Tomorrow afternoon we will be learning the results from one of the most consequential FOMC meetings in recent memory. The S&P 500 Index (SPX) has fallen about 10% in a week. Under any normal circumstances that would be considered a correction, but more headlines were focused upon the return of a bear market because yesterday’s close took the index down over 20% from its January high. Either way, it’s been an ugly few days for most investors in a wide range of asset classes.

The last time the market fell this far this fast was March 2020. At that time, the Federal Reserve came riding to the rescue with a series of accommodative measures. Clearly those are not on the table for tomorrow. Instead, the question is whether the Fed Funds target rate will be raised by 50 or 75 basis points. A 50 bp hike was widely factored in until last Friday’s scary CPI and consumer sentiment numbers. Since then, investors are expecting that the Fed would get more aggressive about fighting inflation, with Fed Funds futures pricing in 75bp hikes for the next two meetings with almost 100% certainty.

At this point it is hard to know what investors want. Remember, we have spent most of the past two years – heck, most of the past 13 years – hoping for and enjoying accommodative policies from the Fed and other central bankers. We are now having to deal with a changing economic backdrop. Investors usually don’t like surprises and having gone through the process of painfully pricing in higher rates, it is likely that a 75bp hike accompanied by inflation fighting rhetoric is expected by most. Chairman Powell is in a difficult spot, and it will be crucial to hear his methodology for avoiding the stagflation that many investors are fearing.

