Related Content

- IBKR Traders’ Insight Radio Podcast: “Inflation, Rates & Recession – What’s the Worst that Could Happen?”

- Traders’ Academy: Introduction to Macroeconomics

U.S.-based businesses and consumers alike appear to be increasingly on edge, as fears intensify about prolonged, high levels of inflation, interest rates, and a potential recession.

For goods-related firms, the spending outlook seems somewhat bleak, especially as they face a potential, broad-based consumer shift towards services, as well as higher costs of capital driven by higher rates. These apparent, dire conditions are made even more desperate when coupled with ongoing supply chain disruptions spurred by the Ukraine-Russia conflict, and Covid-lockdowns in China.

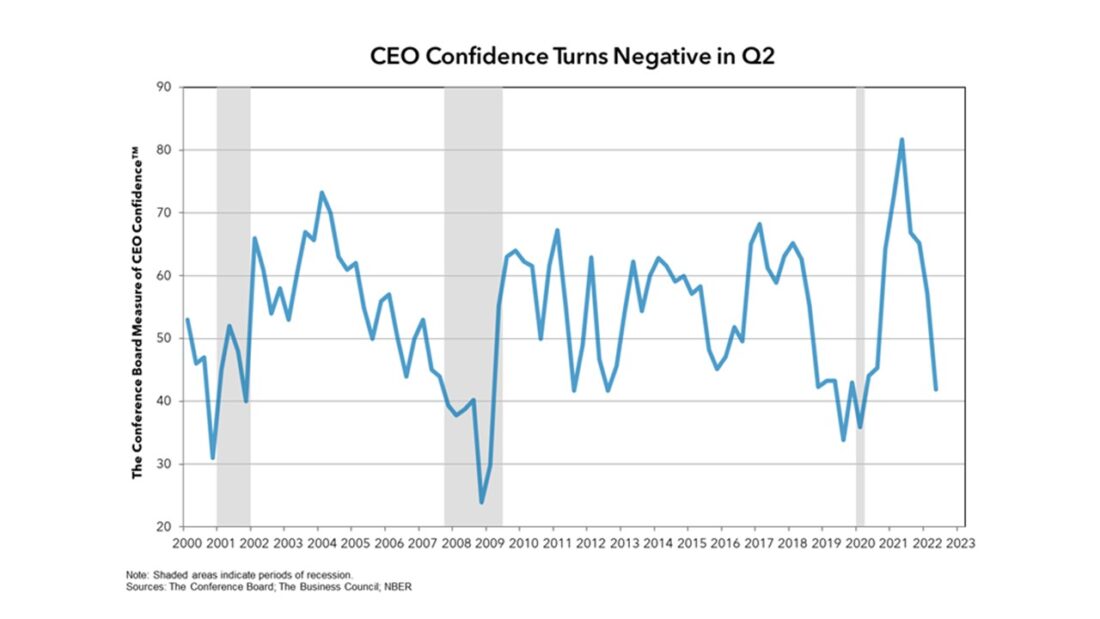

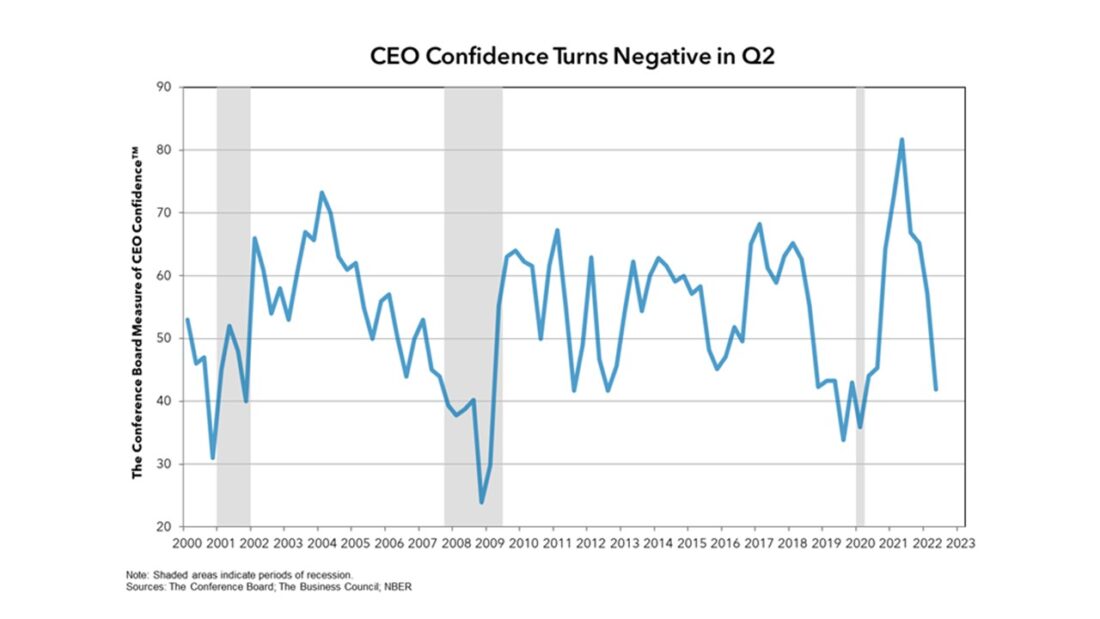

Some figures released Tuesday from the Conference Board’s Measure of CEO Confidence™, in collaboration with The Business Council, drew a clear picture of the intensifying concerns. Consider, for example:

- The measure fell for the fourth consecutive quarter in the second quarter of 2022, plunging 15 points from the prior quarter to 42; this is squarely in negative territory, as a reading below 50 reflects more negative than positive responses – and resides at levels not seen since the onset of the pandemic;

- 54% of CEOs said they are passing along higher input costs to their customers, which may contribute to cooling in consumer spending heading into the summer;

- 63% of CEOs expect to expand their workforce, down from 66% in Q1;

- 38% of CEOs expect to increase their capital budgets in the year ahead, down from 48% in Q1;

- Nearly 60% of CEOs expect inflation will come down over the next few years, but the U.S. will have a very short, “mild recession” which the Fed offsets, while 11% foresee a “challenging recession”;

- 20% said inflation will stay elevated over the next few years, and U.S. growth will slow significantly (stagflation).

Checking Out?

