With supply chains in a crunch, making it difficult for manufacturers to build enough new cars, demand and prices for used cars have been turbocharged.

October is usually a slow month for used car sales, but not this year. As supply chains remain crunched and the U.S. emerges from the coronavirus pandemic, used cars have become one of the hottest big-ticket items.

Demand is outpacing supply and prices are rising. The Manheim Index, a key measure for the used car industry, shows that overall prices were trending more than 38% in October over where they were a year ago. According to data from CarMax, a main driver of rising inflation back in June was the price of used cars, with prices up as much as 50%.

All this has been good news for TRED, a Seattle-based online peer-to-peer used car marketplace. The company, which was launched in 2012, disclosed on Tuesday that it raised $25 million in Series B financing, putting its total funding at $37 million.

This round came from investors including Vivek Raj of Geneses Investments, Ian Anderson at Westlake Financial and Mike Kraus at CMFG Ventures. Earlier investors included Great Oaks Venture Capital, former GM chairman and CEO Rick Wagoner, and billionaire venture capitalist Chris Sacca.

Though it makes up only a small slice of the used car market, TRED nonetheless has a lot going for it, as our data shows. Led by founder and CEO Grant Feek, TRED purports to offer better deals for buyers and sellers than competitors by taking only listing and sales fees starting at around $100. In exchange, the company provides many of the conveniences of dealerships, including advertising the listing, verifying buyer information, handling paperwork and title transfers, and help with buyer financing.

