The week in review

- Unemployment rate decreased to 4.8%

- Durable orders: +1.8% (m/m)

- Hourly earnings: +0.60% (m/m)

The week ahead

- NFIB survey

- JOLTS

- Retail sales

- Consumer sentiment

Thought of the week

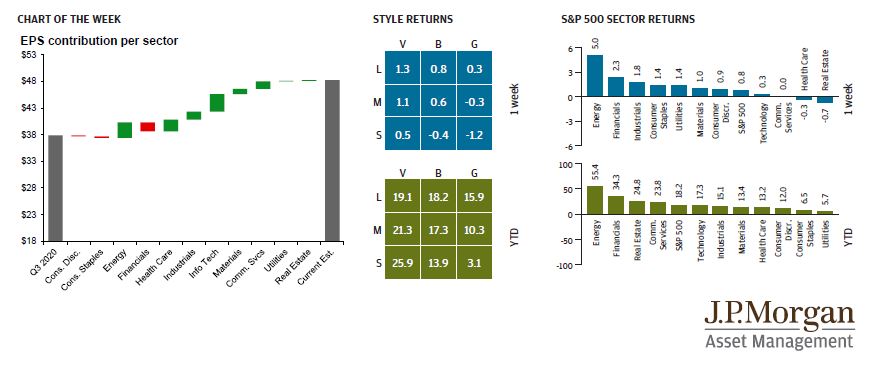

With 4.6% of market cap reporting, our current estimate for Q3 2021 S&P 500 operating earnings per share (EPS) is $48.25 ($40.42 ex-financials). This represents EPS growth of 27.3% from a year prior, and 21.2% since 3Q19. However, on a sequential basis, estimates point to an earnings contraction of 7.3% q/q. The projected slowdown in quarterly growth can be attributed to macro headwinds such as the spread of the delta variant, supply chain disruptions, slower economic growth and rising wages. That said, the average price of oil increased 73.4% during the quarter and the U.S. dollar declined by 1.4%, both of which should help support earnings.

At the sector level, energy, materials and industrials are projected to lead the way, while financial profits look to have declined. Health care is expected to see earnings rise 37.2% y/y, and technology and communication services should also post solid gains. Although current estimates are showing an earnings decline relative to the second quarter, on average analysts tend to underestimate earnings by 5.3% at the start of the quarter. As such, earnings may surprise to the upside, supporting equity markets against a backdrop of higher volatility.

Click here to access the material on J.P. Morgan’s website.

—

Past performance does not guarantee future results.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be appropriate for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the

program explores the implications of current economic data and changing market conditions.

The J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature

or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment.

Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://www.jpmorgan.com/privacy.

This communication is issued in the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2021 JPMorgan Chase & Co. All rights reserved.

©JPMorgan Chase & Co., October 2021.

Unless otherwise stated, all data is as of October 11, 2021 or as of most recently available.

Disclosure: J.P. Morgan Asset Management

Past performance does not guarantee future results.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The price of equity securities may rise or fall because of changes in the broad market or changes in a company’s financial condition, sometimes rapidly or unpredictably. International investing involves a greater degree of risk and increased volatility. There is no guarantee that companies that can issue dividends will declare, continue to pay, or increase dividends. Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage.

JPMorgan Distribution Services, Inc., member of FINRA.

J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc. and JPMorgan Asset Management (Canada) Inc.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from J.P. Morgan Asset Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or J.P. Morgan Asset Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.