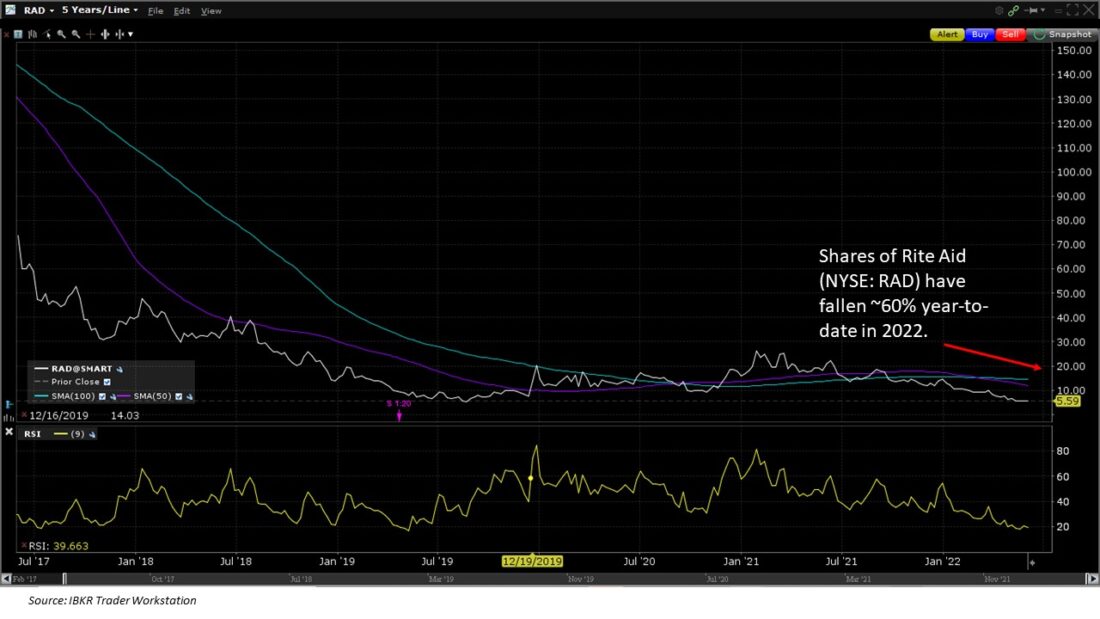

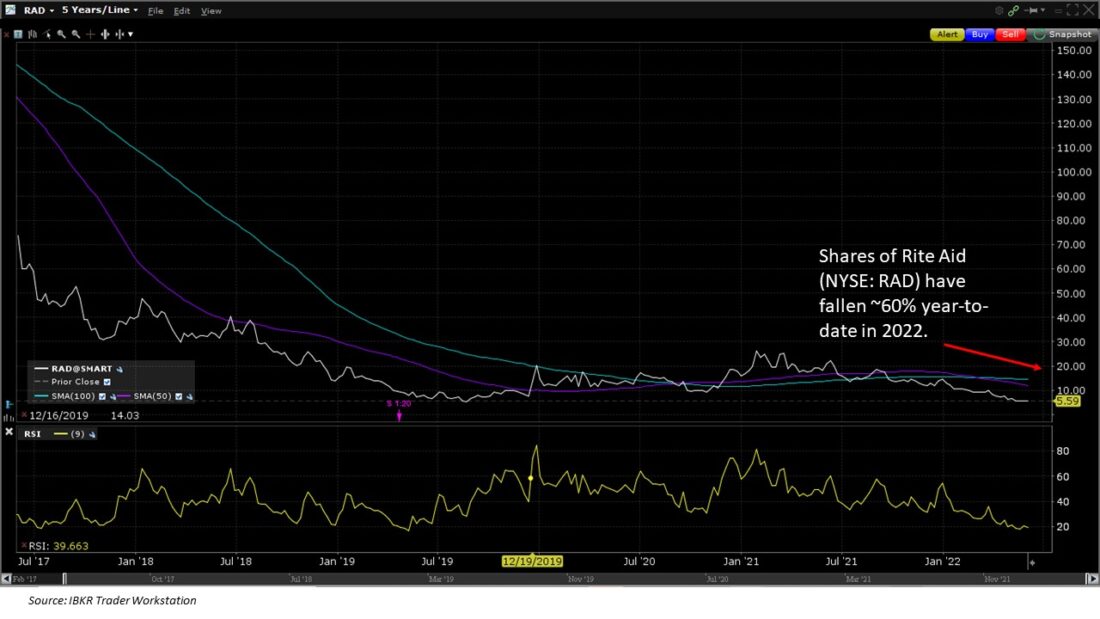

Against this backdrop, for instance, Rite Aid Corporation (NYSE: RAD) CEO Heyward Donigan said on the firm’s latest earnings call that his iconic drugstore chain been under a “strain”, as Covid “brought significant headwinds” to the business, including supply chain pressures that impacted inventory and sales, store traffic shifts due to continued “work from home”, as well as a tightening labor market.

For Rite Aid’s fiscal fourth quarter of 2022, the company posted a net loss from continuing operations of a little more than US$389 million, or a US$7.18 loss per share. The loss comes despite a US$525 million uptick in full year revenues to $24.6 billion, underscored by a 12% rise in pharmacy sales, as well as a year-over-year improvement in its leverage ratio to 5.4x from 6.7x.