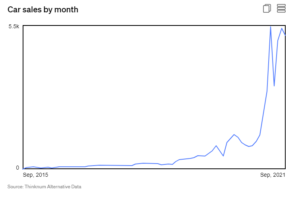

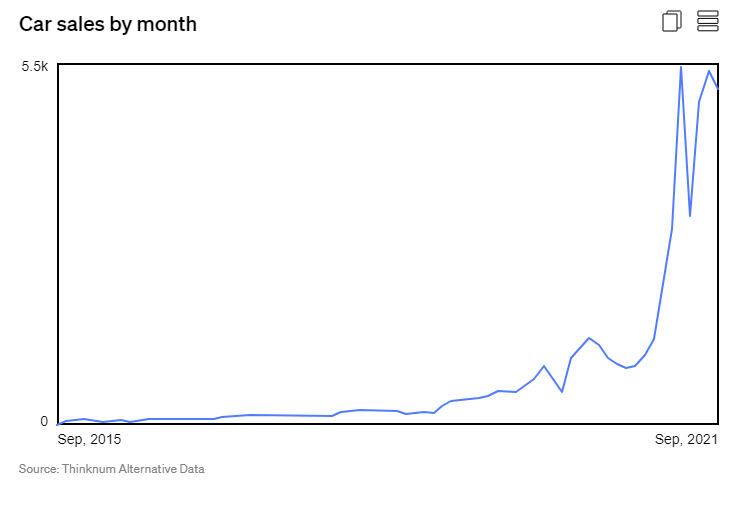

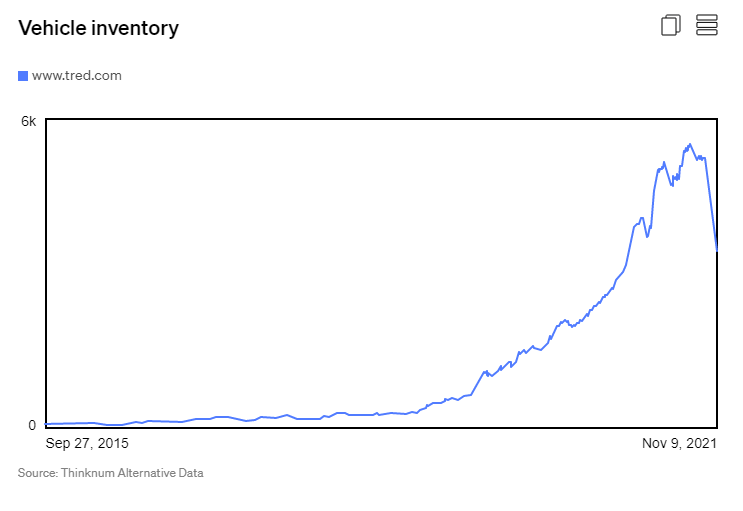

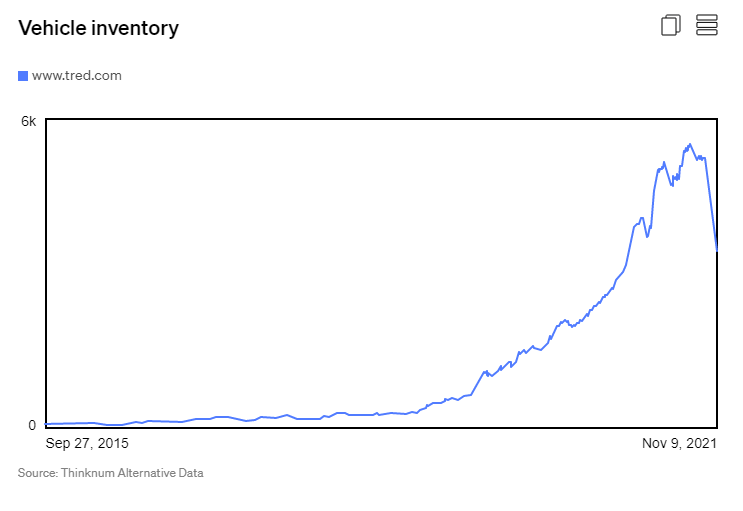

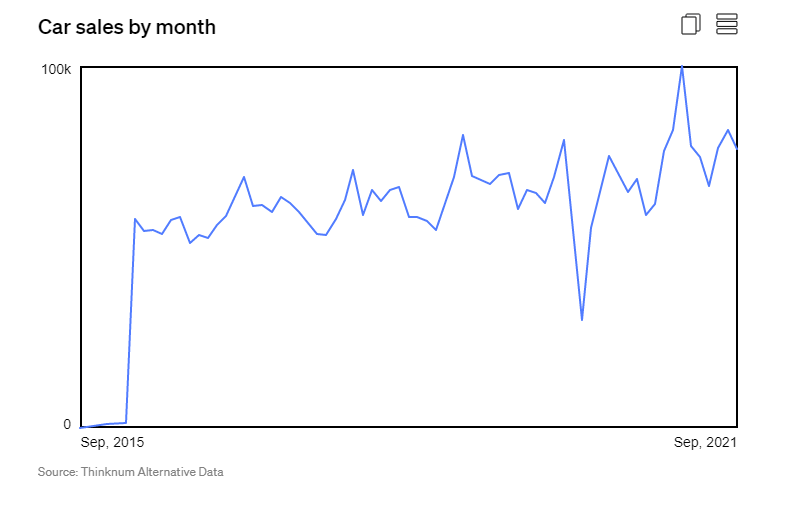

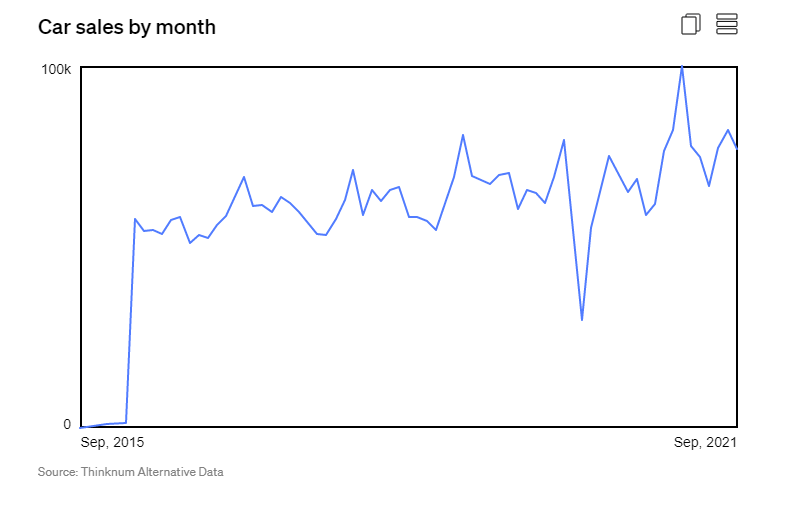

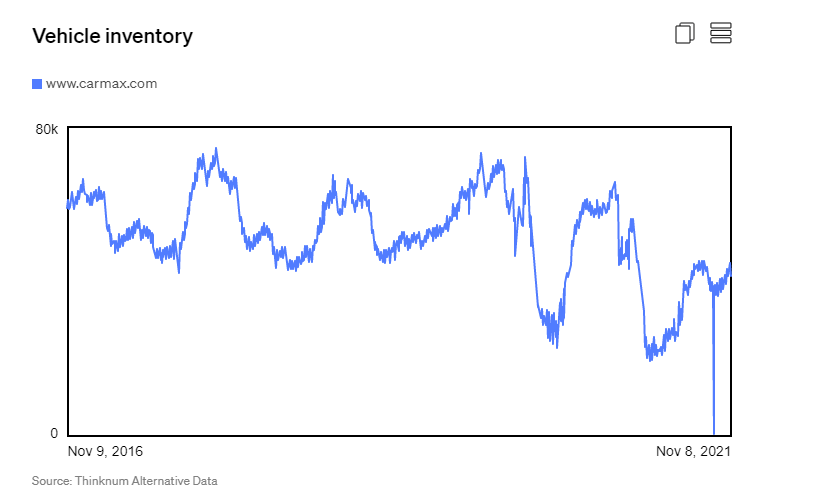

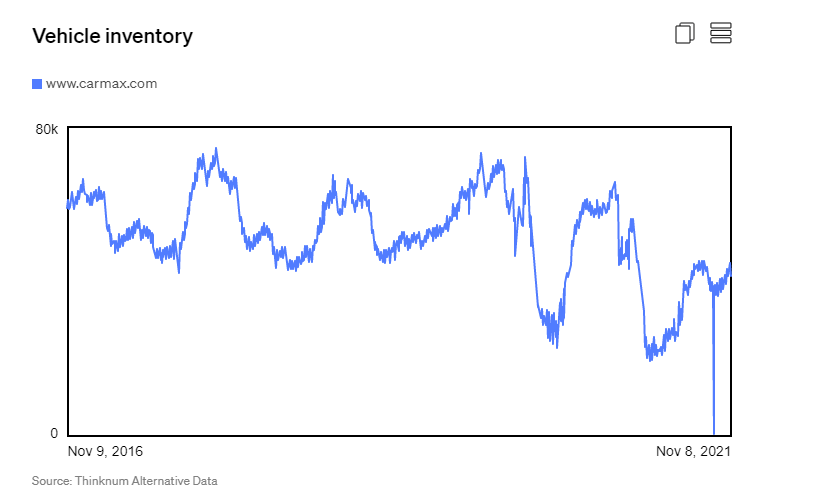

Just within the past few months, sales and inventory have both shown massive increases for TRED. Inventory has however started to tumble as vehicles were selling faster than new listings could appear.