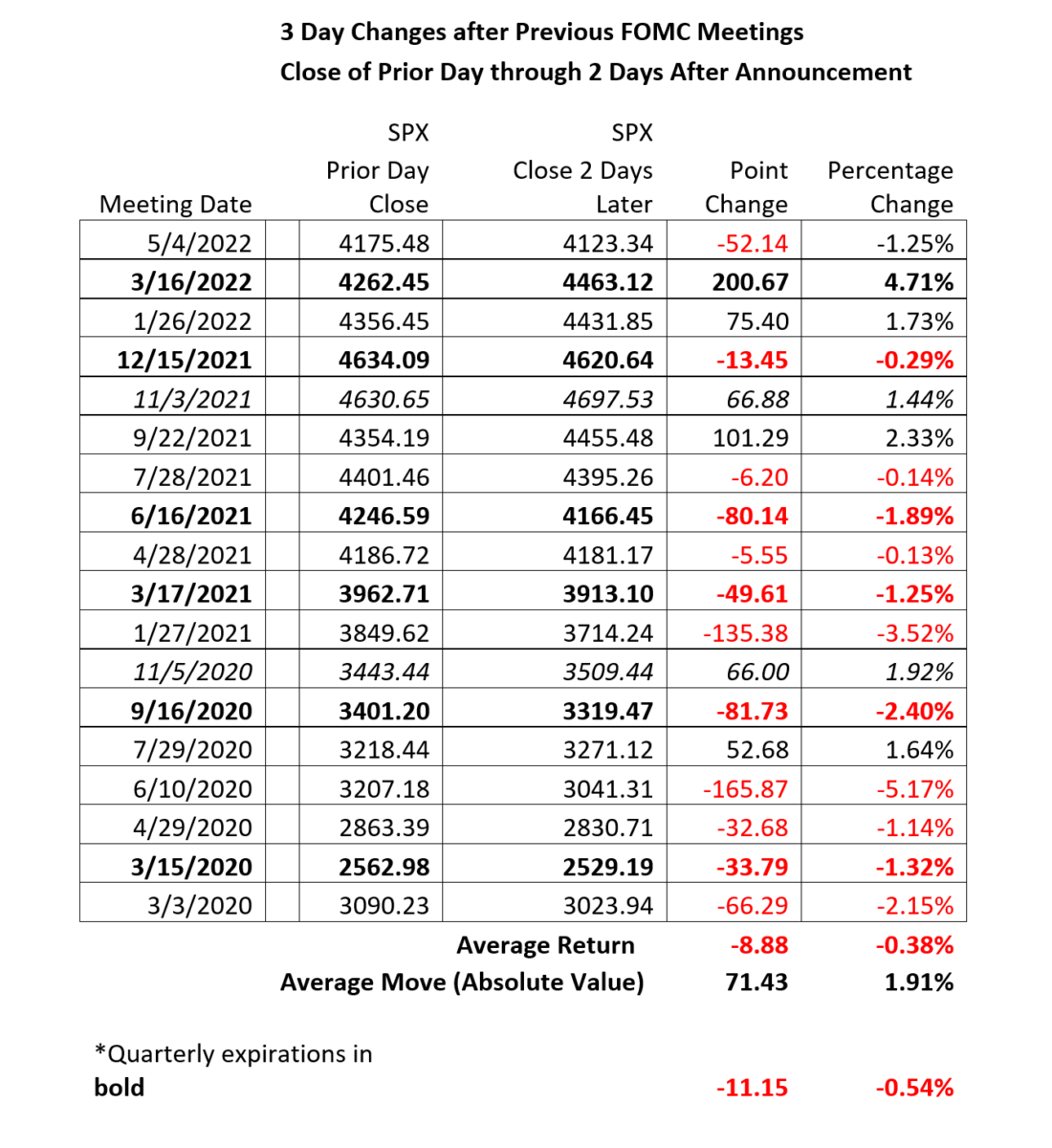

That said, after such a wave a of selling it is entirely possible that investors could respond positively. The response may be reflexive and could fade quickly, which is what we saw after the last meeting. We rallied sharply yet gave back all Wednesday’s gains and then some on Thursday and Friday of that week. The table below shows those results along with SPX’s moves in each of the three-day periods that began on the day of the meeting and ending two days later (usually Wednesday to Friday):

This week has the added excitement of a quarterly expiration on Friday. Until the March 2022 expiration, which followed the meeting prior to the last, those periods were almost uniformly negative – even amidst a raging bull market for most of that time. One could argue that that the March 2022 rally had the same countertrend move that we saw over the past two years, and it came during another oversold period of trading. This seems like an opportune time to check whether options traders have a particular view about post-FOMC trading.