Rite Aid also suffered a full year net loss per share of US$9.96, an increase of US$1.87, driven by non-cash impairment charges.

Year-to-date, the price of Rite Aid’s shares has plunged more than 60%.

To help regain its footing, the Camp Hill, Pennsylvania-headquartered company is embarking on a “cost rationalization” program that aims to achieve US$170 million in savings, in part by closing roughly 6% (145) of its stores. Meanwhile, widespread reports of rampant shoplifting in Rite Aid stores, such as in New York City, seem to have contributed to the firm’s distress.

Credit Under Pressure

To date, however, retail companies appear to generally be in a better position to stave-off bankruptcies compared to 2020, when a flood of firms filed for protection, including notable names such as J. Crew, Neiman Marcus, J.C. Penney, Guitar Center, Brooks Brothers, and many others.

Fitch Ratings recently noted that the institutional leveraged loan default environment is expected to remain benign through 2023 despite concerns about inflation, supply chain challenges, continued pandemic uncertainties, and rising interest rates. In fact, the default rate hit a decade low of 0.6% at the end of 2021 – a total of 21 defaults compared to 96 in 2020, according to Fitch.

The ratings firm further said its 1.5% default outlook for 2022 remains unchanged, with expectations for a 1.25%-1.75% range for 2023. Fitch noted, however, that the 2022 default rate could end up below 1% depending on the fate of a few large, distressed issuers – notably Envision Healthcare, Cineworld Cinemas, and Travelport.

“The leisure and entertainment default rate could reach 14% in 2022 contingent on Cineworld and Travelport, the second and third largest issuers on the Top Market Concern Loans list,” Fitch added.

Still, perceptions about several high-yield companies’ creditworthiness have dimmed recently, with many five-year credit default swap (CDS) spreads having gapped wider over the past three months, according to Bloomberg data, including:

| Firm | Ticker | CDS Spread (bps) | 3-Month Spread (bps) |

| The Gap | NYSE: GPS | 664.65 | +333 |

| Mattel | NASDAQ: MAT | 310.70 | +176 |

| Bath and Body Works | NYSE: BBWI | 410.50 | +166 |

Indeed, corporate concerns about inflation, rates, and recession are also shared by consumers, which will likely pose further headwinds to the retail industry’s sales and profits.

Flailing Confidence

Consumers may become more reluctant to open their wallets to big ticket items, for example, amid soaring prices, rising interest rates, as well as a general increase in household debt.

Consumer confidence has long been flailing below pre-pandemic levels, unable to rise above the 132.6 level set in February 2020. The May 2022 figure posted Tuesday by The Conference Board seems to continue the languishing pattern that has been in place over the past 27 months.

The Conference Board’s Consumer Confidence Index® fell slightly in May to 106.4, down from an upwardly revised 108.6 in the prior month. The Present Situation Index declined to 149.6 from 152.9 in April, along with the Expectations Index, which ticked down to 77.5 from 79.0.

While consumers “do not foresee the economy picking up steam in the months ahead,” they do anticipate that labor market conditions are likely to remain “relatively strong, which should continue to support confidence in the short run,” noted Lynn Franco, senior director of economic indicators at The Conference Board.

However, Franco observed that the latest consumer confidence data revealed that “purchasing intentions for cars, homes, major appliances, and more all cooled—likely a reflection of rising interest rates and consumers pivoting from big-ticket items to spending on services.” Moreover, vacation plans “have also softened due to rising prices,” as inflation “remains top of mind for consumers,” she said.

“Looking ahead, expect surging prices and additional interest rate hikes to pose continued downside risks to consumer spending this year,” Franco added.

Yet, consumers also seem be contending with a long list of other risks that appear to be looming on the horizon – namely rising debt burdens, and an increasingly downbeat outlook on job wages to keep pace with inflation.