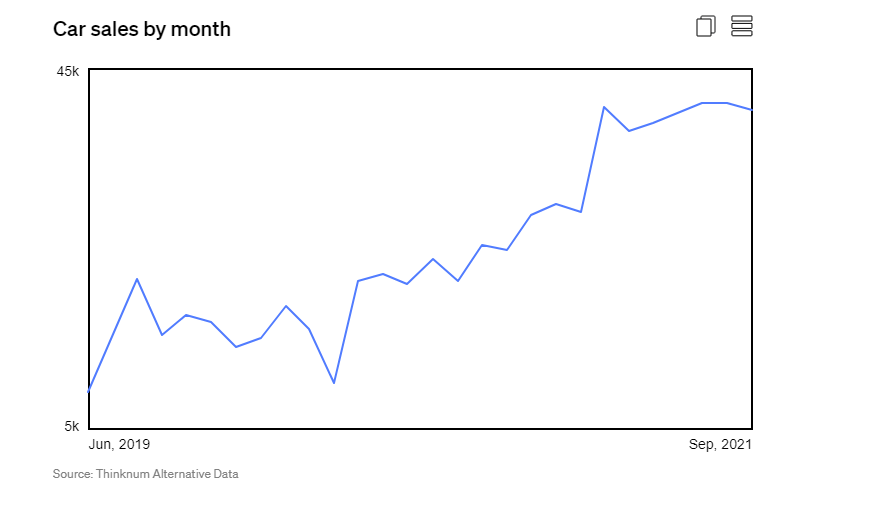

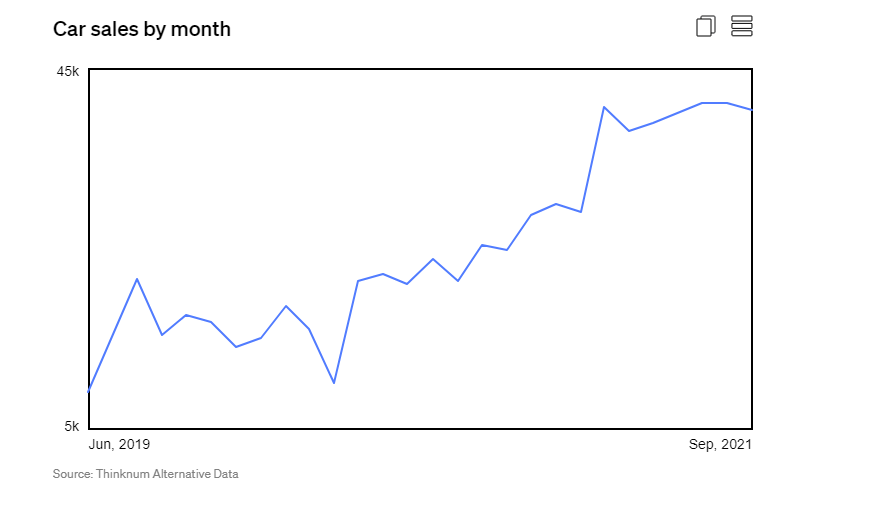

Similar trends are playing out at some of TRED’s largest competitors such as Richmond, Virginia-based CarMax, the largest retailer in the U.S. dedicated to used cars. Sales however have shown a less dramatic surge, while meanwhile inventory has continued to rise and fall. One could surmise that cars are selling faster through newer, trendier Tred.