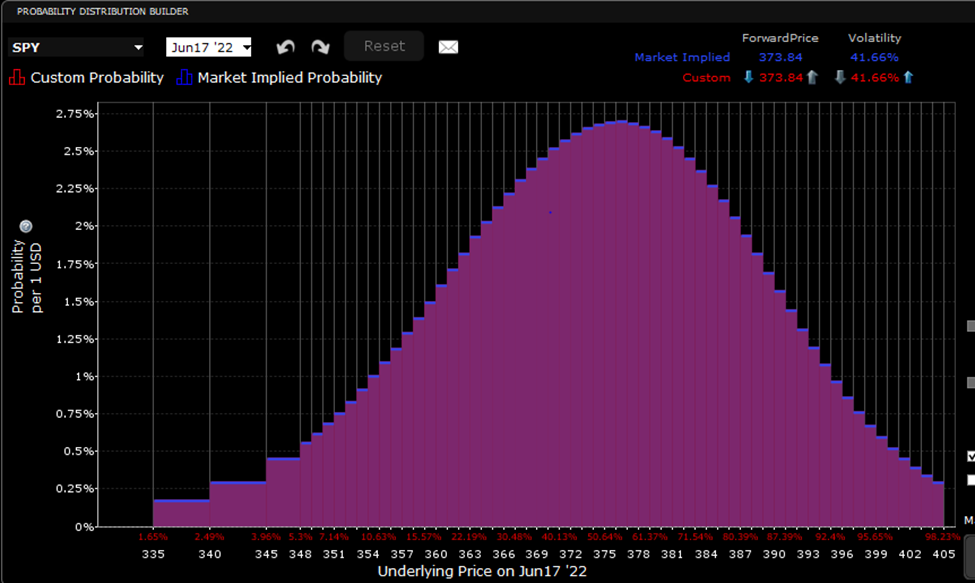

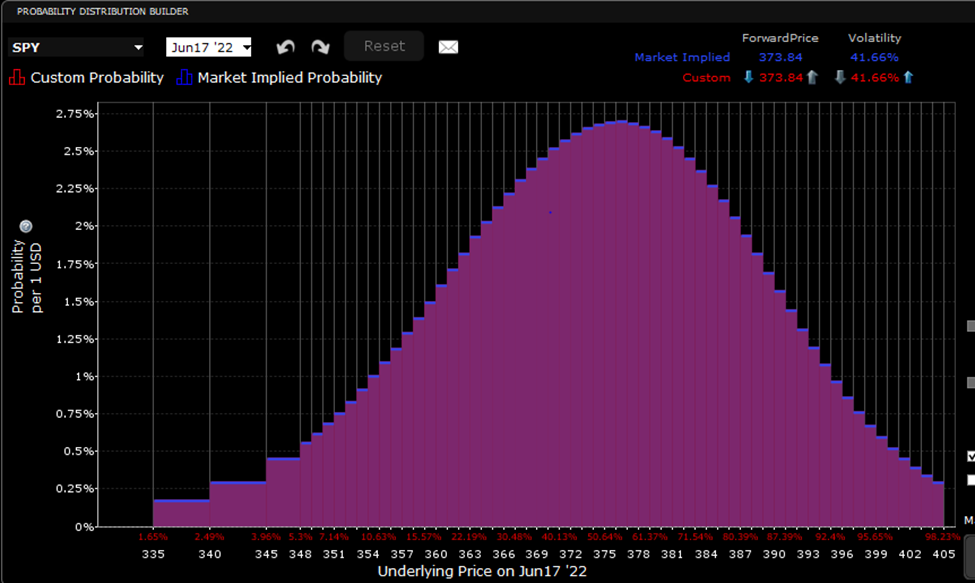

We will start with the IBKR Probability Lab. It shows an almost complete lack of bias ahead of the meeting. The peak probability assumption is right around current levels and the distribution is quite symmetrical:

IBKR Probability Lab for SPY Options Expiring June 17th

Source: Interactive Brokers

We also have not seen skew or implied volatility change markedly today. That does not seem surprising, considering the breadth of yesterday’s selloff. At money options are pricing in about a 2.5% average daily move between now and Friday. That is a fairly high expectation, but it seems to imply that we will be getting some clarity that can dampen the recent wild moves.

