We interrupt your regularly scheduled earnings week programming to bring you this special report. OK, it’s not all that special because it happens every six weeks, but it’s Fed Day, and that overrides all the usual market concerns.

Market consensus seems to be centered around the concept of a “dovish hike,” which sounds contradictory. The hike is all but priced in, with Fed Funds futures are currently pricing in a 99.6% expectation for a 25-basis point hike this afternoon, but the “dovish” part is somewhat of an open question. Futures are currently pricing in only an 18% chance for a hike in September, but 46% for November. Thus, we need to focus on the nuances and subtleties of the FOMC’s statement and of course Chair Powell’s press conference to see if the Federal Reserve is indeed moving towards a more dovish stance.

While it is indeed evident that inflation has improved considerably from its vertigo-inducing levels, a wide range of inflation measures are still reading well above the Fed’s stated 2% target. The disinflation that we’ve been experiencing is both welcome and a necessary precondition for stable prices, but not a sign that the Fed has achieved its goals.

Let’s recap recent inflation reports. Several economists I know prefer to use 3-month moving averages because they smooth out potential monthly gyrations while also eliminating stale 11-month old data from the comparisons. The Fed’s stated preferred measure is the PCE Core Deflator. The last three readings have been 0.31%, 0.38% and 0.32%. That annualizes to just over 4%. Last I checked, 4 is greater than 2. Core CPI, which showed a lower-than-expected monthly rise of only 0.16% in June, looks different when annualized along with the prior 0.44% and 0.41%. That also annualizes to 4%.

It thus seems unreasonable to expect the FOMC to declare victory today. They can certainly recognize the improving inflation picture that we all see, but it also seems unlikely that they would do anything to offer any room for markets to reignite inflationary expectations. The best way for them to achieve that would be to reassert their vigilance against inflation by continuing to offer rhetoric that skews toward higher rates and tight monetary policies. Stock traders would relish softening rhetoric, but it is not clear that the FOMC statement will offer anything beyond an acknowledgement that inflationary pressures are abating.

But that could change once the Chair starts his press conference. We’ve seen Powell soften his message when questioned by reporters – either by leaving himself some wiggle room or by choosing to avoid outright confrontation – and we’ve also seen traders seize upon even the slightest nuance that can be interpreted in a bullish light. Think about Powell’s use of the term “neutral” that led to a huge rally in February.

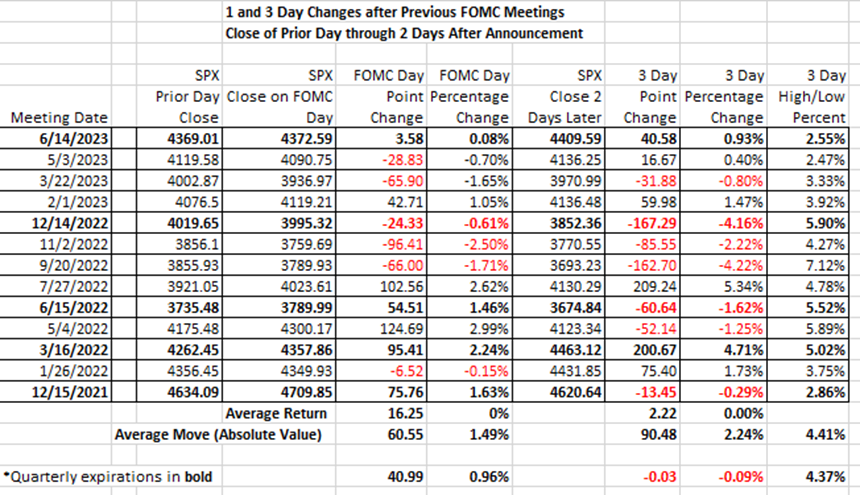

Volatility expectations remain relatively muted ahead of today’s meeting. Some of this is recency bias. As shown in the table below, we didn’t move much after the last two meetings, so traders don’t expect much at this one.