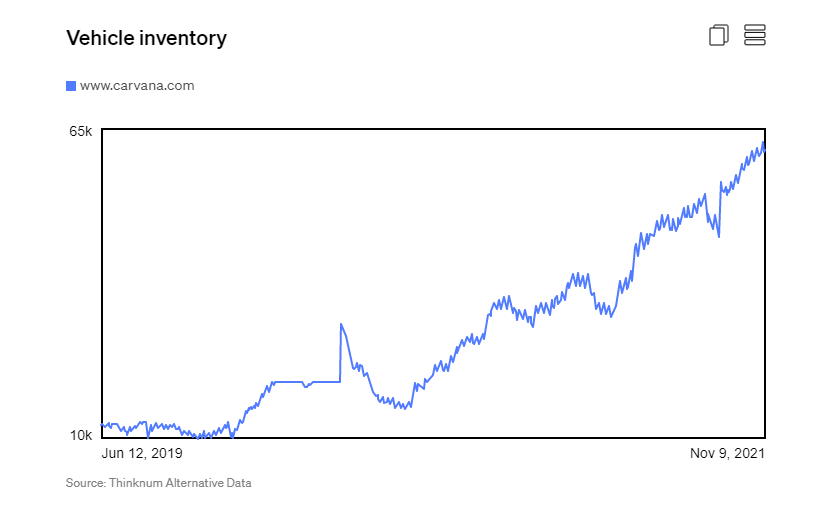

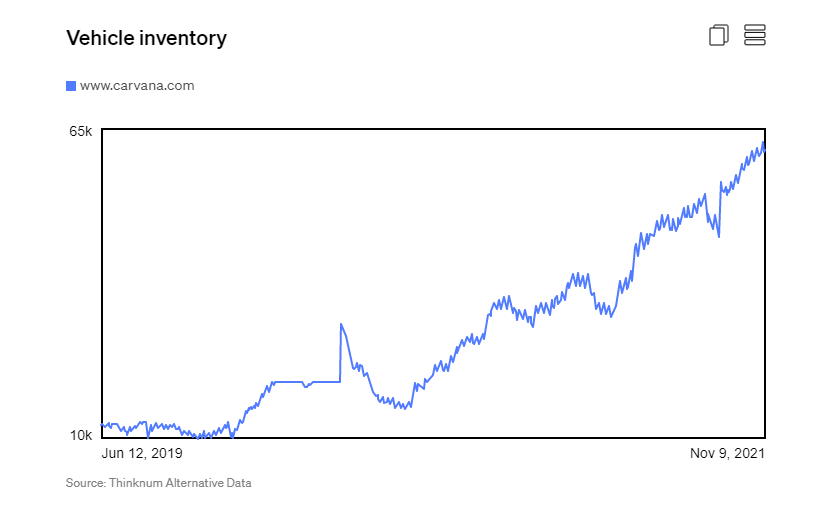

Meanwhile, Tempe-based Carvana, which is similar to CarMax but promises less hassle, has also steadily increased sales through the past year, accelerating since April. Inventory, on the other hand, has sharply increased since the beginning of 2021.

Overall, it appears TRED is looking like it could be overdue for an expansion into further markets, and that is indeed what management is intending to do with the company’s latest capital infusion. Tred currently includes sellers only in Portland, Oregon; the San Francisco Bay area; Seattle-Tacoma, Washington; Southern California; San Antonio, Texas; Austin, Texas; and Dallas, Texas.

Buyers are able to purchase vehicles off of TRED from other markets currently but must have it shipped to their location.

“We see a future where people are transacting cars much more regularly, every year or two, just using their phone instead of using the traditional Craigslist or dealership model every 10 years,” Feek told GeekWire. “So we’re very excited about the future of the space and we’re really excited to go scale our model and hopefully be one of the major platforms that people use for it.”

—

Originally Posted on November 9, 2021 – Used Car Seller TRED Just Raised $25 Million. Here’s Why the Deal Was A No Brainer for Investors

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Business of Business - Thinknum Media and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Business of Business - Thinknum Media and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.