According to the Federal Reserve Bank of New York’s Center for Microeconomic Data, total household debt rose US$266 billion in the first quarter of 2022 to a staggering US$15.84 trillion, with balances that now stretch $1.7 trillion higher than at the end of 2019, before the COVID-19 pandemic.

The Center’s Quarterly Report on Household Debt and Credit highlighted that mortgage balances increased by US$250 billion during the first quarter of 2022 to a total of US$11.18 trillion at the end of March, while auto loans rose by US$11 billion, and student loans increased by US$14 billion to a whopping total of US$1.59 trillion.

Although households reportedly amassed around US$2.5 trillion in excess savings between March 2020 and January 2022, mainly as a result of federal stimulus measures, as well as an uptick in wages, and asset price appreciation, some market participants suspect much of their financial cushion may have already become depleted – notably, since many Covid-inspired federal benefits, such as the supplement to unemployment benefits, reached their expiry in September.

Meanwhile, average hourly earnings (AHE) clocked-in at 5.5% year-over-year in April 2022, down from the 5.6% set in March, and a far cry from inflation levels at 8.3% over the same period.

Investors will likely be watching the U.S. jobs report closely Friday for any signs of improvement in the labor market. Economists in a Bloomberg survey expect 325,000 nonfarm payrolls were added in May, along with a 0.1% decline in the unemployment rate to 3.5%, and AHE to have fallen to 5.2%.

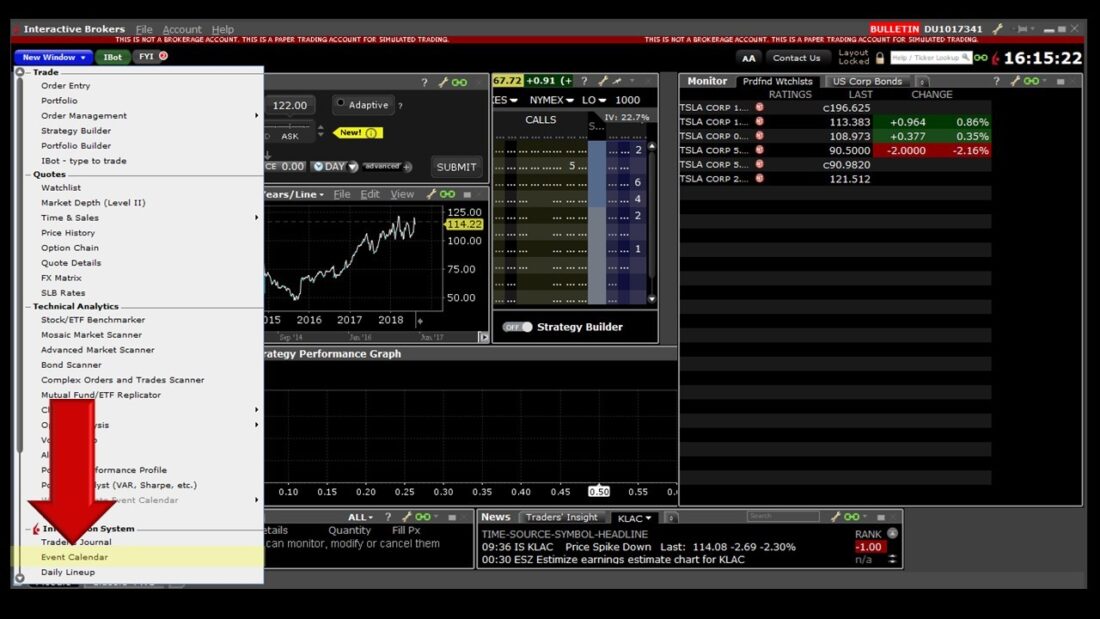

In the meantime, select the Event Calendar option in the IBKR Trader Workstation for a full list of U.S. and global corporate events and earnings, dividend schedules, economic data, IPOs and more.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.