Source: Interactive Brokers

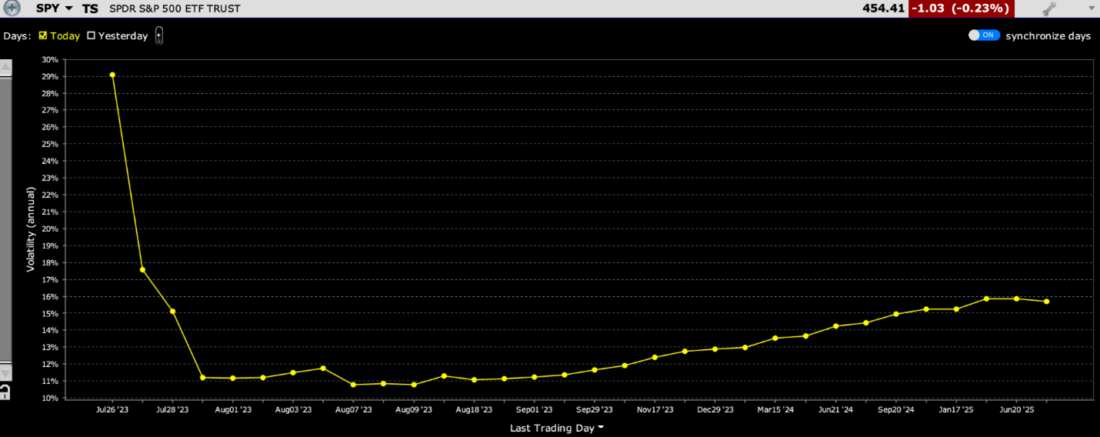

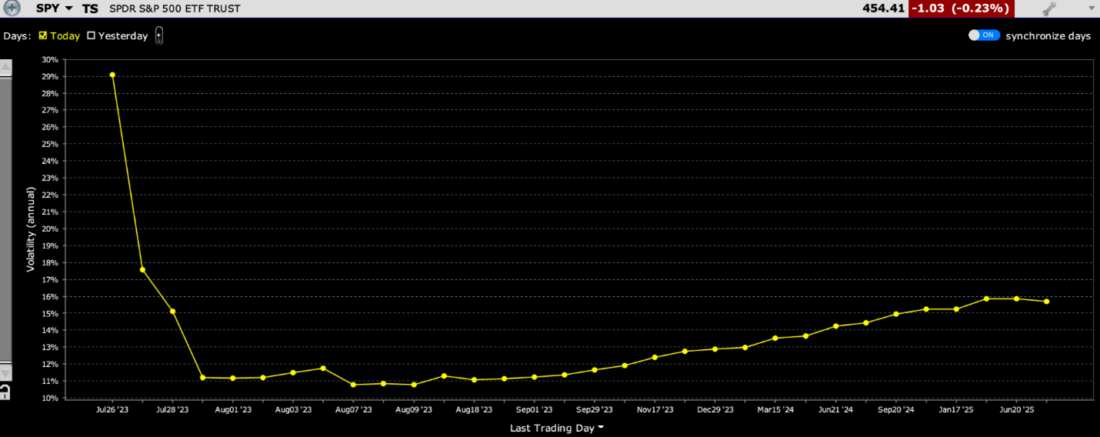

The table shows the results for the period since the FOMC began its rate hiking cycle. If volatility has been decreasing both in the market overall and around Fed Days, then it is not unreasonable for traders to price in only modest assumptions for current and future movements. Using the term structure of volatility for SPY options, we see a spike for today through Friday, but it is important to keep in mind that that the options market is still pricing in a less than 2% move for today and less than 1% daily moves through Friday:

Term Structure of Volatility for SPY Options

Source: Interactive Brokers

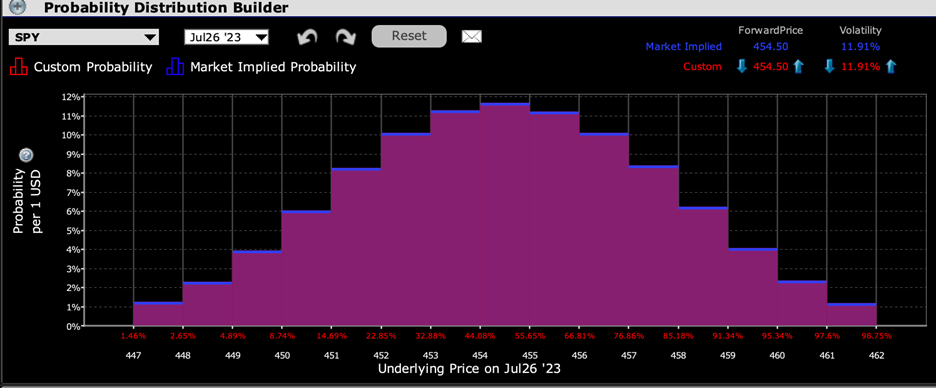

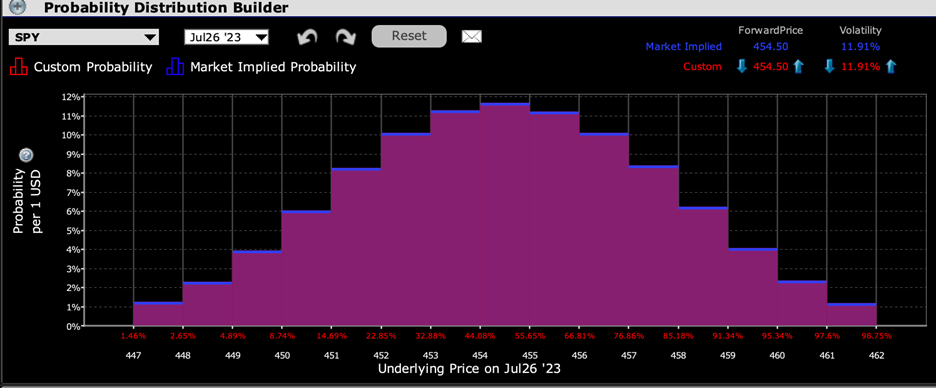

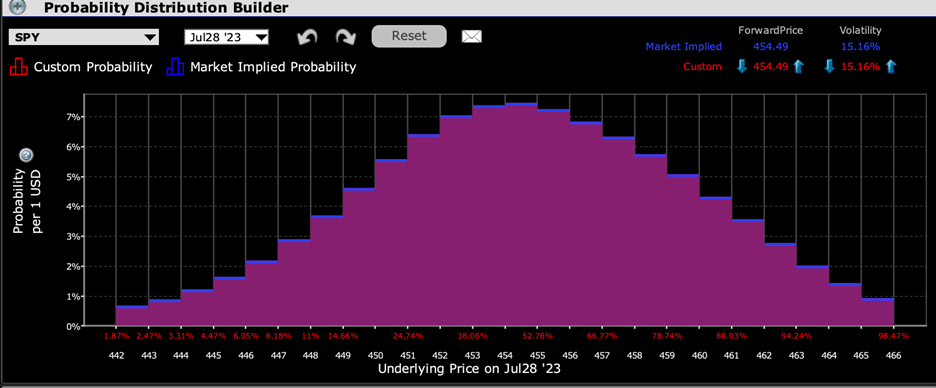

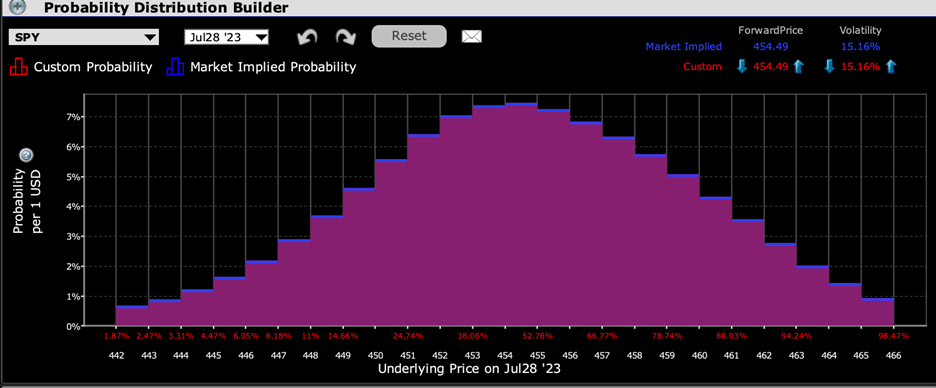

Unsurprisingly, the IBKR Probability Lab shows relatively symmetrical assumptions for outcomes for options expiring today and Friday, with peak probabilities in at-money options:

IBKR Probability Lab for SPY Options Expiring June 26th, 2023

IBKR Probability Lab for SPY Options Expiring June 28th, 2023

Source: Interactive Brokers

Bottom line, traders and investors seem comparatively complacent about today’s FOMC meeting. That has worked for them in recent weeks. Let’s see if it continues. Conversely, the complacency meets that the potential for surprise is heightened.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.