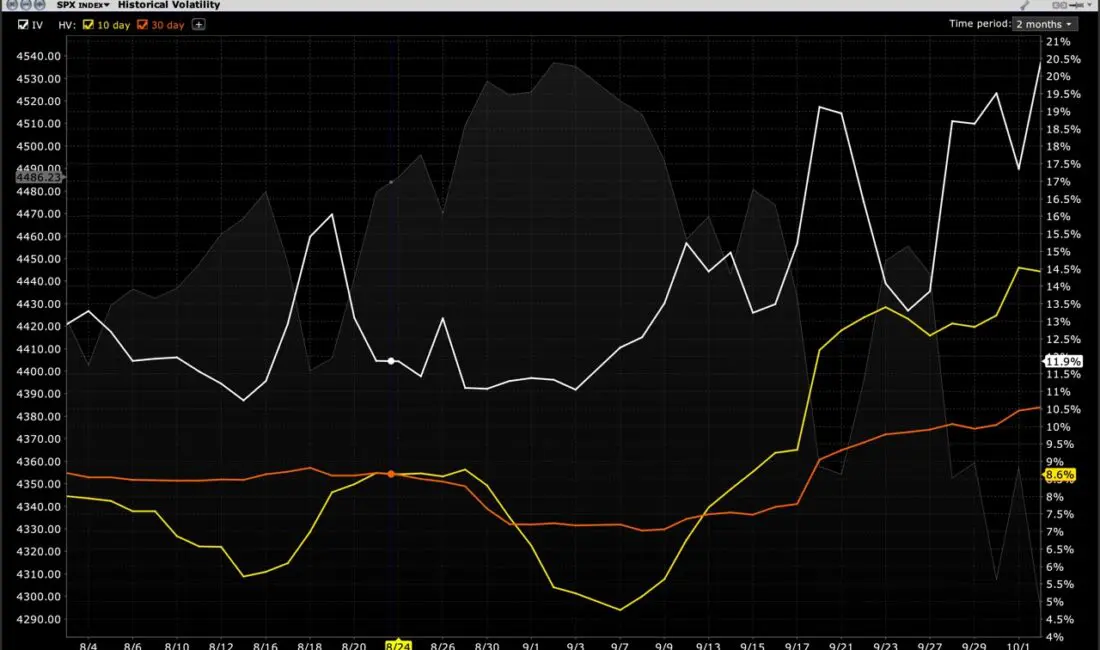

Sometimes a picture tells 1,000 words. I’ll let the following graph do much of the talking:

S&P 500 Index (SPX) Implied Volatility (white), 10 day (yellow) and 30 day (orange) Historical Volatilities

Source: Interactive Brokers

Volatility has been rising. No s— Sherlock.[1] When we see major indices bounce up 1% one day and down the next, of course markets are more volatile than they’ve been for most of the past year. Over the past 10 days, we’ve had 5 close-to-close moves of more than 1%, with a 6th coming in at 0.95%. There has been no shortage of reporting about the recent 5% correction from the all-time highs reached just over a month ago. Never mind the fact that corrections used to be 10% moves, the fact that we hadn’t had even a 5% drawdown in months meant that volatility had been suppressed. These moves have pushed up historical volatility, and implied volatility has bounced even faster. (It is important to keep the various terms about volatility in perspective. Historical volatility looks backward, measuring the daily moves in a given stock or index over a prescribed period of time. Implied volatility looks forward. It is the level of volatility that traders expect over the remaining life of the option. A fuller description is available here: https://ibkrcampus.com/traders-insight/securities/options/making-sense-of-the-three-types-of-volatility/)

I believe that the rising volatility is the result of traders and investors coming to grips with the potential changes to the extraordinary monetary and fiscal stimuli that have helped propel asset prices higher. As we have discussed at length (here, here, and here, among others), we have noted that the Federal Reserve has been fairly explicit about reducing its bond purchases in the coming weeks, which reduces monetary accommodation, while Congress is unable to agree on spending measures and the debt ceiling, all of which are fiscal headwinds. Over the past year and a half, we had an extraordinary consensus that the Fed and Congress were market-friendly tailwinds. Consensus dampens volatility and uncertainty amplifies it.

There are other factors currently pushing implied volatility higher. On Friday we have the monthly payrolls release from the Department of Labor. Fed Chairman Powell has stated that although we have recovered sufficiently for the Fed to reduce and eventually end its monthly bond purchases, he is reluctant to consider raising interest rates until or unless the labor situation improves further. We will learn on Friday how we are progressing towards that goal. We could find ourselves in a bind. A number that is weak would obviously be a problem for the economy, but traders might like that result if it is weak enough for them to believe it will delay Fed tightening. On the flip side, a too-strong report could spook traders into worrying that the Fed could push interest rates forward. It is important to remember that the economy is not the stock market and vice versa. Sometimes what is good for one is not a positive for the other. It is no surprise that traders would push implied volatility higher ahead of an economic release that could have an outsize effect on monetary policy.

One other factor to keep in mind is the upcoming earnings season. JP Morgan has become the unofficial bellwether for the start of earnings season, and they report next Wednesday, October 13th. As usual, banks lead the way, and a parade of major companies follow. We have seen several retailers sell off after reporting earnings over the past few weeks, with supply shocks being blamed for either shortfalls or uncertain guidance. As a result, many investors are approaching the upcoming reports with a greater degree of trepidation than they were just a few weeks ago. Again, uncertainty usually results in higher volatility.

There may be another earnings-related factor increasing volatility as well. Companies refrain from buybacks in the weeks before they release earnings. The many companies that are scheduled to report in the coming month are refraining from buybacks. That removes a set of large, dedicated buyers from the marketplace, which could be exacerbating some of the recent declines.

When volatility increases as the result of uncertainty, the market is telling us that the risk/reward calculus may be changing. If risks are potentially rising, it is all the more important for investors to consider whether their risk tolerance is sufficient for the risks they are assuming. Bottom line, if the recent moves have made you uncomfortable, then you are likely taking on too much risk. Consider measures to reduce your exposures. If you are comfortable even amidst the heightened volatility, than you may be positioned to try to take advantage of opportunities that might present themselves.

—

[1] “s—” is short for “surprise”. Get your mind out of the gutter.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.