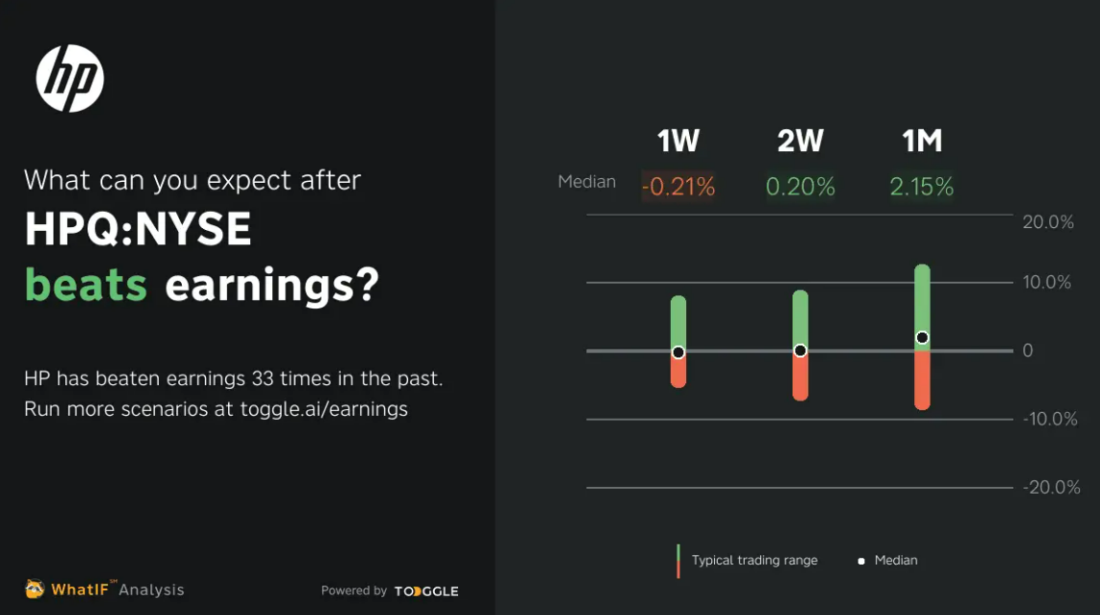

Earnings Update: HP reports tomorrow

Consumer demand for PCs, IT spending and inventory levels are factors to look out for at HP earnings. Click here to observe how the stock could perform after its results.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

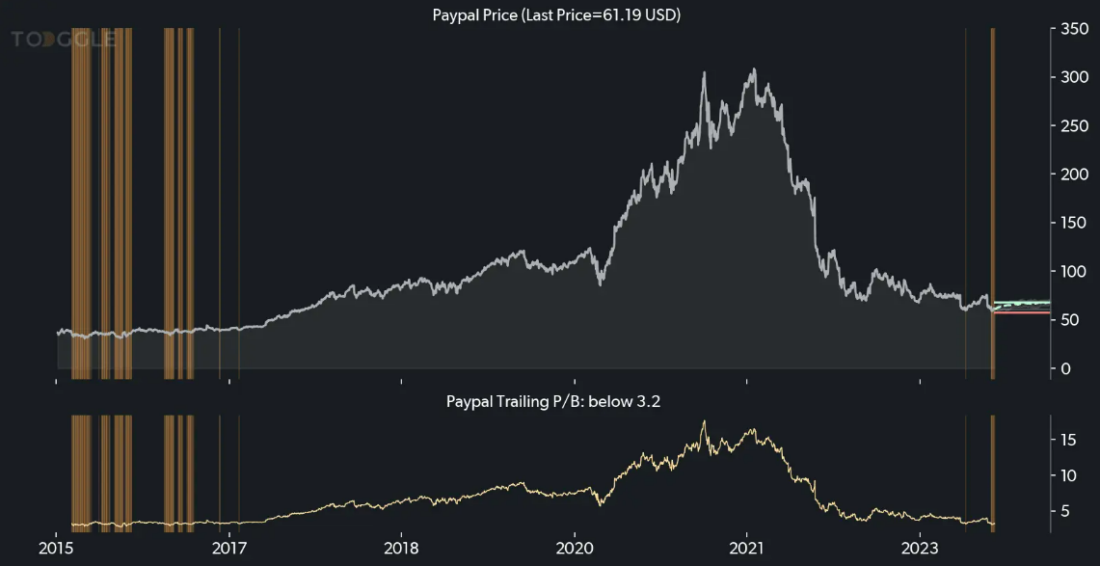

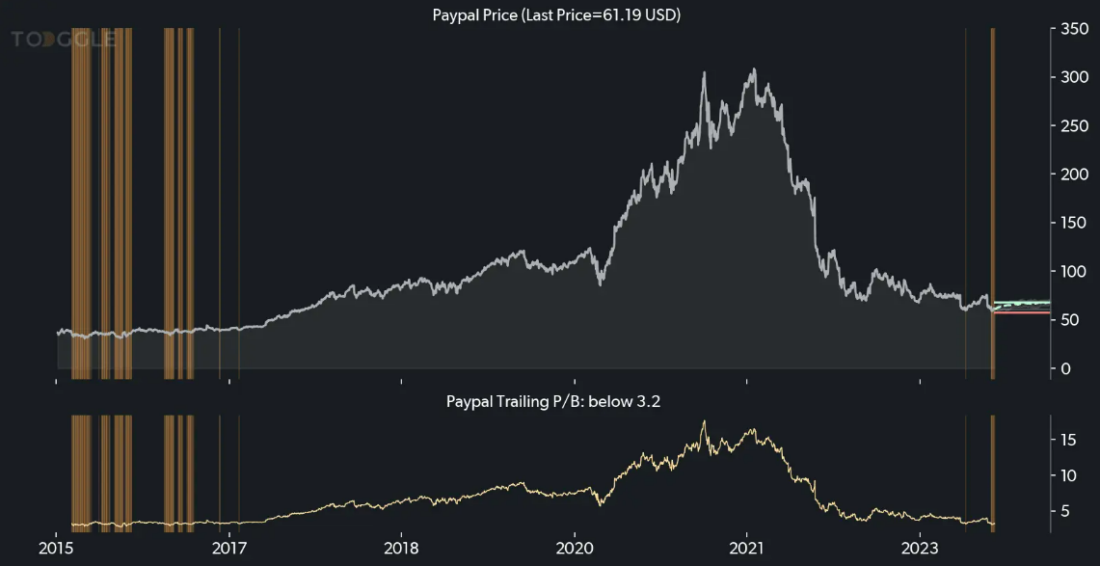

Asset Spotlight: Paypal’s trailing P/B at a low

TOGGLE analyzed 10 similar occasions in the past where Paypal’s trailing P/B ratio hit a low and historically this led to a median increase in the stock’s price over the following 6M. Read full insight!

General Interest: The south side of the moon

India rejoiced a few days back as its moon lander Chandrayaan-3 successfully touched regolith last Wednesday.

In another proof that we’re in a Golden Age of science, we’re going back to the moon. For now we’re sending landers – some successful, others less. But we’re working towards stomping the gray moon dust with our own boots.

And that’s when the lunar pole comes into play. On the south side of the moon there’s water – which we can use for producing oxygen for human manned bases.

We had our first taste of general AIs, we got confirmation about aliens on Earth, now we’re thinking about people living on the moon. What’s next on your sci-fi bingo card?

Read more about the race to the Moon here on the WSJ.

—

Originally Posted August 29, 2023 – US Stocks are killing it

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.