TLDR:

Today we look at individual building blocks to create your own portfolio.

Yesterday we discussed 6 “paragon” portfolios, including extremes across the risk spectrum like being 100% in cash or 100% in stocks.

Today, we list 7 building blocks for your portfolio, with strong tailwinds at their back in this market phase. This is in preparation for part 3 tomorrow, where we’ll assemble them into a model portfolio for Q4’23 and onwards.

Cash offers mouth-watering interest. With a remarkable 5.4% yield, cash is all of a sudden fashionable. We keep cash in our allocations as dry powder, to buy something later at lower valuations.

This is the right moment for Treasuries. Mid-cycle is a good moment to load on Treasuries, especially when the Central Bank stops hiking.

Play the AI revolution with the ‘Magnificent Seven’ stocks. 7 stocks have led the market higher in the last 12 months: Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla. One might be wary of buying stocks at the nadir, but momentum can last deep into the mid-cycle – especially at the onset of new technology.

The market is full of Value stocks. Do you reckon the market is expensive? Think again! Rock-bottom bargains abound, from ALB to EMN to VZ the market is full of forlorn stocks with value levels last seen in 2008. Go to TOGGLE’s Explore and select the “Cheap” filter.

Oil is rich in carry and momentum. How would you like 8% carry and strong tailwinds as trade recovers at the end of the inflationary bout?

Crypto is the bull market nobody talks about. Once upon a time, there was a bull market in crypto and people were enthused by NFTs. Then AI came, and we moved on. But Crypto has not disappeared, and smart contracts will once again come to the fore in the future. Load on those ETHs.

Real estate will benefit from the return to the office. Real estate comes from a brutal battering: higher rates and work-from-home policies were a perfect storm to crash prices lower. But we’re past all that, and REITs of all colors might be getting ready to shine again.

Tomorrow we’ll take these 7 lego blocks and try to assemble them in a coherent portfolio ready for the next phase of the cycle!

What’s happening in the markets?

This section is powered by Open AI connected to TOGGLE AI

Since the U.S. Supreme Court granted individual states the authority to establish their own sports betting regulations, the realm of sports betting has rapidly captivated the nation. Dominating this market are FanDuel and DraftKings, together commanding over 70% of the domestic online sports wagering sector.

An intriguing development has emerged with the entrance of a fresh contender, as renowned sports network ESPN, under the umbrella of Walt Disney ownership, has teamed up with PENN Entertainment to introduce ESPN Bet—an exclusive sportsbook tailored for enthusiasts.

This announcement triggered a response in the financial realm: Flutter Entertainment, the parent company of FanDuel, witnessed a 4.25% decline in stock value, while DraftKings’ stock plummeted by 10.88%, although it made a slight recovery of 1.5% in after-hours trading. In past instances where DraftKings’ stock has experienced a single-day decrease of over 10%, historical trends show a subsequent rise of approximately 3.5% within the subsequent week, and potentially a surge of over 10% within the subsequent two weeks.

Nevertheless, the arrival of ESPN, fortified by its substantial marketing influence and extensive ecosystem, could potentially pose challenges for the prominent sports betting giants.

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

Earnings Update: Spectrum Brands reports tomorrow

The home-essentials brand owner missed earnings last quarter, but still saw an increase in its stock’s price. Click here to observe how the stock could perform if it were to miss earnings again.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Amex stock drops

TOGGLE analyzed 11 similar occasions in the past where American Express stock saw a big move down and historically this led to a median increase in stock’s price over the following 1M. Read full insight!

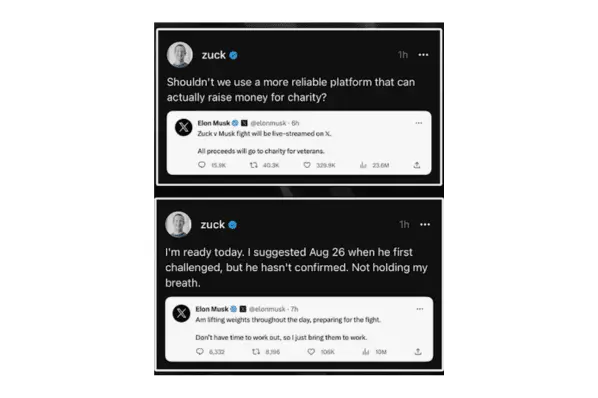

General Interest: Elon’s new excuse

Is Elon a pathological liar?

Yes, but no. The line blurs in business, as the Theranos trial made clear – Tim Draper himself defended Elizabeth Holmes and explained that companies need to be visionary.

Be it as it may, in the case of the match fight Musk is pulling a classic Musk move. First it was his mom, who asked the fight to stop. Now he needs surgery before the fight. It appears there will always be an excuse around the corner – so just like Zuck, we’re not holding our breath over the fight.

But that’s not really the point. The truly fantastic aspect that emerges from this story is that Musk’s fluid relation with truth has no impact whatsoever on his admiring hardcore fans – who love him more than ever. From “self-driving cars in 2015”, to “men on Mars in 2022”, Musk shows us that over-promising works.

Anyway, here’s a fun reddit thread where people poke fun at Elon and his ‘fanboys’.

—

Originally Posted August 10, 2023 – Where should I invest, part 2

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: TOGGLE Relationship with IBKR

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.