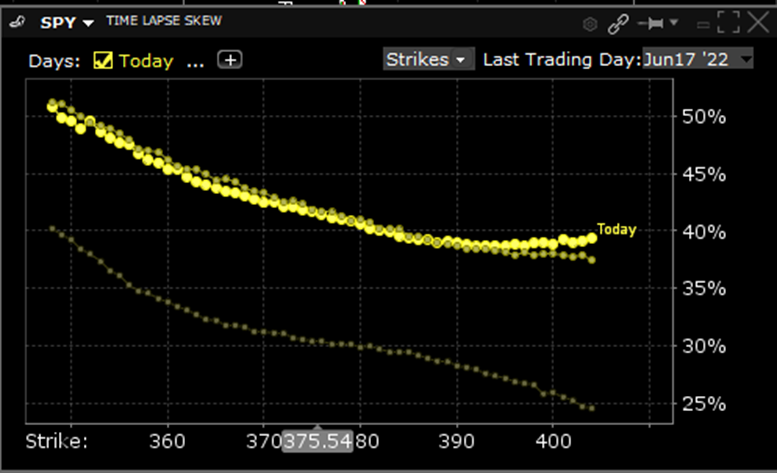

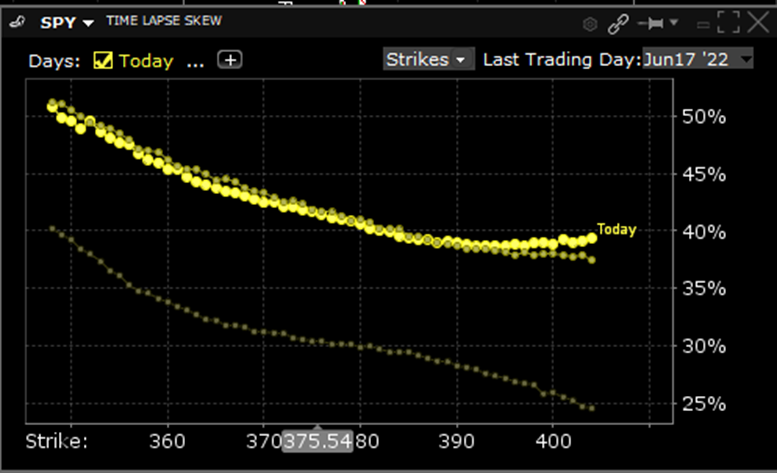

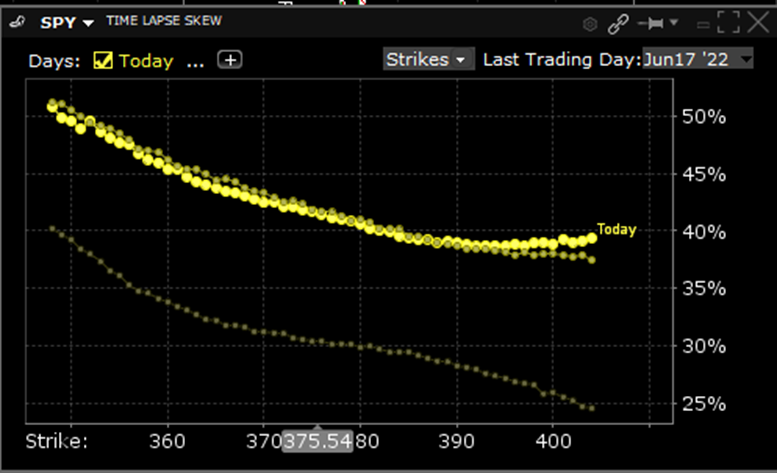

Time Lapse Skew for SPY Options Expiring June 17th, From June 14th, 13th, 10th

Source: Interactive Brokers

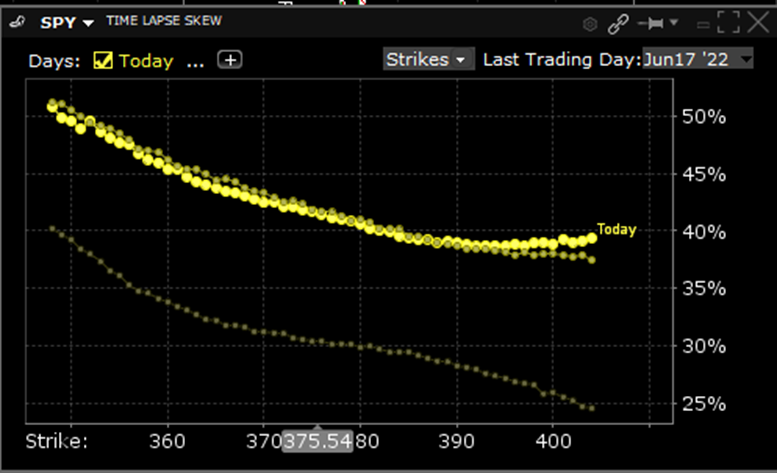

Finally, we do see a much steeper skew for options expiring this week than we do for options expiring in each of the sequential months. Frankly, the flattish skew displayed by July and August options is more surprising than the steep skew for this week’s. Even after the recent drops, options traders are not especially risk averse this summer.

Time Lapse Skew for SPY Options Expiring June 17th, July 15th, August 19th

Source: Interactive Brokers

In short, the options market seems about as confused as everyone else about what might happen after tomorrow’s FOMC meeting. In my mind, the most likely outcome is for a knee-jerk rally after yesterday’s massive sell-off, followed by a period of digestion as investors come to terms with the amounts that rates will need to rise and the Fed’s balance sheet will need to shrink. In other words, we could easily end up right back where we are – which is what the options market seems to be implying.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